Number of head 100 Enterprise REVENUE

advertisement

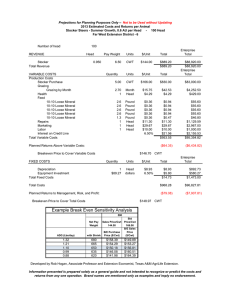

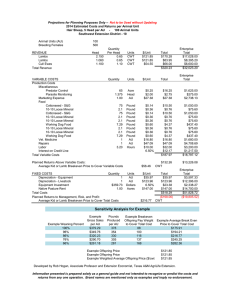

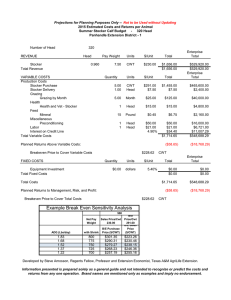

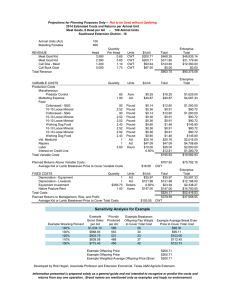

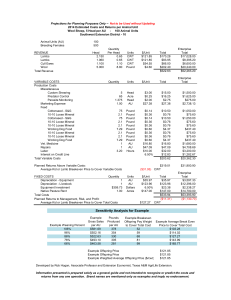

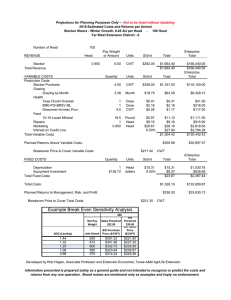

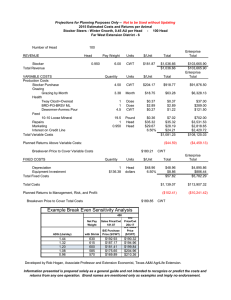

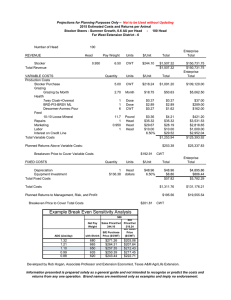

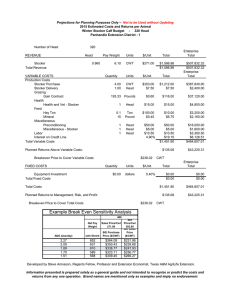

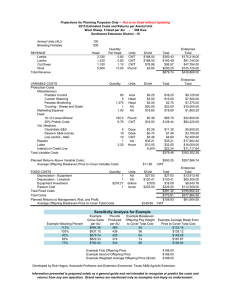

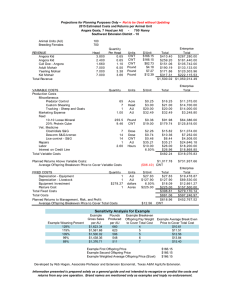

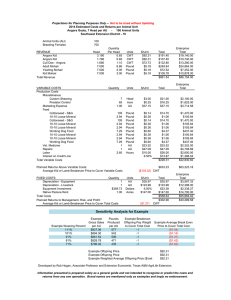

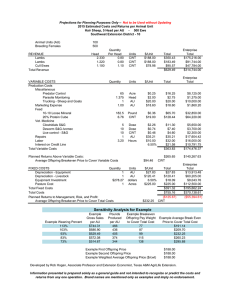

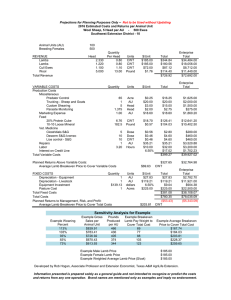

Projections for Planning Purposes Only -- Not to be Used without Updating 2014 Estimated Costs and Returns per Animal Stocker Steers - Summer Growth, 0.6 AU per Head - 100 Head Southwest Extension District - 10 Number of head 100 REVENUE Head Stocker Total Revenue 0.950 VARIABLE COSTS Production Costs Stocker Purchase Grazing Grazing by Month Health Feed 10-10 Loose Mineral 10-10 Loose Mineral 10-10 Loose Mineral 10-10 Loose Mineral 10-10 Loose Mineral Miscellaneous Trucking Repairs Marketing Labor Interest on Credit Line Total Variable Costs Pay Weight $/Unit CWT $144.00 Units $/Unit 5.00 CWT $166.00 $830.00 $83,000.00 2.70 1 Month Head $15.75 $4.17 $42.53 $4.17 $4,252.50 $417.00 2.6 2.6 2.6 2.6 1.3 Pound Pound Pound Pound Pound $0.36 $0.36 $0.36 $0.36 $0.36 $0.94 $0.94 $0.94 $0.94 $0.47 $93.60 $93.60 $93.60 $93.60 $46.80 0.95 1 0.950 1 Head Head Head Head $9.50 $11.14 $20.17 $10.00 6.50% $9.03 $11.14 $19.16 $10.00 $21.54 $951.78 $902.50 $1,114.25 $1,916.15 $1,000.00 $2,154.24 $95,177.84 ($62.58) ($6,257.84) 6.50 Quantity Planned Returns Above Variable Costs: Breakeven Price to Cover Variable Costs FIXED COSTS $146.43 Quantity Depreciation Equipment Investment Total Fixed Costs 1 $88.06 Units Head dollars $/Unit Total Enterprise Total Units $889.20 $889.20 Total $88,920.00 $88,920.00 Enterprise Total CWT Total $8.81 $5.72 $14.53 $880.61 $572.39 $1,453.00 Total Costs $966.31 $96,630.84 Planned Returns to Management, Risk, and Profit: ($77.11) ($7,710.84) Breakeven Price to Cover Total Costs $8.81 6.50% Enterprise Total $148.66 CWT Example Break Even Sensitivity Purchase Analysis Weight (Lbs/Hd): 500 Net Pay Weight Sales Price/Cwt 144.00 Bid Price/Cwt 166.00 ADG (Lbs/day) with Shrink B/E Purchase Price ($/Cwt) B/E Sales Price ($/Cwt) 1.32 1.21 1.10 0.99 0.88 680 665 650 635 620 $158.79 $154.68 $150.58 $146.47 $142.37 $149.58 $152.96 $156.49 $160.18 $164.06 Developed by Rob Hogan, Associate Professor and Extension Economist, Texas A&M AgriLife Extension. Information presented is prepared solely as a general guide and not intended to recognize or predict the costs and returns from any one operation. Brand names are mentioned only as examples and imply no endorsement.