Document 10990258

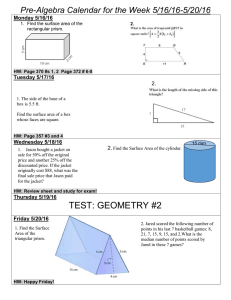

advertisement

Safer to carry than cash If used properly, they can help establish a good credit report (employers often check your credit report before hiring) Helpful in emergencies Offer purchase protection •96% have Credit Cards •The average student has 6 credit cards •The average credit card balance is $3262!!! salliemae.org •Increases impulsive spending •Ties up future cash •Leads to overspending Let’s say that you see a coat marked down from $220 to $180. Wow, What a bargain! But you sadly don’t even have the $180, but wait, you do have a credit card…so you CHARGE IT! With your part-time job, you can pay $15 a month. OOPS! You paid late one month so the credit card company charged you a late fee of $30. •After 16 months of paying $15 you own the jacket. •Ultimately the jacket cost you $228.26- $8.26 more than its full price. •And the jacket is no longer in style! START A BUDGET-List your money sources. • Paychecks, money from gifts •Follow the Pay yourself first rule: Financial advisors recommend that you save 10% of all your income For one month, keep track of where you spend your money •Use a personal money tracker for one monthyoucandealwithit.com •Develop categories for your spending. •Set up a budget using your findings and predict your spending for one month. •Test your budget by comparing your predictions with your actual expenses •Adjust accordingly for the next month. Here are some tactics that Credit Card companies try to reel you in with… •Appealing to your social conscience, ex. The American Express Red card donates 1% of your spending to charity. •Advertising some spectacular “benefits” up front- when you get a credit card offer in the mail, you see the 0.0% number on it and some might think “It’s free money!” but this only applies for a short time. •Mixing your desire to spend time with your family- the old family board game, The Game of Life, now has a new addition to the game: Visa cards. •Distributing a lot of “points” that don’t provide strong merchandise choice.- they say that if you buy more, you’ll receive points, and when you earn enough you can exchange them for a variety of items. The catch is, you have a limited variety you can choose from and you have to spend thousands of dollars to get it. Now, credit card companies are trying to target pre-teen girls. They have created a Hello Kitty credit card! Be Smart. SUMMARY: • Use credit wisely when necessary. • Budget to avoid having to use credit cards. • Don’t be lured in by credit card companies. Don’t let credit card debt become your financial handcuffs!