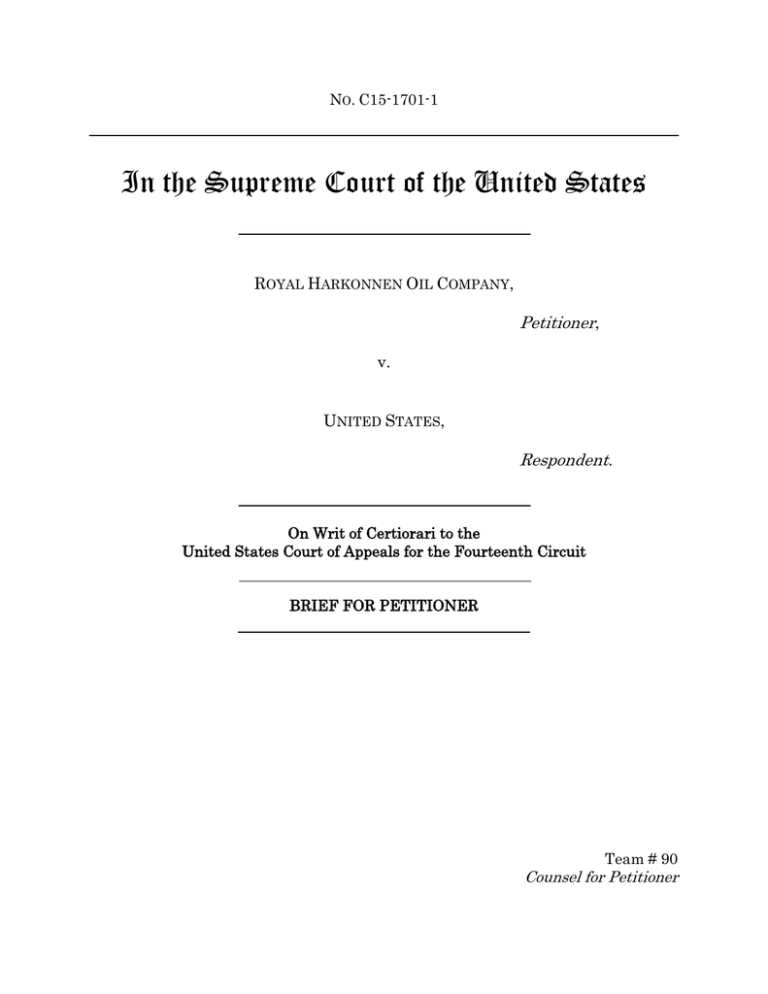

In the Supreme Court of the United States Petitioner Respondent

advertisement