GAO Testimony

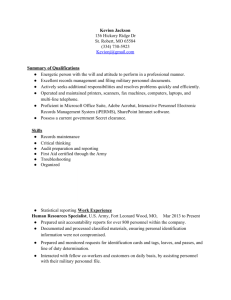

advertisement