Federal Income Taxation Chapter 8 Tax Expenditures (Muni-Bonds) Professors Wells Presentation:

advertisement

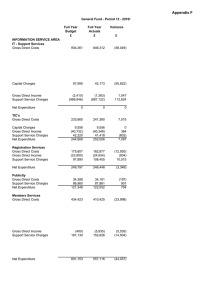

Presentation: Federal Income Taxation Chapter 8 Tax Expenditures (Muni-Bonds) Professors Wells September 30, 2015 Tax Exempt Interest p. 519 Code §103 – exclusion from gross income for interest on state and local debt obligations. Economic effect: reduce the amount of interest payable by the state/local govt. obligor. Note the leakage for this gross income exclusion between (1) benefit to local govt and (2) cost to U.S. Treasury. Tax Expenditure cost is $23.1 billion. 2 U.S. Constitutional Authority to Tax Muni Bond Interest? p. 520 Would taxation of muni-bond interest by U.S. Government be constitutional? Consider the rights of states as being impaired if federal taxation occurs. Cf., South Carolina v. Baker (p. 521) that muni-bond interest is taxed if bonds are not in “registered” form. Code §§103(b)(3) & 149. Why this rule? 3 Private Activity Bonds, etc. Code §§141-150 p.526 Use of muni-bonds (1) for government functions and (2) to assist private industry (by acting as intermediary). Code §148 re “arbitrage” bonds. 4 Sale of Home p.324 §121 excludes gain on sale of home of up to $250,000 ($500,000 for married filing jointly) The benefits of this exclusion arguably changes taxpayer behavior on where they have their wealth. Is this a good thing? The Tax Expenditure cost of this benefit is $17.5 billion. 5 Dividend Income p.1112 §61(a)(7) treats dividends as part of gross income §1(h)(11) provides a preferential tax rate for dividends and capital gains. The Tax Expenditure estimate for this benefit is $65.9 billion. The Warren Buffet rule. Why should this form of income be taxed preferentially over ordinary income? See p. 1144 for upside down subsidy implications. 6 Tax Expenditure Budget p.531 What is a “tax expenditure”? - deviations from the norm for the measurement of economic income (both positive and negative amounts) What is the “tax expenditure budget”? What is the starting point for measuring the deviation from true income? Appropriations without the budget process? Use “dynamic scoring”? 7