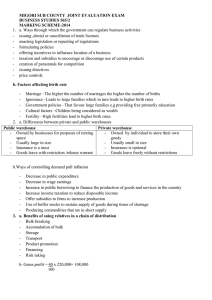

Intelligent Market-Making in Artificial Financial Markets

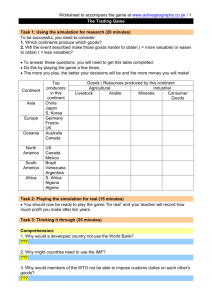

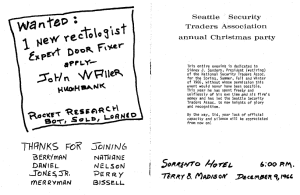

advertisement