About This File:

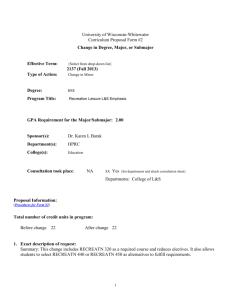

advertisement