Resource Allocation and Consumption Referencing: When is More Income Welfare Reducing?

advertisement

Resource Allocation and Consumption Referencing:

When is More Income Welfare Reducing?

Preliminary and incomplete—please do not circulate.

Curtis Eaton

Jesse Matheson

∗

University of Calgary

May 24, 2009

Abstract

We analysis the link between affluence and well-being using a simple general equilibrium model in which a pure Veblen good is consumed. Individuals derive utility from

the pure Veblen good solely on how much they consume relative to others. Resources

devoted to the Veblen good provide us with a measure of deadweight loss, as they make

no contribution to utility in equilibrium. We ask: Under what preference conditions

does the proportion of productive capacity devoted to the pure Veblen good increase

as an economy becomes more affluent? In a very general preference framework we

derive a necessary, but not sufficient, condition under which the Veblen good crowds

out standard forms of consumption and leisure, resulting in an inverse relationship

between affluence and utility. With additional structure on the model we are able to

fully characterize the behavior of deadweight loss and utility as an economy becomes

more affluent.

∗

Corresponding author; Department of Economics, University of Calgary, 2500 University Drive NW,

Calgary, AB, T2N 1N4, jmatheso@ucalgary.ca. Eaton: eaton@ucalgary.ca. We thank Herb Emery, Juan

Moreno-Cruz, Francisco Gonzalez and participants of Department of Economics Wednesday Workshop Series,

at the University of Calgary, for their comments and suggestions. Funding from the Social Science and

Humanities Research Council is gratefully acknowledged.

1

In recent years, a great deal of attention has been paid to what is sometimes called the

Easterlin paradox: in wealthy societies, there is no discernible positive correlation between

average perceived well-being and per capita income. That is, in societies like our own,

over time we get richer, but we don’t get happier (see Galbraith (1969), Easterlin (1974,

1994), Helliwell (2003)). A number of studies suggest that consumption referencing may

provide an explanation (see Hirsch (1976), Sen (1983), Frank (1985, 1999), Hopkins and

Kornienko (2004)). Recent work by Eaton and Eswaran (2009) suggests that, in the presence

of consumption referencing, affluence itself may explain the Easterlin paradox. This paper

explores the possible link between affluence and well-being in more depth. Broadly speaking,

we wish to address the following question: In a world where relative consumption matters,

is the Easterlin paradox is an inevitable consequence of affluence?

Following the lead of Eaton and Eswaran (2009), to address this question cleanly, we

capture the essence of consumption referencing using the notion of a pure Veblen good —a

good that yields utility to those who consume it based solely on how much they consume

relative to the amount consumed by others. For our purposes, the pure Veblen good has

one very attractive feature. In equilibrium, everyone’s utility is independent of the amount

they consume of the Veblen good. Hence all resources allocated to the Veblen good are

squandered.

To address our research question, we use a simple, competitive, general equilibrium model

that is standard in all respects save one—the presence of a pure Veblen good. The productivity of human and non-human resources is exogenous, and the technology is linear. The size

of the population is fixed, so that we can focus on per-capita productivity and well-being.

The preferences and the endowment of individuals are identical.

Broadly, an economy can become more affluent through technological change, that enhances the productivity of human or of non-human resources, or through an increase in the

quantity of non-human resources. In our model, the productivity of human resources is cap2

tured by one parameter. Since the production technology is linear, both the quantity and

the productivity of non-human resources can be captured by one additional parameter. So

an increase in either of these parameters represents more affluence.

In the context of our model, our research question can be posed more precisely: Under

what conditions on preferences does the proportion of total productive capacity that is

devoted to the pure Veblen good increase as the economy becomes more affluent?

In Section 2 we explore this and related questions in a relatively general framework for

preferences, and we discover an interesting sufficient, but not necessary, condition under

which the answer to our question is definitely yes. In Sections 2 and 3, we impose additional

structure on the model in an effort to gain additional insight.

1

The General Model

In this section we deal with a relatively general version of our model, and in subsequent sections we introduce two versions of the model that incorporate more structured specifications

of the Veblen component.

1.1

Assumptions

The economy consists of a large number of identical individuals, with preferences represented

by the additively separable utility function:

U (xi , yi , vi ) = F (xi ) + G(yi ) + V (vi , v)

(1)

where xi is individual i’s consumption of leisure, yi her consumption of a standard good (i.e.

a composite commodity), and vi her consumption of a pure Veblen good. The quantity v

is the mean consumption of the Veblen good in the economy. F (xi ) is the contribution of

3

leisure to individual i’s utility, G(yi ) the contribution of the standard good, and V (vi , v) the

contribution of the pure Veblen good.

We adopt the standard increasingness and concavity assumptions regarding the utility

generated by private consumption of these three goods.

Assumption 1. increasingness and concavity

F 0 (xi ) > 0,

F 00 (xi ) < 0.

G0 (yi ) > 0,

G00 (yi ) < 0.

V1 (vi , v) > 0,

V11 (vi , v) < 0.

In addition, we assume that the standard good and leisure are essential.

Assumption 2. standard good and leisure essential

lim F 0 (xi ) = ∞,

lim G0 (yi ) = ∞.

xi →0

yi →0

In the spirit of Veblen and the literature on consumption referencing, we assume that the

individual’s utility from the Veblen good is a decreasing function of average consumption of

the Veblen good in the economy.

Assumption 3. consumption referencing

V2 (vi , v) < 0

Now imagine an initial situation in which everyone is consuming the same amount of the

Veblen good. It will then be the case that vi = v for all individuals. Now suppose that

everyone’s consumption of the Veblen good changes by the same amount, ∆v. No one’s

relative consumption of the Veblen good has changed, and accordingly, if the Veblen good

4

is pure, no one’s utility from the Veblen good will have changed. This will be the case

if V1 (v, v) = |V2 (v, v)|, or if V1 (v, v) + V2 (v, v) = 0. Accordingly, we adopt the following

assumption:

Assumption 4. a pure Veblen good

V1 (v, v) + V2 (v, v) = 0.

Each individual is endowed with one unit of time, which is allocated to leisure and work,

and one unit of a non-human resource. The technology for producing the standard and

Veblen good is linear in both the quantity of labor and the quantity of the non-human

resource, and is completely described by two exogenous productivity parameters, a and w.

Specifically, r units of the non-human resource produce ar units of either the Veblen good

or the standard good, and l units of labor produce wl units of either the Veblen good or the

standard good. Notice that a is the productivity of the non-human resource1 , and w is the

productivity of the labor or human resource.

All markets are competitive, so the general equilibrium prices of labor and the non-human

resource are w and a, respectively. The equilibrium prices of the standard and Veblen goods

are unity, and the equilibrium price of leisure is w.

1.2

The Representative Individual’s Choice Problem

Since she is endowed with one unit of the human resource (time) and one unit of the nonhuman resource, in general equilibrium the representative individual’s productive potential

1

For simplicity, we will interpret a as the productivity of the non-human resource. However, given the

linearity of production in the model we could just as easily talk about a as a composite parameter that

captures both the productivity and quantity of the resource. To see this let q denote quantity of the resource

and b its productivity. Then aggregate productivity potential is just a ≡ qb. So we can interpret comparative

static results wrt a as in either way.

5

is w + a. Using Becker’s terminology, her full income is w + a. So her budget constraint is

wxi + yi + vi ≤ w + a

The representative individual’s choice problem is then

maxxi ,yi ,vi

U (xi , yi , vi ) = F (xi ) + G(yi ) + V (vi , v)

subject to

wxi + yi + vi ≤ w + a,

xi ≤ 1,

vi ≥ 0

There is no need to incorporate non-negativity constraints for leisure or the standard good

in the formulation of the choice problem since both goods are assumed to be essential.

Obviously, there are four sorts of solution to this choice problem, depending on whether

the solution values of xi and vi are positive or 0, and a complete analysis would deal with all

of them. We focus on just one them, the case in which the solution values for xi and vi are

both positive. Implicitly, then, we are assuming that labor productivity, w, is large enough

so that the individual does not allocate all of her time to leisure, and that her productive

potential, w + a, is large enough so that she spends a positive amount of the Veblen good.

An interior solution of this sort is characterized by the following conditions:

F 0 (xi )

= G0 (yi ) = V1 (vi , v)

w

wxi + yi + vi = w + a

6

1.3

The Equilibrium of the Model

As all agents are identical, in equilibrium everyone will choose the same quantities, xi = x? ,

yi = y ? and vi = v ? . Hence, the (interior) equilibrium of the model is characterized by the

following conditions:

F 0 (x? )

= G0 (y ? ) = M U (v ? )

w

wx? + y ? + v ? = w + a

(2)

(3)

where M U (v) is defined as the marginal utility of the Veblen good when all individuals

choose the same quantity of it. That is,

M U (v) ≡ V1 (v, v)

A graphic representation of the equilibrium will prove to be helpful. For this purpose,

consider the following optimization problem. Fix the representative person’s expenditure on

the Veblen good, and optimally allocate the remainder of her resources to leisure and the

standard good. Optimality dictates that

F 0 (x)

= G0 (a + w(1 − x) − v)

w

This condition implicitly defines a locus L(v, a, w) corresponding to the optimized value of

G0 (y) (equal to the optimized value of F 0 (x)/w), given v, a and w.

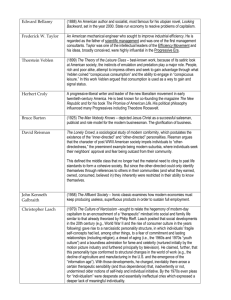

In Figure 1 we illustrate the graph of L(v, a, w), across feasible values of v. This graph

must satisfy certain obvious properties. It must intersect the vertical axis at a point above

the horizontal axis (L(0, a, w) > 0), it must be upward sloping (L1 (v, a, w) > 0), and it must

be asymptotic to the vertical line v = w + a (because the standard good and leisure are

7

essential).

In the figure we also illustrate the graph of M U (v). Because it is determined by the

relative strength of two possibly opposing effects, the slope of this graph is not constrained—

it can be positive, zero or negative. Recall that M U (v) is just V1 (v, v), so

M U 0 (v) = V11 (v, v) + V12 (v, v)

| {z } | {z }

MP E

M SE

For convenience, we call the first effect the marginal private effect (MPE) and the second

the marginal social effect (MSE) of an infinitesimal increase in v. MPE is by assumption

negative, but MSE could be positive, and if it is the effects are opposed. Obviously, if MSE

exceeds the absolute value of MPE, the graph is upward sloping. In this case, as v increases

the marginal private value of the Veblen good increases.

Any point of intersection of the two graphs determines an equilibrium value of v. In

Figure 1 there are three such values. However, the v2 equilibrium is unstable. Roughly

speaking, if we begin at this equilibrium point, a small change of v in either direction creates

forces that lead to further adjustments in the same direction. For example, if quantity of

the Veblen good is increased by a small amount, a situation is created in which the marginal

value of resources devoted to the Veblen good exceeds their marginal value in either of the

other uses, leading to a further increase in quantity of the Veblen good. In contrast, the v1

and v3 equilibria are stable. For our purposes, unstable equilibria are uninteresting, and are

therefore ignored2 .

2

See the appendix for the stability conditions. We also show that, given assumptions 1–3, there always

exists at least one stable equilibria

8

1.4

Deadweight Loss

Because, in equilibrium, all individuals choose the same quantity of the Veblen good the

following derivative is of interest:

∂V (v, v)

= V1 (v, v) + V2 (v, v) = 0

∂v

The second equality follows from Assumption 4—the pure Veblen good assumption. When

everyone consumes the same amount of the pure Veblen good, the private marginal utility

of the good (V1 (v, v)) is exactly offset by its social marginal disutility (V2 (v, v)). Hence, the

equilibrium utility of the representative person is independent of the quantity consumed of

the Veblen good. Regardless of how much or how little of the Veblen good is consumed, it

contributes nothing to the well-being of the people who consume it.

It follows then that resources devoted to the pure Veblen good are simply squandered.

The share of resources devoted to the Veblen good is just

sv =

v∗

a+w

Clearly, sv is the obvious index of the proportionate deadweight loss in this economy.

With this background, it may be helpful to pose our research question yet again. Under

what conditions on preferences do either or both of the following inequalities hold?

∂sv

∂sv

> 0,

>0

∂a

∂w

9

1.5

Comparative Statics

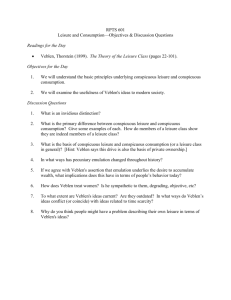

In Figure 2 we illustrate the comparative statics of this system3 . Consider and increase in the

productivity of the non-human resource, from e

a unit to â. Clearly this leads to a downward

shift in L(v, a, w). The initial equilibrium may be at either v1 or v2 . At either equilibrium,

consumption of the Veblen good unambiguously increases as a increases.

If the initial equilibrium is v1 , where MSE does not dominate MPE, marginal utility of

the standard good and leisure decrease in response to the increase in a, from which it is

clear that both y ? and x? increase as a result of the increase in a. Hence, equilibrium utility

increases. In this case, without further assumptions, nothing can be said about the sign of

∂sv /∂a – proportionate deadweight loss may either increase or decrease as a increases.

If instead the initial equilibrium is v2 , where MSE dominates MPE, the marginal utility

of leisure and standard consumption increase in response to the increase in a, implying that

both y ? and x? decrease in response to the increase in a. It follows that equilibrium utility

will also decrease, since in equilibrium only the standard good and leisure create utility. In

addition, since consumption of both leisure and the standard good decrease in response to

an increase in the productivity of the non-human resource, it is the case that ∂sv /∂a > 1.

In other words, when MSE dominates MPE more than all of the added productive potential

(e

a − â) is squandered on increased production of the pure Veblen good.

The marginal change in equilibrium utility with respect to a can be written as

dU (x? , y ? , v ? )

=

da

dv ?

1−

da

V1 (v ? , v ? )

which is the sum of the change in utility due to the change in private consumption, V1 (v ? , v ? ),

and the change in utility due to a change in social consumption, V2 (v ? , v ? )dv ? /da. As

V1 (v ? , v ? ) = V2 (v ? , v ? ), the sign of dU (x? , y ? , v ? )/da is determined by the magnitude of

3

A formal derivation is available in the appendix.

10

dv ? /da, which depends on the sign of M U 0 (v). When the MSE does not dominates the

MPE, consumption of v increases by less than the full increase in a. Therefore, utility increase as a result of greater consumption of y and x. Conversely, if the MSE dominates

the MPE, consumption of v increases by more than the full increase in a, crowding out

consumption of y and x. As a result, utility decreases with a.

Comparative statics for a change in resource productivity are summarized in Proposition

1.

Proposition 1 (Comparative Statics for a). If at the equilibrium M U 0 (v) < 0 (MSE is less

than MPE), then

dx?

> 0,

da

dy ?

> 0,

da

dv ?

>0

da

dU

>0

da

dsv

T 0.

da

But if at the equilibrium M U 0 (v) > 0 (MSE is greater than MPE), then

dx?

< 0,

da

dy ?

< 0,

da

dv ?

>1

da

dU

<0

da

dsv

> 1.

da

If at the equilibrium M U 0 (v) = 0 (MSE is equal to MPE), then

dx?

= 0,

da

dy ?

= 0,

da

dv ?

=1

da

dU

=0

da

dsv

> 0.

da

An increase in labor productivity (w) also generates a downward shift in L(v, w, a), so

some the comparative static results are the same. Such an increase unambiguously leads to

an increase in equilibrium consumption of the Veblen good. At equilibrium v1 it leads to an

increase in consumption of the standard good, and at equilibrium v2 it leads to a decrease

in consumption of the standard good. At v2 leisure consumption must decrease, because

F 0 (x? )/w decreases. However, at v1 leisure may either increase or decrease, depending on

the curvature of F .

11

The corresponding change in equilibrium utility can be written as:

dU (x? , y ? , v ? )

=

dw

dv ?

1−x −

dw

?

V1 (v ? , v ? ) T 0

1 − x? is the incremental change in income resulting from the change in productivity. If

v ? changes by an amount greater than this change, utility and labor productivity will be

inversely related. Suppose M U 0 (v) = 0, so the change in v ? is given by

dv ?

1

=1− 1−

x? ≥ 1 − x?

dw

r(x? )

(4)

where r(x) = −x? F 00 (x)/F 0 (x), is equivalent to the Arrow-Pratt measure of relative risk

aversion4 . The extent to which v ? increases, and utility decreases, when w increases depends

on the curvature of F (x). Because M U 0 (v ? ) = 0 any increase in consumption income,

(1−x)w+a, is fully allocated to v, and the marginal utility of consumption, G(y ? ) = M U (v ? ),

remains constant. Increasing w makes leisure expensive relative to consumption, and x?

declines, increasing (1− x)w + a. The benefits of less leisure—greater income—are dissipated

in consumption of the Veblen good. r(x) provides us with a measure of how much x is

sacrificed. If r(x) is less than one, F 0 (x) increases slowly when x is decreased, and large

amounts of leisure are sacrificed. When r(x) is greater than one, F 0 (x) increases rapidly when

x is decreased, and relatively small amounts of leisure are sacrificed. Therefore M U 0 (v) = 0

is a sufficient, but not necessary condition for utility to be non-increasing in productivity.

4

In the appendix we provide a full derivation of dv ? /dw, which, when M U 0 (v) = 0, reduces to:

wG0 (y ? )

dv ?

= 1 − x? − 00 ?

dw

F (x )

substituting F 0 (x? ) = wG0 (y ? ) and multiplying the numerator and denominator by x? , resulting in Equation

4.

12

Proposition 2 (Comparative Statics for w). If MPE-MSE is less than 0, then

dx?

T 0,

dw

dy ?

T 0,

dw

dv ?

> 0,

dw

dU

T0

dw

dsv

T 0.

dw

dU

<0

dw

dsv

> 0.

dw

If MPE-MSE is greater than or equal to 0, then

dx?

< 0,

dw

dy ?

≤ 0,

dw

dv ?

> 0,

dw

The comparative statics outlined in propositions 1 and 2 are very revealing. When MSE

dominates MPE, as the economy grows more affluent through increases in the productivity

of either labor or the non-human resource, the share of total productive capacity devoted to

the pure Veblen good increases at rate that is larger than the rate at which total productive capacity is increasing. Consequently, equilibrium utility declines as productive capacity

increases. This illustrates just how destructive Veblen competition can potentially be. The

results are less clear in the case where MPE dominates MSE. In this case, consumption of all

goods and utility increases as the productive capacity of the economy increases. However, we

cannot conclusively say what happens to proportionate deadweight loss. When human productivity increases, consumption of the Veblen good and standard good is always increased,

but the change in leisure, deadweight loss and utility are all ambiguous.

In the next two sections we add more structure to the model by specifying specific

functional forms for V (vi , v). This allows us to explore a number of the possibilities in

more depth.

13

2

When the Difference Matters

In this section we consider the case in which individuals care about the difference between

their own consumption, vi , and mean consumption in the economy, v.

V (vi , v) = D(vi − v)

where D() is an increasing and strictly concave function of its one argument, vi − v. In this

formulation, it is the difference vi − v that individuals value. In this sense, vi − v is individual

i’s effective consumption of the Veblen good. Since effective consumption may be positive,

negative or zero, it is necessarily the case that D0 (0) is finite.

Given this specification,

V1 (vi , v) + V2 (vi , v) = D(vi − v) − D(vi − v) = 0 for all vi and v

A number of things that follow from this are worth noting. Obviously, the pure Veblen

good assumption (Assumption 4) is satisfied for this specification since it requires only that

V1 (vi , v) + V2 (vi , v) = 0 when vi = v. In addition, it is the case that given any vector

(v1 , v2 , ..., vN ), a uniform change ∆v in each individual’s consumption of the Veblen good

changes no one’s utility from the Veblen good. Further, since everyone chooses to consume

the same quantity of the Veblen good in the equilibrium of the model M U (v ∗ ) is a constant.

M U (v ∗ ) = D0 (0)

From this it is clear that MSE and MPE are identical, and equal to zero.

14

maxxi ,yi ,vi

U (xi , yi , vi ) = F (xi ) + G(yi ) + D(vi − v)

subject to

wxi + yi + vi ≤ w + a,

vi ≥ 0,

xi ≤ 1

Since the standard good and leisure are essential, y ∗ and x∗ are invariably positive. Since

people are endowed with just one unit of time, x∗ is bounded above by unity, and since the

Veblen good is not essential, v ∗ is can be equal to zero. So, there four cases to consider:

(x∗ = 1, y ∗ = 0); (x∗ < 1, y ∗ = 0); (x∗ = 1, y ∗ > 0); (x∗ < 1, y ∗ > 0). In the general model

we ignored all but last case. Here we explore all four cases.

In Case 1, individuals allocate all of their time to leisure (x∗ = 1), and none of their

income to the Veblen good (v ∗ = 0). This requires that

F 0 (1)

≥ G0 (a) ≥ D0 (0)

w

From these conditions it is clear that this corner equilibrium arises when the productivity of

human and non-human resources are low enough.5

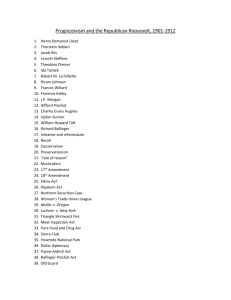

This scenario is depicted in region B of Figure 3. In this case, marginal increases in

w do not contribute to utility or consumption since no one works, marginal increases in a

are devoted to the standard good. Since non-human resources are devoted entirely to the

standard good and human resources to leisure, there is no deadweight loss in this economy.

Define ā as follows: ā ≡ G0−1 (D0 (0)); ā is the largest value of a such that v ∗ is equal to 0. Define a

function w(a) as follows: w(a) ≡ G0 (a)/F 0 (1); given a, w(a) is the largest value of w such that x∗ = 1. The

function w(a) is upward sloping and w(0) = 0. If a ≤ ā and w ≤ w(a), no one consumes any of the Veblen

good and no one works.

5

15

In fact, the equilibrium is Pareto-efficient. The comparative statics for this case are

dy ?

= 0,

dw

dx?

= 0,

dw

dv ?

= 0,

dw

dU

=0

dw

dsv

=0

dw

dy ?

= 1,

da

dx?

= 0,

da

dv ?

= 0,

da

dU

>0

da

dsv

=0

da

In Case 2, individuals allocate some of their time to work (x∗ < 1), and none of their

income to the Veblen good (v ∗ = 0). This requires that

F 0 (x? )

= G0 (a + w(1 − x∗ )) ≥ D0 (0)

w

This scenario is depicted in region A of Figure 2. In this case people allocate a portion of

their time to paid labor, and all of their income the standard good, so again there is no

deadweight loss, and the equilibrium is Pareto-efficient. The comparative statics for this

case are

dy ?

> 0,

dw

dx?

T 0,

dw

dv ?

= 0,

dw

dU

>0

dw

dsv

=0

dw

dy ?

> 0,

da

dx?

> 0,

da

dv ?

= 0,

da

dU

>0

da

dsv

=0

da

In Case 3, individuals allocate all of their time to leisure (x∗ = 1), and some of their

income to the Veblen good (v ∗ > 0). This requires that

F 0 (1)

≥ G0 (y ? ) = D0 (0)

w

y? + v? = a

This scenario is depicted in region C of Figure 3. As the productivity of non-human resources

16

increases, all the added productivity is devoted to the production of the pure Veblen good,

and consequently added productivity is not reflected in higher utility or well-being. To see

this, start at an equilibrium and increase a by ∆a. If all the added productivity is devoted

to the Veblen good, it remains the case that M V (v) is equal to the constant D0 (0), and

consequently that the conditions characterizing the equilibrium are still satisfied G0 (y ? ) =

D0 (0). The comparative statics with respect to w are identical to those in Case 1; those for

a are

dy ?

= 0,

da

dx?

= 0,

da

dv ?

= 1,

da

dU

=0

da

dsv

>1

da

Notice that, not only does the proportionate deadweight loss increase as the productivity of

the non-human resource increases, but the rate of increase exceeds one.

In Case 4, individuals allocate some of their time to leisure (x∗ = 1), and some of their

income to the Veblen good (v ∗ > 0). This requires that

F 0 (x? )

= G0 (y ? ) = D0 (0)

w

wx? + y ? + v ? = w + a

This scenario is depicted in region D of Figure 3. Comparative statics with respect to a are

identical to those for the previous case – as a increases all the added productivity is devoted

to the Veblen good, so deadweight loss increases at a rate that exceeds one. The picture

is even worse when labor productivity increases. As w is increased, individuals are led to

reduce their consumption of leisure, and to allocate all of the added income—that arising

from the increase in w plus that arising form the additional time allocated to work—to the

Veblen good. As a result, as w is increased, deadweight loss again increases at a rate greater

than one, and equilibrium utility actually decreases..

dy ?

= 0,

dw

dx?

< 0,

dw

dv ?

> 1,

dw

17

dU

<0

dw

dsv

>1

dw

When it is the divergence of one’s own consumption of the Veblen good from mean

consumption that matters to people, the answer to the question that motivates this paper

is a clear yes – in affluent economies, where human and/ or non-human resources are very

productive, the proportionate deadweight loss associated with Veblen competition grows as

the economy becomes more affluent, and in certain cases, added productivity actually leads

to a decrease in equilibrium utility.

3

When the Ratio Matters

In this section we consider the case in which individuals care about the ratio of vi to v.

V (vi , v) = R

v i

v

where R() is an increasing and strictly concave function of its one argument, vi /v. In this

formulation, it is the ratio vi /v that individuals value, and this ratio can be regarded as the

individual i’s effective consumption of the Veblen good.

Given this specification,

vi

vi

vi

1

V1 (vi , v) + V2 (vi , v) = R0 ( ) − 2 R0 ( )

v

v

v

v

The pure Veblen good assumption (Assumption 4) is satisfied for this specification since

when vi = v the right hand side of this expression of equal to 0. There is another sense

in which this specification captures the spirit of a pure Veblen good. Given any vector

(v1 , v2 , ..., vN ), a uniform positive proportionate change of all the vi leaves utility from the

Veblen good unchanged, since

R

v i

v

=R

λvi

λv

18

for all λ > 0

Under this specification

1

M U (v) = R0 (1)

v

So M U 0 (v) is

M U 0 (v) = −

1 0

R (1) < 0

v2

The fact that M U 0 (v) is always negative tells us that MPE dominates MSE. However, as v

gets large, the dominance becomes weaker and in the limit, MPE is equal to MSE.

The representative consumer’s choice problem is now

maxxi ,yi ,vi

vi

U (xi , yi , vi ) = F (xi ) + G(yi ) + R( )

v

subject to

wxi + yi + vi ≤ w + a,

xi ≤ 1

Notice that there is only one non-negativity constraint for this problem, since under the ratio

formulation M U 0 (v) goes to infinity as v goes to zero.

The conditions that characterize the corner equilibrium where x∗ = 1 are

F 0 (1)

≥ G0 (y ? )

w

R0 (1)

= G0 (y ? )

v?

y? + v? = a

(5)

(6)

(7)

The interior equilibrium is characterized by the following conditions:

F 0 (x? )

= G0 (y ? )

w

R0 (1)

= G0 (y ? )

v?

wx? + y ? + v ? = w + a

19

(8)

(9)

(10)

In Figure 3 we illustrate the partition of (a, w) space corresponding to these two possibilities.

Since M U 0 (v) is negative, we know a lot about the comparative statics of the ratio

model from Propositions 1 and 2. Equilibrium consumption of both the standard good and

the Veblen good are increasing in a and w, as is equilibrium utility, and leisure is strictly

increasing in a. However, it is not clear what happens to the index of deadweight loss, sv ,

as productivity increases.

dy ?

> 0,

dw

dx?

T 0,

dw

dv ?

> 0,

dw

dU

>0

dw

dsv

T0

dw

dy ?

> 0,

da

dx?

> 0,

da

dv ?

> 0,

da

dU

>0

da

dsv

T0

da

We are able however to generate additional interesting results all of which are driven by

the curvature of G(y). We use the Arrow-Pratt measure of relative risk aversion. Obviously,

risk aversion is not an issue in this model where there is no risk, so we call the measure the

Arrow-Pratt measure of curvature. It is defined as

G00

r(y) = −y 0

G

We restrict attention to G() functions such that r(y) is, for all positive y, either less than,

equal to, or greater than 1. As it turns out, r(y) = 1 is a knife-edge case. On one side of

the knife-edge, the Veblen problem is worse in rich economies than in poor ones, and on the

other the opposite is true.

20

The knife-edge case, r(y) = 1

If and only if G is the logarithmic function, is r(y) = 1 for all positive y. So, for concreteness

assume that

G(y) = α ln y,

α>0

Then

G0 (y) =

α

y

There are three scenarios which we believe are interesting. The first occurs when a = 0.

In this case, consumption of leisure is a positive constant, x̄, and consumption of the Veblen

good and the standard good increase with w at a constant rates. Therefore, deadweight loss

is a constant, s̄v , across all values of w. For a strictly positive a, increasing w may lead to an

increase or a decrease in x? , but in the limit it tends to the same x̄. As w tends to infinity,

deadweight loss also tends to the constant s̄v . When a increases without bound, individuals

eventually allocate all of their time leisure, and in the limit deadweight loss approaches a

constant greater than s̄v . Proposition 3 describes these limiting conditions.

Proposition 3 (Limiting Conditions when r(y) = 1). If r(y) = 1, for all y, then:

3.1 If a = 0 then for all w

x? = x̄,

sy = s̄y ,

sv = s̄v

where x̄, s̄y and s̄v are constants which sum to one, are bounded by zero and one.

3.2 If a > 0, then as w increases without bound

lim x? = x̄,

w→∞

lim sy = s̄y ,

w→∞

where x̄, s̄y and s̄v are the same constants as in 3.1.

21

lim sv = s̄v

w→∞

3.3 As a increases without bound

lim x? = 1,

a→∞

lim sy = ŝy ,

a→∞

lim sv = ŝv

a→∞

where ŝy and ŝv are constants which sum to one and are bound by zero and one.

In an economy where there is no non-human resource (a = 0), the proportion of the

human resource that is allocated to the Veblen may be big or small, but it is independent

of labor productivity.

When a > 0, as w increases without bound, x? approaches x̄ from above, y ? and x?

increase without bound, and sy and sv approach the constants s̄y and s̄v from below. So in

this case, proportionate deadweight loss is an increasing function of w.

Increasing a without bound leads to a similar result. x? approaches 1 from below, y ? and

v ? increase without bound. When a is large enough, but strictly finite, x? = 1, and sy and

sv hit their limits, ŝy and ŝv . So, in this case, proportionate deadweight loss is an increasing

function of a until x? = 1, after which deadweight loss is constant.

Relative curvature less than unity r(y) < 1

We now restrict attention to the set of functions G(y) such that r(y) is less than one for all

y. Marginal utility is then diminishing at a slower rate for the standard good consumption

than it is for Veblen good. Therefore we find that as productive capacity increases, through

increases in the productivity of the human or non-human resource, the portion of resources

allocated to the Veblen consumption decreases. In fact, in the limit, consumption of the

standard good crowds out consumption of the Veblen good, and the economy operates at

full efficiency.

Proposition 4 (Limiting Conditions when r(y) < 1). If r(y) < 1, then

22

4.1 As w increases without bound

lim x? = 0,

w→∞

lim sy = 1,

w→∞

lim sv = 0

w→∞

4.2 As a increases without bound:

lim x? = 1,

a→∞

lim sy = 1,

a→∞

lim sv = 0

a→∞

Assuming that w is large enough so that x∗ < 1,as increasing w decreases the consumption

of leisure, and increases the consumption of both the standard good and the Veblen good.

However, the portion of total resources, w+a, which goes to the Veblen good is incrementally

smaller. This follows from Equation 5, which to hold requires an increasingly larger amount

of the standard good consumed for every unit increase in Veblen consumption. Therefore,

as w increases without bound, sv tends to zero from above and sy tends to one from below.

The consumption path across an unbounded a is similar, as standard consumption is

given increasingly greater portions of the income increase. These increases in income are

now independent of the price of leisure, and individuals therefore allocate wealth to their

leisure time until income is only made up of resource endowments.

Relative curvature greater than unity r(y) > 1

Now, consider the limiting conditions when r(y) is greater than unity. This is the Veblen side

of the knife-edge case, as wealthier economies allocate a greater portion of their resources to

consuming the Veblen good. Increases in a and w always leads to greater deadweight loss.

As Proposition 5 states, deadweight loss is especially large if the an economies’ affluence

comes from its non-human resources.

Proposition 5 (Limiting Conditions when r(y) > 1). If r(y) > 1, for all y, then the

23

following limiting conditions hold:

5.1 As w increases without bound

lim x? = x̃,

w→∞

lim sy = 0,

w→∞

lim sv = s̃v

W →∞

where x̃ and s̃v are constants, which sum to one and are bound by zero and one.

5.2 As a increases without bound:

lim x? = 1,

a→∞

lim sy = 0,

a→∞

lim sv = 1

a→∞

When r(y) is greater than unity the marginal utility of y diminishes quickly relative to

marginal utility of v. Therefore, to ensure Equation 9 is satisfied, an ever larger portion of

income must be allocated to the Veblen good for a unit increase of standard consumption.

Notice also this impacts the marginal tradeoff between consumption and leisure when w

increases. x? approaches a positive constant from above, rather than tending towards zero,

as productivity increases without bound.

Specifying effective consumption as the ratio, rather than the difference, of individual and

mean consumption introduces a price effect, which ensures that standard consumption an

increasing function in income. However, if marginal utility of consuming the standard good

is rapidly diminishing—that is at a rate greater than unity—deadweight loss in resource use

also increases as an economy becomes more affluent.

4

Conclusion

In this paper we analysis a simple general equilibrium model in which individuals allocate

their resources between a standard consumption good, leisure and a pure Veblen good. As

24

utility is derived from the Veblen good only based on relative consumption, in equilibrium

any resources devoted to the Veblen good are squandered. Using this model, we ask: Under

what preference conditions will greater affluence, in the form of greater resource or human

productivity, lead to an increase in the proportion of resources dedicated to the Veblen good?

In a very general preference framework we derive a necessary, but not sufficient, condition

under which the Veblen good crowds out standard forms of consumption and leisure, resulting

in an inverse relationship between affluence and utility. With additional structure on the

model we are able to fully characterize the behavior of deadweight loss and utility as an

economy becomes more affluent.

References

Easterlin, Richard A. (1974) ‘Does economic growth improve the human lot? some

empirical evidence.’ In Nations and Houeholds in Economic Growth: Essays in Honour

of Moses Abramovitz, ed. Paul A. David and Melvin W. Reder (New York: Academic

Press, Inc)

(1994) ‘Will raising the incomes of all increase the happiness of all?’ Journal of Behavior

and Organization 27(1), 35–47

Eaton, Curtis B., and Mukesh Eswaran (2009) ‘Well-being and affluence in the presence of

a veblen good.’ The Economic Journal. Forthcoming

Frank, Robert (1985) ‘The demand for unobservable and other nonpositional goods.’ The

American Economic Review 75(1), 101–116

(1999) Luxury Feaver: Why Money Fails to Satisfy in an Era of Excess (New York: The

Free Press)

Galbraith, John Kenneth (1969) The Affluent Society (Boston, Mass.: Houghton Mifflin

Company)

25

Helliwell, John F. (2003) ‘How’s life? combining indivdiual and national variables to

explain subjective well-being.’ Economic Modelling 20(2), 331–360

Hirsch, Fred (1976) Social Limits to Growth (Cambridge, Mass.: Harvard University Press)

Hopkins, Ed, and Tatiana Kornienko (2004) ‘Running to keep the same place: Consumer

choice in a game of status.’ American Economic Review 94(4), 1085–1107

Sen, Amartya (1983) ‘Poor, relatively speaking.’ Oxford Economic Papers 35(2), 153–169

26

Figure 1

L(), MU ()

L (v, a , w )

MU (v)

MU (0)

L(0, a, w)

0

v

v1

v2

27

v3

w+a

Figure 2

L(), MU ()

L(v, a~, w) L(v, aˆ , w)

MU (v)

L(vˆ2 , aˆ , w)

L(v2 , a~, w)

L(v1 , a~, w)

L(vˆ1 , aˆ , w)

0

v1

v̂1

v2

28

v̂2

v

Figure 3

w

[v

*

]

> 0, x* < 1

D

[v

*

*

]

= 0, x < 1

A

C

B

[v

[v

0

*

*

]

> 0, x* = 1

]

= 0, x* = 1

a

a

29

Figure 4

w

[x

*

]

<1

A

B

[x

*

]

=1

a

0

30