1 u i m l a ip

advertisement

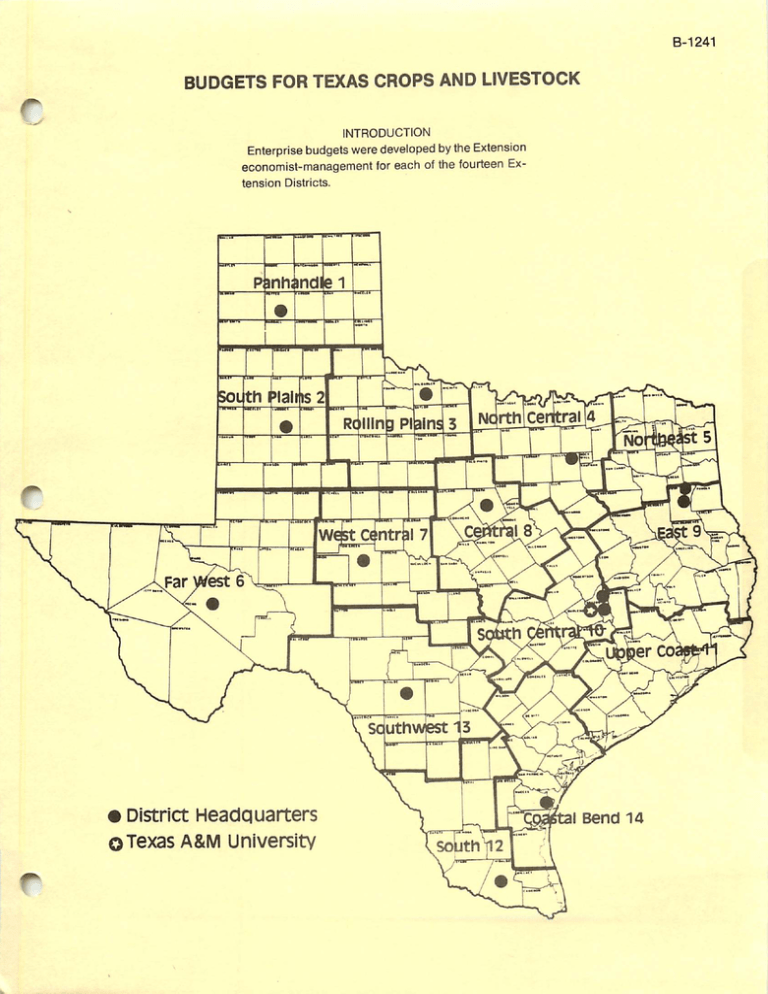

nos -A—mi vi puaa leg /aisjaAiun iawv sexaio sjauenbpeaH pwjsiq • L A _ ^a H — , " S i <ad =£= s, .—^^n, ; mJ mil' "•«•• riNi ! ■■ """g r f U fi "H ritfU _«■*■«■ ■itt 4«li - M M sumid tuinpci 1 2 11 41U 2 suieiui m IfllOS Ml ua riBS wuaii uj l aipueguBd !■! " « au wn-i—— M •sjoujsjo ucHsua} -X3 usepnoi ai|) jo goea joj }uawa6euew-is!WOuooa uojsuajx3 am Aq pado|3Aap aja/w sja6pnq asudjaiug NOIlOnaOHlNI M001S3M1 qnv sdouo svx3i aod siaoana 1*31.-8 CONTENTS An Introduction Procedure to the Te x a s Crop and Livestock Budgets Te r m i n o l o g y Used 1n Budgets Calculating Annual Capital Requirements C a l c u l a t i n g M a c h i n e r y, E q u i p m e n t a n d L i v e s t o c k O w n e r s h i p C o s t s Other Information Available Limitations Availability Appendix I. Formulae for Estimating Machinery Cost 9 9 10 10 10 11 11 11 12 Equipment Fuel Procedure 12 12 Calculations 12 12 12 Cost Breeding, Livestock Depreciation Interest Building Fuel Repair Labor Property Insurance Depreciation Interest Operating TEXAS Calculation Costs and Maintenance Labor Depreciation Interest Auto and Fuel Repair Operator Insurance, Depreciation Interest V 3 5 5 6 7 7 9 Tractor, Machinery and Implement Cost Calculation5 Field Capacity Calculation Fuel Requirement and Cost Calculations Lube Cost Calculation Repair and Maintenance Insurance Depredation Interest on Investment Note on Hours of Annual Use of Tractors, Machinery and Implements Repair Hired Insurance • 9$P"V 1 2 on Truck and Cost Calculation Maintenance Labor License, and on Milking 13 13 Investment Procedures Calculations Ta x e s Investment and Working Livestock Insurance (Purchased Livestock) on Investment Cost or Calculation Utility and Procedure Cost Maintenance Ta x on Capital Cost PA N H A N D L E Investment Calculation DISTRICT Procedure CROP 13 13 13 14 14 14 14 15 15 15 15 15 15 15 16 16 16 16 16 16 C1.1 Alfalfa Establishment, Alfalfa, Corn for Corn Furrow Grain, for Corn Furrow Irrigated, (Natural Furrow Irrigated, (Natural Gas) C1.7 Irrigated, Sorghum, Furrow Irrigated, Sorghum Wheat, for Pasture, Crop Tractors, Custom C1.19 Gas) C1.21 Sprinkler Gas) C1.25 Gas) C1.27 Gas) C1.29 Sprinkler Irrig C1.31 (Natural Gas) C1.33 Irrig. Report and Input C1.35 Equipment C1.36 Resources Truck C1.39 Resources Operation Irrigation C1.40 Resources C1.41 Equipment Farming Budget Establishment, Implements or (Natural (Natural Products Operating Auto Irrigated, Permanent Gas) C1.23 (Natural Irrigated, C1.15 C1.17 (Natural Irrigated, C1.13 Dryland (Natural Irrigated, Sprinkler Pasture Gas) Dryland Furrow Permanent (Natural H a y, Irrigated, Sprinkler C1.9 C 1 . 11 Dryland Furrow Soybeans, Gas) Dryland Wheat, Wheat, (Natural C1.42 Operations Parameters Machinery Cost TEXAS PA N H A N D L E - H I G H C1.43 Report Report C1 PLAINS LIVESTOCK Cow-Calf 11 Budget ■-y^k C1.3 C1.5 Sorghum, Sorghum, Gas) Gas) Sorghum, Sorghum, C1.1 (Natural Furrow Forage Gas) Irrigated, Forage Forage (Natural Sprinkler Grain, Silage, Irr1. C1.45 L1 . .46 1 L1.1 i«s«\ Livestock TEXAS Products PLAINS SOUTH Alfalfa Establishment, Alfalfa H a y, Cotton, Grain Irrigated Sorghum, Sorghum, Furrow Dryland (Heavier Dryland Irrigated Aside Irrigated Soybeans, Wheat, Wheat, Wheat, Tractors, Operating Irrigated Pivot Set Crop (Heavier Sprinkler Center Soils) Soils) Row Crops Irrigated Irrigated Aside Land Soils) (Sandy for Input Te x t . iii Soil) Wheat Equipment Resources Soils) Soils) Report and C2.13 C2.15 C2.17 C2.19 C2.21 C2.23 C2.25 C2.31 Soils) Te x t u r e (Heavier C 2 . 11 C2.29 Te x t u r e (Heavier C2.9 C2.27 Irrigated (Sandy Irrigated Products Implements Soil) Te x t u r e d Furrow Dryland Furrow Soil) Dryland Dryland Wheat, Te x t u r e d Furrow S u n fl o w e r s , Wheat, Soils) (Sandy for S u n fl o w e r s , Soils) (Sandy (Heavier Land Soils) (Sandy C2.3 C2.7 Soils) Te x t u r e d Irrigated Sprinkler Set (Sandy (Heavier Sorghum, Sorghum, Te x t u r e d C2.1 C2.5 Irrigated (Heavier Sprinkler Grain Irrigated Dryland Furrow Cotton, (Sprinkler) Sprinkler Dryland L1.3 C2.1 (Sprinkler) Furrow Corn, Cotton, Irrigated Irrigated Corn, Cotton, Report DISTRICT C2.33 C2.35 C2.37 C2.39 C2.41 C2.43 C2.45 C2.46 C2.48 Auto or Truck Custom Operation Farming Budget C2.51 Operations C2.52 Parameters Report Cost PA N H A N D L E - H I G H PLAINS Alfalfa Report LIVESTOCK Establishment, Alfalfa Alfalfa, Cotton, Cotton, Dryland Dryland, Planting) Guar, Guar, Sorghum, Sorghum, Dryland, Wheat, Wheat, H a y, (Solid (2X2 Cotton, Sorghum, C3.1 C3.3 C3.5 1v Irrigated C 3 . 11 Rows) C3.13 Row C3.15 Pattern) C3.17 Narrow Planting C3.9 Irrigated 40" Conservation Tillage C3.19 Irrigated C3.21 Dryland C3.23 Irrigated C3.25 Dryland C3.27 Irrigated C3.29 Conservation Dryland Dryland, C3.7 Establishment, Dryland, Dryland(2x1 Dryland Irrigated Bermudagrass Cotton, L1.3 C3.1 Irrigated Bermudagrass Cotton, CROP Dryland Establishment, Coastal C2.55 L1.1 L1.1 Report DISTRICT Alfalfa, Coastal C2.54 Budget Products PLAINS ROLLING C2.50 Equipment Cow-Calf Livestock TEXAS C2.49 Resources Irrigation Machinery TEXAS Resources Conservation Tillage C3.31 . 33 C3 Tillage C3.35 •^Mt^ rCrop Products Implements Tractors, Operating and Report Equipment C3.37 C3.38 Resources C3.41 Input Auto or Truck Custom Resources Operation Resources Irrigation C3.44 Operations Budget Parameters Machinery TEXAS ROLLING Cost PLAINS Farrow C3.45 Report DISTRICT Cow-Calf to Report LIVESTOCK Finish Livestock NORTH CENTRAL Alfalfa Coastal Set Aside with Production Cotton C4. Production L 3 . 11 1 C4.1 Ye a r Establishment Bermudagrass Overseeded Corn L3.9 Bermudagrass Coastal Bermudagrass L3.7 Second Bermudagrass L3.3 Hogs Hay Hay 1 L3.5 Report DISTRICT CROP Alfalfa C3.48 1 Production Budget Products TEXAS Coastal Production P1g Calf L3. L3. Hog Finishing Stocker C3.47 Production Feeder r C3.43 Equipment Farming V C3.42 Hay Pasture Ryegrass after after & Clover C4.3 C4.5 C4.7 C4.9 C 4 . 11 Wheat C4.13 Wheat C4.15 Cotton Set Aside Land with Diversion Payment C4.17 Wheat Set Aside Land with Diversion Payment C4.19 Land without Diversion v Payment C4.21 Sorghum Sorghum Production Wheat Wheat Tractors, Production, Auto Custom Production Input Crop C4.31 Row C4.33 C4.34 C4.39 C4.40 C4.41 Operations C4.42 Report Cost TEXAS Dairy C4.37 Equipment C4.44 Report DISTRICT LIVESTOCK Cow-Calf (with Production to C4.45 L4. 1 Production Production Hog P1g Market L4.1 Silage) (without Finishing Feeder Silage) Production L4.3 L4.5 L4.7 Production L4.9 L4. 11 Hogs Goat Production L4.13 Sheep Production L4.15 Stocker Livestock NORTHEAST C4.29 Resources Parameters Stocker Grazing Resources Farming Farrow with OA.21 Resources Operation Dairy C4.25 Equipment Truck Machinery NORTH CENTRAL Wheat Continuous after and Irrigation Budget C4.23 Report Implements or after Continuous Products Operating Hay Production, Wheat Crop for Calf Calf Production Products TEXAS Corn, Procuction (Native Pasture) L4.19 C5. L4.21 1 Management C5.1 Report DISTRICT Typical L4.17 Corn, High Cotton, Level Typical Cotton, High Sorghum, Sorghum, Management Level Management Typical High Coastal Coastal Management Management Level Bermudagrass Bermudagrass H a y, C5.3 C5.5 C5.7 C5.9 Management C 5 . 11 Establishment C5.13 Typical Management C5.15 C o a s t a l B e r m u d a g r a s s H a y, H i g h L e v e l M a n a g e m e n t C 5 . 1 7 Soybeans, Typical Soybeans, Wheat Wheat High Level Production, Production, Management Management Typical High Management Level Southern Coastal Peas Bermudagrass Coastal Small Yuchi Christmas Tree Tree C5.33 Establishment Peaches, & Ye a r vi i C5.41 C5.45 Ye a r C5.47 Third Ye a r C5.49 Fourth Ye a r C5.51 Fifth Ye a r C5.53 Twelfth Report and Cut) C5.37 Second through Products C5.35 (Wholesale) (Choose First Peaches, Implements Pasture Production Peaches, Tractors, C5.29 Grains Peaches, Crop C5.25 C5.27 Pasture Production Sixth C5.23 C5.31 Peaches, Peaches, C5.21 Bermudagrass-Clover Clover Christmas Management C5.19 Equipment Ye a r s C5.55 C5.57 C5.58 Operating Auto Input or Resources Truck Custom Resources Operation Resources Irrigation C5.67 Operations Budget C5.68 Parameters Machinery NORTHEAST Cost TEXAS Cow-Calf with Production with Production Market Hog Stocker Stocker Contract Broiler Contract Breeder Operating Auto Custom or Production L5.19 Pullet Production L5.21 Irrigated Equipment Resources Resources V111 L5.17 Breeder Resources Operation L 5 . 11 L5.15 Cotton, Truck L5.9 Production Dryland Input L5.7 Calf Report DISTRICT and L5.5 L5.13 Report Implements L5.3 Production Products TEXAS Products L5.1 Calf Broilers Upland Tractors, Replacement Production Cotton, Crop Replacement Production Contract WEST C5.71 L5.1 Raised Pig Light Report DISTRICT Purchased Feeder Heavy C5.70 Production Production Dairy Report Lease Cow-Calf Dairy C5.65 C5.66 Equipment Farming Livestock FAR C5.62 L5.23 C6.1 C6.1 C6.3 C6.5 C6.6 C6.9 C6.10 C 6 . 11 Irrigation Equipment C6.12 ^ Farming Operations Budget Machinery FAR C6.13 Parameters Report Cost TEXAS WEST Report DISTRICT Cow-Calf Livestock WEST Report DISTRICT Sorghum, Coastal Coastal Bermudagrass Bermudagrass Coastal Hybrid Pasture, Establishment, Bermudagrass Coastal Pasture, Bermudagrass Hay Establishment, Kleingrass Pasture, Oats, Grain Peanuts, Irrigated, Cotton, Cotton, Crop Products Tractors, Auto Custom j^\ Irrigation and Input or Irrigated C7.7 Grazing Dryland Grazing Solid Planting C7.15 C7.17 C7.21 C7.23 Irrigated C7.27 Resources Resources Equipment C7.13 C7.25 Resources Operation C 7 . 11 Dryland Equipment Truck C7.9 C7.19 Report Implements Operating C7.5 Dryland for C7.3 Dryland Dryland Small Spanish Dryland Irrigated and L6.3 C7.1 C7.1 Irrigated H a y, Sudan-Sorghum Kleingrass CROP Establishment, C6.16 1 L6.1 Dryland Bermudagrass Coastal L6. Production Products TEXAS CENTRAL C6.15 C7.29 C7.30 C7.33 C7.34 C7.35 C7.36 Farming Operations Budget C7.37 Parameters Machinery WEST CENTRAL Report Cost TEXAS DISTRICT Report LIVESTOCK Cow-Calf L7.3 Goat Production L7.5 Budget Coastal Bermudagrass Coastal Establishment, Bermudagrass Corn H a y, Native Oats Runner Spanish Spanish Dryland, Dryland, Peanuts, Peanuts, Dryland Peanuts, Sudan-Sorghum Dryland Solid Skip-Row Irrigated, Irrigated, Peanuts, Sudangrass Dryland Grazing, Peanuts, Peanuts, Dryland Pasture, Solid Skip-Row C8.3 C8.5 C8.7 C8.9 Dryland Pasture, for C8.1 Dryland H a y, Grass Dryland Dryland Establishment, Kleingrass L7.9 1 Dryland Sorghum, Kleingrass C8. Dryland Pasture, Silage, Kleingrass L7.7 Report CROP Bermudagrass Coastal Runner L7.1 Production Products DISTRICT Runner C7.40 1 Sheep TEXAS Runner L7. Production Ranch Livestock CENTRAL C7.39 C 8 . 11 C8.13 C8.15 C8.17 C8.19 Planted C8.21 Planting C8.23 Plant Planting C8.25 C8.27 Dryland, Solid Plant C8.29 Irrigated, Solid Plant C8.31 H a y, Dryland C8.33 Pasture, Dryland C8.35 ^ Wheat, Dryland Peaches, C8.37 Irrigated, Peaches, Irrigated, Peaches, First Ye a r C8.39 Second Ye a r C8.41 Third Ye a r C8.43 Irrigated, P e a c h e s , I r r i g a t e d , F o u r t h t h r o u g h F i f t e e n t h Ye a r s C 8 . 4 5 Crop Tractors, Products Implements Operating Auto Report and C8.56 Operations C8.58 Parameters C E N TM R aA cL h i n e r y T E X A S C oDsI tS T R I C T Cow-Calf Dairy Dairy Production to Report C8.60 R eL pI V o rEt S T O C K C8 L .86. 1 1 Production (with Production Farrow Hog Pig Dryland, Production Hogs L8.3 L8.5 L8.7 L8.9 L 8 . 11 Goat Production L8.13 Sheep Production L8.15 Stocker Calf Products DISTRICT Corn, Silage) Production Market TEXAS L8.1 Silage) (without Finishing Feeder Corn, C8.55 Equipment Budget l C8.54 Resources Farming A$y\ C8.52 Resources Operation Irrigation Livestock EAST C8.48 Resources Truck Custom r Equipment Input or C8.47 Dryland, High Procuctlon Report CROP Typical Level C9. Management Management L8.17 L8.19 1 C9.1 C9.3 Cotton, Dryland, Peanuts, Peanuts, Dryland, Irrigated, Sorghum, Sorghum, Soybeans, Southern Sweet Dryland, Typical Management C9.7 Level Typical Dryland, Management Management Level Typical (Fresh Corn Management Management Market), Dryland Production, Dryland Pasture, Bermudagrass Common Crimson C9.5 High Bahlagrass Common Management High Dryland, Peas Typical Dryland Pasture, Bermuda-Clover, Clover C 9 . 11 C9.13 C9.15 C9.17 C9.19 C9.21 Dryland Dryland Establishment, C9.9 Dryland C9.23 C9.25 C9.27 Coastal Bermuda Est., Dryland, Typical Management C9.29 Coastal Bermudagrass Coastal Bermuda H a y, Pasture, Dryland C9.31 Dryland C9.33 Coastal Berm. Est., Dryland, High Level Management C9.35 Coastal Arrowleaf LA S-1 Bermuda-Clover, Summer Christmas Christmas C9.37 Clover Establishment, Dryland C9.39 Clover Establishment, Dryland C9.41 Lovegrass Small Dryland Pasture, Grains Pasture, Te m p o r a r y Tree Tree Production Peaches, Second Peaches, Third xii C9.45 Dryland C9.47 (Wholesale) C9.49 (Choose First C9.43 Dryland Pasture, Production Peaches, Dryland & Ye a r Ye a r Ye a r Cut) C9.53 C9.57 C9.59 C9.61 "*s^!\ Peaches, 1^^ Fourth Ye a r C9.63 Fifth Ye a r C9.65 Peaches, Peaches, Crop and Custom Truck C9.69 C9.70 C9.76 Resources Operation C9.78 Resources C9.79 Equipment Farming C9.80 Operations Budget Parameters Cost DISTRICT TEXAS L9.1 Production Calf L9.3 Production L9.5 Contract Broilers L9.7 Contract Broilers L9.9 Contract Broiler Contract Breeder Products TEXAS Breeder Pullet DISTRICT Corn, L 9 . 11 Production L9.13 Report CROP C10. Wheat, C10.3 Dryland C10.5 Dryland Land, Bermudagrass xi i i With Cover Establishment, L9.15 1 C10.1 Dryland Sorghum, Aside Production Dryland Cotton, Coastal C9.84 1 L9. Production Stocker Set C9.83 Report LIVESTOCK Dairy CENTRAL C9.81 Report Cow-Calf f^ C9.67 Resources Irrigation Livestock SOUTH Ye a r s Equipment Input or Twelfth Report Implements Operating Machinery EAST through Products Tractors, Auto Sixth C10.7 Crop C10.9 Dryland C 1 0 . 11 Coastal Bermudagrass Coastal Bermudagrass Kleingrass H a y, Pasture, Establishment, Kleingrass Pasture, Grain C10.23 C10.25 C10.27 Dryland Pasture, C10.29 Dryland C10.31 Report Implements and C10.33 Equipment Input C10.34 Resources Truck Custom C10.21 Dryland Grazing, Products or C10.19 Dryland H a y, Sorghum Auto C10.17 Dryland H a y, Sorghum Operating C10.15 Dryland Oat Tractors, Dryland Dryland Oats, Small C10.13 Dryland H a y, Kleingrass Crop Dryland C10.38 Resources Operation C10.40 Resources Farming C10.41 Operations Budget C10.42 Parameters Machinery SOUTH CENTRAL Report Cost TEXAS DISTRICT Cow-Calf Report LIVESTOCK Feeder Production L10.3 Pig Production L10.5 Hogs L10.7 Production, Broilers, Contract Costs Broiler L10.1 Calf Finishing Contract C10.45 L10. 1 Production Stocker Dairy C10.44 Without & Returns Breeder Silage per House Production L10.9 L 1 0 . 11 L10.13 Contract Breeder Pullets, 3 House Unit, 2 Batches L10.15 Contract Cage Egg Production xi v - 2 House Unit L10.17 Contract Livestock TEXAS Commercial Products COAST UPPER Cotton, Cotton, Rice, Dryland, Custom Dryland, Level Typical High Input C 11 . 9 Management C 11 . 11 Management C 11 . 2 1 Resources C 11 . 2 2 Resources C 11 . 2 3 C 11 . 2 4 Operations Parameters Cost BEND C O A S TA L Cow-Calf Production, C 11 . 2 7 Report DISTRICT LIVESTOCK C 11 . 2 8 L14.1 Partially DISTRICT Corn, Improved Pasture Report CROP Irrigated Cotton, Cotton, Forage C 11 . 2 5 Report Products TEXAS C 11 . 1 5 C 11 . 1 8 Equipment Budget C 11 . 1 3 C 11 . 1 7 Resources Operation C 11 . 5 Management Equipment Truck C 11 . 3 C 11 . 7 Management Level and Farming Livestock SOUTH High C 11 . 1 Management Report Irrigation Machinery TEXAS Management Typical Dryland, Implements or L10.21 C 11 . 1 Management Level Products Operating Auto High Dryland, Soybeans, CROP Management Level Typical Dryland, Soybeans, Tractors, High Irrigated, Sorghum, Crop Typical Irrigated, Sorghum, L10.19 Report DISTRICT Dryland, Rice, Pullets Sorghum L14.1 L14.3 C12.1 C12.1 Dryland C12.3 Irrigated C12.5 H a y, Dryland C12.7 Sorghum, Dryland Sorghum, Sorghum, Irrigated Dryland, Wheat, Peanuts, C12.13 C12.15 Dryland C12.17 Spanish, Dryland C12.19 Irrigated C12.21 Broccoli, Irrigated C12.23 Cabbage, Irrigated C12.25 Cantaloupes, Irrigated Carrots, C12.27 Irrigated C12.29 Cucumbers, Irrigated C12.31 Honeydews, Irrigated C12.33 Ye l l o w Bell Jalapeno Onions, Irrigated C12.35 Peppers, Irrigated C12.37 Peppers, Watermelons, Watermelons, Citrus Tillage Irrigated Spanish, Peanuts, C 1 2 . 11 Conservation Soybeans, Citrus C12.9 Establishment, Establishment, First Second Irrigated C12.39 Dryland C12.41 Irrigated C12.43 Ye a r, Irrigated C12.45 Ye a r, Irrigated C12.47 Grapefruit Establishment, 3rd Ye a r, Irrigated C12.49 Grapefruit Establishment, 4th Ye a r, Irrigated C12.51 Grapefruit, Grapefruit, Mature Purchased Grove, Mature Irrigated Grove, Irrigated C12.53 C12.55 Oranges Establishment, 3rd Ye a r, Irrigated C12.57 Oranges Establishment, 4th Ye a r, Irrigated C12.59 Oranges, Mature xv i Grove, Irrigated C12.61 Oranges, Purchased Mature Grove, Plant Cane Ratoon Bermuda Type Cane, Grasses, Bermuda Establishment, H a y, Pasture, Grass Kleingrass Crop Tractors, #^\ Auto Establishment, Custom C12.93 Parameters Report Cost TEXAS Cow-Calf Cow-Calf Livestock SOUTHWEST Unimproved Production, Cow-Calf Bermuda Coastal Coastal Bermuda 1/3 Production, Products TEXAS Coastal C12.95 Report AREA Production, C12.96 L13.1 Brush Improved Country Pasture Improved Pasture Report DISTRICT Pasture Bermuda Pasture, xvi i C12.81 C12.92 Operations Machinery SOUTH C12.79 C12.91 Equipment Budget C12.75 C12.90 Resources Farming C12.73 C12.88 Resources Operation C12.71 C12.84 Resources Truck C12.69 C12.83 Equipment Input Irrigation Jfifey Dryland Report and C12.67 C12.77 Dryland Pasture, Implements or Dryland Dryland Products Operating Irrigated Establishment, Kleingrass Irrigated Irrigated B u f fl e g r a s s , C12.63 C12.65 Irrigated Grass Bermuda B u f fl e Irrigated Establishment, L13.3 L13.5 L13.7 C13.1 Establishment, Pasture, L13.1 Dryland Dryland Irrigated C13.1 C13.3 C13.5 Coastal Coastal Bermuda Bermuda Coastal Forage H a y, Pasture, Establishment, Bermuda Sorghum Oats Forage H a y, For For Grazing, Sorghum Corn for Corn for Irrigated Irrigated Grazing, Sorghum Forage Irrigated Irrigated Irrigated H a y, H a y, C13.7 C13.9 C 1 3 . 11 C13.13 C13.15 Dryland C13.17 Irrigated C13.19 Silage, Irrigated C13.21 Food, Irrigated C13.23 Cotton, Irrigated, Long Season Va r i e t i e s C13.25 Cotton, Irrigated, Short Season Va r i e t i e s C13.27 Dryland, Short Season Va r i e t i e s C13.29 Cotton, Sorghum, Dryland C13.31 Irrigated C13.33 Dryland C13.35 Irrigated C13.37 Sorghum, Guar, Guar, Peanuts, Florunner, Peanuts, Spanish, Soybeans, Winter Wheat, Spring Wheat, Spring C13.39 Dryland C13.41 Irrigated Wheat, Winter Irrigated Wheat, Processed Beets, Cabbage, Irrigated C13.45 Dryland C13.47 Irrigated C13.49 Dryland C13.51 Irrigated C13.53 Irrigated Cantaloupes,Irrigated Carrots, Irrigated xv i i i C13.43 C13.55 C13.57 C13.59 Processed Carrots, Irrigated Cucumbers, Irrigated Cucumbers (Pickles), C13.63 Irrigated C13.65 Lettuce, Irrigated C13.67 Onions, Irrigated C13.69 Fresh Market Processed Pecan Pecan C13.61 Spinach, Spinach, Orchard, Orchard, Irrigated Irrigated Establishment Pre-Production C13.71 Phase C13.73 Phase ( Ye a r s C13.75 1-4) C13.77 P e c a n O r c h a r d , E a r l y P r o d u c t i o n P h a s e ( Ye a r s 5 - 9 ) C 1 3 . 7 9 Pecan Orchard, Operational Phase ( Ye a r s 10-20) C13.81 P e c a n O r c h a r d , E a r l y P r o d u c t i o n P h a s e ( Ye a r s 5 - 9 ) C 1 3 . 8 3 Pecan Crop Tractors, Orchard, Products Custom and Truck C13.85 C13.87 C13.88 C13.92 Resources Operation C13.94 Resources C13.95 Equipment Farming C13.96 Operations C13.98 Parameters Machinery SOUTH Cost TEXAS Cow-Calf Production, Cow-Calf Cow-Calf Livestock TEXAS 10-20) Resources Irrigation Budget ( Ye a r s Equipment Input or Phase Report Implements Operating Auto Operational C O A S TA L C13.101 Report AREA C13.102 L13.1 Unimproved Production, 1/3 Production, Products BEND Report Brush Improved Improved Report DISTRICT Country Pasture Pasture CROP L13.1 L13.3 L13.5 L13.7 C14.1 Corn, Coastal Plain Upland Upland Corn Corn, Upland, Set Aside Aside Land, Land Tillage Upland Clean with Peanuts, Peanuts, Tilled Cover Crop B u f fl e Coastal Coastal C14.25 Crop Tractors, Custom Irrigation Farming Dryland Establishment Pasture, Establishment, Pasture, Dryland Dryland Dryland Report Implements and Input or Dryland Pasture, Products Operating Auto C14.27 Bermudagrass Kleingrass Equipment Resources Truck Resources Operation Resources Equipment Operations xx C14.19 C14.23 Bermudagrass Kleingrass C14.17 Irrigated Establishment, Grass C14.15 C14.21 Watermelons Grass C14.13 Dryland Soybeans B u f fl e C14.9 C 1 4 . 11 Conservation Land Aside Plain Upland Sorghum, C14.5 C14.7 Coastal Sorghum, Set Tillage Dryland Sorghum, Set C14.3 Conservation Cotton, C14.1 C14.29 C14.31 C14.33 C14.35 C14.37 C14.39 C14.41 C14.42 C14.47 C14.48 C14.49 C14.50 C14.51 Budget Machinery TEXAS Parameters C O A S TA L Cow-Calf Livestock Budget Cost BEND Production, Report C14.54 Report DISTRICT LIVESTOCK C14.55 L14.1 Partially Products Improved Report Index Pasture L14.1 L14.3 11 /jf*V AN INTRODUCTION TO THE TEXAS CROP AND LIVESTOCK BUDGETS* Estimating the production costs and returns of farm enterprises for planning purposes is a difficult, but important, task. Timely and accurate cost of production estimates are necessary: (a) to make input use decisions, and to arrange for operating capital requirements, (b) for enterprise selection, (c) to estimate the potential profitability of capital investment decisions, and (d) to develop marketing strategies and assess their impact on costs and returns. Budgeting is a deceivingly simple tool which can be used for analysis of problems ranging from day-to-day detailed choices to major questions about the size and type of farm business. Budgeting, as a management tool, is the testing and estimation of likely outcomes from decisions before they are implemented. Enterprise budgets are both a product of and the basic building block for the planning process. The Texas Crop and Livestock Budgets are projected enterprise budgets jointly prepared by the Texas Agricultural Extension Service (TAEX) and the Texas Agricultural Experiment Station (TAES) to assist farmers and ranchers in estimating "real" economic costs and returns of production, in current dollars.1 The information presented in the budgets is prepared as a management planning guideline and therefore is not intended to recognize or predict the costs and returns from any particular farm or ranch operation. It is suggested that users modify the budgets to fit their individual situations by making changes in yields, input levels, prices and other factors. A column titled "Your Estimate" is provided on each budget to make modifications convenient. Furthermore, the expiration date on each budget indicates updating is necessary. * Prepared by Robert H. Jenson, Assistant for Management Analysis, Department of Agricultural Economics, Texas A&M University, College Station, February, 1986. This paper is designed to accompany the distribution of the Texas Crop and Livestock Budgets (TAEX). 1 Alternative procedures are mixed in their method of handling the impact of inflation on costs, or attempt to estimate nominal cash costs of production either before or after relevant taxes. In fact, most budgets are a mixed bag of nominal, real, before-tax, after-tax, cash and non-cash concepts and procedures. The 1986 crop budgets include the anticipated government deficiency payments for cotton, corn, sorghum, and wheat To qualify for these payments producers must be in compliance with the government program for the respective crops. In evaluating the whole farm situation proper acreage adjustments and fallow acreage costs must be included when determining costs and returns per acre. Procedure One of the major problems involved in enterprise budgeting is the lack of information concerning the amount of production which will result from a particular combination of inputs. Information for the Texas Crop and Livestock budgets is .assembled from published and unpublished sources. The data are obtained and continually revised with the cooperation of farmers, ranchers, and agribusiness firms through informal surveys and personal contacts. Data supplied by these sources are confidential and provide average values which are used in developing and revising budgets. Scientific sampling techniques required to produce statistically reliable estimates, however, are not used due to time .and cost limitations. When possible, published information from the Texas Statistical Reporting Service and published research from the Texas Agricultural Experiment Station (TAES) are used in preparation of the budgets. Regionally based agricultural economists provide leadership in assembling the data and constructing the budgets. The input levels used, the combination of inputs and machinery operations, and the type and length of ownership of machinery and equipment are not necessarily profit-maximizing. They are only believed to be representative or typical for the specified geographic area. Budget preparation is a time consuming task involving numerous data and mathematical calculations. A computer program has been developed to aid in budget preparation. The TAEX budgets are prepared using the Microcomputer Budget Management System (MBMS).2 This 2 McGrann, James, M., Kent D. Olson, Timothy A. Powell and Ted R. Nelson, "Microcomputer Budget Management System User Manual." Dept of Agricultural Economics, "^ Texas A&M University, College Station, February 11, 1986. #*\ computerized tool stores and retrieves base data, prices, and other factors; calculates machinery, capital, and labor costs; organizes the costs and returns in a variety of formats; and performs a number of budgeting analyses. Terminology Used in Budgets An enterprise budget is an economic recipe for the production of a commodity usually expressed in terms of the production unit (e.g., per bushel, per head, etc.) or by a common resource (e.g., per acre of cropland). It is a statement of all expected revenues and expenses, both actual and imputed. There are three general types of costs that make up the total economic cost of producing any farm commodity. These are variable costs, fixed costs, and overhead costs. Variable costs (sometimes referred to as operating costs) are those short-run costs that may change with changes in level of production and/or are controlled by the manager. They are generally the cost of items that will be used up during one production cycle. If the manager !^*v decided to cease the production activity, these costs are avoidable. Examples are such operating inputs as fuel, fertilizer, chemicals and some hired labor costs. In the long run, all production costs are variable. In the TAEX published budgets, variable costs are further divided into pre-harvest and harvest costs where applicable. This separation is particularly useful for decisionmaking in which crop abandonment or graze-out are common practices. Once variable costs are incurred (e.g., seed after planting), they have the characteristics of fixed costs and are referred to as "sunk" costs. Income above variable costs serves to guide most farm management decisions, particularly in the short run. If income over variable costs is negative, and since variable costs are by definition avoidable, a producer will minimize his losses by ceasing production. Selecting enterprises which maximize income over variable costs will lead to greater short-run profit. Fixed costs may be defined as those costs that either do not change with the level of production or cannot be controlled or avoided. Examples are items such as property taxes, 3 insurance, depreciation, and interest on investment Cash or fixed dollar land rents and owneroperator labor may also be considered fixed costs. Fixed and variable cost analysis is a useful tool in determining profitability of an investment (e.g., machinery) based on its life or ownership period. It can aid in determining the best replacement policies, whether to own or custom-hire services, and a host of other decisions. However, fixed and variable cost analysis does not adequately explain the cash flow and income tax effects of an investment Cash flow analysis is directed more to the question of fiscal feasibility, or the ability to meet the financial obligations of the investment, than to the question of profitability. Consequently, the two types of analysis must be used together in order to present a clear and total picture of investment alternatives. Overhead costs are costs of machinery, equipment, buildings, and management that cannot be directly identified with an individual enterprise. Since these items are involved in the overall farm operation, it is sometimes difficult to reasonably include them in enterprise budgets. Examples of overhead costs might be telephone service, office supplies, general utilities *^% and legal and secretarial expenses. The allocation of fixed and overhead costs is not generally required for most farm management decisionmaking. At best, it is an arbitrary procedure for shared resources (e.g., the fixed costs are allocated by percentage of total annual use in the Texas budgets). However, estimates of the fixed resource requirements and the relative efficiency at which alternative enterprises use fixed and limiting resources is important to enterprise selection. The concept of opportunity cost, rather than incidence of cost, is used in estimating a number of production cost items. The opportunity cost of a production resource is its current value in its next best alternative use. The opportunity cost concept is useful in estimating the appropriate costs of inputs that are either not purchased or do not have a clear market value, such as equity capital, land rents, returns to operator labor, and farm-produced feedstuffs. Cost incidence versus opportunity cost is the primary difference between economic cost of production and cost estimates derived from cost accounting records when all inputs to the ^i 0 y \ production process are included. The projected net return in the budgets (the "bottom line") is the residual returns remaining after accounting for accrued and imputed costs to other factors of production. (The variable and fixed costs discussed above.) In most cases, the net return is a projected return to certain overhead, management, and profit (risk) for the enterprise, the only remaining factors of production for which returns have not been imputed. Calculating Annual Capital Requirements Annual operating capital is the short term capital required to finance cash variable and fixed costs during the enterprise production cycle. The MBMS program allows for the internally generated cash (e.g., from the sales of products of the enterprise) to offset the operating input expenses. Any cash surplus is carried forward as savings and any deficit constitutes an operating capital requirement The annual capital requirement is the weighted average net capital requirement (weighted by days outstanding). The annual operating capital is not the minimum or maximum of short-term financing required by the enterprise. Annual capital requirements may even be negative if accumulated monthly receipts are greater than expenses over the production cycle. The interest charge on borrowed capital and the interest savings on surplus cash are listed separately on the budgets to allow for different interest rates. The TAEX budgets assume that 100% of the required capital is borrowed (0% equity capital is used to meet operating requirements). Calculating Machinery, Equipment and Livestock Ownership Costs One of the more difficult tasks in estimating costs of production is estimating the cost of owning and operating farm machinery. Coupled with this difficulty is the associated problem of how to allocate the cost of items (e.g., tractors) shared by a number of enterprises on a farm. The MBMS program divides equipment and livestock into seven categories: tractors, selfpropelled machinery, implements, equipment, auto and trucks, breeding, milking and working livestock, and buildings and other improvements. Current replacement values and capital budgeting techniques are used as the basis for calculating projected ownership costs (depreciation, interest, taxes and insurance) in the TAEX budgets. This projected (economic) cost may be more or less than the estimated cost based on the book values and IRS-approved depreciation schedules of the various classes of equipment and livestock (rather than current market value) for established farms or ranches that have a combination of used and new machinery. This method, however, more closely reflects the "real" earnings required to cover the "real" cost of recapturing equipment investment, especially during high rates of inflation. The depreciation method based on book value and used for income tax purposes underestimates the total amount of capital needed for replacement of machinery and equipment under inflation. Accelerated depreciation schedules, combined with short accounting lives, may overestimate the real economic depreciation needed for long run production. Users of the budgets should review their fixed costs closely and be conscious of the differences in ownership cost based on current replacement values versus those developed from historical or accounting costs .and used for income tax purposes. Since detailed information on equipment fuel, lubrication, repair and labor requirements is not generally available, MBMS uses a series of functional relationships and parameter settings for each machinery and equipment item to estimate ownership and operating costs. (See machinery and equipment data and parameters at the end of each budget set and formula section that follows). The hourly cost calculated for each piece of machinery or equipment and the per acre or or per mile cost of each farming operation, including associated labor and materials costs, is also printed at the end of each set of crop budgets. Other Information Available Budget analyses available from the budget generator are detailed line item reports, summary reports and reports by stage, operation, resource, residual returns and expense type. The crop budgets are printed using the report by stage. The livestock budgets use the residual returns and operations reports. Also available is the ability to generate whole farm cash flow 6 summaries on the basis of enterprise budgets and the number of units of each in the farm organization. Details concerning this information may be obtained from the economistmanagement serving the particular Extension district Limitations Careful evaluation of the resource situations must precede the drawing of inferences from an enterprise budget Farms having resource situations (available land, machinery, capital, and management, for example) that differ from the situation assumed by the budgets can come to considerably different conclusions. Differences in assumed annual hours of use of machinery and equipment because of farm size or other uses, or size of the machinery used, can make significant differences in per unit costs and net returns. These differences in resources and organization must be evaluated and accounted for adequately if reliable conclusions are to be drawn. The Texas Crop and Livestock Budgets are projected budgets, not historical or actual. It is difficult to make accurate estimates of future prices, yields, or other production uncertainties. Most of the budgets are prepared 12 to 18 months in advance of the crop harvest or the end of the livestock production cycle. Therefore, the user should evaluate current production outlook information and use his expectations to update the budgets in preparing to use them. In addition, year-to-year comparisons of the published budgets are not advisable due to changes in farm size, technology, and farming patterns. Availability The Texas Crop and Livestock Budgets are published annually and distributed in loose-leaf form on a subscription basis. Various budgets are published for each of the fourteen Extension Districts in the state. To subscribe send $100 to: Extension Farm Management, Dept of Agricultural Economics, Texas A&M University, College Station, Texas, 77843. Individual copies of budgets for major enterprises in a particular Extension District may be obtained at no cost through local county Extension offices. APPENDIX I. FORMULAE FOR ESTIMATING MACHINERY COST4 TRACTOR, MACHINERY AND IMPLEMENT COST CALCULATION5 The tractor, self-propelled machinery, and implement calculation section is the major computational part of MBMS. Several options are available to users to calculate both hourly and per acre costs. The two major options are for calculation of repair, maintenance and depreciation costs. Option one is based on user defined costs associated with an hourly use base while option two duplicates the procedure and formulas in the 1983 ASAE Yearbook to calculate repair, maintenance and depreciation costs. Nearly all of the published budgets are calculated using option two, so that is what will be explained here. Field Capacity Calculation The field capacity of different implements and self-propelled equipment must be calculated to determine tractor hours or self-propelled hours per acre. Calculated capacity for tractors and self-propelled machinery is similar except that selfpropelled machinery has its own capacity estimate. A wheel tractor or a track layer relies on the implements to determine capacity and power requirements. Since multiple implements are allowed on one tractor the slowest implement should determine the overall capacity. A tractor multiplier is used to convert the implement hours per acre into tractor hours per acre. The implement hours per acre is calculated from the implement information. The capacity of self-propelled machinery, such as a combine, is calculated from the speed, width and field efficiency information. The following equation is used to calculate capacity. jPn C = (S * W * FE) / 8.25 where C = acres per hour calculated capacity S = implement speed in miles per hour W = swath width of the implement in feet FE = field efficiency is the ratio of accomplishment in acres per hour compared to theoretical maximum efficency Speed is expressed in miles per hour, width in feet, and field efficiency as the ratio of actual capacity to theoretical capacity. The constant, 8.25, is used to convert the units to acres per hour. The tractor and machine hours per acre are used to calculate operator hours per acre and fuel per acre. They are also used to allocate the fixed costs of interest, depreciation and the annual lease payment The required operator's hours are a multiple of the tractor or machinery hours per acre. We expect the operator to work longer than the machine due to pre-operation checkouts, waiting, etc. This additional time is expressed as a percentage of the tractor or the machine hours. The following equations are used to calculate operator's hours per acre for tractors or self-propelled machinery. 4 For a complete listing of formulas used by MBMS see the "Microcomputer Budget Management System User Manual", Chapter 9 (See footnote 2). 5 Irrigation equipment calculations are nearly identical except calculated on an acre-inch basis. 9 Operator's hours/acre = Tractor hours/acre * labor multiplier Operator's hours/acre = Machine hours/acre * self-propelled labor multiplier The operator wage is multiplied by the operator's hours per acre to calculate the cost of operator labor per acre. Operator cost/acre = operator's hours/acre * wage rate Fuel Requirement and Cost Calculations Fuel cost is calculated using equivalent PTO horsepower of the implements) and the required fuel use multiplier of the fuel type. Equivalent PTO horsepower required varies directly with implement width, tillage depth, soil texture, and speed of operation. All these factors determine draft of an implement For tractors pulling two or more implements, the required horsepower for that tractor is the sum of the required horsepower for each implement The formulas for calculating fuel cost are shown below. CFC = (F * HPR * FM) where CFC = calculated fuel use cost per hour HPR = equivalent PTO horsepower required FM = fuel use multiplier for each fuel type FM^iin. = .54X + .62 - .04 * (697X)05 FMdiescl = .52X + .77 - .04 * (738X + 173)05 FMLPG = .53X + .62 - .04 * (646X)0 5 X = HPR divided by the maximum PTO horsepower available Lube Cost Calculation Lube cost per hour is calculated as a percent of the fuel cost The multiplier is stored in the parameter file. LC = FC * (LM * .01) where LC = lube cost per hour FC = fuel cost as defined for the two options LM = lube multiplier Repair and Maintenance Repair, maintenance and depreciation calculation procedure duplicates the Agricultural Engineers Yearbook of 1983, sections: ASAE EP391 and ASAE D230.3. The formulae for these calculations are: R = LP * RC#1 * ((HPU + AU)/1000)RC*2 - (HPU/1000)RC*2)/ AU where R = repair and maintenance cost per hour (R & M) LP = current list price RC#1 = repair coefficient #1 HPU = hours of previous accumulated AU = hours of annual RC#2 = repair coefficient #2 10 use use /0SS^ ') Repair Coefficient #7 RC#1 is a variable that helps determine the shape of the repair curve for a specific machine. Repair Coefficient #2 RC#2 is an exponent variable which, in conjuction with RC#1, determines the shape of the repair curve. Repair and maintenance costs are highly variable and unpredictable as to time of occurrence. These equations are but estimates of average values. A typical variation could be expected to range from 50 percent to 200 percent of the estimated cost in this data. Insurance Insurance cost is based on a fixed percentage of market value. Insurance cost per hour is calculated by the following formula: INS = (INR * .01 * M) / HAU where INS = insurance cost per hour INR = insurance rate based on current market value (%) M = current market value HAU = hours of annual use Depreciation Depreciation is based on equations to estimate the remaining value of the machine and on the assumption of constant annual use of the machine. Two values that are specified are factors used to calculate salvage value and hourly depreciation. DF#1 is the percentage of original value that remains after the first year depreciation. DF#2 is a component of the standard double declining balance equation. Values for both depreciation factors were taken from the 1983 Agricultural Engineers Yearbook. Depreciation cost calculation uses the two depreciation factors to calculate salvage value and to adjust current market value. This value is then divided by the number of years of expected ownership times annual use. The formula for calculating depreciation (D) is: D = M - SV / (HAU * YO) where D = depreciation per hour M = current market price SV = LP * DF#1 * (DF#2) ** YO LP = list price DF#1 = depreciation factor #1 DF#2 = depreciation factor #2 YO = years owned HAU = hours of annual use Interest on Investment Interest on investment is calculated using the following formula. JF* IC = ((M + SV) * (IR * .01)) / (2 * HAU) where IC = hourly interest cost on capital investment 11 M = current market value, purchase price SV = salvage value, defined in depreciation calculations HAU= hours of annual use IR = interest rate, annual percent Note on Hours of Annual Use of Tractors, Machinery and Implements Hours of annual use (HAU) is a key variable in all the equations. The machinery cost in the budgets can be significantly different from an actual farm with different annual machinery use. EQUIPMENT COST CALCULATION PROCEDURE The costs of equipment such as augers, livestock handling equipment, etc. are calculated with defined data. The option to have costs calculated does not exist as with tractors and machinery. Depreciation, interest, insurance, taxes, fuel consumption, and repair and maintenance costs are all calculated from defined data. Fuel Costs Fuel costs are calculated by multiplying the annual use by the fuel price. The annual use is calculated by multiplying the specified gallons per hour of use by the annual hours of use. Not all equipment uses fuel. Repair and Maintenance Calculations The hours of owner and hired on-farm labor and off-farm purchased parts and labor for a specific repair and maintenance base hours of use level are defined. The formula for this calculation is as follows: R = ((FHL * CHL + FOL * COL + PLS) / BASE) where R = repair and maintenance cost per hour (R & M) FHL = on-farm hired labor (hr) CHL = cost of on-farm hired labor for R & M FOL = on-farm owner labor for R & M (hr) COL = cost of on-farm owner labor for R & M PLS = off-farm parts, labor and supplies for annual R & M BASE = operating hours on which repair and maintenance cost is based Hired Labor The amount of hired operator labor is specified on an hourly basis when the enterprise budget is defined. The hourly quantity is multiplied by the hourly labor wage stored in the labor resource file to determine hourly hired labor cost. This value is added to repair and maintenance hired labor to determine total hired labor cost Insurance Insurance costs per hour are based on a fixed percentage of market value divided by hours of annual use. INS = (INR * .01 * M) / HAU where INS = insurance cost per hour INR = insurance rate based M = current HAU = hours of annual use 12 on current market market value value ^^ ^7 Depreciation Depreciation is a measure of the actual decline in value of the equipment in the current year. It is dependent on the portion of remaining life used in the current year and on the current market value adjusted for salvage value. D = ((HAU / RL) * (M * (1 - (SV * .01)))) / HAU where D = current depreciation per hour HAU = hours of annual use RL = remaining life M = current market value SV = salvage value as a percent of current market value Interest on Investment Interest costs per hour are based on the average amount of investment (market value) adjusted for one-half of depreciation in the current year. The total interest cost is then divided by hours of annual use. IC = ((M - D * HAU/2) * (IR * .01)) / HAU where IC = interest cost of capital M = current markt value D = depreciation as defined in depreciation calculations HAU = hours of annual use IR = interest rate (%) AUTO AND TRUCK CO.ST CALCULATION PROCEDURES The costs of operating automobiles and trucks include both fixed ownership costs and variable operating costs. Fixed costs include depreciation, interest on investment, annual insurance premium, license and tax. Operating costs include repair and maintenance costs, fuel costs and owner operator labor costs. Costs are calculated on a per hour and per mile basis. Fuel Fuel costs are calculated on both a per hour basis and on a per mile basis. Both are dependent on the efficiency of fuel use and on fuel costs. FCMI = FUC / FU FCHR= FCMI * MPH where FCMI = fuel cost per mile FU = miles per gallon of fuel FUC = fuel cost per gallon of fuel FCHR= fuel cost per hour MPH = average speed of operation in miles per hour Repair and Maintenance Calculations The hours of owner and hired on-farm and off-farm purchased parts and labor for a specific repair and maintenance base hours of use level are defined. The formula for this calculation is as follows: 13 R = ((FHL * CHL + FOL * COL +PLS) / BASE) where R = repair and maintenance cost per hour (R & M) FHL = on-farm hired labor (hr) CHL = cost of on-farm hired labor for R & M FOL = on-farm owner labor for R & M (hr) COL = cost of on-farm owner labor for R & M PLS = off-farm parts, labor and supplies for annual R & M BASE = operating hours on which repair and maintenance cost is based Operator Labor The number of hours of operator labor used for each vehicle is based on the number of hours the vehicle is in operation. Hours of annual use is determined by multiplying the number of miles the vehicle is driven annually by the average speed of operation. OL = (1 / MPH) * MAU * LMULT where OL = hours of owner operator labor used annually MPH = average speed of operation in miles per hour MAU = miles of annual use LMULT = labor multiplier Insurance, License, and Taxes The annual insurance premium and any applicable licensing fees and taxes paid for each vehicle are defined values. Depreciation Depreciation is a measure of the actual loss of value in the auto or truck occurring in the current year. Thus it may be different than depreciation used for tax purposes. The formula takes the fraction of remaining life used in the current year (AU/RL) and multiplies it by the current market value of the auto or truck (M) less salvage value (LP * SV * .01). -*% D = (AU / RL) * (M * (1 - (SV * .01))) where D = current annual depreciation AU = annual use based on miles RL = remaining life based on miles M = current market value SV = salvage value as a percent of current market value Interest on Investment Interest on investment is calculated as the opportunity cost of capital. Interest is calculated on the actual market value of the vehicle less half the year's depreciation. This is justified by thinking of interest in the following manner: the opportunity cost of capital is the rate of return on capital which could be obtained in an alternative use. The alternative use of capital in this case would be to sell the vehicle and use the receipts in another investment. IC = (M - D / 2) * IR * .01 where IC = total interest cost or opportunity cost of investment M = current market value D = d e p r e c i a t i o n a s d e fi n e d i n d e p r e c i a t i o n c a l c u l a t i o n IR = interest rate 14 ^^ ^^ BREEDING, MILKING AND WORKING LIVECTOCK The cost of owning livestock depends on whether the animals were raised or purchased. Raised animals must include all production inputs associated with raising the animal. Purchased animals are treated like any other purchased asset, so depreciation must be calculated. Livestock costs include interest on investment, insurance and property tax cost Livestock Insurance INS = INR * .01 * M where INS = insurance cost INR = insurance rate based on current market value (%) M = current market value Depreciation (Purchased Livestock) Depreciation is a measure of the actual loss of value in the purchased livestock occurring in the current year. Thus it may be different than depreciation used for tax purposes. The formula takes the fraction of remaining life used in the current year (1/RL) and multiplies it by the current market value of the livestock (M) less salvage value . D = (1/RL) * (M * (1 - (SV * .01))) where D = current annual depreciation RL = remaining life M = current market value SV = salvage value as a percent of market value Interest on Investment Purchased and raised animals are treated as a capital asset. There is an interest opportunity cost of holding onto the animal. This cost is calculated by the following formula: IC = (M-D/2) * IR * .01 where IC = opportunity cost of holding the animal M = current market value D = depreciation as defined in depreciation calculation IR = interest rate BUILDING CO.ST CALCULATION PROCEDURE Building costs include both ownership costs and variable or operating costs. Ownership costs include depreciation, interest on investment, insurance and property tax. Operating costs include repair and maintenance costs and annual fuel costs or utility payments. The procedures and formulas to calculate these costs are given below. Fuel or Utility Cost Annual fuel or utility cost is defined. Repair and Maintenance The repair and maintenance cost calculation procedure requires the following data: off-farm parts and labor cost, and the number of hours of hired labor and operator labor which are used for repair and maintenance. 15 R = ((FHL * CHL) + (FOL * COL) + PLS) where R = annual repair and maintenance FHL = on-farm hired labor CHL = cost of on-farm hired labor FOL = on-farm owner-operator labor COL = cost of on-farm owner-operator labor PLS = off-farm parts and labor Labor The labor for operation of the building is specified when the enterprise budget is defined. On-farm labor costs for maintenance and repair are calculated when repair and maintenance costs are determined. Property Tax The calculation of property tax is also straightforward. Annual property tax is entered as a $/yr value that appears in the fixed cost section of the budget Insurance Insurance is the cost of insuring the capital investment (building) against loss or damage. Thus it is based on a percentage of the current market value of the building. INS = INR * .01 * M where INS = insurance cost INR = insurance rate based on current market value (%) Depreciation Depreciation is a measure of the actual loss of value in the building occurring in the current year. Thus it may be different than depreciation used for tax purposes. D = (1 / RL) * (M * (1 - (SV * .01))) where D = current annual depreciation RL = remaining life (yrs) M = current market value SV = salvage value as a percent of current market value Interest on Investment Interest on investment is calculated as the opportunity cost of capital. Interest is calculated on the actual market value of the building less half the year's depreciation. IC = (M - D / 2) * IR * .01 where IC = total interest cost or opportunity cost of investment M = current market value D = depreciation as defined above in depreciation calculation IR = interest rate (%) OPERATING CAPITAL CO.ST CALCULATION PROCEDURE Annual operating capital is the short term capital required to finance cash variable and 16 fixed costs during the enterprise production cycle. The MBMS program allows for the internally generated cash (e.g., from the sales of products of the enterprise) to offset the operating input expenses. Any cash surplus is carried forward as savings and any deficit constitutes an operating capital requirement. The annual capital requirement is the weighted average net capital requirement (weighted by the days outstanding). The annual operating capital is not the minimum or maximum of short-term financing required by the enterprise. Annual capital requirements may even be negative if accumulative monthly receipts are greater than expenses over the production cycle. An example will illustrate how the annual operating capital interest borrowed and interest earned are derived. Suppose you can borrow money at 12% interest, and you can receive 12% interest on any cash surplus (called operating capital borrowed and operating capital equity in the parameter file). Assume 100% of the operating capital is borrowed. The following table shows the effect of three transactions. Date 01/01/84 01/15/84 02/01/84 02/15/84 Cash Receipts — 50 100 — Cash Expenses 100 — — — Difference 100 50 100 — Balanc Days Annual Interest to Da Date Outstanding Capital on OC -100 -50 50 50 15 15 14 4.167 2.083 -1.944 .50 .25 -.233 The annual capital is calculated as the outstanding balance times the days outstanding divided by 360 (e.g., 100 X 15 / 360 = 4.167). This value times the interest rate yields interest payed or received (e.g., 4.167 X .12 = .5). In the budgets annual capital and interest will appear positive (+) for money borrowed and negative (-) for money earned, i.e., interest earned is a negative cost There are two operating capital interest rates in the budgets including: (1) interest rate on borrowed capital and (2) interest rate on surplus cash flow or savings. Separating operating capital into these categories allows for different interest rates. 17