FREC 410 Agricultural Trade Policies: Barriers & Taxes International Ag. Trade & Marketing

advertisement

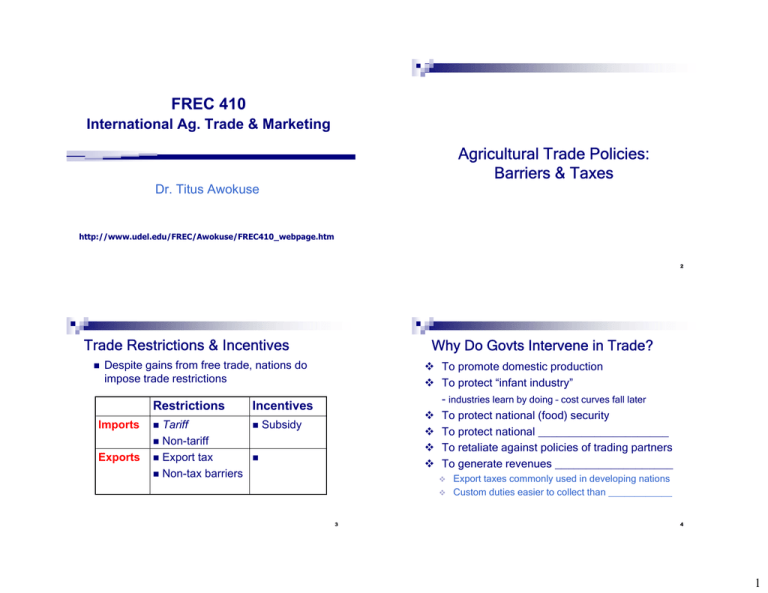

FREC 410 International Ag. Trade & Marketing Agricultural Trade Policies: Barriers & Taxes Dr. Titus Awokuse http://www.udel.edu/FREC/Awokuse/FREC410_webpage.htm 2 Trade Restrictions & Incentives Why Do Govts Intervene in Trade? Despite gains from free trade, nations do impose trade restrictions Imports Exports Restrictions Incentives Tariff Non-tariff Export tax Non-tax barriers To promote domestic production To protect “infant industry” - industries learn by doing – cost curves fall later To protect national (food) security To protect national _____________________ To retaliate against policies of trading partners To generate revenues ___________________ Subsidy 3 Export taxes commonly used in developing nations Custom duties easier to collect than ____________ 4 1 Import Restrictions: Tariffs Effects of Trade Policies Definition: is a tax on imported good or service usually Price collected by customs at the ____________ Specific tariff: tax levied as a fixed charge for each unit of imported commodity (Pm = Px+ Tm ) Import policy effects depend on country size: Large country: has large share of world market and domestic trade policies can affect world price e.g. $5 per 100 pounds of tomato imports Ad valorem tariff: tax levied as a percentage of the value of imported commodity (Pm = Px+ tmPx) effect _________________ Two main types: Two types of effects: Small country: very small share of world market and domestic trade policies do NOT _______________ e.g. ___________ on value of tomato imports 5 Basic Assumptions 1) Two countries (e.g., US and Mexico) 2) Each country has producers and consumers of a tradeable good (e.g., Tomatoes) 3) Tomatoes is a ________________ good 4) The markets are perfectly competitive 5) The two countries are initially trading freely. Then, one country initiates a trade policy and there’s no ________________ by the other country 6 Free Trade Equilibrium Pm =Px =Pw Exporter (Mexico) Importer (USA) World Mkt P P P Pw Pw Sm ES Sx Dx Dm Pw Dm ED A 7 B Q Qw Q W Q X 8 2 Price Effects of Tariffs: Effects of Import Tariff Large Country Case Pm =Px+Tm Exporter (Mexico) World Mkt Importer (USA) P P Dm P Sm ES Sx Dx Pw Pw Px =Pw2 Pw2 Importing country (U.S.) price increase by less than the amount of the tariff Pm U.S. Pw Forces is assumed to be a large importer ROW to pay part of the tariff through a lower world price ED A C Px D Sx B Q Dx Qw2 Pw Qw Q Qw W Pm Y Z Sm X Q Dm 9 10 Welfare Effects of Tariffs: Effects of Import Tariffs: Summary Large Country Case Large Country Case Importing Co. Consumers: Import price rises --- CS falls Importing Co. Producers: Import price rises --- PS rises Induces output increase by _______________________ Increase in employment Increase in profits and/or _______________________ Importing Co. Government: A tariff drives a wedge between foreign and domestic prices Reduction in importing ____________________________ Increase in importing country producer surplus Efficiency loss: caused by distortion faced by domestic ______________________________ Terms of trade gain: reflects tendency of a tariff to reduce foreign export prices Receives tariff revenues 11 TOT=PX/PM 12 3 Effects of a Tariff: Effects of a Tariff: Small Country Case Small Country Case Small countries have very small share of world market Import tariff has NO effect on world price (exogenous) Export supply curve is horizontal at level of world price EFFECT of Tariff (see graph given in class) World price is NOT changed Redistribution of income from consumers to ____________________________ Price of import in importing country will rise by the amount of the tariff Higher domestic price reduces import ___________________________ 13 14 Welfare Effects of a Tariff: Small Co. Case Importing Co. Consumers (Lose): Import price rises --- CS falls Export Tax Importing Co. Producers (Gain): Import price rises --- PS rises Induces output increase by existing domestic firms Increase in employment Increase in profits and/or payments to fixed costs Importing Co. Government (Gain): Receives tariff revenues --- _________________________ National welfare: Decrease …why? 15 16 4 Export Tax Trade Restrictions & Incentives Despite gains from free trade, nations do impose trade restrictions Export tax can be collected: directly from exporters (producers) or indirectly Imports Exports Restrictions Incentives Tariff Non-tariff Export tax Non-tax barriers Subsidy pays producers a price lower __________________. More prevalent in LDCs: easy way for govt revenue collection source Subsidy through a govt. _____________________ of funding for govt. spending Domestic prices in exporting country is forced to be lower than world price by the ____________________ 17 Export Tax: Large Country Case 18 Effects of Export Tax Two types of Export Taxes Specific tax: Pm = Px + Tx levied as a fixed charge __________________ e.g. $1 per bag of tea Exporting & Importing country: Output level (supply and demand) Price level (See 3-panel Graphs) Ad valorem tax: levied as a fraction of the value of e.g. 5% tax on tea Pm = Px(1+ tx) where 0 < tm < 1 19 20 5 Export Tax Free Trade Pm =Px =Pw Exporter Importer World Mkt P P P Sx Dx Exporter P P Pw Dm Sm ES Sx Dx Pw Importer World Mkt P Sm ES Pw Pw Dm Pm =Px+Tx Pm Pw Pw Px ED ED A B Q Qw Q W A Q X C Px D Sx B Dx Q Qw2 Pw Qw Q Qw W Y Pm Z Sm X 21 Welfare Effects Exporting Co. Consumers (gain): Export price falls --- ____________________ from producers to consumers and the govt. In the importing country, _______________________ Export price falls --- _____________________ Induces output decrease by existing domestic firms Decrease in employment Decrease in profits and/or payments to fixed costs Exporting Co. Government (gain): In the exporting country, income is transferred Exporting Co. Producers (lose): 22 Welfare Effects of Export Tax: Summary Export Tax: Large Country Case Q Dm from consumers to producers Also, income is transferred from foreign consumers to the exporting country govt There is --- ______________________________ Receives tax revenues 23 24 6 Welfare Effects of Export Tax: Summary Large Country Case Small Country Case Income transferred from producers to consumers and the govt. in the exporting country In the importing country, income is transferred from consumers to producers Also, income is transferred from foreign consumers to Effects of Export Tax: Small countries have very small share of world market Export tax has NO effect on world price (exogenous) Export supply curve is horizontal at level of world price EFFECTS (see graph given in class) the exporting country govt. (The more inelastic the MD and more elastic the XS curves, the greater the share of the tax cost falls on the importing country consumers --- ________________________ World price is NOT changed Redistribution of income from producers to consumers and govt Price of export in exporting country will fall by tax amount Lower domestic price increases domestic demand and _________________________________ 25 26 Non-Tariff Trade Barriers: Types Import Quota Import embargo (_________________) Voluntary export restraint (_____) Non-Tariff Trade Barriers (NTBs) Quota E.g. 27 on trade imposed by the exporting country limits on Japan’s auto export to US in 1981 Packaging and labeling requirements Health and food safety regulations Foreign exchange restrictions Import currency under-valuation Export currency _______________________ 28 7 Import Quota Import Quota vs. Tariff Absolute limit on import quantity Similar results on prices and welfare Enforce by issuing import licenses to some domestic firms or foreign govts. (e.g. cheese, sugar, apparels) Import tariff = import quota (at same quantity level) Domestic govt. receive revenue from tariff Import license holders receive quota rents Result in increase in domestic prices for good (See graph given in class): Cost of quota may be higher than tariffs, if foreign govt is import license holder (true in most cases) 29 30 31 8