UNCTAD Secretary-General's High-Level Multi-Stakeholder Dialogue on Commodities

advertisement

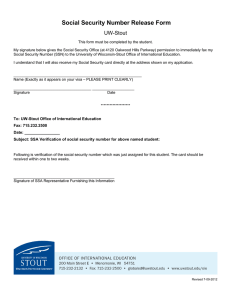

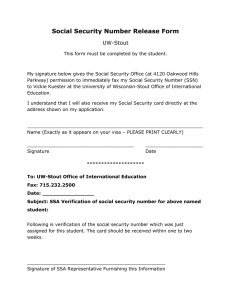

UNCTAD Secretary-General's High-Level Multi-Stakeholder Dialogue on Commodities in the context of UNCTAD XII 28-29 January 2008 China, Terms of Trade & Development Strategy in SSA By Mr. Raphael Kaplinsky Professor, Open University, UK The views expressed are those of the author and do not necessarily reflect the views of UNCTAD CHINA, TERMS OF TRADE AND DEVELOPMENT STRATEGY IN SSA Raphael Kaplinsky, Dept of Policy and Practice, The Open University, UK High Level Multi-Stakeholders Dialogue On Commodities in the Context of UNCTAD XII The drive to industrialisation • Close association between incomes and industrialisation • The terms of trade favour manufactures Commodities-manufactures terms of trade The drive to industrialisation • Close association between incomes and industrialisation • The terms of trade favour manufactures • Manufactures are (relative to agriculture) income elastic and price inelastic • Synthetic substitutes for natural products • Manufacturing embodies rents – agriculture does not • Manufacturing can be labour intensive – primary commodities are very capital intensive China’s growth is not unique.. GDP (constant prices) 3.5 Log of export growth Log of GDP growth Growth of exports 3 2.5 2 1.5 6 5 4 3 2 1 01 6 1 11 16 21 26 31 36 6 11 16 21 26 31 36 Ye ars from be ginning of growth surge 41 41 Years from beginning of export surge China (1989-2003) China (1989-2003) Japan (1960-2003)Japan (1960-2003) Korea (1963-2003) Korea (1963-2003) Share of Global Population 25 20 15 10 5 0 1960 1964 1968 1972 1976 China 1980 India 1984 Japan 1988 1992 Korea, Rep. 1996 2000 2004 Share of manufacturing value added Share of the world 1985 East Asia China South Asia Latin America and Caribbean Sub-Saharan Africa Middle East, North Africa, Turkey 4.1 1.4 0.8 6.7 1.0 1.5 1998 13.9 7.0 1.8 5.2 0.8 2.4 Share of developing countries 1985 1998 29.2 10.2 5.9 46.9 7.1 10.8 57.7 29.3 7.3 21.8 3.4 9.8 World Manufacturing Export Price, 1986-2000 20 15 10 5 0 -5 -10 19 86 19 87 19 88 19 89 19 90 19 91 19 92 19 93 19 94 19 95 19 96 19 97 19 98 19 99 20 00 Annual price change (%) 25 IMF, World Economic Outlook Database EU Imports from China 1st Q 2005/1st Q 2004 China Market Share in EU-25 Imports Volumes % Price % 1 Q 2004 % 1 Q 2005 % T-shirts 164 -26 7 17 Pullovers 534 -47 6 38 Men’s trousers 413 -16 6 35 Blouses 186 -24 6 22 Women’s coats 184 -18 6 10 Bras 139 -15 30 49 Socks and pantyhose 63 -22 30 54 Linen and ramie yarns 51 1 27 45 Linen fabrics 257 1 10 45 Source: Euratex data as reported by Nathan Associates 0 Resource based manufactures Low technology Medium technology High-income Upper-middle-income Lower-middle income China Low income High income Upper-middle-income Lower-middle income China Low income High-income Upper-middle-income Lower-middle income China Low income High-income Upper-middle Lower-middle China Low income %of sectors Caught between a rock and a hard place 70 60 50 40 30 20 10 High technology Percentage of sectors with negative price trends, 1988/92000/2001 by technological intensity and country-grouping Actual and projected global share of China’s consumption of base metals 30% 25% %of total 20% 15% 10% 5% 0% 1950 1953 1956 1959 1962 1965 1968 1971 1974 1977 1980 1983 1986 1989 1992 1995 1998 2001 2004 2007 2010 Coppe r Source: Macquarie Mining Alum inium Zinc Nick e l Ste e l Ir on Or e (Tr ade ) China's Share of Global Demand China's Share of Total World Growth 26% 100% 99% 95% 24% 90% 80% 22% 68% 67% 51% 50% 20% 18% 16% 14% 8% 0% Steel Nickel Copper Aluminium Source: Macquarie Mining 2003 10% 2002 10% 2001 20% 2000 12% 1999 30% 1998 2000-2003 1995-2003 1997 40% 1996 % share 60% % of total World 76% 73% 70% Steel Nickel Copper Aluminium 1995 100% 28% Enormous demand potential Kgs/capita GDP per capita ($US1995) Aluminium Copper Steel Japan 1955 1975 0.6 10.5 1.2 7.4 80 599 5,559 21,869 Korea 1975 1995 1.0 15.0 1.3 8.1 84 827 2,891 10,841 China 1990 1999 2002 2003 0.7 2.3 3.3 4.0 0.6 1.2 2.0 2.4 59 108 160 200 342 756 933 1,103 The agricultural sector, 2007-2016 (OECD/FAO, 2007) • Biofuels raise grain prices • Raised demand in China for: –Beef –Pigmeat –Milk powder –Oilseeds for cattle • “…structural changes such as increased feedstock demand for biofuel production, and the reduction of surpluses due to past policy reforms, may keep [agricultural product] prices above historic equilibrium levels during the next 10 years…. • Winners are: • Brazil (sugar, oilseeds, meat) • Argentina (cereals and dairy products) • Russia/Ukraine (coarse grains) • East and south east Asia (rice, veg oils, poultry) Clothing exports 2000 and 2004 1,800 1,500 $m 1,200 900 600 300 0 Kenya Lesotho Madagascar 2000 Mauritius 2004 S Africa Sw aziland Value of SSA and China C+T exports to US, 2004/2006 AGOA -26 85 Kenya -5 113 Lesotho -15 171 Madagascar -26 108 Mauritius -48 104 SA -53 89 Swazi -24 136 Number of countries accounting for 90% of SSA Exports (excl SA) 25 20 15 10 5 0 Agricultural Materials Ore and Metals Fuels Share of SSA fuel exports 50% 40% 30% 20% 10% 0% Nigeria Angola Equatorial Guinea Congo, Rep. Sudan Share of SSA exporters of ores and minerals (excl SA) 30% 20% 10% 0% Mozambique Zambia Guinea Mauritania Congo, Dem. Rep. Share of SSA agricultural exports excl SA 30% 20% 10% 0% Cote d'Ivoire Kenya Ghana Cameroon Nigeria SSA EXPORTS SA, Lesotho, Swaziland, Madagascar, Kenya, Mauritius Hard commodities Clothing footwear SSA LOSS SSA GAIN Oil exporters, Zambia, SA, DRC, Botswana, Ghana, Ivory Coast, etc CHINA IMPORTS CHINA EXPORTS All SSA Oil SSA LOSS SSA GAIN Most SSA SSA IMPORTS Clothing footwear So what? • A complex picture with nuanced impacts and opportunities • Imbalances in the global economy • We don’t know the spread effects • How long will the terms of trade reversal last? Regarding precious stones and hard commodities • Descent into conflict? • The economic management of mineral rents – stability – over time • Impact on other sectors (“Dutch Disease”) • How to maximise backward linkages • But should forward linkages be encouraged? • Adverse distributional effects • But this is a small group of countries in SSA Regarding soft commodities • How to take maximum advantage, and speedily • How to maximise positive distributional impact by including small scale producers • Also addressing niche sectors Regarding manufactures • Manufacturing is the source of capability-growth and employment • But the Washington Consensus circumscribes trade and industrial policies, • So: –How to protect producers in the local market? –How to maintain access to external markets –How to sustain industrial policies