& Santosh Shanbhag A

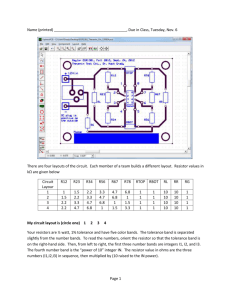

advertisement