«::V !'•• ;.":!:

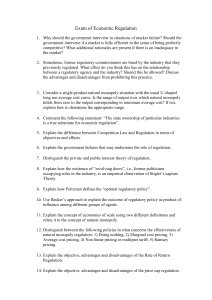

advertisement

;.":!:

!'••

.;',-.

«::V

s;

MJ.T. LIBRAR5ES

-

DEWEY

Digitized by the Internet Archive

in

2011 with funding from

Boston Library Consortium

Member

Libraries

http://www.archive.org/details/accesspricingcom00laff2

Cewey

working paper

department

of economics

ACCESS PRICING AND COMPETITION

Jean-Jacques Laffont

Jean Tirole

95-11

July, 1994

massachusetts

institute of

technology

50 memorial drive

Cambridge, mass. 02139

ACCESS PRICING AND COMPETITION

Jean-Jacques Laffont

Jean Tirole

95-11

July, 1994

MASSAC HUSE.7 z, MSTiTLi

OF TECHNOLOGY

1

MR

2 9 1995

LIBRARIES

<"!

95-11

Access Pricing and Competition*

Jean- Jacques LaiFont^and Jean Tirole*

July

*We thank

^Institut

Jerry

6,

Hausman and John Vickers

Universitaire de France,

and

1994

comments.

d'Economie Industrielle, Toulouse,

for helpful

Institut

France

*Institut

bridge,

d'Economie

MA USA

Industrielle, Toulouse, France;

CERAS,

Paris;

and MIT, Cam-

°t

5--//

Abstract

In

many

industries (electricity, telecommunications, railways), the

network can be described as a natural monopoly. A central issue

is how to combine the necessary regulation of the network with the

organization of competition in activities which use the network as an

input and are potentially competitive (generation of electricity, value-

added

services, road transportation).

In this

paper we derive access-pricing formulas in the framework of

an optimal regulation under incomplete information.

how

First,

we study

access-pricing formulas take into account the fixed costs of the

network and the incentive constraints of the natural monopoly over

the network. Second,

we examine

the difficulties coming from the ac-

counting impossibility to disentangle costs of the network and costs

of the monopoly's competitive goods. Third, the analysis

is

extended

to the cases where governmental transfers are prohibited, where the

competitors have market power, and where competitors are not regulated.

is

Fourth, the possibility some consumers bypass the network

taken into account. Finally the role of access pricing for inducing

the best market structure

results

is

assessed.

The

conclusion summarizes our

and suggests avenues of further research.

Introduction

1

many

In

industries (electricity, telecommunications, railways), the network can be de-

scribed as a natural monopoly.

However,

many

activities

which use the network

as

an

input are potentially competitive (generation of electricity, value added services, road

A

transportation).

central issue

is

how

to

work with the organization of competition

Two

different types of policies

combine the necessary regulation of the netin those activities.

can be observed. In the USA, the local network mo-

nopolies in the telephone industry have been prevented from entering the value added

markets as well as the long distance market because of the Department of Justice's belief

that

in

it

is

impossible to define access rules to the network which create

those markets

4

.

The argument

here

is

that

the network to provide unfair advantages to

it is

its

R&D subsidies...)

superior quality of access,

cost auditing. In the language of

competition

too easy for the monopoly in charge of

own products

even

if

(favorable access charges,

subsidiaries are created to improve

modern regulatory economics, asymmetries

between the regulator and the monopoly are so large that

tion

fair

of informa-

competition

fair

is

not

possible.

The

alternative policy of defining access charges

common. The long

also

(BT)

to reach

market.

The

and

letting the

regulatory choice of the access charges

regulatory review of 1991,

its

European Community

BT

is

BT in the long distance

complex.

For instance, in the

has argued that the current setting of access charges creates

competitor (Cave (1992)). Note also that

it

is

the goal of the

to define "reasonable" access charges to organize the competition

of electricity generation in Europe.

Other examples of

computer reservation systems and gas

It is difficult

activities

with regulated access are

pipelines.

to appraise the difficulties of regulating access

if all

the imperfections of

regulatory processes are taken into account simultaneously. In this paper,

we

start

an optimal benevolent regulation of a network monopoly facing a competive fringe

potentially competitive markets

focus

incorporated into our modeling.

a

first

of a

The modeling

step,

we choose

of the costs

to focus

more general theory

in

from

in the

and we successively introduce various imperfections. To

on access we neglect the relevant

policy.

is

distance operator Mercury pays access charges to British Telecom

consumers through the local loops and compete with

unfair advantages for

monopoly compete

issue of

network externalities, which could be easily

Perhaps more importantly, we ignore the divestiture

and benefits

on the

of vertical integration

is

complex, and, in

vertically integrated structure as a building block

which breakups might be desirable.

'"'DO J... Jid not believe that judicial and regulatory rules could be effective in preventing a monopolist

affiliate that provided competitive products and services" Noll (1989).

from advantaging an

The

existing theoretical literature on network access pricing includes

two papers

build-

on contestable markets theory. Willig (1979) studies interconnection by competing

ing

He

suppliers.

may

stresses the fact that strategic behavior

deter socially beneficial entry (for example to expand

regulation)

and analyses the extent

to

its

lead the network operator to

rate base under rate of return

which Ramsey pricing

market structure. Baumol (1983) discusses similar

compatible with the best

is

issues in the

framework of railroad

ac-

cess pricing. Vickers (1989) addresses the access pricing issue within the Baron- Myerson

model

of regulation under incomplete information.

monopoly (network

integrated

sector of services with

commodity

in particular a vertically

plus services) with the case of an imperfectly competitive

and without participation

Section 2 describes the model.

olized

He compares

A

of the network operator.

monopoly operates a network.

(for concreteness, local telephone), as well

It

produces a monop-

another commodity (long

distance telephone) which faces a competitively produced imperfect substitute.

The

long

distance operators require access to the local network in order to reach the final consumers.

That

the potentially competitive market needs to use the monopolized

is,

The purpose

an input.

access.

We

start

of the paper

is

commodity

normative theory of how to price

to develop a

by postulating that the regulator has complete information and faces a

social cost for public funds associated with the deadweight loss of taxation.

price

must then exceed marginal

deficit. Equivalently, access

for a further

any,

is

meant

The

access

cost in order to contribute to the reduction of the overall

can be priced at marginal cost and a tax levied on access. Sec-

tion 3 studies the impact of the regulator's incomplete information

cost structure

as

on the monopoly's informational

about the monopoly's

Incomplete information

rents.

departure from marginal cost pricing of access.

The

may

call

further distortion,

to reduce the monopoly's rent. Section 4 explores conditions

if

under which

the observability of the monopoly's subcosts, namely the cost related to the monopolized

good and the

The

analysis

ceive any

its

cost related to the competitive

is

extended

good

respectively, improves social welfare.

in Section 5 to the case

where the monopoly does not

monetary transfer from the regulator and therefore must cover

revenue.

The

access charge

is

cost with

then higher or lower than in the absence of a firm-level

budget constraint, depending on whether the monopoly's fixed cost

6 generalizes our access pricing formula to the case in

is

its

re-

is

high or low. Section

which the substitute commodity

produced by a competitor with market power rather than by a competitive industry

and Section

7 considers the case in

competitive segment at

all

which the regulator has no mandate to regulate the

(including the production of the competitive good by the

monopoly.)

Sections 6 and 7 emphasize the complexity of regulating a competitive segment with

limited instruments.

when consumers

Limitations on regulatory instruments are particularly penalizing

of the competitive

commodity can bypass the use

of the monopolized

good

(local telephone).

The determination

of the access price

conflicting goals of limiting inefficient bypass

it

and

must then trade

off

the

of contributing to budget balance (be

the State's or the firm's). Unless the regulator

is

able to simultaneously tax the long

distance market to raise funds to cover the firm's fixed cost and use the access charge to

approximate the

efficient level of

bypass, only a rough balance between these objectives

can be achieved. The separation of the regulatory function from the taxation authorities

creates serious difficulties in the presence of bypass (Section 8).

Section 9 links the determination of the access charge with the choice of a market

structure and with the promotion of entry in the competitive segment.

ponent pricing rule recently advocated by some economists

is

The

efficient

com-

assessed in the light of our

normative treatment. Section 10 compares the theoretical precepts with two regulatory

practices,

namely the

British Telecom.

fully allocated cost

method and the Oftel

The Conclusion provides a

summary

brief

access pricing rule for

of our analysis

and discusses

avenues of further research.

The Model

2

A monopoly

operates a network with cost function

Co

Q

where

of

co,

Q)

Co0 >

,

effort

is

F(.) on [3,

J3]

C0eo <

,

with a

strictly positive density function /.

0]).

With the network the firm produces a quantity

q

of a

let

(1)

private information of the firm

is

>

telephone).

0,

exerted by the firm in operating the network.

rate assumption {jg[F(3)/ f(3)]

monotone hazard

Coq >

,

a parameter of productivity, and eo a level

a parameter of adverse selection which

c.d.f.

and

(/3,

the level of network activity, 3

nonmonetary

,3 is

a

is

=C

:

Let us assume that q

units of this

also a

good

1

the classical

monopolized commodity

commodity require

S(qo) be consumers' utility for this good, with S'

The monopoly produces

We make

3 has

;

>

0,

S" <

q

(local

units of network

0.

(long distance telephone) in quantity q x

.

This

other production has an imperfect substitute produced in quantity q2 by a competitive

fringe. Let V' ( <?i ^2 )

,

be consumers'

utility for these

two commodities.

In addition to the network input the production of

C\

where

t\

is

=

good

1

also generates a cost

Ci{3,e x ,qi)

the effort exerted to reduce the cost of producing

(2)

good

1.

The

disutility of

effort

is

+

v{e

ex

with

)

y>'

>

0,

0" >

>

y'"

and

0.

good 2 generates a

In addition to the network input the production of

c

is

common

knowledge. Because we wish to focus on the network monopoly's incentive

we need not

to provide access,

Total network activity

investigate incentive issues in the fringe.

Q=

therefore

is

qo

+ qi + q2

FT

Under complete information, the

effort levels.

lator.

We make

Let

t

=

-

p 2 q2

Let a denote the access unit charge

.

The

paid by the competitive fringe to the monopoly.

and

-

cq2

fringe's level of profit

aq2

is

then

(3)

.

utilitarian regulator observes prices, quantities, costs,

denote the net transfer received by the monopoly from the regu-

from the

sale of the competitive

good and network good

to the con-

sumers, and that the firm receives the access charges. This obviously involves no

The monopoly's

utility level

U = tThe

1

+

regulator must raise

A (where A

S(q

)

>

+ V(q

t

)

+

is

then

+

ip(e

+ C + Ci — p

ex

)

+

— piqi

q

x

.q 2 )

-

p

<?o

~

Pl?l

V(qi,q 2 )

+

[t

p qQ

-

-

ii>(e

~ P2<?2 -

aq2

(4)

.

with a shadow price of public funds

+

(1

'M(*

utilitarian regulator

piqi

- p 2 q2 -

loss of

:

because of distortive taxation). The consumers'/taxpayers'

Under complete information an

S(q

:

the accounting convention that the regulator reimburses costs, receives

directly the revenue

generality.

where

cost cq 2

(1

+ e + aq2 +

t)

+

A)(f

p 2 q2

+ CQ + C - p

X

q

-

utility

piqi).

is

(5)

would maximise

+ C + C\ - p

-

cq2

-

q

- piqi)

aq2

(6)

under the individual rationality (IR) constraints of the monopoly and the fringe

U = -0(e o +

t

EI

= p 2 q2 —

ei)

cq 2

—

+

aq 2

aq 2

>

>0

(7)

0.

I

Since public funds are costly, the monopoly's IR constraint

can be rewritten

is

$

binding and social welfare

S(q

-

+

(1

Similarly, raising

4-

)

V(ft, ft)

+

A) (V(e

ci)

constraint

+C

money through

the term Xaq2 in social welfare).

+

+

Apxft

(/3, co,

?o

+ ft + ft) +

(9), social

S(q

-

+

(1

A) (V(e

Assuming that 5 and

The

access charge

is

)

+

V

+

ex)

=

+

V(ft, ft)

+C

(P, e

are concave

valuable (see

(10)

,

A(p

ft

+ Pift + P2ft)

<7o

+

+

ft

Ci(j3,

and Co and C\ convex

^^

1

A

=

?t

2

optimal

we can write

(12)

+

j_

A ft

1

+

A

(14)

772

are (respectively) the price superelasticities of goods 0, 1,2, and

v'(e

+

ex)

= -C0eo = -Clei

Straightforward computations show that

f/

=

770

(ftft~ft2ftl)

ft=ft

772

=

pi

Opi

</,-

.

(15)

and

^

<

ft

\

nfi

lb

l

^

<

772

n-i

111)

)

ftft2

(ftft~7i2fti)

772

;

ft ft

t

+

.

;

ftft

= — —0q

in (eo, ex, ft, Q),

(11)

11.

m

P2

rj

cq2 )

7/o

1

n-G»-c

u ft) +

r±rl

+A

=

= Pi-C g-Cx

Lim

ft,

+

ft)

Pi

77,-

is

(9)

chosen to saturate the fringe's IR

is

characterized by the first-order conditions, that

£i

,

Ci, ft)).

p2 -c.

Po

where

Ci(0,

welfare takes the final form

U=

770,

cq2

:

Substituting (10) in

where

-

Aag2

the access charge from the fringe

a

regulation

+

ft

Ap

+

ftftl

=

7.-i

i*'

jt-

The benchmark

J

'

=

1

'

2

=

z

1

<

2

-

-

pricing rules are

Ramsey

pricing rules because A

>

0.

The

access

charge can be rewritten

1

Access

°2

(1

2

is

7/ 2

priced above marginal cost because deficits are socially costly.

low or when the social cost of funds

issues raised by

If

(18)

A

can be viewed as a tax used to raise money.

-

,

,

is

+

is

high

It is

when

the elasticity of good

high. In the next section

we address

various

asymmetric information.

the regulator has two instruments, the access price and a tax on good

(14) can

The term

be rewritten a

+

marginal cost of access.

r2

=

Cqq

+ y+x^

Furthermore,

it

is

2,

r2 equation

,

an d a can obviously be taken equal to the

clear that

if

the regulator had access to a

nondistortive (lump sum) tax, marginal cost pricing of commodities and access would be

optimal.

Access Pricing and Incentives

3

The

first

pricing.

issue

we consider

is

the extent to which asymmetric information affects access

Let us consider the case where accounting rules enable the regulator to observe

separately Co and C\.

Let Eo((3,Co,Q) denote the solution in

the solution in

e\

of

C =

x

t

Ci(0,ei,q{).

e

The

of

=

Co

Co{{3,eo,Q) and

firm's utility

+ aq2 -ij,(Eo(P,Co,Q) + E

1

let

Ei(j3,C\,qi)

can be written

(19)

(l3,Cl ,ql j).

Appealing to the revelation principle we consider a revelation mechanism

{*(£),

which

C

(/3),

CM,

qi 0), q2 0),

specifies the transfer received, the sub-costs to

produced, and the access price to be received

if

Q0), a(0)}

(20)

be realized, the quantities to be

the firm announces a characteristic

Neglecting momentarily second-order conditions, and using the rent variable

U(j)

=

t(,3)

+ a(/3)q2 (<3)-T!>(EQ (0,

CM,

Q(0))

+ Ei(0,

CM,

?i (/?))),

j3.

monopoly can be written

the incentive constraint of the

^=-^^Hw + w)-

c

Since

-^ >

^- >

and

>

(IR) constraint {U(3)

0,

the rent

for all

down

boils

/?)

decreasing in

is

U{0)

Optimal regulation

+\[po(0)to(po{fi))

-(1

+

A) {v(e

+

(j3)

>

0.

(22)

+ V( qi (pM,P2(P)),

(/?, e Q ((3),

rationality

to

+ M0)qi(pM,P2(P))

+C

ei (0))

and the individual

from the maximization, subject to (21) and

results

{s(qo(po(P)))

\l

/?

(21)

fc(po (0))

(22), of

fc(Pt(fl, P»{0)))

+P2{P)9i(pi{P),Pi(fi))]

+ qMPlPiifl)) + toMfiMP)))

+ C (^eMMPi(0),P2(0)))+cq2iPi(0),P2m)]-XU(0)}dF(0).

t

We

obtain (see appendix

Po

Pi

~

A

"

Cqq

l

—

+

C\ qi

Xf,

l

p2

+

1

A

£

tf7_0_f

+A

/

Pl

+

1

A

_

F

A

1

?\

T

(23)

1).

- C0Q

Po

:

f

A / Po

dQ\

-Co Q -c = _A_

i + A

p2

A

\

[

,Q)/

j?i

_J_ F

1_

"

fj

,Q)

i

C03 (/3,eo,Q) \

C0eo (^eo,g)J

Ugl

C03 (P,e

C0eo (/?,e

d

y/

i

2

+

A

d

<9?i

ry_5_

/ p2

f

I

f

agl

Clg (y3, ei gl n

CUl {P,euqi)}J

)

,

_ Cofl (/?,e ,g)

)

c0eo (/?,eo,g)/'

All prices are modified by an incentive correction related to the sub-cost function Co

and

pi has

The

an additional correction associated with C\.

now be written

can

access charje

3

'

J

=c

A

p2

is

F

,

v

d

f

C'OB

(

^^TTA^ rTA7 ^i" c^r

Let us analyse the new term, which

that there

A

+

no correction

for the

is

most

(

'

due to incentive constraints.

efficient

type as F((3)

=

0.

First,

we observe

Second,

-jf-

=

— Co/j/Co eo

same

the

to

is

the rate at which the firm must substitute effort and productivity to keep

level of cost for the

determine the firm's

network ar "ivity. From

The

rent.

conversely

The

if it is negative.

we

see that

it is

a crucial term

regulator wants to limit this costly rent.

and

positive, he raises the access price

is

(21),

If

-Sni^f)

therefore reduces quantities to extract rent

and

on the access charge thus depends on

effect of incentives

fine characteristics of the cost function.

Access charges must be increased (decreased) for incentive reasons

network

of the

C

is

—

>

Co0gCoe o

is

obtained

if

(<)

>

"Spence-Mirrlees"' condition on cost, Cqqq

clear positive sign

Intuitively, production

marginal cost. However,

effort increases the

about

lie

if,

as

is

more

ambiguous.

if

an increase

its

in the level of

Q

characteristics (in elasticity

the quantity elasticity of the marginal effect on cost of the productivity charac-

if

teristics

is

must be decreased (increased)

increases (decreases) the "ability" of the firm to

0.

and our previous assumptions, a

reasonable, effort decreases the marginal cost, the effect

terms,

the cost function

such that

t-OeoQCoQ

With the

if

j3 is

larger (smaller) than the quantity elasticity of the marginal effect

on cost

of

effort).

From

we know 5

Leontief's theorem

charge (and on good

1)

disappears

iff

Co

If

there

furthermore C\

is

is

separable in

in addition that

the incentive effect on the access

there exists a function £ such that

=C

(/?,

(£(/?,e ),Q).

ei)

(23)

on the one hand, and

no incentive distortion on any commodity

:

qi

on the other hand,

the dichotomy between pricing rules

(unaffected) and the cost reimbursement rules (see below) holds.

The

access pricing rule can then be rewritten

1

Note that

Pi

— Cqq —

is

T}2

la

7iJ

also possible to find conditions

conclusions for the incentive correction

(29)

A

C\ qx

Pi

It

+

:

on the

when

it

-aOQ

Pi

cost function that yield

exists.

nonambiguous

For instance, the following class of

cost functions leads to a well defined sign of the incentive correction in the access charge

3

From

Leontief's theorem we

know that

^-

independent of

(-Oe„

function £(.) such that (29) holds (see Laffont-Tirole (1990a)).

10

Q

is

:

equivalent to the existence of a

Co

If

d

>

b(d

Let us

<

now

6),

=

(3Q

the incentive correction

-

„c/->&

c

eQ

Q

positive (negative).

is

consider the effort levels (in the case of dichotomy) obtained by maximizing

under (21) and (22) with respect to

(23)

d

60

,

ei).

We

obtain

'/''(eo

+

ei)

= -C0eo

^'(eo

+

ei)

= -Clei

2\F

(iTwr

(e

ei)

(w + w) +

0,(eo

+

ei)

Wdc: Cui

Equations (30) and (31) can be interpreted as cost reimbursement

(31)

rules.

If

the con-

ditions underlying the irrelevance of subcost observability (see Section 4) hold, one can

obtain sufficient conditions for the optimal contract to be implementable through a single

menu

of linear sharing rules

share of the total cost which

is

t

= A — B(Cq +

C\) where

B =

From

(30), (31),

and

reimbursed.

the most efficient type receives from the regulator a

tract)

and equates

its disutility

lump sum

^'fc

F({3)

=

1

=

1

^'fc

we

0,

"

1S

t ^ie

see that

transfer (fixed price con-

of effort to the marginal cost reduction as under complete

information.

REMARKS

1. -

The most

relevant cost functions

seem

to

be such that higher production

higher effort levels and therefore induce higher rents.

for

marginal costs and therefore indirectly

call for a general

Incentive considerations raise

reduction of quantities. Access

prices are increased for the competitor but simultaneously the

high prices for

its

own product and

own

misrepresentation.

efficiency of its

this link

2.

is

-

If

is

products. Because access costs are the

the competitor's, the current model

The

levels call

may

monopoly

same

penalized by

is

for the

monopolist

understate the incentives

s

for

firm cannot claim simultaneously high access costs and high

own products

(see Laffont-Tirole (1993,

Chapter

5) for

an example where

suppressed).

the fringe

is

not regulated but

is

competitive, the same results obtain

;

P2

=

o.

—

c

then ensured by competition rather than by the existence of a shadow cost of pubiic

funds.

11

3.

Let us consider implementation of the optimal revelation

-

ing specification

C =

now

includes

t

qi

+q2

.32)

)

(33)

monopoly can be rewritten

objective function of the

i(fi)

+

){q

i/ 1 (/?-e 1 )<7i-

1

where

follow-

:

C = H (p-e

The

mechanism with the

-^20- HQ-

Co

l

(

the access charge.

H?(Z))

-

)

The second-order

(34)

condition of incentive compat-

ibility is

d[3{

and the revelation mechanism

r(

The

price

firm

now

is

free to

+ qi +

\q

°

equivalent to a nonlinear reward function

is

v f_&_)

Co

choose

and the quantity of good

its

An

cost,

(as well as

1

which determines

alternative implementation

Co, C\, production levels qo,

the conditional

demand

\

is

.

good

it is

TJ-\(C\

= D 2 (qi,

chooses.

example) which

service (good 1)

selects the level of

raises the cost for the

is

C\

=

=

all prices

leading to the

jQ + Co(p,e

+

a)

and substitute

in (36).

,Q)

It

decreasing in the access charge

i

(an

network, but decreases the cost of

-iqi +Ci{/3,e l ,q 1 ).

12

c

For this purpose consider

some unobservable action

:

Co

will affect the

can be advised to choose the

picks.

it

it

for

it

obtained by writing the transfer as a function of costs

easy to check that the transfer received by the firm

vestment

knows that

its rent.

function of good 2, q2

Suppose that the monopoly

(36)

among

indifferent

is

4. -

it

It

2).

and access charge a

qi

:

+iir i(£i))

access charge but

access price defined in formula (27) since

same weighted

\qiJ)

q2 J

inits

Under complete information the optimal investment

is

=

i

level,

which minimizes

total cost,

qi/Q. Under incomplete information, the moral hazard constraint on investment

dE

- .dE

l

is

x

Q+ dc; qi=0

dco

or

.^qi dEildCx

QdEo/dCo'

1

To decrease the

C

and C\, may use

(implying

exist

if

j^P-

^

who

rent of asymmetric information the regulator,

cost

reimbursement rules with different rates

j^-) and this

may

observes both

for sharing overruns

lead to a distortion of investment (which would not

the regulator were not observing separately sub-costs Co and C\ as in the next

section).

If

1

i

too low (too high), the access price

is

(favor

good

2)

and

may be viewed by

is

to foster

is

increased (decreased) in order to favor good

the firm as a nonrecognition of

its

On

low access charge

investment costs in the network.

indeed low to decrease those types of investment which

4

A

an increase (decrease) of investment.

may be

It

excessive.

Sub- Cost Observability

Section 3 derived the optimal regulation under the assumption that the regulator could

audit the costs of the regulated

monopoly

well

from the cost of the commodity produced

Using

Ck

instead of

e k in

(l

A

X)rp'

(1

+

+

A)/

XFr

+

cost of the network

in the competitive sector.

the optimization leading to (30)

+

=

enough to separate the

d{E

°

dEk

dCk

+ El)

00

W Hj'

and

"

=

'

(31),

we have

\

l

(37)

high-powered scheme on activity k corresponds to a case where the transfer received

by the firm

is

highly dependent on cost

Ck

,

i.e.

where

(

— §§*•)

is

Indeed

high.

if

^

is

high in absolute value, marginal cost reductions on activity k per unit of effort are small

and therefore the firm

is

already induced to exert a large effort on activity

for further reference that if the cross

If

terms

gC

^

vanish the terms

sub-costs are not observable, the firm minimizes

chooses {e k } or, equivalently

{Ck },

its effort for

so as to minimize T.I=q

13

(

— ff^)

k.

are equal.

any cost

Ek {/3,Ck ,Q k

)

Also, note

target.

subject to

C

It

-f

= C

C\

Q Q = Q,Q\ =

(with the convention

Hence, in the absence of sub-cost

qi).

observation the marginal effort levels to reduce sub-costs (— -Sf-) are equalized 6

Whether the regulator wants

in

to give differentiated incentives

on

different activities

the case of sub-cost observability hinges on the cross-partial derivatives

that this expression

absolute value proportional to

in

is

which the firm can substitute 3 and

determinant of the firm's rent.

no point

is

of effort to

minimize cost

+

=C

C\

solution to the system

in order to

|^ = -^

{

observability

is

useless if

This result

d

2

tells

Section 3) and

it is

at

the main

total effort Yi\=Q Ek(3, Ct,

= Ek (3,C,Qo,Q\),

and Co + C\ = C }.

for all (k,£)

we obtain

which

(see

appendix

2)

is

Qk)

the unique

:

:

the firm faces uniform incentives

ii)

measures the rate

has a unique solution e k

the firm faces higher incentives

i)

(note

reduce rents.

Solving for the optimal regulation

Under sub-cost

h

the level of cost or the level of effort does not affect this

assume that the minimization of

formally, let us

subject to Co

effort in activity k (see

-&

).

E

QC

in using sub-cost observability to try to affect the firm's allocation

rate, there

More

If

A

de

.

E k /dCk d3 =

on those

on

activities

and therefore sub-cost observability

all activities

K for all k

for which low costs reduce rents

and some constant K.

us that the incentive constraints of the firm are identical with or

2

without sub-cost observability when d Ek/dCkd3

=

=

constant for k

the optimal pricing rules and in particular the optimal access pricing

0, 1.

Consequently

unaffected in this

is

case by sub-cost unobservability.

A

characterization of the subclass of cost functions satisfying the sub-cost-irrelevance

property with

that

K

=

is

easily obtained.

=

for

A:

=

0Ck d3

some functions

On

H

k

and

0,1

<*

ek

the subcost functions must be such

= Ek {3,Ck ,Q k = Hk {3,Q k + G k {Ck ,Q k

G k for k = 0, 1

)

)

and, since

C <

ejk

0,

)

for

A:

=

)

Ck = Ck (Q k Hk (3, Q k )-e k

,

the other hand, recall that the dichotomy property holds

Ck = Ck (Zk (3,e k ),Q k

at

all k,

:

d2 Ek

for

For

when

).

:

0,1.

'Then, the theory of access pricing is similar to the one of Section 3 but for marginal costs evaluated

the effort levels induced by the incentive scheme denned when sub-costs are not observable.

14

These related conditions are

d

dQ k

The dichotomy

different.

fdEk \

d 2 Ek

33

dCk d/3

V

J

requires

d 2 Ek

dCk

dQ k

8Q k d0

while the irrelevance of sub-cost observation requires

d2 E

=

dCk d(3

The

tfforallJfc.

class of cost functions

Ck (0,e k ,q k =

)

satisfies

the sub-cost irrelevance property for any d k

=

property for d k

On

3q k "

,

bk

e k qk

(with

bk

Ckqk >

0)

and the dichotomy

b k only.

Ck (3,e k ,qk = ^t

the other hand,

satisfies

)

the dichotomy property but not the

sub-cost irrelevance property.

Optimal Access Pricing

ernment Transfers

5

We now assume

us for

that the regulator

prohibited from transferring

is

example consider a constant returns to

irrelevance of subcost observability hold

Co

=

H

{3

l

let c

=

H

(f3

—e

)

cj

,

=

H\(3 — e

-

e Q )(q Q

l

x )

scale case

+

qi

+

qi{Pi,a

where the dichotomy and the

q2 )

(we omit the fixed cost for notational simplicity).

PoqoiPo) +Piqi(Pi,*

+

to the firm. Let

(/3-e l )q1

Under symmetric information, the budget constraint

-<-'o(<7o(Po)

money

:

C =H

and

Absence of Gov-

in the

+ c) + aq

2

of the

(p\,a

monopoly

is

+ c)

+ c) + q2 (pi,a + cj) - c^p^a + c) - t >

15

0,

(38)

where

must now be interpreted

t

consumer charges

The

U= —

(so

as the firm's

v(eo

t

+

regulator wishes to maximize, for each value of

subject to constraint (38) (where

U

is

leads to the incentive

=

-V(e

is,

-co (qO ( Po(0))

max

>

+

:

e 1 ((3))

(39)

(40)

0.

:

7i (pi(i3),

c iqi ( Pl (;3), a(/3)

[S(q (p (3)))

-Pi(0)qi

s.t.

+

+ V( qi

+

c)

program

regulator's optimization

/

:

+ Pi((3)qi (pM, a(0) + c) + a(0)q2 (Pl (/3), a(0) + c)

Po(/3)qo(po(i3))

-

each 3

for

social welfare

+ ei (/?)),

(/?)

-iP'(e (3)

U(0)

constraint

t,

namely

and individual rationality constraints

=

C\,

)-p l q l (p l ,a. + c)-(a + c)q2(pi,a + c) + [f

q (p

firm's rent,

t(3)

U(f3)

The budget

Cq,

the firm's welfare).

Under asymmetric information, the

U{B)

paid from

is

ei)).

S(qo{Po))+V(qi{pi,a + c),q2 {pi,a + cfj-p

The

manager's compensation and

(

a(0)

=

is

Pl (3), a(8)

+

c)

U((3)

+ q2 (P i(/3), a(0) +

+

0(«o(/?)

c))

+ eM).

(41)

:

+ c),q2

( Pl

(0),a(0)

+ cj) - Po(3)q

[pM, <3) + c) - P2(3)q 2 (pM, a(8) + c) +

(po(3))

U{3)\ dF(3)

(39), (40), (41).

Let fi(3) be the Pontryagin multiplier of the state variable

U

and

(1

+

multiplier of the budget constraint. Optimizing over prices we obtain the

as in Section

2 with \{3) replacing

sality condition fi(3)

=

0,

A.

\(3))f{3) the

same equations

Using the Pontryagin principle and the transver-

we have

16

Optimizing over

0'(eo(/9)

+

ci(/3))

effort levels

=

we

get finally

v

/

H'^qM + qi ((3) + q

:

2

((3))

~

Si k0)S0)d(3

,f

(i

\'\'j

"(eo(0)

+

+ Hp))S{p)

e 1 (0))

and

neoifi)

When

with

(

+

ei(fl)

=

SiMMiPW

/

-

#{*(/?)

-

.

^

{eatf)

+

ei(fl).

the dichotomy does not hold, formulae similar to those of Section 3 are obtained

1+A) /L)

replaced by

Sg\0)f0W

In particular the access pricing equation

a

"m

c0Q +

,

1

Under the assumption

+

P2

A(/?)

+

becomes

www

ss

,

(i

2

+

f

m)m

dQ\ c0eo

on how binding the budget constraint

is.

is

shifted

by the

upwards or downwards depending

Consequently, the access charge

than in the absence of budget constraint when the fixed cost

is

is

higher (lower)

high (low).

Access Pricing and Competitor with Market Power

Competition

for

(42)

/

of dichotomy, the ratios of Lerner indices are unaffected

lack of transfers, but the whole price structure

6

-coa]

a

in the

competition

electricity in

markets using the network as an input

in long distance

often imperfect, as

is

the case

telecommunications, or competition in the generation of

England. To account

analysis of Section 5 with the

is

for this

market power we pursue the balanced- budget

same technology (guaranteeing the dichotomy and the

irrelevance of sub-cost observation).

17

If

the competitor has market power and

is

unregulated, the maximization of expected

welfare must be carried under the constraint that the competitor chooses price so as to

maximize

its profit

:

+ ft#(ft,p2 -

ttfri.ft)

From

)

ap2

+ a) Aft,;*) =

(c

0.

r

(43)

tfp 2

we

the first-order condition of this maximization program (see appendix 3)

obtain the access pricing rule

:

09

1+

V2

X(/3) I

T/2

'/l^

(44)

-

TJ12V21

with

V2

=

7/i7/ 2

V2]

'

Equation (44)

is

superelasticity

and only

r\\

demand

if 7/217/12

corrected for market power.

>

—

7/1(7/2

1).

>

budget (reflected in A

power. To explain

7/ 2 i7/i 2

good 2 describe the

More

to offset the

demand

for

0) calls for a higher final price

increase in p 2 (that

monopoly

case

good

than

(t/ 2 i

2),

interesting

=

t/ 12

=

in the

However, with dependent demands, there

the expression of

t/j )

:

pi

is

is

monopoly

r/

2 if

<

0), n\

7/2

absence of monopoly

to a social loss equal

Because marginal revenue

in the access price) reduces this

is,

the

is

the need to balance the

monopoly power amounts

distortion.

changes

exceeds the regular superelasticity

demand

elasticity

notice that the

this,

It

-).

effects of

times the monopoly's profit p 2 <l2l Tl2i once the standard subsidy p 2 q 2 /V2

made

the

for

In the independent

and therefore (assuming a constant

in

7/1

and p 2 on the mark up or monopoly power 1/(1

in pi

to A

-

T]

complex, but can be given a natural interpretation. The two terms

the derivatives of the elasticity of

in

is

27/17/2

- U T]21

+ 7/217/2 -

(

see (44))

decreasing, an

is

Hence

profit.

7/2

a second effect (described by the term

<

t/

2

.

7/217/12

reduced to lower the monopoly profit p2?2/ r/2- To rebalance

consumers' choice between the two substitutes. P2 must also be reduced, and so must

be the access charge.

If

the social welfare function did not include the competitor's profit (an extreme

of depicting the redistribution problem), similar calculations

a

"An

=

C Q

+

-

\(3)

P2

t~t:^

would yield

P2Vij;{^)+PiVx2i: {^) +

:

^_

P2>

l+A(J)7/ 2

alternative formula would be obtained

way

7/17/2-7/127/21

if

a nonlinear access pricing rule was used.

conclusion.

18

See the

Restricted Regulation

7

In practice, the regulator

may

let (or

be instructed to

let)

the natural monopoly select his

and regulate only the price of the monop-

pricing behavior in the "competitive market"

olized

good and the access

set its

charges on value added services. This section studies the design and consequences

price to the network. For instance, France

of such restricted regulation

a competitive fringe.

We

We come

under simplifying assumptions.

is

free to

back to the case of

consider the class of regulatory mechanisms that associate with

an announcement $ prices po{P) and

The managerial compensation

a((3).

defined as a residual by the balanced budget constraint, once efforts e

Pi

Telecom

and

t((3) is

then

and

price

t\

have been chosen.

The

monopoly has an additional

analysis proceeds as in Section 5 except that the

moral hazard variable pi which leads to the first-order equation, that the monopoly's

marginal profit be equal to zero

:

9qi,

~ co ~

MP = qi + ^-[pi

i

Cl]

dpi

dq

2

+ ^\P2 - Co dp!

,

c]

=

0.

we make the following assumptions

Concavity of profit

:

dm <

*&£

dpi

Generalized strategic complements

The standard

:

^^- >

0.

condition for strategic complementarity

d

~

W + T^tPl

opi

°0

L

~

c l]]/ dP2

is

>

0.

J

Here, the monopolist also receives income from giving access.

for generalized strategic

complementarity

is

A

sufficient condition

strategic complementarity plus the condition

that the marginal profit on access increases with p 2 (condition that holds with linear

demand and constant

Appendix

6

returns to scale).

shows that

for a given

shadow

price, the access price is lowered relative to

the unrestricted control case, in order to reduce the

complementarity for a given p x

strategic

.

On

monopoly price through (generalized)

the other hand, monopoly power on good

1

To rebalance the consumers' choice between the two goods, p 2 must be raised.

The effect of restricted regulation on the access price is therefore ambiguous in general.

raises

px

.

However,

in the

case of linear

demand, for the optimal

remains the formula of full regulation.

19

pi,

the access pricing

formula

Access Pricing and Bypass

8

A

practical

problem encountered

ing access to the network

may

in

the telecommunications sector

useful as

is

is

the following

giv-

:

expands the space of commodities offered and

it

decrease the rents of asymmetric information by shrinking the incumbent's scale of

More

operation.

the incumbent

cations for

far

may

it

be useful for yardstick reasons

also

if

the technology of

correlated with the monopolist's technology. However, in telecommuni-

is

example giving access

possibility of

So

directly

to the

network to long distance operators leads to the

bypass of the local loop by large consumers to connect with these operators.

we had no need

of long distance,

to distinguish

between producer prices and consumer prices

and we could assume without

was

loss of generality that access pricing

the only tool used to oblige the competitor to participate in the fixed costs of the local

loop.

However, when bypass

is

feasible high access prices required for funding these costs

induce inefficient bypass.

Nonlinear prices for local telecommunication

there

is

a

much more

efficient

way

of dealing with this

necting consumer prices and producer prices

The monopolist has marginal

The

fringe has marginal cost C2

10

b is

the

same

is

Let t2 be a tax on good

is

2.

price of

good

With a competitive

=

2 charged to those

price of

good

—

a

[0,1] of

[0,

+ c2 + t2

a

=

The

cost

b.

c2

+

t2

= p 2 + b-

good

2

is

then

:

.

the local loop

is

.

through bypass

has paid a fixed cost

is

de facto

a

9.

See Laffont-Tirole (1990b) for a different example of the use of nonlinear prices to

9

However, this option

is

consumers

and a (low) marginal

00)

i

10

long distance.

Ci for

fringe the price of

who bypass

2 obtained

p2

given that consumer

But,

distributed according to a c.d.f. G(9).

p2

The marginal

network and

Let V(pi,p 2 ) be the indirect utility function.

p2

The

.

problem which amounts to discon-

Consider the case of a continuum

.

8

.

characterized by a fixed cost 9 €

for everyone, 9

help mitigate this dilemma

9

cost cq for the local

with identical preferences V(qi,q 2 ).

bypass technology

may

fight bypass.

rarely available to regulators.

The dichotomy property

is

assumed so that we can study pricing

issues independently of incentives

who bypass

For given prices (p u p2,a) consumers

are those with 9 lower than 9'

defined by

V(pi,p2 )

Leaving aside good

r

Max

9'

r*

[V(p u p 2

/

+

where

J

8m

= -9 m +

V(Pl ,p2

optimal pricing and access pricing are then the solution of

0,

+ b- a) - 9 +

[V(pi,p 2 )

+

(1

+ A)

(1

+

r

- c - Co)ft(a) + (p 2 - a -

Pl

x

(

-d-

A) [(p,

?i

Let

77 x

(a), 772(a),

demand

with the

=

=

?i(Pi,P2

+ 6 - a)

g 2 (a)

9l(?l,P2)

77 12

Let

AR

2)

AR =

is

-d-

(p x

an income

the switch occurs.

Co)(qi(a)

effect.

AR

<

It is

- qj +

(p 2

switches to bypass.

for raising funds,

means that

less

c2

-

co)q2 ]]dG(9)

dG{9)

(45)

seems

AR ~

difficult to predict

11

.

the sign of

Then, from appendix

p2

?2(Pl,P2)elasticities

demand

-

a

-

and revenues associated

t}i,t) 2 ,t]i2,t}2i,Ri,R 2

functions qi,q2

c 2 )q 2 (a)

If

we think

it is

-

(p 2

-

c2

.

-

co)q 2

.

of the difference between prices

the difference of "collected taxes"

taxes are collected

5

AR. So we

we have

when

when

the switch occurs.

(see equation A5.3 in

-

c2

Tf 2

"Co

if

the complete results only

+

A

1

XtJi

1

l+\rj 2

are superelasticity formulas for the hybrid population of consumers

bypass and those

Note that

A

1

-

will give

:

Co

p2

,

+ b - a)

when no switch occurs

Pl

rf l

?2(Pi,P2

5).

Pl-Ci--

1

-

n

c 2 )q 2 {a)

the loss of profits (including access charge and tax on

This should favor a lower access price than

where

(pa

functions qi(a),q 2 (a) and the prices Pi,p2 and let

and marginal costs as taxes

for

=

be the

(a), /721(a), i£ 1 (a), i? 2 (a)

when a consumer

appendix

=

72

the elasticities and revenues associated with the

It

+

co) 9l

:

for ease of notation

?i(a)

good

+ b-a).

in

who do

who

not.

addition a direct subsidy (or tax) for bypass was available this effect would disappear.

21

The

deviation of the access price from the marginal cost

Q

-

where

is

772

mation

f

1

are constant,

if

7/2l(a)

772(a)

f

the proportion of those

the classical super-elasticity and similarly

L

1

r72(a)/'

who bypass

ft

:

ss J71)

12

,

is

small (then

we obtain the

f2

*

72

approxi-

:

~

a

Pricing access at marginal cost

We

_

1

1+Alf2

p2

If elasticities

A

cp _

then

is

is

Co.

then appropriate.

have assumed here the existence of transfers.

If

there

is

no transfer, similar results

hold as long as the tax revenue on good 2 goes to the monopoly.

If not,

access prices

participate strongly in raising funds to pay for the fixed costs of the local loop and very

bypass

inefficient

is

be expected.

to

Access Pricing and Entry

nent Pricing Rule.

9

:

The

So far we have focussed on pricing access when there exist competitors

The concern was the

which need access.

firms. In other

cost.

The optimal

now

that the competitor

access pricing rule

for

some

services

efficiency of supply of services given existing

words we have assumed that the regulated firm's

the access price. Suppose

Compo-

Efficient

may be

must pay a

affected

rival enters regardless of

fixed entry or operating

by the existence of

this fixed cost,

because the entrant does not internalize the consumer surplus created by the introduction

of

good

Ideally one

2.

would

like to

use direct entry subsidies to deal optimally with the

entry decision. [Under incomplete information about the entrant's cost, one would need a

nonlinear transfer function of the quantity to be produced

is

about the variable

fixed cost

if

cost,

it

is

may be optimal

induce a better entry decision

about the fixed

cost]. In

the absence of such

to lower the access price obtained so far to

13

.

Also, concerned with entry decisions,

::

the asymmetry of information

and a stochastic decision of entry as a function of the announced

the asymmetry of information

alternative instruments

if

Baumol has proposed a simple and

In the absence of these assumptions different taxes for those

who bypass and

those

influential

who do

not would

be desirable.

:3

The

are a

relatively favorable interconnect prices levied

dynamic version

market structure.

A

on Mercury to access British Telecom's network

widely believed that they were designed to realise a particular

different but related reason for low access prices is the high switching costs of

of this point.

It is

consumers.

00

u

access pricing rule

,

In our notation, this rule

and

the monopoly's price

its

recommends an access

rule)

which

The

idea

and only

is

:

= pi-ci.

(46)

that an entrant with marginal cost c on the competitive segment will enter

if it is

more

efficient

p2

ECP

price equal to the difference between

marginal cost in the competitive market

a

•

(ECP

rule"

from the precepts of contestability theory.

follows

if

component pricing

called the •'efficient

=

a

:

+c=

(pi

-

Cj)

rule under perfect substitutes

+c<

The

:

pi

&c<

c\.

make

following assumptions

this rule

optimal. First, the monopoly's and the entrant's goods are perfect substitutes. Otherwise

entry by a less efficient entrant

may be

Second, the regulator observes the

desirable.

monopoly's marginal cost on the competitive market. Third, the entrant has no monopoly

power. Otherwise, the choice of p\ not only determines the access price, but also constrains

the entrant's

monopoly power. Fourth, and

relatedly, the technologies exhibit constant

returns to scale. Fixed entry costs for instance would create several difficulties with the

Baumol

On

rule.

On

the one hand, the no-monopoly-power assumption would be streched.

the other hand, the entrant might not enter because he does not internalise the increase

consumer surplus created by

in

[Incidentally,

pricing.

But, p 2

=

a

entry. Fifth, the

Baumol seems

+ c is lower

+ ci).] On

to

benchmark pricing

recommend Ramsey

than the Ramsey price for cost

(cq

rule

is

marginal cost

pricing as the benchmark.

+ c)

if

p\

the

is

Ramsey

the other hand,

if

those five conditions are satisfied,

argued that the access pricing rule (46)

is

irrelevant.

for cost (cq

should supply only access

(p\

is

irrelevant)

;

or c

>

C\

Either c

<

cx

it

price

can be

and the monopoly

and no access should be given

(a

is

irrelevant).

•

ECP

rule

under imperfect substitutes

differentiation (as

we have done

the competitive segment.

To

we assume constant returns

entrants,

until

:

now) to

In the rest of this section

justify the presence of several firms in

retain the spirit of the

for the

much

as possible.

known marginal

cost for the

Baumol

to scale, competitive entrants,

and the dichotomy property

we introduce

rule as

monopoly's cost function. For instance, we

can take the sub-cost functions assumed in Section

5.

The dichotomy

ensures that the

pricing rules will not be affected by incentive corrections.

•

4

is offered by a single supplier who also competes

the single-supplier component's price should

component,

offering the remaining product

See Baumol (1993)

with others

cover

its

in

:

"If

a component of a product

incremental cost plus the opportunity cost incurred when a rival supplies the

23

final

product".

our model the Baumol rule amounts to

In

a(0)=p (!3)-c 1

1

Competition

=p

1

(f3)-Q-.

competitive segment implies that

in the

= Pi(fl) + c — C\.

/>2(/?)

Optimizing expected social welfare under constraint (46) and under the incentive constraints (see

appendix

we obtain the

6),

=

a

access pricing rule

+

Coq

1

where

is

ife

an "average

V2

=

—

9i

T>2

:

+

.

,

Vi

+

92

to the formula a

—+

P2

92

;

9i

=

772

+ 92

Pi 9i

92

is

72i

;

= Coq + ^^L ^

772

92

72

here of dichotomy), the elasticity used

The

(47)

"

M/3) 72

elasticity"

Pi 9i

Compared

+

9i

9i

+

obtained in Section 5 (in the case assumed

not the correct one, namely

~ 7712*721

7l72 + 72 721

771*72

difference between the two formulas (assuming that there

centive correction) stems from the fact that the

Baumol

is

rule ties the

no need

Symmetric demands and

p2

-

c

-

Co

=

pi

-

ex

-

Co,

costs.

One then has

for

r/ 2

and

c

=

c\.

an

in-

:

These imply that

or

a

Thus

=

fji

for

two prices on the

competitive segment. Let us compare the two rules in some specific cases

-

(48)

»7l2-

92

symmetric demands and

=

-

pi

cx

.

component pricing

costs, the efficient

rule

is

consis-

tent with optimal regulation.

-

ous

Linear demands, symmetric

symmetry assumption

in

costs,

and captive customers.

one respect

the monopoly has captive customers while

:

competitors do not. Under linear demands, the

with d

<

b

and a 2 <

at

.

demand

9i

=

ai

-

&Pi

+ dP2

92

=

a2

—

bp2

+

>

pi

and

24

a

<

functions are

dpi

Marginal costs are identical

Pi

Let us alter the previ-

px

:

—

Ci

=

C\.

c.

Our formulas then

yield

The

intuition

that the

is

monopoly must charge a higher price than

because captive customers make markup relatively

markup on good

turn, this high

component

efficient

efficient in

can be viewed as an access subsidy relative to the

1

pricing rule.

previous example that ai

=

a 2 but c x

,

Pi

The

intuition

now

is

<

< p2

Then our formulas

c.

and

that under linear

partially reflect the cost differential c 2

—

<

a

demand

C\.

price cap

Price Caps

:

—

pi

Let us assume in the

yield

:

c\.

— p\ must

the price differential pi

There

The

"cost absorption".

is

must therefore be lower than that recommended the

Remark on

competitors

covering the fixed cost. In

Linear symmetric demands, cost superiority of monopoly.

-

its

efficient

Suppose that the monopoly

is

component

only

access price

pricing rule.

regulated according to the

:

a

with the access pricing rule

po

+

aipi

<

a

= pi-

cx

(49)

p,

:

or

p2

This of course

lator

If

makes use

(see

l

not pure price cap regulation (neither

a and a x

appendix

Pi

- Cqq _

(1

~

Cqq

-

a

''

J

\

.

On

-

Cigi

_

1

effort level

(?

-f

qx

q<i

respectively

~

v_

ft

we

=

Lqq

H

+

notice two differences. First

q2

and therefore Cqq

than under optimal regulation.

25

i\\ is

given by (49).

Then

—

the other hand, under a price cap, effort

production level

+

7o

the multiplier of the price cap constraint and

(48)

qx

v)

P\

Comparing with

and

7)

Po

is

practice) because the regu-

are chosen approximately equal to q

Po

where v

is

of the cost information c\.

the weights

we obtain

is

=Pi-c + c.

is

is

1

—

u will in general differ from

optimal conditionally on the total

evaluated at a (conditionally) higher

Access Pricing

10

To assess current practice

Co

in Practice

=

CqQ

+

Fully distributed costs

a)

in allocating

:

=

kQ C\

,

C2 =

and

Ciqi

cq2

The most popular method

.

of pricing access consists

the fixed cost to the firm's products in a mechanistic way. For instance, a

markup above marginal

product's

model, assume that

in the light of the theoretical

= Cqt —,

Po

may be uniform

cost

pi

=

(c x

+

Co)

+

—

This accounting rule generates "excess" revenue ^4°.

:

a

,

=

Cq

4. *ap. 4.

+

—

=

bm.

^

,

that covers the

fixed cost.

It

component

interesting to note that this accounting rule satisfies the efficient

is

pricing rule, as

Px

This of course need not be the case

-

cx

=

a.

Po

where 5

is

=

Co(l

+

6), pi

-

(co

+ ci)(l + S),

There

is

demand and

proper cost,

The

Oftel rule

and

B2 =

long distance, access).

The

co(l

+

S),

a.

is

(a

entry considerations.

:

—

The

idea of the rule

fully distributed costs. Let

arbitrary and has no reason to reflect the

The

access rule designed

Telecom's (BT) network can be sketched as follows

Ci)li,

=

no point dwelling on the conceptual drawbacks of

us just recall that the fixed cost allocation

b)

a

chosen so as to ensure budget balance, yields

Pi-cl >

—

of distributing the fixed

For example, a markup proportional to marginal cost, namely

cost.

A)

methods

for alternative

is

Co)q 2 denote

BT's

AD

"access deficit"

:

by Oftel

Let

B =

for the access to British

(po

profits in its various

is

B\

co)qo,

product

cost of giving access

is

BT's

=

(p\

—

lines (local,

here equal to the fixed cost

to set a usage-based price of access to

Namely the margin above the

—

ko.

local network.

proportional to the access deficit

per unit of BT's output in this activity and to the share of BT's variable profits provided

by this activity. For the long distance

a

-

c

activity,

=

AD

qx

one thus has

B

B + B + B2

x

x

26

:

l')0)

B

Xote that

2

depends on the access price and that

itself

mination of access prices under

fully distributed costs)

(as

is

the case for the deter-

formula (50) involves a fixed point.

In practice (again as in the case of fully distributed costs), the access price

outcome of a dynamic tatonnement, whose path ought

If

the budget

is

balanced (that

is, if

to be studied in

AD = B +Bi+B

2 ),

must be the

more

detail.

the Oftel formula interestingly

reduces to

= pi-ci

a

which

yields

To

there

exactly the "opportunity cost" of

is

under budget balance the

is

is

Oftel formula thus

rule.

usage -and not only cost- based, suppose that

competition not only on the long distance domestic market (goods q x and q 2 ),

but also on the international market (good q$ produced by

competitors).

its

The

in the activity.

component pricing

efficient

see that the access pricing rule

BT

The

BT

and good

q4

produced by

Oftel rule then defines different access prices for competitors, a 2 on

the domestic long distance market and a 4 on the international market despite identical

access costs

15

With obvious

.

a2

~

cO

=

notation,

AD

B

TT

HLoBi

x

aQ d a 4

^TJ

1l

~

<k>

=

AD

B3

93

Ef=0^i'

and so

a4

The markups

The

Oftel rule

is

-

=

Co

-5-7—

n 3 /q3

(51)

•

are thus proportional to BT's unit revenues on the competitive segments.

therefore related to our access pricing formula, in that both are usage-

revenue imposed by competitors on the network provider. The

based and

reflect the loss of

difference

between the Oftel rule and our formula (29)

is

that the unit revenues replace

the superelasticities.

11

Conclusion

In a first best world, access pricing to a

network

(like

any other pricing) should be marginal

cost pricing. In practice the appropriate rule departs

from the

first

best

and depends on

the constraints and on the available instruments.

First, the provision of the

nondistortive

;;;

lump sum

taxes.

For the sake of the argument.

network imposes fixed costs which cannot be financed by

Competitors should then contribute to the fixed cost of

In practice, a

domestic

therefore network costs

may

call

uses two domestic local loops while an

Further, the access price peak load structure can only be coarse, and

differ for the two types of calls if their timing stuctures differ within pricing

international call uses only one.

bands.

27

the network. This contribution, which takes the form of an access price above marginal

cost, reduces either the financial

burden of the regulator

(in

the case of transfers) or the

price distortions associated with the firm's budget constraint.

Second, asymmetric information of the regulator about the firm's costs

may

introduce

other standard distortions, because informational rents must be taken into account

defining proper marginal costs.

may be

Further distortions

desirable

if

when

network and

competitive segment subcosts cannot be disentangled.

When

taxation of the competitive goods

is

feasible, access

can be priced at marginal

cost while taxes contribute to covering the fixed cost. [Note nevertheless that the marginal

cost referred to

firm,

and

is

is

the marginal cost which arises from the optimal regulation of the

in general different

from the

first

best marginal cost because effort

This disconnection of consumer and producer prices

very handy

is

competitive segment can bypass the network.

By

and taxation mandates reduces the

number

price

regulators'

if

consumers on the

contrast, a separation of regulatory

of instruments,

must then arbitrate very imperfectly between the goals of limiting

and participating

pricing rules

to the coverage of fixed costs.

become more and more complex

to use access prices, rather

lower].

is

It is

clear

and the access

inefficient

bypass

more generally that

access

as well as inefficient as the regulator tries

than complementary instruments, in order to meet various

market structure goals such as inducing proper entry or reducing monopoly power

in the

competitive segment or to achieve distributive objectives.

Last,

we have shown that our

analysis can shed substantial fight

on the effectiveness

and of

existing policies

Looking forward, our analysis can be pursued in several directions.

With a proper

component pricing

of policy proposals such as the efficient

rule

such as the Oftel rule for British Telecom.

regulatory model of predatory behavior, one should be able to investigate the conjecture

that access pricing

products.

The

is

a

intuition

more

is

efficient tool to

the following

:

A

prey than the pricing of the competitive

low price

for the competitive

product signals

a high efficiency. This information can be used by the regulator to extract the monopoly's

rent in the future.

On

the other hand, a high access price seems

immune

to ratcheting.

Next, one could substitute to the optimal regulation various types of current regulations (price cap, rate of return)

and analyze how the deviations from optimal regulation

impact on the access pricing formulas (see

for

example the Remark

could even depart from the regulatory context and see

in Section 9).

how competition

One

policy alone would

deal with access pricing. Excessive access prices could be considered as a predatory tool

to

eliminate competition as has been claimed in the

Our framework

AT&T

also enables us to discuss a current

case before divestiture.

debate in Europe. Telecommuni-