TAX POLICY AND CAPITAL FORMATION UNDER THE EMU: Robert S. Chirinko

advertisement

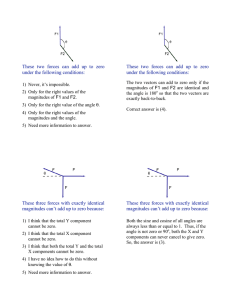

TAX POLICY AND CAPITAL FORMATION UNDER THE EMU: PERSPECTIVES ON GERMAN ECONOMIC POLICY 12 Robert S. Chirinko 1 Department of Economics, Emory University, Atlanta, GA 30322, USA 2 CESifo, Munich, 81679, Germany Forthcoming in Heinz Herrmann and Reiner Koenig (eds.), Investing Today For The World Of Tomorrow: Proceedings Of The Second Annual German Bundesbank Spring Policy Conference (Berlin: Springer-Verlag). A paper copy of the entire manuscript is available from the author, rchirin@emory.edu. OVERVIEW I beg the reader not to discard this somewhat utopian scheme with the sterile objection of "utterly impracticable." Let its practicability be tested not by prospects for speedy enactment but by the contribution it has to make to orderly thinking about the basic issues of budget policy. Richard Musgrave, 1959: vii In fact, one of the most useful roles an economist can perform is to remind policymakers that the economy is complex, that we must be keenly aware of the unintended consequences of our actions, and that choices must be made among competing objectives. We politicians don't always want to hear these things, but it is important that we do. Lee Hamilton, 1992: 61. This paper offers a framework for considering capital formation and how it can be affected by tax policy. The economics literature is particularly useful in isolating the major channels through which tax policy affects capital formation and focusing attention on the key empirical magnitudes that largely determine outcomes. The purpose of this framework is not to develop a "blueprint" for policy action but rather, as noted by Musgrave, to contribute "...to orderly thinking about the basic issues of budget policy." Section 2 begins by examining an essential question facing policymakers: is there too little capital? One set of well established theories and evidence suggests that capital formation is excessive; another set that it is deficient. While the debate remains unsettled, we nonetheless adopt the operating assumption that raising capital formation is an intermediate policy goal. The three key channels translating tax policy into real outcomes are presented in Section 3 and Figure 5 (attached). Central to any discussion is the "price" of capital. The rental price (or user cost) of capital is an enormously helpful concept converting the complicated dynamics associated with capital formation into a relatively simple and measurable variable. The user cost channel translates changes in tax policy into changes in the price of capital. The extent to which these altered price incentives affect capital formation is captured by the substitution channel. Quantifying this channel has led to much controversy in the economics literature, and that debate is reviewed briefly. Finally, capital formation's ultimate effect on the output of goods and services is through the production function. Exogenous and endogenous growth theories have substantially different implications for the size of the production channel. The goal of this section is to highlight the key economic magnitudes that determine the ultimate impact of tax policy on real outcomes and to provide an overview of the empirical debate. Policy lessons relevant to Germany are discussed in Section 4. The effects of the EMU in attenuating and amplifying the potency of tax policy are reviewed. This section then uses the threechannel framework to discuss four current German policy initiatives: business income tax cuts, capital gains forgiveness, energy tax increases, and labor market reforms. Tensions and tradeoffs between competing policy goals are highlighted. In 1947, Dr. Edwin Nourse (the first chairman of the U.S. Council of Economic Advisers) was discussing economic policy issues with President Harry Truman and his assistant, John Steelman, and remarked "On the one hand...but then on the other hand..." After Dr. Nourse left the office, a somewhat frustrated Truman supposedly asked "John, do you think you could find me a one-armed economist?" Regrettably, President Truman and perhaps some readers will remain disappointed. We are not in a position to provide definitive answers to the issues surrounding tax policy and capital formation. Nonetheless, the economic literature offers important insights that can address the following questions facing policymakers: 1) Should The Capital Stock Be Increased? 2) How Is Tax Policy Translated Into Economic Incentives? 3) What Are The Key Magnitudes Affecting The Impact of Tax Policy? 4) How Does The EMU Affect These Channels? 5) Are Current Policy Initiatives Likely To Succeed? Figure 5 A Framework For Tax Policy Analysis Tax Policy User Cost Channel Economic Incentives Substitution Channel Capital Formation Production Channel Output