Why Do Companies Hold Cash? Research Discussion

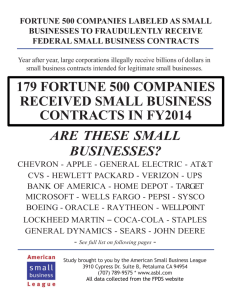

advertisement