Stat 328 Final Exam

advertisement

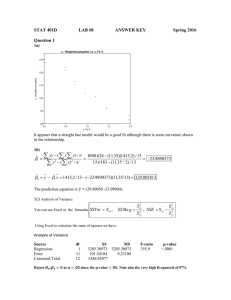

Stat 328 Final Exam Summer 2000 Prof. Vardeman 1. Attached to this exam is a yellow JMP-IN printout useful in the analysis of some data taken from Statistics for Business and Economics by McClave, Benson and Sincich. The data concern gasoline consumption from 1970 through 1993. For these years, in the JMP data table there are the year (numbered " through #%, " being 1970) and: C œ Auto Fuel Consumption (billion gallons) Cw œ Per Capita Auto Fuel Consumption ("!!! gallons) B" œ US Population Size (millions) B# œ Average Gross Weekly Earnings ("*)# dollars) B$ œ Price of Regular ($ per gallon) B% œ Relative Price of Auto Fuel (B$ Î G T M ) B& œ Available Dollars œ B# † B" Initially consider trying to model C in terms of the B's. Some relevant correlations and scatterplots are on page 2 of the printout. (a) Which single variable (of B" through B& ) would produce the largest V # in a SLR analysis of C? What sign would be on its fitted regression coefficient, ,? Explain both. variable: explanations: sign on its ,: Now consider analysis of Cw (not C). Page 3 of the printout concerns a SLR analysis of Cw as a function of B# , the single predictor of Cw with the highest V # in SLR. (b) There are, on the plot on page 3 of the printout, two clusters of points. The one on the right comes from the first "! data points and the one on the left from the last "%. These 2 groups correspond to years before and after the "Mideast oil embargo." A sensible thing to do in this context would be to ask whether there should be 2 SLR's instead of just one here. Defining a dummy variable " .œœ ! for years "-"! for years ""-#% and fitting the model Cw œ "! € "" . € "# B# € "$ . † B# € % to these data produces WWI œ Þ!!#$)%#(. Give some quantitative assessment of whether single SLR is adequate here, or whether 2 are needed. (Explain what you calculate, why you do so and what it indicates. A full blown test isn't required.) Regardless of your answer in (b), now consider a single SLR analysis of these ÐB# ß Cw Ñ data. -1- (c) Using the simple linear regression model, give 95% confidence limits for the increase in mean yearly per capita fuel consumption that seems to accompany a $1 increase in weekly earnings. (No need to simplify.) (d) Suppose your job is to make an early guess (before figures on fuel use are available) at 2000 per capita auto fuel consumption, based on reports that say B# œ #(! for this year. Give 95% prediction limits. (You may read these from the printout instead of doing calculations.) Vardeman used JMP-IN's stepwise regression facility and found that the 5 œ # variable regression equation with the largest V # (that can be built from these predictors) is Cw œ "! € "" B" € "& B& € % Ð œ "! € "" B" € "& B# † B" € %Ñ (*) Pages 4 through 8 of the printout concern the fitting and use of this model. (e) What is a :-value for testing whether population size (B" ) could be safely dropped from this model (leaving B& )? Where did you get it and what does it indicate here? :-value: origin and interpretation: (f) What "P" is the difference in mean fuel consumptions for two years with (respectively) B" of #(! (million) and #($ (million) and B# of $!! and $"!? (Give the linear combination of " 's of interest here.) -2- (g) What, for B" œ #(!, are 95% confidence limits for the increase in mean per capita fuel consumption this model says accompanies a $1 increase in average gross weekly earnings? (No need to simplify.) (h) What do you see in the plot of residuals for this model against sCw on page 5 of the printout? (If it makes any difference, the 10 points on the right are the 10 "pre-embargo" points.) (i) From looking at the JMP data table on pages 7 (to which some things have been added subsequent to fitting the model (*)) identify a case that you think is probably highly important in the fitting of model (*). What draws your attention to this case? (j) Page 8 of the printout is a plot of /3 versus /3•" for this data set, where 3 is both the case number and the year number (3 œ " being 1970). What does this plot indicate about the MLR regression analysis under model (*)? Note that 1993 (the 3 œ #%) case in the data set, had /#% ¸ Þ!"Þ If I told you the values for B" and B& for 1994 (for example, say they are B" œ #'" and B& œ ''ß !!!) and asked you to adjust your prediction of C#& derived from the fitted version of model (*), how (in qualitative terms) would you make use of this information about /#% ? (Would you adjust up or down, and why?) -3- 2. The pink printout attached to this printout is from a JMP analysis of some data again from Statistics for Business and Economics by McClave, Benson and Sincich, this time fashioned after a study from the Journal of Marketing Research meant to evaluate the effectiveness of short-run supermarket strategies. $ different Display levels (" œ "normal space," # œ "normal plus end-of-aisle" and $ œ "twice normal") and 3 different Price levels (" œ "regular," # œ "reduced" and $ œ "cost to store") were used. The response variable C œ weekly sales ($"!!) was observed for a single product $ different times for each of the $ ‚ $ different combinations of levels of the two factors. (a) On page 2 of the printout is a plot of C versus a "cell number" variable that names the combinations of Display and Price " œ Ð"ß "Ñß # œ Ð"ß #Ñß $ œ "ß $Ñß % œ Ð#ß "Ñß á ß * œ Ð$ß $Ñ. Do you see anything in that plot to cause you to worry about the constant variance assumption? There is on pages 3&4 a JMP-IN "Fit Model" MLR analysis using "cell" as a nominal variable. On it is a pooled estimate of 5 . What is that estimate, and what in the context of this problem is it estimating? comment on plot: =Pooled œ _____________ 5 here is: (b) Give and interpret a :-value for testing whether there is any difference at all among the * different cell means (* different short run marketing strategies) in terms of mean sales. :-value: origin and interpretation: (c) Give a 95% prediction interval for the next sales figure for the "twice normal space"&"cost to store" marketing strategy for this item. (No need to simplify.) -4- Pages 5 through 10 of the printout refer to a JMP analysis of these data using "nominal" variables Display and Price. First there is a "no-interactions" analysis. Then there is a "full model"/"with interactions" analysis. (d) Does it look from the printout that one really needs to include interactions in a two-factor analysis of these data? Explain. (Offer some quantitative support for your position.) Regardless of your answer to (d), for the rest of this exam, consider a "with interactions" analysis. (e) Give 95% two-sided confidence limits for the main effect of the "normal space" level of Display. What is being measured here in terms of the * different mean sales figures? (No need to simplify the limits.) limits: interpretation: (f) Below is a $ ‚ $ table. Write in it estimated interactions for the * different combinations of levels of Display and Price. (Some of these can be gotten directly from the printout, others you'll have to do a bit of arithmetic to get.) Price " # $ " Display # $ (g) Suppose that in fact the MLR model with (with dummies) is a good one and that estimates of the model parameters here are in fact exactly the true values (that's too much to hope for, but pretend they are perfect). What do you assess as the fraction of weeks that the "normal space"&"regular price" marketing strategy will produce sales of at least $1000? -5- AutoFuel Rows 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 Year 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 y 67.8 69.51 73.5 78 74.2 76.5 78.8 80.7 83.8 80.2 71.9 71 70.1 69.9 68.7 69.3 71.4 70.6 71.9 72.7 72 70.7 73.9 75.1 y' 0.33057 0.335635 0.350167 0.368098 0.346891 0.354167 0.361468 0.366485 0.37646 0.356286 0.315766 0.308696 0.301765 0.298081 0.290732 0.290566 0.296635 0.290774 0.293469 0.293975 0.288115 0.279889 0.28935 0.290972 x1 205.1 207.1 209.9 211.9 213.9 216 218 220.2 222.6 225.1 227.7 230 232.3 234.5 236.3 238.5 240.7 242.8 245 247.3 249.9 252.6 255.4 258.1 x2 308.84 314.35 327.51 327.45 313.91 303.96 308.35 311.88 312.42 302.91 285.32 280.75 276.95 281.83 281.87 277.96 278.15 275.09 272.21 269.55 264.23 259.9 259.17 258.57 1 x3 0.36 0.36 0.37 0.4 0.53 0.57 0.59 0.62 0.63 0.86 1.19 1.31 1.22 1.24 1.21 1.2 0.93 0.95 0.95 1.02 1.16 1.14 1.12 1.1 x4 0.689 0.672 0.641 0.633 0.786 0.794 0.775 0.763 0.715 0.852 1.074 1.125 1.033 0.998 0.942 0.917 0.703 0.706 0.683 0.713 0.774 0.729 0.705 0.678 x5 63343.08 65101.89 68744.35 69386.65 67145.35 65655.36 67220.3 68675.98 69544.69 68185.04 64967.36 64572.5 64335.49 66089.14 66605.88 66293.46 66950.7 66791.85 66691.45 66659.72 66031.08 65650.74 66192.02 66736.92 Correlations y x1 x2 x3 x4 x5 y 1.0000 -0.2337 0.4484 -0.3940 -0.2701 0.7521 x1 -0.2337 1.0000 -0.9476 0.7992 0.0487 -0.1168 x2 0.4484 -0.9476 1.0000 -0.8619 -0.2193 0.4236 x3 -0.3940 0.7992 -0.8619 1.0000 0.6298 -0.3560 x4 -0.2701 0.0487 -0.2193 0.6298 1.0000 -0.4383 x5 0.7521 -0.1168 0.4236 -0.3560 -0.4383 1.0000 Variable Scatterplot Matrix 85 y 80 75 70 x1 250 230 210 x2 310 280 260 x3 1.2 0.8 0.4 x4 1.1 0.9 0.7 70000 x5 68000 66000 64000 70 75 80 85 210 230 250 260 280 310 .4 .6 .81.0 2 1.4 .7 .8 .9 1.0 1.2 64000 67000 70000 y' By x2 0.38 0.36 0.34 0.32 0.30 0.28 0.26 250 260 270 280 290 x2 300 Linear Fit Linear Fit y' = -0.0662 + 0.00133 x2 Summary of Fit RSquare 0.835699 RSquare Adj 0.828231 Root Mean Square Error 0.013311 Mean of Response 0.319792 Observations (or Sum Wgts) 24 Analysis of Variance Source DF Sum of Squares Mean Square F Ratio 1 0.01982645 0.019826 111.9007 Error 22 0.00389794 0.000177 Prob>F C Total 23 0.02372439 Model <.0001 Parameter Estimates Term Estimate Std Error t Ratio Prob>|t| Intercept -0.066219 0.036592 -1.81 0.0840 x2 0.0013324 0.000126 10.58 <.0001 3 310 320 330 Response: y' Summary of Fit 0.86164 RSquare RSquare Adj 0.848463 Root Mean Square Error 0.012502 Mean of Response 0.319792 24 Observations (or Sum Wgts) Parameter Estimates Term Estimate Std Error t Ratio Prob>|t| 0.07819 0.122224 0.64 0.5293 x1 -0.001541 0.000164 -9.42 <.0001 x5 0.000009 0.000002 5.34 <.0001 Intercept Effect Test Source Nparm DF Sum of Squares F Ratio Prob>F x1 1 1 0.01386884 88.7268 <.0001 x5 1 1 0.00445715 28.5149 <.0001 4 Whole-Model Test 0.38 0.36 0.34 0.32 0.30 0.28 0.26 .26 .28 .30 .32 .34 y' Predicted .36 .38 Analysis of Variance Source DF Sum of Squares Mean Square F Ratio 2 0.02044189 0.010221 65.3892 Error 21 0.00328250 0.000156 Prob>F C Total 23 0.02372439 Model <.0001 0.02 0.01 Residual 0.00 -0.01 -0.02 -0.03 .26 .28 .30 .32 .34 y' Predicted .36 .38 5 x1 0.38 0.36 0.34 y' 0.32 0.30 0.28 0.26 200 210 220 230 240 x1 Leverage 250 260 Effect Test Sum of Squares F Ratio DF Prob>F 0.01386884 88.7268 1 <.0001 x5 0.38 0.36 0.34 y' 0.32 0.30 0.28 0.26 62000 64000 66000 x5 Leverage 68000 70000 Effect Test Sum of Squares F Ratio DF Prob>F 0.00445715 28.5149 1 <.0001 6 AutoFuel Rows 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 Year 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 y' 0.33057 0.335635 0.350167 0.368098 0.346891 0.354167 0.361468 0.366485 0.37646 0.356286 0.315766 0.308696 0.301765 0.298081 0.290732 0.290566 0.296635 0.290774 0.293469 0.293975 0.288115 0.279889 0.28935 0.290972 x1 205.1 207.1 209.9 211.9 213.9 216 218 220.2 222.6 225.1 227.7 230 232.3 234.5 236.3 238.5 240.7 242.8 245 247.3 249.9 252.6 255.4 258.1 x5 63343.08 65101.89 68744.35 69386.65 67145.35 65655.36 67220.3 68675.98 69544.69 68185.04 64967.36 64572.5 64335.49 66089.14 66605.88 66293.46 66950.7 66791.85 66691.45 66659.72 66031.08 65650.74 66192.02 66736.92 Predicted y' 0.330591 0.343294 0.371671 0.374353 0.351154 0.334544 0.345507 0.355182 0.35928 0.343223 0.310336 0.303247 0.297575 0.309923 0.311787 0.305592 0.3081 0.303438 0.299146 0.295316 0.285666 0.278091 0.278634 0.279363 7 Residual y' -0.00002 -0.00766 -0.0215 -0.00625 -0.00426 0.019622 0.01596 0.011303 0.01718 0.013063 0.00543 0.005449 0.00419 -0.01184 -0.02105 -0.01503 -0.01147 -0.01266 -0.00568 -0.00134 0.002449 0.001798 0.010716 0.01161 hy' 0.377233 0.191471 0.184017 0.22516 0.093032 0.10008 0.074328 0.132417 0.203671 0.090936 0.09163 0.114295 0.130581 0.047313 0.046835 0.052121 0.062455 0.068079 0.076881 0.088698 0.104674 0.129494 0.143484 0.171117 Cook’s D Influencey' 8.865e-7 0.036642 0.272538 0.031289 0.004383 0.101469 0.047122 0.047932 0.202166 0.040043 0.006983 0.009224 0.006468 0.01559 0.048735 0.027931 0.019918 0.026807 0.006199 0.00041 0.00167 0.001178 0.047898 0.071588 Correlations Variable esubi esub(i-1) esubi 1.0000 0.7274 esub(i-1) 0.7274 1.0000 1 rows not used due to missing values. Scatterplot Matrix 0.02 esubi 0.01 0.00 -0.01 -0.02 0.02 esub(i-1) 0.01 0.00 -0.01 -0.02 -0.02 -0.01 .00 .01 .02 -0.02 8 -0.01 .00 .01 .02 supermarket Rows Combination Display Price Sales 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 1 1 1 2 2 2 3 3 3 4 4 4 5 5 5 6 6 6 7 7 7 8 8 8 9 9 9 1 1 1 1 1 1 1 1 1 2 2 2 2 2 2 2 2 2 3 3 3 3 3 3 3 3 3 1 1 1 2 2 2 3 3 3 1 1 1 2 2 2 3 3 3 1 1 1 2 2 2 3 3 3 9.89 10.25 10.3 12.11 12.15 11.82 15.77 15.59 15.98 11.91 12.33 12.21 18.6 19.1 19.26 24.92 25.27 25.11 12.26 12.02 11.8 15.16 15.01 14.98 18.01 18.33 18.52 1 1 Plot 25 20 Sales 15 10 0 2 4 6 Combination Sales 2 8 10 Response: Sales Summary of Fit RSquare 0.99832 RSquare Adj 0.997573 Root Mean Square Error 0.222428 Mean of Response 15.50593 Observations (or Sum Wgts) 27 Parameter Estimates Estimate Std Error t Ratio Prob>|t| Intercept 15.505926 0.042806 362.24 <.0001 Combinat[1-9] -5.359259 0.121074 -44.26 <.0001 Combinat[2-9] -3.479259 0.121074 -28.74 <.0001 Combinat[3-9] 0.2740741 0.121074 2.26 0.0362 Combinat[4-9] -3.355926 0.121074 -27.72 <.0001 Combinat[5-9] 3.4807407 0.121074 28.75 <.0001 Combinat[6-9] 9.5940741 0.121074 79.24 <.0001 Combinat[7-9] -3.479259 0.121074 -28.74 <.0001 Combinat[8-9] -0.455926 0.121074 -3.77 0.0014 Term Effect Test Source Combination Nparm DF 8 8 Sum of Squares F Ratio Prob>F 529.11512 1336.849 <.0001 3 Whole-Model Test Combination 25 25 20 20 Sales 15 15 10 10 10 15 20 Sales Predicted 25 10 Analysis of Variance Source Sum of Squares 8 529.11512 Error 18 0.89053 C Total 26 530.00565 Mean Square F Ratio Sum of Squares 66.1394 1336.849 0.0495 Prob>F DF Prob>F 529.11512 1336.849 8 <.0001 Least Squares Means 0.3 0.2 0.1 Residual -0.0 -0.1 -0.2 -0.3 -0.4 15 20 Sales Predicted F Ratio <.0001 Least Sq Mean Std Error Mean 1 10.14666667 0.1284186825 10.1467 2 12.02666667 0.1284186825 12.0267 3 15.78000000 0.1284186825 15.7800 4 12.15000000 0.1284186825 12.1500 5 18.98666667 0.1284186825 18.9867 6 25.10000000 0.1284186825 25.1000 7 12.02666667 0.1284186825 12.0267 8 15.05000000 0.1284186825 15.0500 9 18.28666667 0.1284186825 18.2867 Level 10 25 Effect Test DF Model 15 20 Combination Leverage 25 4 Response: Sales Summary of Fit RSquare 0.901961 RSquare Adj 0.884136 Root Mean Square Error 1.536836 Mean of Response 15.50593 Observations (or Sum Wgts) 27 Lack of Fit Source DF Sum of Squares Lack of Fit 4 51.070481 Pure Error 18 0.890533 Total Error 22 51.961015 Mean Square F Ratio 12.7676 258.0669 0.0495 Prob>F <.0001 Max RSq 0.9983 Parameter Estimates Term Estimate Std Error t Ratio Prob>|t| Intercept 15.505926 0.295764 52.43 <.0001 Display[1-3] -2.854815 0.418274 -6.83 <.0001 Display[2-3] 3.2396296 0.418274 7.75 <.0001 Price[1-3] -4.064815 0.418274 -9.72 <.0001 Price[2-3] -0.151481 0.418274 -0.36 0.7207 Effect Test Source Nparm DF Sum of Squares F Ratio Prob>F Display 2 2 169.13925 35.8063 <.0001 Price 2 2 308.90539 65.3944 <.0001 5 Whole-Model Test Display 25 25 20 20 Sales 15 15 10 10 10 15 20 Sales Predicted 25 12 Analysis of Variance Source 13 14 15 16 17 Display Leverage Effect Test DF Sum of Squares Mean Square F Ratio Sum of Squares F Ratio DF Prob>F 4 478.04464 119.511 50.6003 169.13925 35.8063 2 <.0001 Error 22 51.96101 2.362 Prob>F C Total 26 530.00565 Model Least Squares Means <.0001 Level 6 Least Sq Mean Std Error Mean 1 12.65111111 0.5122786036 12.6511 2 18.74555556 0.5122786036 18.7456 3 15.12111111 0.5122786036 15.1211 18 19 Price 25 20 15 10 10 12 14 16 Price Leverage 18 20 Effect Test Sum of Squares F Ratio DF Prob>F 308.90539 65.3944 2 <.0001 Least Squares Means Level Least Sq Mean Std Error Mean 1 11.44111111 0.5122786036 11.4411 2 15.35444444 0.5122786036 15.3544 3 19.72222222 0.5122786036 19.7222 7 Response: Sales Summary of Fit RSquare 0.99832 RSquare Adj 0.997573 Root Mean Square Error 0.222428 Mean of Response 15.50593 Observations (or Sum Wgts) 27 Parameter Estimates Estimate Std Error t Ratio Prob>|t| Intercept 15.505926 0.042806 362.24 <.0001 Display[1-3] -2.854815 0.060537 -47.16 <.0001 Display[2-3] 3.2396296 0.060537 53.51 <.0001 Price[1-3] -4.064815 0.060537 -67.15 <.0001 Price[2-3] -0.151481 0.060537 -2.50 0.0222 Display[1-3]*Price[1-3] 1.5603704 0.085612 18.23 <.0001 Display[1-3]*Price[2-3] -0.472963 0.085612 -5.52 <.0001 Display[2-3]*Price[1-3] -2.530741 0.085612 -29.56 <.0001 Display[2-3]*Price[2-3] 0.3925926 0.085612 4.59 0.0002 Term Effect Test Source Nparm DF Display 2 Price Display*Price Sum of Squares F Ratio Prob>F 2 169.13925 1709.373 <.0001 2 2 308.90539 3121.892 <.0001 4 4 51.07048 258.0669 <.0001 8 Whole-Model Test Display 25 25 20 20 Sales 15 15 10 10 10 15 20 Sales Predicted 25 12 Analysis of Variance Source Sum of Squares 8 529.11512 Error 18 0.89053 C Total 26 530.00565 Mean Square F Ratio Sum of Squares 66.1394 1336.849 0.0495 Prob>F F Ratio DF Prob>F 169.13925 1709.373 2 <.0001 Least Squares Means <.0001 Level Press 14 15 16 17 Display Leverage Effect Test DF Model 13 2.0037 9 Least Sq Mean Std Error Mean 1 12.65111111 0.0741425609 12.6511 2 18.74555556 0.0741425609 18.7456 3 15.12111111 0.0741425609 15.1211 18 19 Price Display*Price Profile Plot 25 2 25 Sales 20 LS Means 20 3 1 15 10 15 1 2 Price 3 10 25 10 12 14 16 Price Leverage 18 20 20 Effect Test Sum of Squares F Ratio DF Prob>F 308.90539 3121.892 2 <.0001 Sales 15 Least Squares Means Level Least Sq Mean Std Error Mean 1 11.44111111 0.0741425609 11.4411 2 15.35444444 0.0741425609 15.3544 3 19.72222222 0.0741425609 19.7222 10 10 15 20 Display*Price Leverage Effect Test Sum of Squares F Ratio DF Prob>F 51.070481 258.0669 4 <.0001 Least Squares Means Least Sq Mean Std Error 1,1 10.14666667 0.1284186825 1,2 12.02666667 0.1284186825 1,3 15.78000000 0.1284186825 2,1 12.15000000 0.1284186825 2,2 18.98666667 0.1284186825 2,3 25.10000000 0.1284186825 3,1 12.02666667 0.1284186825 3,2 15.05000000 0.1284186825 3,3 18.28666667 0.1284186825 Level 10 25