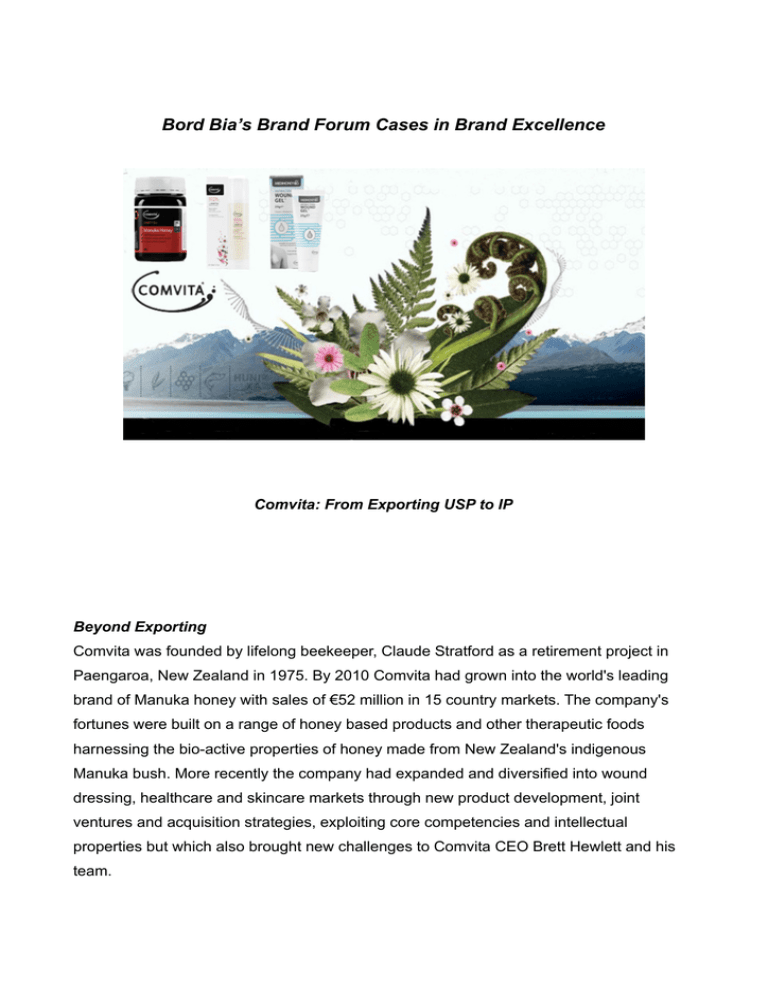

Bord Bia’s Brand Forum Cases in Brand Excellence

advertisement

Bord Bia’s Brand Forum Cases in Brand Excellence Comvita: From Exporting USP to IP Beyond Exporting Comvita was founded by lifelong beekeeper, Claude Stratford as a retirement project in Paengaroa, New Zealand in 1975. By 2010 Comvita had grown into the world's leading brand of Manuka honey with sales of €52 million in 15 country markets. The company's fortunes were built on a range of honey based products and other therapeutic foods harnessing the bio-active properties of honey made from New Zealand's indigenous Manuka bush. More recently the company had expanded and diversified into wound dressing, healthcare and skincare markets through new product development, joint ventures and acquisition strategies, exploiting core competencies and intellectual properties but which also brought new challenges to Comvita CEO Brett Hewlett and his team. Through careful planning and an export orientation, successive management teams had developed the fledgling business into an internationally renowned honey brand. Its many export, innovation and community level awards marked it as a true New Zealand export success story. By 2010, Comvita employed 260 people including 150 personnel in international operations which generated about 80% of total turnover. Its performance was enviable, clocking consistent annual growth of around 15%-20% since the mid-1990's. In fact Hewlett estimated, Comvita's brand premium gave it a critical margin advantage of between 20-50% over its competitors. In Hewlett's opinion, it was the category in which Comvita competed – health and wellness - that was the secret to its success with people investing in their health during the good and bad times in equal measure. Industry commentators attributed Comvita's market leadership not only to good strategic planning but also, proven products, the company's ability to leverage intellectual property proximity to and knowledge of its customer base, constantly pushing itself up the value chain. As Hewlett observed, “You can't run an international business in New Zealand by satellite. You need to be in the market, on the ground. You need your own people who understand the brand and everything behind it, so they can talk to people as directly as possible”. But what made Comvita's success all the more sweet was how it had remained true to its founding vision - caring for the community and producing natural products that work in a way which preserves the environment for generations to come. Pioneering Products In 2011, Comvita produced, marketed and sold a range of about 120 natural health products based on honey, fruit and vegetable extracts, plant and fish oils and colostrum. It competed in a wide range of categories including health foods, health additives, skincare products, beauty, and medical honey. In many of these cases Comvita marketed products to a variety of segments. In addition Comvita marketed several trademark protected products including Medihoney™ and two functional foods Synergy12™ and Hunixa™. While manufacturing the bulk of its products, the company also engaged other New Zealand manufacturers on contract to supply certain products. Stratford's belief in the curative and sustaining powers of Manuka honey was pioneering at the time he co-founded Comvita with 20-something Alan Bougen in the elder man's garage in 1975. In 2011, approaching 101 years of age, Stratford's longevity seemed testament to his convictions. The casual entrepreneur explained that “around the ages of 24-26 I suffered a lot of ill-health....I started producing and consuming bee pollen at that stage and I've been taking it for the last 80 years”. While all honeys contained anti-bacterial properties, the particular bio-active qualities of Manuka honey distinguished it from others. This became central to the company's marketing strategy as management sought to tap into trends for health and wellness both locally and internationally. The problem for Stratford in those early days was the he was ahead of his time, selling health foods when most local people had not even heard of the category. Consequently exporting played a vital role in the company's success from very early on. With a small domestic market, many New Zealand businesses were forced to consider internationalisation an intrinsic part of their growth strategies, pursuing niche positions in global markets. But for Comvita it also helped build credibility, awareness and pull in the home market. Active exporting really took off in the late 1980's and early 1990's when Comvita was launched in the UK, Singapore, Hong Kong, Australia and the USA through a variety of distributors. At that stage in its development it had grown to employ 50 people, based mainly in New Zealand. Fortunately for Comvita, New Zealand's reputation as a 'clean and green' combined with the growing reputation for Manuka honey as a health product acted like a springboard for its export plans while supporting its product's positioning. Conversely transportation costs and an appreciating New Zealand dollar made it difficult for exporters to compete in international markets without a compelling brand proposition that consumers valued. Management at Comvita leveraged those country of origin associations while positioning Manuka honey as an ideal health food, thereby tapping into an emerging trend for health and wellness food products. Growth Through Exporting Soon, however, it became evident that for Comvita to survive as a brand it needed to ramp up scale and international market presence. The company began investing in infrastructure, systems, technology, managerial talent and marketing to help fuel growth. In 1998, Graham Boyd joined as CEO when annual sales were approaching €5million, generated through the sale of Manuka honey based products. Initially the company secured funding from a number of private shareholders to finance the required expansion. Later in 2003 Comvita went public, listing on New Zealand's NZAX stock exchange. With these changes Comvita took steps toward strategic development for the business over the medium term, assessing risks and opportunities in the international arena. Securing a steady supply of its core ingredient, Manuka honey was critical to fuel growth of the brand. The volume and quality of any given commercial honey harvest was prone to fluctuation due to poor weather conditions and the impact of the varroa mite on bee populations among other factors. Consequently Comvita began working with honey farmers to improve the quality and volume of supply through Manuka breeding programmes. While the company continued its stockpiling policy it also agreed forward contracts to ensure a steady flow and predictable pricing. Similarly the company commissioned and conducted scientific research to help substantiate product claims and lay the ground for future research and development initiatives. Overcoming Challenges of Internationalisation By 2002 Comvita's direct exports accounted for about 50% of its €11.5 million turnover and it was evident the organisational structure needed to adapt. Furthermore, since Comvita began actively exporting its products to European and Asian markets, the company had learned many valuable lessons about cultural sensitivities and the need to adapt the distribution channels accordingly. Boyd estimated that a further 25% of company turnover was being exported indirectly by tourists returning home from New Zealand and through third-party enterprises selling abroad independently. This grey market presented headaches for his company's marketing mix and communications strategy. Perhaps more importantly there was the challenge of managing a consistent and coherent marketing message across cultural gaps based not only on language but on values. Impact of Culture As such, Comvita began tailoring its international marketing strategy on a market by market basis. For example, Australia which was then Comvita's biggest export market had mushroomed to about €1.2 million in sales in two years since market entry, a volume and potential that merited more direct support from head office. Similarly in Japan, the company decided to establish its own subsidiary Comvita Japan- the company's first direct market presence – along with a warehouse in Yokohama to support distribution which was focused on mail-order systems primarily; already a popular channel among Japanese consumers. In 2004 Comvita entered the Singaporean and Korean markets via distributors and also penetrated the Chinese market selling its products through a network of some 200 dutyfree shops. It also tested its first ever Comvita-branded shop, opening the store in an upmarket shopping mall in Shenzen city, just across the border from Hong Kong. Meanwhile in Hong Kong, Comvita worked with a local distributor with whom it placed one of its own employees – a Chinese New Zealander – to help build a shared vision for the brand. While Comvita used various distribution channels it tended to focus on the same core attributes irrespective of the market. The company used local Public Relations companies to generate a buzz about the brand and spread the word about forthcoming product launches, emphasising their unique qualities while continuing to exploit the country of origin and natural associations, especially for Asian markets. Additionally, a convergence of eastern and western attitudes with respect to health seemed to support Comvita's positioning. With western cultures coming to appreciate food as medicine and eastern cultures coming round to the beneficial role of technology in medicine and health, Comvita was well placed to ride the trend of health and wellness. Risk Management Increasingly, as the company grew and sought to expand into new market opportunities, risk management became a critical strategic issue. Conscious that it was still wholly dependent on the supply and sale of Manuka honey, Comvita embarked on the acquisition trail in 2003. Not only did it wish to secure supply but management wished to augment its product portfolio in a bid to leverage and develop the Comvita brand. First off it purchased honey producers Bee and Herbal NZ Ltd. and Api-Med, a Waikato University biotechnology start-up focused on honey based medical wound dressings. Acquiring Bee and Herbal would help strengthen the company's purchasing power and reinforce relationships with commercial beekeepers at home. Diversification Meanwhile, the purchase of Api-Med positioned Comvita for entering the $6 billion global medical wounds dressing market with its patented technology for gel-based wound dressings. Ongoing and emerging research indicated that not only did Manuka honey offer significant benefits in dressing wounds but that segments of the medical community were increasingly receptive to the idea of using natural health remedies as substitutes to established products. Comvita had part of the solution but knew time was of the essence to capitalise on the gap in the market. The final parts of the puzzle came later in 2005 Comvita when announced a partnership with a UK business to manufacture the Api-Med style wound dressings in the UK using their technologies. This partnership was vital to penetrating sales with primary healthcare institutions such as the UK's National Health Service for example. Sales were slow to transpire and Comvita realised it would need to identify suitable partners in other regional markets to fast-track product development in light of the complexity and differences in medical products regulatory frameworks. 2005 also marked Boyd's retirement from the CEO position, being replaced by Brett Hewlett. In 2006 Comvita also signed a licensing agreement with US company Derma Sciences for the Americas which expanded into a global license in 2010. Under the licensing agreement, Derma Science would manufacture and market wound dressing products using Comvita's Manuka honey-based technologies. In 2007, as part of its strategy to become the global leader in medical honey, Comvita purchased Medihoney™ from Australian honey brand Capilano. Medihoney™ was the market leader in honey-based wound dressings sold throughout Europe, Australia and New Zealand supported by multiple peer-reviewed journal articles. That same year Comvita re-branded all its ApiMed and Derma Science related business under the trademark Medihoney™. As part of the 2010 global licensing agreement with Derma Sciences, Comvita acquired a 16.7% stake in the medical products company as it expanded sales and marketing into Asia. Together, these and other moves such as the diversification into plant and fish oils and the launch of skincare and beauty product ranges, represented a major shift and broadening of the Comvita brand proposition. But such augmentation brought with it further marketing and communications challenges. Integration Even though Comvita had built a reputation for high-quality and premium priced products in international markets, management found it difficult working through distributors. Using one's own teams on the ground in offshore markets seemed to offer the greatest return on investment. That way, representatives could sell the product according to company objectives and gain first-hand market knowledge to feed back into the company's decision making processes. In 2005 export sales to Australia, Japan, Hong Kong and the UK accounted for 60% of turnover, with the UK accounting for a significant portion of those sales or about €3.2 million. It seemed the time was right to flex some muscle as Comvita acquired its UK distributor. It eventually also bought back the rights from its Hong Kong distribution partners in 2009. Around that time in Hong Kong Comvita began rolling out its tried and tested direct sales presence model, opening 5 stand alone Comvita stores in key locations and over 40 in-store shops such that by 2010 after 7 years competing in the regional market, Comvita had expanded to over 300 Comvita branded outlets in more than 40 cities across China, Hong Kong and Taiwan. Subsequently it launched the concept of Comvita retail stores in the United Kingdom. Commenting on the move, Hewlett explained “controlling our route to market and getting closer to our consumers has provided us with a distinct ongoing business advantage....It can also allow us immediate distribution of new products and continuous real-time market feedback.” In an interview in 2010 Hewlett was keen to distinguish Comvita from the typical exporter model, “we like to think we're not just an export company but an international company because we do some of our product manufacturing in Australia and we own much of our own channel and route to market”. Intellectual Property Conversely such moves created as many challenges as opportunities, requiring the company to develop in-house expertise in Intellectual Property (IP) protection, patenting and patent law. Until that point, the company had been rather reactionary in safeguarding trademarks, product formulations and brands that it had developed, but the Api-Med acquisition transformed management's understanding of the company's value proposition in this new market. This new bio-technology driven intellectual property required the company to be proactive in asserting its first-mover position. It also catalysed further scientific research into the benefits of Manuka honey – critical for marketing medicinal and functional food products. But the value of IP protection extended beyond Comvita's technologies and brand as well. In 2006 Comvita moved to register Manuka as a trademark in Europe in order to protect the name on behalf of New Zealand Manuka honey farmers for example, thereby safeguarding its own interests as well. The move was made in response to threats from me-too style brands piggybacking on the Manuka name. In ways, the company led by Hewlett in 2010 was remarkably different from that founded by Stratford 35 years previously. Over that time Comvita had grown as a business, and internationalised successfully. Through careful management of the corporate brand and the company's resources, specifically its supply chain and its expanding portfolio of intellectual property, Comvita had effectively transformed itself into a leader in health and wellness, marketing functional foods, beauty care and medicinal products. It had, nevertheless, remained true to its New Zealand roots and its original corporate mission. In light of the company's new ownership structure, expert opinion was divided as to the whether the combination of these advantages would be enough to outpace new entrants in the highly competitive regional markets and emerging product markets like wounds dressings, while continuing to deliver the returns investors might expect of a market leader like Comvita. For Hewlett, at least, he was confident Comvita was in good stead for continued growth and success over medium term. Key Learnings For Irish Brands 1. Intellectual Property (IP) is an invaluable part of the brand and should be protected. It is a broad concept encompassing a product's functionality, product branding and scientifically proven efficacy as well as new commercial applications. 2. Risk management becomes increasingly important as a brand grows and people come to trust in it. Comvita invested in various aspects of its business network, operations and communications to mitigate potential risks to continued sales growth and brand equity. 3. Often, cultural sensitivities and market adaptations can be keys to international success as demonstrated by Comvita's customisation of entry strategies and routes to market in places such as China, Japan and the UK. 4. All boats float on a rising tide and Comvita will reap longer-term benefits by investing in its suppliers and in protecting the Manuka name from copyright infringement in Europe, for example. 5. The different stages of growth over business life demand different skills, competencies and management resources and Comvita's strategy and structure has changed accordingly as it shifted from exporting to international organisation. 6. Growth and business transformation require investment and commitment of resources and energies from management and stakeholders. Furthermore, Comvita leveraged acquisitions and mergers well on the basis of good-fit with the core and original founding philosophy. Annexes Annex 1: Excerpts from Comvita Website Annex 2: Comvita Online Shop Annex 3: Selection of Comvita Products Range