Life Point Hospitals, Inc. (LPNT) Matt Titus

advertisement

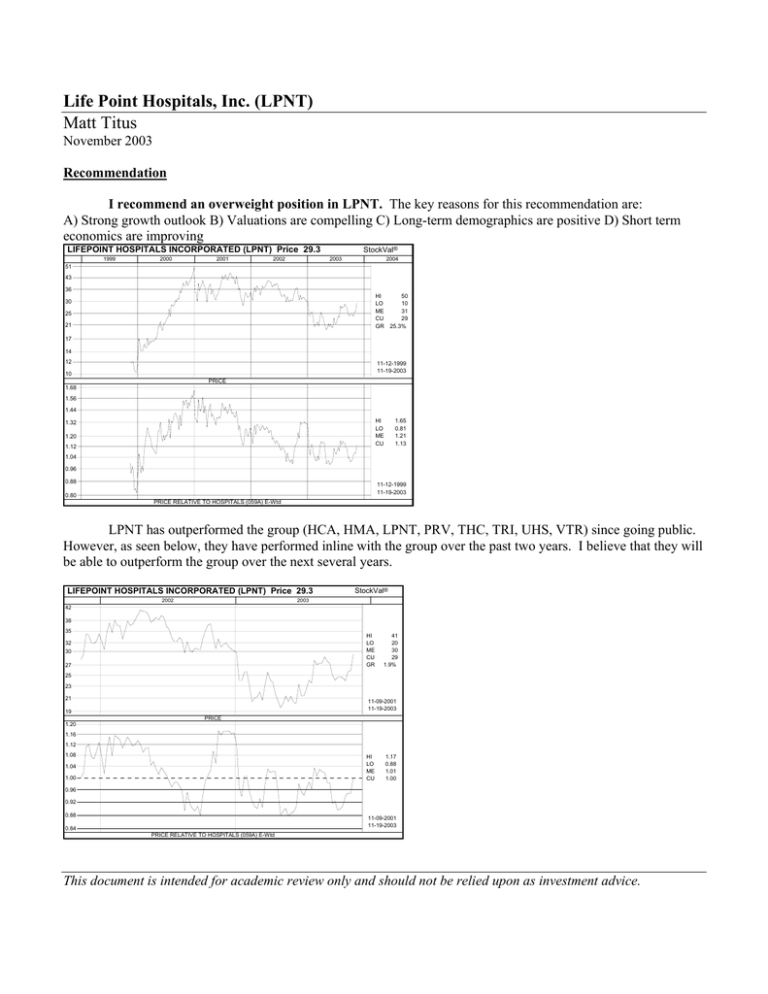

Life Point Hospitals, Inc. (LPNT) Matt Titus November 2003 Recommendation I recommend an overweight position in LPNT. The key reasons for this recommendation are: A) Strong growth outlook B) Valuations are compelling C) Long-term demographics are positive D) Short term economics are improving StockVal® LIFEPOINT HOSPITALS INCORPORATED (LPNT) Price 29.3 1999 2000 2001 2002 2003 2004 51 43 36 HI LO ME CU GR 30 25 21 50 10 31 29 25.3% 17 14 12 11-12-1999 11-19-2003 10 PRICE 1.68 1.56 1.44 HI LO ME CU 1.32 1.20 1.12 1.65 0.81 1.21 1.13 1.04 0.96 0.88 11-12-1999 11-19-2003 0.80 PRICE RELATIVE TO HOSPITALS (059A) E-Wtd LPNT has outperformed the group (HCA, HMA, LPNT, PRV, THC, TRI, UHS, VTR) since going public. However, as seen below, they have performed inline with the group over the past two years. I believe that they will be able to outperform the group over the next several years. LIFEPOINT HOSPITALS INCORPORATED (LPNT) Price 29.3 2002 StockVal® 2003 42 38 35 HI LO ME CU GR 32 30 27 41 20 30 29 1.9% 25 23 21 11-09-2001 11-19-2003 19 PRICE 1.20 1.16 1.12 1.08 HI LO ME CU 1.04 1.00 1.17 0.88 1.01 1.00 0.96 0.92 0.88 11-09-2001 11-19-2003 0.84 PRICE RELATIVE TO HOSPITALS (059A) E-Wtd This document is intended for academic review only and should not be relied upon as investment advice. LPNT outperformed the S&P 500 in 1999 and 2000, then was a good defensive name in 2001 and 2002, but has under performed by seventeen percent so far in 2003. StockVal® LIFEPOINT HOSPITALS INCORPORATED (LPNT) Price 29.3 1999 2000 2001 2002 2003 2004 52 40 32 HI LO ME CU GR 26 20 16 50• 8 30 29 28.3% 12 10 8 05-07-1999 11-19-2003 6 PRICE 5.8 4.6 3.6 HI LO ME CU 2.8 2.2 1.6 5.61 • 0.77 3.55 3.73 1.2 1.0 0.8 05-07-1999 11-19-2003 0.6 PRICE RELATIVE TO S&P 500 COMPOSITE ADJUSTED (SP5A) M-Wtd I anticipate that the group will remain mainly a defensive sector over the next several years; however, owing to several positive fundamental and demographic elements, I think that the hospital group will make a solid holding. LPNT will be especially good since I believe that their higher-than-group average growth rate will help them outperform the defensive nature of the group in up years and their conservative balance sheet will allow them to remain a good defensive player in down years. Growth Catalysts LPNT will be able to grow earnings in three ways over the next several years. First, as the economic condition if the United States improves, utilization of health care will also improve. Coupled with positive demographic changes in the U.S. population, utilization will increase even in the face of increasing cost shifting to the consumers in the form of higher co-pays and deductibles. I will cover this in more detail in the economic section of this piece. LPNT, as a rural hospital also stands to gain significantly if the proposed changes in the Medicare Drug Benefit Bill are passed, which has passed the House but has not been voted on in the Senate. Whether a hospital chain is predominantly urban or rural is relevant for several reasons. Currently rural Medicare reimbursements are lower than urban. The Medicare bill may include: increases to rural providers due to a reversal of the cost differential status between rural and urban providers, an increase to rural hospital that treat a disproportionate share of low income individuals, lowering the labor cost portion of the reimbursement which is currently a positive for urban facilities, including a new low-volume adjustment if a facility is the only one in a fifteen mile radius and has low volumes, and including a full market basket increase through 2007. LPNT management has stated that they are ready to start growing through acquisition again. LPNT only needs to make one or two $50 million dollar acquisitions in the next 12 months to grow their top line around 10%. LPNT management has commented that this is what they plan to do. If they can grow the top line around 10% just through acquisitions and experience improved demographics LPNT will be able to produce earnings growth ahead of expectations. 2 Price Target I used a dividend discount model and valuation metrics to determine a target price for LPNT. In my model, I used an ROE of 17%. This is lower than the current ROE of 20%, which is an all-time high for LPNT. I wanted to use a more conservative ROE since when LPNT starts acquiring again; new facilities will initially bring down LPNT’s ROE. I used the consensus growth rate of 15%. Any growth above this, which I believe is possible, will lead to an even higher target price. ROE Growth Book Value Payout Rate Risk Free 17% 15% 1 35% 5% Multiple 4.32 BV 8.91 TGT 38.47 The DDM produced a target price of $38.47. This gives a 31% upside to the closing price on 11/20/2003. I will cover valuation metrics in more detail later on, but if LPNT returns to their mean Price to Book valuation of 4.5 their target price would be $40. If LPNT returns to their mean forward price to earnings valuation, that would give a target price of around $44.50. There is significant upside in the stock even if you take the conservative target of $40. Company Overview Source: S&P Corporate Records LifePoint Hospitals, Inc. (LPNT) operates 21 general, acute care hospitals located in non-urban areas with an average population of approximately 27,000 (based on 1999 data) in Alabama, Florida, Kansas, Kentucky, Tennessee, Utah and Wyoming. In 20 of the company's 21 markets, LPNT's hospital is the only hospital in the community. Approximately half of LifePoint's facilities are located in Kentucky and Tennessee. Many of the company's hospitals are located in states that have certificate of need laws, which laws may have the effect of limiting the development of competing facilities. LPNT's hospitals usually provide the range of medical and surgical services commonly available in hospitals in non-urban markets. These hospitals also provide diagnostic and emergency services, as well as outpatient and ancillary services such as outpatient surgery, laboratory, radiology, respiratory therapy and physical therapy. During 2000, LPNT sold Springhill Medical Center, Barrow Medical Center, Trinity Hospital and Halstead Hospital to community-focused buyers. In addition, it sold Riverview Medical Center to one of the largest acute care hospitals in Baton Rouge, Louisiana. These sales allowed the company to pay down existing borrowings under its credit facility, reinvest in existing markets and provide funds for future acquisitions. EMPLOYEES- January 31, 2001, 4,890 Full Time; 1,560 Part Time. 3 Sustained Competitive Advantage When thinking about the sustained competitive advantage of LPNT, you need to consider it on an urban versus rural basis and a for-profit versus a not-for-profit basis. An advantage LPNT has, as a rural company, is less competition from specialty hospitals. Specialty hospitals focus on specific, generally higher profit types of procedures, such as orthopedic or cardiology procedures. The concern is they are taking dollars from hospitals that provide emergency and charitable services. Some (≈70%) of them are physician owned, causing a potential conflict of interest as well. According to the GAO, there are around 100 of them in 28 states, but around two-thirds of them are in Arizona, California (11), Kansas (8), Louisiana, Oklahoma (9), South Dakota (7), and Texas (20). Around sixty percent of the specialty hospitals under development are located in California, Louisiana, and Texas. These hospitals tend (≈83%) to locate in states without CON laws, and approximately eight-five percent are in urban areas. Although in 2001, specialty hospitals only accounted for 1% of Medicare’s inpatient expenditures, two-thirds of which was in cardiac hospitals, they are growing rapidly. Specialty hospital’s Medicare inpatient margin is two hundred and twenty basis points lower than for-profit general hospitals, but is still one hundred and seventy basis points lower when considering all payor types. Twenty-five specialty hospitals are expected to open within the next year. I believe that specialty hospitals will continue to be a source of competition for urban facilities unless government action, as proposed in the current Medicare Drug Benefit Bill. Even if a form of relief is passed, any existing facilities will be grandfathered in. The other competitive advantage that LPNT and all public hospitals have is the ability to take share from the not-for-profits. By having access to the equity markets, LPNT is able to bring extensive capital resources to bear when purchasing and then upgrading a facility. Not only does this allow them to increase earnings from operating efficiencies, they are also able to bring new product offerings, such as cardiac specialists and advanced imaging to that market. This allows them to take share from other hospitals that do not have these resources. Economic Analysis The state of the economy affects hospitals on several fronts. In a weak economy, unemployment will be higher which will reduce the number of corporate insured and increase uninsured and government insured. A weak economy may also reduce utilization trends for elective care. Below are some recent highlights from the U.S. census bureau: Insurance Coverage: The U.S. Census Bureau recently stated for 2002: • The number of uninsured increased by 2.4m in 2002 as compared to 2001, which is 15.2% of the total population compared to 14.6%. Unemployment has increased 30bp from 5.8 to 6.1%. • The percentage of people with employment-based health insurance dropped from 62.6% to 61.3% in 2002. • The percentage of people covered by the government rose from 25.3% to 25.7% mainly due to an increase in Medicaid coverage (from 11.2% to 11.6) For the population between 18 and 64 years old, 82% of workers had insurance and 74.3% of non-workers had insurance. • 99.2% of those 65 and over have coverage due to Medicare • 74.7% of people without health coverage were covered again within a year. 4 Also from the U.S. Census Bureau for 48 month study between 1996-1999: • During the study, Hispanics were the most likely to go without coverage for at least one month (40.6%) as compared to Whites (14.6%) and Blacks (28.8%). • Suburban individuals (72.6%) were the most likely to have continuous coverage as compared to rural (64.7%), and city (62.2%). • The median spell without coverage was 5.6 months. A continuing weak employment situation will still be a headwind for organic growth in the space in the short term. There is a lag between improvements in the labor market and improvements in hospital utilization. On a secular basis, there will definitely be an increase in demand as baby boomers began to utilize more care. The following graph shows cross sections of the U.S. population as of July 1. 2000. According to the U.S census bureau, the over-65 age group has been growing at slightly less than 1% per year. They estimate that this will increase to a growth rate of around 2% by 2007. This suggests that the latter part of the decade should bring strong growth in admissions. Although I do think that LPNT will make a good long term holding based on the demographics, hospitals in general are still a defensive group and may under perform other areas of the market, such as technology and cyclicals. However knowing this, may lend the ability to opportunely buy LPNT on any weakness in the group due to asset rotation. 5 Facility Capacity Inpatient Days per Bed 6000 80.0% 5500 70.0% 5000 60.0% 4500 50.0% 1975198119851989199319972001 Number of Hospitals Capacity Utilization days Total Hospital Capacity 285.0 4.0% 275.0 2.0% 265.0 0.0% 255.0 -2.0% 245.0 -4.0% 235.0 -6.0% 225.0 215.0 -8.0% 1975198119851989199319972001 Inpatient days per bed Percent Change Source: American Hospital Association We have seen a long decline in the number of hospitals and a bottoming out and turnaround in capacity utilization. I do not think that we will see an increase in the number of hospitals because today’s environment still provides a large number of not-for-profit facilities that would be cheaper to buy rather than build. However, on the outpatient side I would expect to see strong growth in non-CON states unless there is action by congress. A CON state is a state where a Certificate of Need must be filed in order to add new facilities. Government Budgeting Government reimbursement rates can have a dramatic affect on this group. The group was more than cut in half following the BBA on ’98 and the cuts to Medicare. I do not anticipate this happening, but if the deficit continues to worsen this is not a group that you would want to hold when the red ink comes out. However, all else being equal, this may be a good group to get into after any balanced budget initiative on the premise that Medicare funding would return to a normal rate of increase. One issue that may arise in a few years is a cut in reimbursement rates if the drug benefit bill costs too much. 6 Key Markets I have included state population statistics. One risk to LPNT is that it derives a lot of revenue from Tennessee and Kentucky. And although Tennessee is growing, this leaves them open to risks due to economic changes in these states. Percentage Population Change, 1990-2000 Source: U.S. Census Bureau This graph shows population percentage changes through the nineties. Growth was good in the South and West, and was best in the Mountain States. The national average was 13.1%, but the median was just under 10%. Growth rates can very dramatically by county in a state as well. Unemployment is obviously another key factor and I have included state unemployment statistics in the following table. If one wants to play the group as a defensive idea, then one may want to look for companies that have lower unemployment in their markets. Or if one wants to play a cyclical rebound, then look for states that have higher unemployment in fast growing states. 7 Census Population Percent 65 Median % Below Unemployment April 1, 2000 Change & Older Income Poverty 33,871,648 13.8 10.6 47.5 14.2 6.4 20,851,820 22.8 9.9 39.9 15.4 6.5 18,976,457 5.5 12.9 43.3 14.6 6.4 15,982,378 23.5 38.8 12.5 5.2 17.6 12,419,293 8.6 12.1 46.5 7.1 10.7 12,281,054 3.4 15.6 40.1 11 5.3 11,353,140 4.7 13.3 40.9 10.6 5.8 5,740,021 16.7 12.4 36.3 13.5 5.5 4,041,769 9.7 12.5 33.6 15.8 5.5 8,186,453 26.4 9.6 42.4 13 4.4 5,130,632 40.0 13 40.5 13.9 5.6 4,301,261 30.6 9.7 47.2 5.6 9.3 2,233,169 29.6 8.5 45.7 5.1 9.4 1,998,257 66.3 11 44.5 5.2 10.5 281,421,906 13.2 12.4 41.9 12.4 6 * U.S. DOL Sept. 2003 Source: U.S. Census Bureau, Census 2000 Redistricting Data (P.L. 94-171) Summary File and 1990 Census. Area California Texas New York Florida Illinois Pennsylvania Ohio Tennessee Kentucky Georgia Arizona Colorado Utah Nevada United States This chart highlights the largest states, the fastest growing states, and LPNT’s key states of Kentucky and Tennessee. Some critique LPNT for Kentucky and Tennessee’s income and poverty levels, but unemployment is low in both states and Tennessee is growing faster than the national average. Utilization Trends Average Same Store Admissions CYH, HCA, HMA, LPNT, TRI 7.0% 6.0% 6.0% 5.2% 5.0% 4.1% 3.7% 4.0% 3.5% 2.6% 3.0% 1.9% 2.0% 0.9% 1.0% 0.7% 1.1% 6/03 9/03 0.0% -1.0% -0.8% -2.0% 3/01 6/01 9/01 12/01 3/02 6/02 9/02 12/02 3/03 Source: Company reports. Source: Bear Stearns Many investors focus on the short-term quarterly changes in admission rates but do not focus on the longterm trends. The next chart shows the secular trend in admissions. Understanding that positive long-term trends are in place, one may want to purchase LPNT on any group weakness due to short-term fluctuations. 8 Admissions (in thousands) 37,000 36,000 35,000 34,000 33,000 32,000 31,000 30,000 29,000 28,000 27,000 1979 1981 1983 1985 1987 1989 1991 1993 1995 1997 1999 2001 Source: Bear Stearns The next graph shows outpatient utilization. Although growing at a decreasing rate, due to the advent of managed care products, outpatient admissions are still growing. Due to growth in the U.S. population and demographic shifts, I think that outpatient utilization is likely to increase form present levels. in millions Outpatient Visits 600 500 400 300 200 100 0 10.0% 8.0% 6.0% 4.0% 2.0% 0.0% -2.0% 1975 1981 1985 1989 Total Outpatient Visits 1993 1997 2001 Growth in Outpatient Visits Source: American Hospital Association millions per year Inpatient v. Outpatient 610.0 510.0 410.0 310.0 210.0 110.0 10.0 1975 1981 1985 1989 Inpatient Admissions 1993 1997 Outpatient Visits Source: American Hospital Association 9 2001 The group will start running into easier comps in 1Q’04. Coupled with improvement in the employment situation, this could provide for upside in earnings and multiples. To the extent that costs in the form of increased co-pays and deductibles continue to shift costs to individuals, this will be a negative drag on utilization. The final round of the Hewitt data suggests that co-pays will be up again in 2004. I have attached a summary following this report. Pricing Trends Pricing Expectations by Payor Category for the next 2-3 years. Medicare: 2-3% (for 2004, full market basket less program structural changes) Medicaid: 0% (varies by state) Managed Care: 5-8% Self Pay and Other: 0% Source: Bear Stearns October Hospital PPI for all payors came it at 5.8%, which is down from recent highs but still nearly twice the average rate. Hospital CPI, which is for self-pay and managed care, came in slightly higher at 6.0% for inpatient and 6.8% for outpatient, but continues to decelerate. Medicare pricing serves as a floor for all of hospital pricing. Since so many hospitals are not-for-profit and so many are losing money, it is politically difficult for Medicare rates to be held too much lower than a 2-3% increase every year. Managed care rates are also very important. The managed care companies are in a more mature industry and the large national players have a fair degree of pricing power. Another advantage of the rural hospitals is that many of their facilities are the sole facility in the community. This helps even out the pricing power between the hospital company and the managed care company. Malpractice Insurance As of March 2003, medical liability expenses have doubled for nearly half of the hospitals in crisis states costing as much as $11,435 per staffed bed in crisis states compared with $4,228 per staffed bed in reform states. Crisis states as identified by the American Medical Association as of March 2003 are: Pennsylvania, West Virginia, Nevada, Mississippi, Washington, Oregon, Texas, Arkansas, Missouri, Georgia, Florida, Illinois, North Carolina, Kentucky, Ohio, New York, Connecticut and New Jersey. Over the past two years rates have increased 158% in crisis states, 104% in other non-reform states, and 74% in reform states. Reform states are CA, CO, IN, and WI. Acquisitions The group tends to pay somewhere around .8x-1.2x annual revenues for a facility. They see large not-for-profits as net sellers at this time. Generally, all of the companies look at each facility that is available, which average around $40-$60m on the rural side. Other Cap X/ LTM Rev. Community Health HCA Health Management LifePoint Triad Hospitals Average 12/01 4.9% 7.6% 4.0% 5.8% 7.5% 6.0% 3/02 4.5% 8.0% 3.7% 5.6% 7.9% 6.0% 6/02 4.9% 8.6% 4.1% 5.9% 8.3% 6.4% 9/02 4.8% 8.6% 5.1% 7.0% 9.0% 6.9% 12/02 4.7% 8.7% 5.4% 8.2% 8.4% 7.1% 3/03 5.1% 9.0% 5.9% 8.7% 7.7% 7.3% 6/03 4.9% 8.7% 6.3% 8.7% 7.2% 7.2% PRV, UHS, and THC spent 6.6%, 5.7%, and 6.3% of revenue on cap-x on a LTM basis. 10 Recent studies by BCBS and the GAO have shown that increased technology, such as adding cardiac services, increases utilization and spending. At the same time, increased technology can increase efficiencies and reduce cost by shortening length of stay. Spending on new technology and procedures will bring more patients into public facilities in comparison to others. Doctor Retention: One main risk of the smaller companies is their ability to attract and retain doctors. If you only own a relatively small number of hospitals, retention problems at one facility can have a noticeable impact to the top line. It will affect recruiting costs, as those doctors need to be replaced. It will also affect revenues, revenue mix, and bad debt as the old doctor takes the “good” patients who have insurance and the new doctor initially has a larger percentage of Medicaid and self-pay patients. Some of the small companies have traded down quite hard on these problems and have subsequently rebounded. If we see a blow-up of this type, it may provide a good entrance opportunity all things else held equal. Industry Analysis The hospital industry is still in the early stages of its life cycle. The public companies only own 11% of the hospitals in the country. I have included a market share breakdown below. # of Hospitals 185 114 47 49 72 25 28 20 Market Share 3.8% 2.3% 1.0% 1.0% 1.5% 0.5% 0.6% 0.4% Total Public Hospitals Total Non-Public Hospitals 540 4,368 11.0% 89.0% Total Urban Hospitals Total Rural Hospitals 2,741 2,167 55.8% 44.2% Company HCA Tenet Healthcare Corp. Health Management Associates Triad Hospitals, Inc. Community Health Systems Universal Health Services Lifepoint Hospitals, Inc. Province Healthcare Company Total Community Hospitals 4,908 100.0% Source: Company reports; "Hospital Statistics", American Hospital Association. Source: Bear Stearns Bear Stearns also estimates that roughly one third of not-for profit-hospitals are losing money as well. This leaves ample opportunities for LPNT to make acquisitions at a reasonable price. It will also help industry wide utilization rates and the total number of hospitals continues to decline. Another interesting point about the industry is that since it is so young, many of the players do not directly compete against each other. LPNT, for instance is the sole hospital in 20 out of 21 of their markets. I think that the management teams of these companies realize that it is far easier to grow their business by acquiring not-for-profits and taking share from not-for-profits rather than competing head to head against another public facility. 11 Company Management LPNT is unfortunately on their third CEO in the last few years due to untimely deaths of the previous two. This leaves an experience lag at the top of the company and might help explain the depressed P/E ratio. I have met the CEO and CFO and they come across a little less sophisticated than some of the other hospital management teams. However, when I met with them, after debt write-offs by TRI and THC in the third quarter, they seemed to have a good handle on their own bad debt expenses. They do not use retroactive experience based reserving, but make estimates as they see changes in their book of business. They cited the specific example of an increase in selfpayors in the third quarter. LPNT immediately wrote-off the above trend revenue from this payor source. This helps me to be less concerned about the receivables on the balance sheet at LPNT. Earnings: More than consensus growth? LPNT earnings have been revised down this year due to weak economic conditions and the recent restructuring. Although the stock has moved up this year, I do not believe that current consensus includes an economic rebound, the benefits of the Medicare drug bill, and future acquisitions. I would expect 2004 estimates to be revised up by within the next quarter or two. First Call FY1 & FY2 Revision Trend StockVal® LIFEPOINT HOSPITALS INCORPORATED (LPNT) 0% 1.73 1.73 FY1 DEC 2003 CURRENT EST 1.62 DOWN 6.36% FROM NOV 2002 1.73 1.72 1.72 1.72 -3% -6% 1.62 1.59 -9% 1.58 1.59 1.57 1.58 1.59 -12% 0% 11/02 12/02 2.11 2.11 1/03 2/03 3/03 4/03 5/03 6/03 7/03 8/03 9/03 10/03 LAST FY2 DEC 2004 CURRENT EST 1.84 DOWN 12.80% FROM NOV 2002 2.07 -4% 2.06 2.05 2.05 -8% -12% 1.86 1.84 1.83 1.83 1.83 1.83 1.84 6/03 7/03 8/03 9/03 10/03 LAST -16% 11/02 12/02 1/03 2/03 3/03 4/03 5/03 Risks/Concerns Some of the main risks of investing in LPNT include: 1) Management turnover 2) Reliant on Medicare 12 3) 4) 5) 6) 7) 8) Derives a large portion of revenue form two states Open to malpractice litigation Must maintain good physician relationships Must be able to efficiently acquire new facilities Continued cost shifting to individuals Economic and employment weakness Financials This first topic I would like to cover on the financial statements is the hot topic of late: bad debt expense. Revenue Mix/Bad Debt Revenue Mix & Current Bad Debt HCA THC Medicare 28.0 Medicaid 6.0 Managed Care 42.0 Self Pay & Other 24.0 Bad Debt % of Rev. 8.9 8.5 HMA 38.0 9.0 45.0 9.0 TRI 32.0 5.2 39.3 23.5 CYH 31.7 12.2 18.8 37.3 UHS 42 PRV 38 11.4 39 19 LPNT 34.8 15.9 38.6 10.7 7.3 8.6 9.4 7.3 8.6 8.9 50.6 AVG 30.5 17.0 52.5 8.6* * 50bp higher than last Q There are a few factors that contribute to bad debt and the subsequent “surprises”. First, on the front end, the mix of business adds a great deal. Self-pay and self-insured will have a much higher level of uncollectibles, but they are also billed at the top-rate. As co-pays and deductibles continue to increase, uncollectible amounts for insured will also rise. Revenue mix can also affect the multiple. Some analysts frown on Medicare and Medicaid business because of its lower margins and political overhangs. However, looking at LPNT for an example, if they also have lower level self-pay and self-insured, they should not be penalized. LPNT is able to get a lower level of self-pay because in some of their states they can register an eligible individual for Medicaid after the individual receives treatment. This allows them to move that revenue for self-pay to government and collect on it. The front end is also affected by the rate of price increases. If a company is more aggressive on pricing, they will most likely need to increase their reserves or eventually take a “surprise”. On the back end, there are two methodologies used to reserve for bad debt. Five of the companies, including LPNT, use experience-based reserving, meaning they estimate bad debt by each specific payor allowing for a more flexible approach but is subject to management “tweaking”. HMA, PRV, and UHS use actual trailing bad debt. HMA and PRV write off everything after 150 days and UHS ranges from 120 to 180 days. This method takes out management discretion, but the lag may lead to under reserving in rising revenue periods. In the recent past HCA, TRI and THC have been raising prices the most and LPNT, PRV, and HMA have been more conservative. I have attached a report covering this topic. 13 Receivables and Turn Receivables as a Percentage of Revenue 12 Mos. 09-03 2002 2001 HCA 13.8% 14.1% 14.0% THC 23.1% 19.2% HMA 20.6% 20.1% 20.2% TRI 14.3% 14.3% 16.7% CYH 18.8% 18.2% 21.9% UHS 13.7% 14.6% 14.7% LPNT 11.7% 11.4% 9.2% PRV 14.9% 16.7% 20.7% AVG (EWTD) 2000 14.4% 21.1% 23.6% 13.8% 23.2% 16.8% 7.5% 19.0% 1999 12.3% 23.9% 25.0% 11.3% 21.0% 15.1% 9.1% 25.6% 1998 12.0% 23.9% 21.4% 14.9% 19.7% 13.7% 7.3% 21.5% 1997 16.2% 21.3% 14.8% 12.5% 18.1% 0.15 0.16 0.17 0.17 0.18 0.17 0.17 48.5 50.0 68.5 73.1 42.2 73.3 51.1 29.0 68.4 48.8 79.9 82.3 47.5 73.2 55.7 29.0 69.2 47.1 85.2 78.4 53.2 66.8 50.4 29.4 73.8 51.8 78.8 60.3 58.9 69.4 50.4 42.5 32.8 62.8 41.2 57.5 57.0 60.7 60.5 54.8 55.5 Receivable Turn HCA THC HMA TRI CYH UHS LPNT PRV 70.0 49.2 61.4 49.4 36.3 56.9 49.0 81.3 67.3 49.2 63.9 50.0 34.8 58.9 AVG (EWTD) 53.1 56.8 In an environment where costs are shifting to the individual and bad debts are rising, it would make sense to be cognizant of the potential downside due to receivable write-offs. We have seen a few of these already, and they may continue. LPNT has the lowest level of receivables as a percentage of assets. LPNT also stands out as the lowest on receivable turn as well. As stated above, a company’s level of receivables and potential for increasing bad debt expense and/or increasing allowances, is a function not only of the overall economic environment, but of the mix of self-pay and self-insured individuals as well. 14 Income Statement Company Explorer - Income Statement - Latest Twelve Months 24-Nov-03 COMPUSTA T LIFEPOINT HOSPITALS INC LPNT 53219L10 Summary - Millions NET SALES Sales Growth Cost of Goods Sold* Gross Margin EBITDA EBITDA Growth EBITDA Margin EBIT EBIT Margin Interest Expense PRETAX INCOME NET INCOME before Extraordinary Items Net Income Growth Net Margin EPS Diluted, before Extraordinary Items EPS Growth EPS Diluted, from Operations Operating EPS Growth 9/03 871.7 23.5 662.7 24.0 170.1 15.5 19.5 126.8 14.5 13.3 113.5 6/03 826.6 22.8 630.2 23.8 166.9 22.5 20.2 125.5 15.2 13.0 108.3 3/03 782.9 21.1 592.0 24.4 162.3 25.1 20.7 122.6 15.7 12.5 80.9 12/02 743.6 20.1 558.6 24.9 158.0 30.6 21.2 120.1 16.2 13.3 76.3 9/02 706.0 18.1 550.4 22.0 147.3 28.0 20.9 109.4 15.5 13.8 65.1 6/02 673.0 13.4 542.4 19.4 136.3 20.8 20.3 99.1 14.7 14.8 58.0 3/02 646.7 12.4 537.3 16.9 129.7 21.6 20.1 93.7 14.5 15.7 76.7 12/01 619.4 11.2 533.1 13.9 121.0 22.6 19.5 86.3 13.9 18.1 68.7 67.0 95.9 7.7 63.5 119.0 7.7 45.7 14.2 5.8 41.7 19.5 5.6 34.2 14.0 4.8 29.0 6.2 4.3 40.0 77.8 6.2 34.9 95.0 5.6 1.72 93.3 1.54 9.7 1.63 114.5 1.53 28.2 1.16 10.5 1.48 39.9 1.07 13.8 1.40 56.5 0.89 7.2 1.40 83.3 0.76 -1.3 1.19 73.5 1.05 59.1 1.05 67.9 0.94 74.1 0.89 74.2 Net Income Adjusted ** EPS Adjusted ** 67.0 1.54 67.7 1.56 74.9 1.71 72.2 1.64 64.7 1.68 55.3 1.43 41.3 1.07 34.4 0.90 Total Shares Outstanding Diluted Shares 38.4 43.4 38.7 43.3 39.6 43.9 39.6 44.0 39.5 38.6 39.5 38.7 39.4 38.5 39.3 38.4 * Depreciation and Amortization Expense is included in Cost of Goods Sold ** Net Income before Extraordinary Items adjusted for Nonrecurring Pretax Expense (Income) What should be noted about the income statement is the strong growth in revenues coupled with consistent EBITDA margins, which has led to very good earnings growth. 15 Balance Sheet Balance Sheet StockVal ® LIFEPOINT HOSPITALS INCORPORATED (LPNT) FYE Dec 2002 % Chg 2001 % Chg 2000 % Chg 1999 % Chg 1998 Cash & Equivalents ($ Mil) 23.0 -60 57.2 44 39.7 218 12.5 Accounts Receivable 85.0 50 56.7 13 50.0 7 46.7 28 36.4 Inventories 20.5 26 16.3 17 13.9 -3 14.3 2 14.0 Other Current Assets 14.8 -21 18.7 -16 22.2 -14 25.9 39 18.6 0.0 Total Current Assets 143.3 -4 148.9 18 125.8 27 99.4 44 69.0 Plant & Equipment Gross 610.2 12 543.3 9 499.9 1 492.8 11 442.6 Accumulated Depreciation 238.0 16 204.9 12 183.4 -8 198.4 13 176.2 Plant & Equipment Net 372.2 10 338.4 7 316.5 8 294.4 11 266.4 Other Long-Term Assets 218.0 225 67.0 24 54.0 103 26.6 36 19.6 590.2 46 405.4 9 370.5 15 321.0 12 286.0 733.5 32 554.3 12 496.3 18 420.4 18 355.0 28.5 50 19.0 18 71 15.5 4 26.6 42.1 Total Long-Term Assets Total Assets Accounts Payable Short-Term Debt Other Current Liabilities Total Current Liabilities Long-Term Debt Deferred Income Taxes 0.0 46.9 0.0 -1 47.2 42 16.1 -39 26.5 11.1 258 3.1 33.2 20 27.6 0.0 75.4 14 66.2 10 60.4 6 57.2 36 250.0 67 150.0 -46 278.3 8 257.1 9999 0.3 24.9 19 21.0 38 15.2 22 12.5 -41 21.3 25.6 51 16.9 80 9.4 176 3.4 -98 167.7 Total Long-Term Liabilities 300.5 60 187.9 -38 302.9 11 273.0 44 189.3 Total Liabilities 375.9 48 254.1 -30 363.3 10 330.2 43 231.4 5.2 13 4.6 2 4.5 -8 4.9 Other Long-Term Liabilities Minority Interest Preferred Equity Common Equity 357.6 21 295.0 130 128.4 50 85.7 -28 118.7 Total Equity 357.6 21 295.0 130 128.4 50 85.7 -28 118.7 733.5 32 554.3 12 496.3 18 420.4 18 355.0 Total Liab & Equity There are a few things that need to be noted on the annual balance sheet. First, accounts receivable increased by 50% year over year; however, as noted above, I am comfortable with their treatment of uncollectibles. Also, the quarterly balance sheet below shows that receivable growth has significantly declined. One can also see that long-term debt increased by $100m in 2002. However, their total long-term debt to total capital ratios is still only at 41%, which is at the lower end of the group. 16 Balance Sheet StockVal ® LIFEPOINT HOSPITALS INCORPORATED (LPNT) FYE Dec 9/03 % Chg 6/03 % Chg 3/03 % Chg 12/02 % Chg 9/02 Cash and Equivalents ($ Mil) 20.1 -89 19.5 -89 40.3 -45 23.0 -60 183.8 Trade Accounts Receivable 93.1 30 94.2 26 97.8 26 85.0 50 71.5 Inventories 21.4 26 21.1 26 21.0 27 20.5 26 17.0 161.7 -45 155.9 -47 176.9 -3 143.3 -4 292.4 Property Plant Equip Gross 672.8 15 645.0 13 625.7 13 610.2 12 584.7 Accumulated Depreciation 267.1 16 257.7 16 247.7 16 238.0 16 231.0 Property Plant Equip Net 405.7 15 387.3 11 378.0 12 372.2 10 353.7 3.8 3700 0.0 Total Current Assets Intangibles Total Non-Current Assets Total Assets Accounts Payable Short-Term Debt 3.3 3.5 3.6 623.7 47 603.1 44 593.0 47 590.2 46 423.3 785.4 10 759.0 7 769.9 31 733.5 32 715.7 36.1 74 29.2 58 28.4 37 28.5 50 20.8 0.0 75.4 14 76.6 250.0 -8 250.0 75 250.0 67 252.9 26.4 22 25.6 15 24.9 19 22.2 4 306.0 -3 302.2 64 300.5 60 298.9 397.1 6 379.9 -3 392.5 47 375.9 48 375.5 1.5 -68 1.2 -73 0.0 Common Equity 386.8 15 377.9 20 377.4 20 Retained Earnings 117.9 91 101.6 107 97.0 386.8 15 377.9 20 377.4 785.4 10 759.0 7 769.9 Total Long Term Liabilities Total Liabilities Minority Interest 250.0 -1 32.0 44 311.4 0.0 8 Deferred Income Taxes 73.9 0.0 90.3 Long-Term Debt 12 0.0 -4 Total Current Liabilities 85.7 0.0 0.0 4.7 Preferred Stk - Non Redeem Total Equity Total Liabilities & Equity 357.6 21 335.5 88 79.3 110 61.7 20 357.6 21 335.5 31 733.5 32 715.7 I would like to see a higher cash balance than is currently carried. This low cash level will require entering the debt or equity markets in order to fund acquisitions. Cash Flow What stands out here is the large use of cash from investing. LPNT has been using their cash from operations and long-term debt for capital expenditures to renovate facilities and provide new services. They will not have to keep spending on existing facilities at this level, allowing them to use some flow to fund acquisitions. Over the past several quarters, they have made the competitive decision to improve facilities rather than acquire new facilities. However, they have stated that they are actively looking at assets again. 17 Return on Equity LPNT owes their high ROE to their high margins. This leads me to believe that LPNT is good at acquiring facilities and focusing on increasing their efficiencies. I would rather see this trend as compared to a hospital company that acquires more aggressively but does not focus on operating efficiencies. StockVal® LIFEPOINT HOSPITALS INCORPORATED (LPNT) Price 29.0 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 21 18 15 HI LO ME CU 12 20.0 • -3.3 13.6 20.0 9 6 3 12-31-1997 09-30-2003 0 RETURN ON EQUITY % 16 14 12 HI LO ME CU 10 8 15.8 • -5.5 9.3 13.0 6 4 2 12-31-1994 09-30-2003 0 PRE-TAX MARGIN % Valuation StockVal® LIFEPOINT HOSPITALS INCORPORATED (LPNT) Price 29.0 1999 2000 2001 2002 2003 2004 HI LO ME CU 45 30 15 58.3 • 11.4 24.4 15.8 05-07-1999 11-20-2003 0 PRICE / YEAR-FORWARD EARNINGS HI LO ME CU 12 8 4 14.7 • 2.3 4.5 3.3 05-07-1999 11-20-2003 0 PRICE / BOOK VALUE HI LO ME CU 2 2.98 • 0.45 1.69 1.45 1 05-07-1999 11-20-2003 0 PRICE / SALES HI LO ME CU 24 16 8 29.7 • 5.4 11.2 7.7 05-07-1999 11-20-2003 0 PRICE / EBITDA 18 As can be seen in the previous chart, LPNT is trading below historical valuation levels. The next chart show LPNT valuation levels in comparison to the group. Although slightly above the group on a forward P/E basis, LPNT is still trading well below historical multiples. StockVal® LIFEPOINT HOSPITALS INCORPORATED (LPNT) Price 29.0 1999 2000 2001 2002 2003 2004 2.30 • 0.94 1.53 1.04 HI LO ME CU 2 1 05-07-1999 11-20-2003 0 PRICE / YEAR-FORWARD EARNINGS RELATIVE TO HOSPITALS (059A) E-Wtd 3.38 • 1.09 1.45 1.59 HI LO ME CU 3 2 05-07-1999 11-20-2003 1 PRICE / BOOK VALUE RELATIVE TO HOSPITALS (059A) E-Wtd 1.83 • 0.78 1.44 1.48 HI LO ME CU 1.6 1.2 0.8 05-07-1999 11-20-2003 0.4 PRICE / SALES RELATIVE TO HOSPITALS (059A) E-Wtd 4.09 • 0.93 1.32 1.03 HI LO ME CU 2.4 1.6 1.2 05-07-1999 11-20-2003 0.8 PRICE / EBITDA RELATIVE TO HOSPITALS (059A) E-Wtd Finally, LPNT is trading basically inline with the S&P 500. I think that LPNT deserves to trade at a higher multiple given their growth prospects and positive demographic trends. LPNT’s consensus growth rate, which I believe is conservative, of 15 is significantly higher than the S&P 500’s of 11.7. StockVal® LIFEPOINT HOSPITALS INCORPORATED (LPNT) Price 29.0 1999 2000 2001 2002 2003 2004 HI LO ME CU 2 2.23 • 0.70 1.09 0.96 1 05-07-1999 11-20-2003 0 PRICE / YEAR-FORWARD EARNINGS RELATIVE TO S&P 500 COMPOSITE ADJUSTED (SP5A) M-Wtd HI LO ME CU 3 2 1 3.31 • 0.45 1.29 1.05 05-07-1999 11-20-2003 0 PRICE / BOOK VALUE RELATIVE TO S&P 500 COMPOSITE ADJUSTED (SP5A) M-Wtd HI LO ME CU 1.5 1.0 0.5 1.66 • 0.20 1.01 1.01 05-07-1999 11-20-2003 0.0 PRICE / SALES RELATIVE TO S&P 500 COMPOSITE ADJUSTED (SP5A) M-Wtd HI LO ME CU 2.0 1.2 3.48 • 0.71 1.38 0.98 0.8 05-07-1999 11-20-2003 0.4 PRICE / EBITDA RELATIVE TO S&P 500 COMPOSITE ADJUSTED (SP5A) M-Wtd 19 Timing of Purchase LPNT shares reached a bottom in early 2003 and have begun an upward trend. It may be advantageous to purchase shares in an oversold position. However given the prospects of passage of the Medicare Drug Benefit Bill, I do not believe another oversold position will develop soon. I would prefer to own the shares before passage of the bill and I would buy on any weakness if the bill does not pass. In this event, rural reimbursement rate improvements could be enacted as part of another bill. Summary I recommend an over weight position in LPNT and have calculated a target price of $40. I have presented analysis on positive fundamental, economic, and demographic trends, which I believe will overcome the risks. While having a conservative balance sheet and pricing methodology, LPNT is positioned to grow faster than the group and the S&P 500. This unique position allows for a defensive holding with good growth aspects. 20