Fisher College of Business The Ohio State University Syllabus

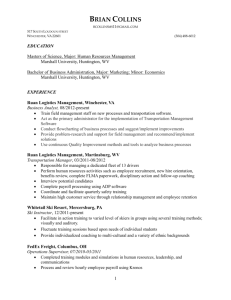

advertisement

Fisher College of Business The Ohio State University Syllabus BusAdm 3630.02-Business Industry Cluster (4812): Introduction to The Financial Services Industry: Insurance, Commercial Banking Investment Banking (2 credit hours) Fall Semester 2013 Senior Lecturer: Robert R. Lane, BA., MA.,MBA 306 Fisher Hall e-mail: lane_424@fisher.osu.edu (primary) e-mail: boblane62@gmail.com (secondary) (Fisher Office) 614-688-1045 (Cell) 614-571-3800 CLASS SCHEDULE: Thursday 5:30pm--7:15p.m., 405 Mason Hall This course is the first in a 2-course sequence that comprises the course requirement for students enrolled in the Fisher Financial Services Cluster and which, when combined with other requirements, provides students with in-depth competence in Financial Services business practices. This first course is pre-requisite for enrollment in the second subsequent course in the sequence which will be offered Autumn Semester and Spring Semester. Instructional staff for the 2-course sequence include representatives from the sponsoring companies that have significant involvement in the financial services industry, including Nationwide Insurance, KeyBank, Morgan Stanley and UBS. Learning Objectives 1) To describe current context of the financial services industry in the U.S. a. Basic structure of U.S. financial services industry b. Issues in the financial services industry following the Great Recession c. Key legislative initiatives including Dodd Frank Financial Reform 2) To gain an understanding of the major players and their respective roles within the financial services industry a. The insurance industry (Autumn Semester)—Insurance Simulation b. The commercial banking industry (Autumn Semester)—Presentations and Case Study c. The Investment Banking industry (Spring Semester)—Cases, presentations, simulation and lectures d. Project assignments with Industry Partners (Spring Semester) 3) Regulatory Compliance a. Too big to fail, too small to survive b. Enterprise Risk Management c. The costs of compliance vs the consequence of not managing risk 4) Marketing and Competition in a global environment a. Differentiation—the role of strategy and positioning the brand b. Decentralized Standardization vs Centralized structure 5) Professional Development a. Developing soft skills b. The role of teamwork in the workplace c. Treating people with respect and dignity d. Working with people or working with data/information e. Developing self-awareness Course Overview The objective of the first course of the financial services industry sequence is to familiarize students with the business environment in which the financial services industry operates in the U.S and perhaps globally. The course is structured with the leadership of corporate executives in the financial services field who will be leading classroom discussions of current topics central to the industry. Students will acquire awareness of, and an appreciation for, the diversity and complexity of business operations in the financial services industry notwithstanding the effects of the latest recession and the seemingly slow recovery. Specifically, the successful completion of this course should enable students to understand and analyze problems which challenge successful operation of companies within this industry, recognizing that the challenges facing these companies may be macro and micro in nature. While the emphasis of the course is on analysis, students will acquaint themselves with the special terms, concepts, and institutions encountered in the financial services environment. Through work with the sponsoring company partners, students are expected to identify and consider approaches to situational contingencies they will face in the financial services environment. Because top-level executives will be visiting us, student interactions with them are expected to exhibit the professionalism characteristic of every Fisher student. This course is a mixture of lecture, case studies, individual and team exercises, in-class group discussion, and an examination. Understanding of the structure, processes, and key issues in the financial services will be gained primarily through readings and lectures. Additionally, since this course assumes that skills gained in the classroom can be applied by the student to “the real world,” there is a strong emphasis on the analysis of complex delivery system problems through the preparation and discussion of a variety of case studies and other assignments. Some classes may require assigned readings. Students must be fully prepared for class. Each student should come to class ready to discuss, validate, argue, and/or state their positions concerning various topics—just as they would in a business setting. Messages related to the course will be sent to you via e-mail between class sessions. Therefore, it is essential that you check your OSU e-mail messages on a regular basis. Schedule of Classes A special “kick-off” session for cluster students, sponsor representatives, faculty, and others will be held on August 20, 2013. Classes will meet each Thursday evening 5:30-7:15pm with the exception of November 28, Thanksgiving. Course Mechanics GRADING With respect to pre-term assignments, each student is required to write two page paper on the required readings, Boomerang by Michael Lewis and The New Digital Age by Jared Cohen and Eric Schmidt. Papers are due at the first class on August 22. A midterm exam will consist of paper that is described in detail under the heading: Tentative Schedule for the first seven weeks. A final examination will be administered for this course counting for 50% of the grade. This examination will cover material from both in-class lectures and assignments, readings, and possible Internet assignments. Please note that anything contained in any of the assigned readings may be on the test, even if it is not covered in class. The final exam date is yet to be determined. There will be NO make-up times or extensions of the date. ATTENDANCE POLICY Students are expected to attend all cluster activities and classes. Absences will be excused only in the case of health problems (doctor certificate required) or death in the immediate family. Unexcused absence may result in reduction of points from the final course grade. CELL PHONE USE Cell phone usage will not be permitted during class which includes texting and email. Feel free to use cell phones outside the classroom during breaks. COMPUTER/TABLET USE Use of computers or tablets in the classroom is allowed only for class-related activities such as taking notes on presentations. PROJECTS, SIMULATIONS and CASE STUDIES The class will divided into nine project teams consisting of four team members including an assigned team lead. Groups or teams will be assigned the second week of the Autumn Semester in anticipation of the Bank and Insurance simulations as well as case studies during the Autumn Semester. CLASS PARTICIPATION Class participation is not only expected, but mandatory and will count at least 20% of the overall grade. Our cluster classes are designed to be highly interactive and the presenters are expecting students to be engaged so ample time will be allocated for Q & A at the end of each class but depending on the presenter, questions may asked as the subject matter is being present Readings and Internet Assignments 1. The Dodd-Frank Wall Street Reform and Consumer Protection Act. If you can find an abbreviated version, that would be advisable as many of the representatives in Congress had not bothered to read the legislation in its entirety. (required) by October 25, 2012 2. How the Mighty Fall and why some companies never give in. Jim Collins (optional) 3. Leadership in the era of Economic Uncertainty. Ram Chararan (optional) 4. Hot, Flat, and Crowded. Why we Need a Green Revolution and how it can Renew America. Thomas L. Friedman (optional) 5. The World is Flat. Thomas L. Friedman (optional) 6. The Return of Depression Economics and the Crisis of 2008. Paul Krugman (optional) 7. The Big Short. Michael Lewis (optional) 8. The Five Dysfunctions of a Team. Patrick Lencioni (required) by end of the Fall Semester 9. The No Asshole Rule. Building a Civilized Workplace and Surviving One that Isn’t. Robert I. Sutton (optional) 10. Too Big To Fail. Andrew Ross Sorking (optional) 11. That Used To Be Us, How America fell behind in the world it invented and How we can come back. Thomas L. Friedman and Michael Mandelbaum (optional) 12. The End Game. John Mauldin (optional but highly suggested) 13. Predictably Irrational)-Dan Ariely (optional) 14. Boomerang, Michael Lewis (required) 15. The Digital Age: Reshaping the Future of People, Nations and Business, Eric Schmidt and Jared Cohen (required) Tentative Schedule for the first seven weeks August 22—Professor Lane—Lecture (Your Career May not be Linear) and overview of expectations of the Semester with a review of the Syllabus August 29—Retail Banking Presentation—Mary Navarro—This session will cover the basics of how a bank makes money (interest margins/fees). Explain the basics of how a bank operates (taking deposits/making loans). Describe the current economic and regulatory challenges in today’s Retail environment. Huntington executives will describe the Huntington footprint and strategy with it focus on the customer (fair play). Most importantly, the relationship between Huntington and Ohio State will be discussed regarding branches and ATMs on campus, and the outreach to students/alumni September 5—Commercial Banking will be the topic for this evening. The presentation and discussion will cover the basics of commercial banking, including the various customer types (small, medium, large corporate, corporate real estate). The HNB executives will describe the basics of how banks evaluate and underwrite credit risk. Moreover, the presentation will cover the role banks play in helping business manage liquidity/cash flow. Further discussion will include how Commercial Banking has evolved since the 2008 financial crisis (e.g. regulatory, economic issues). Some discussion will take place on Huntington’s SBA awards; commitment to help revitalize the neighborhoods near Ohio State. September 12—Risk—What is risk management and how is risk defined? How does a company define its risk appetite based on it brand, strategy, etc.? What role did risk management play before, during and after the economic meltdown of 2008? How dies the current regulatory environment impact the cost of risk compliance? Huntington is one of the founding partners for the Fisher of College Risk Institute which is being introduced this Fall. September 19—Investor Relations—Todd Beekman who heads the Investor Relations group at Huntington will be doing this presentation. What do investors look at when valuing a bank? How does Huntington’ strategy and execution differentiate itself to Investors? How does Huntington compare and differentiate itself to other banks? How has the regulatory environment impacted the banking industry? September 26—Marketing—What is the role Marketing plays in supporting the sales function? The role of innovation and creativity and doing something different to differentiate your bank. The importance of data analytics. Executives will discuss how Huntington arrived at its Fair Play approach (24 hour grace, asterisk free banking, etc.) Other examples, Buckeye Banking, student checking, etc. October 3—Talent Management—Describe the employee-service-profit chain and how hiring the right people leads to superior customer service and profits. Describe how HNB measures and manages Huntington’s culture (e.g., Voice survey) How HNB ensures they have a divers base of current and future leaders (inclusion, succession planning) Midterm Exam—Will consist of an assignment to write a two-page paper incorporating the learnings from the six Huntington lectures but to also articulate what Huntington should do to attract and retain the next generation of bank customers. The paper will provide Huntington with ideas and also provide a mechanism for Huntington to evaluate the writing and thinking skills of the students. It is Huntington’s intention to hire at least 10 Fisher undergraduate students as interns for the Summer of 2014. Midterm Paper will account for 30% of the grade.