University of Northern Iowa Direct Deposit of Payroll Authorization Form

advertisement

University of Northern Iowa

Direct Deposit of Payroll

Authorization Form

Name (Please Print) ______________________________________

(Last, First, MI)

UNI ID# ________________________

I hereby authorize the University of Northern Iowa to initiate direct deposit credit entries and, if necessary, debit entries, or

adjustments to correct any deposit errors to my checking or savings account at the financial institution(s) indicated below.

This authority is to remain in full force and effect until the end of my appointment or the University of Northern Iowa has

received written or electronic notification from me of its termination in such time and in such manner as to afford the

University of Northern Iowa and the financial institution(s) named below a reasonable opportunity to act on it.

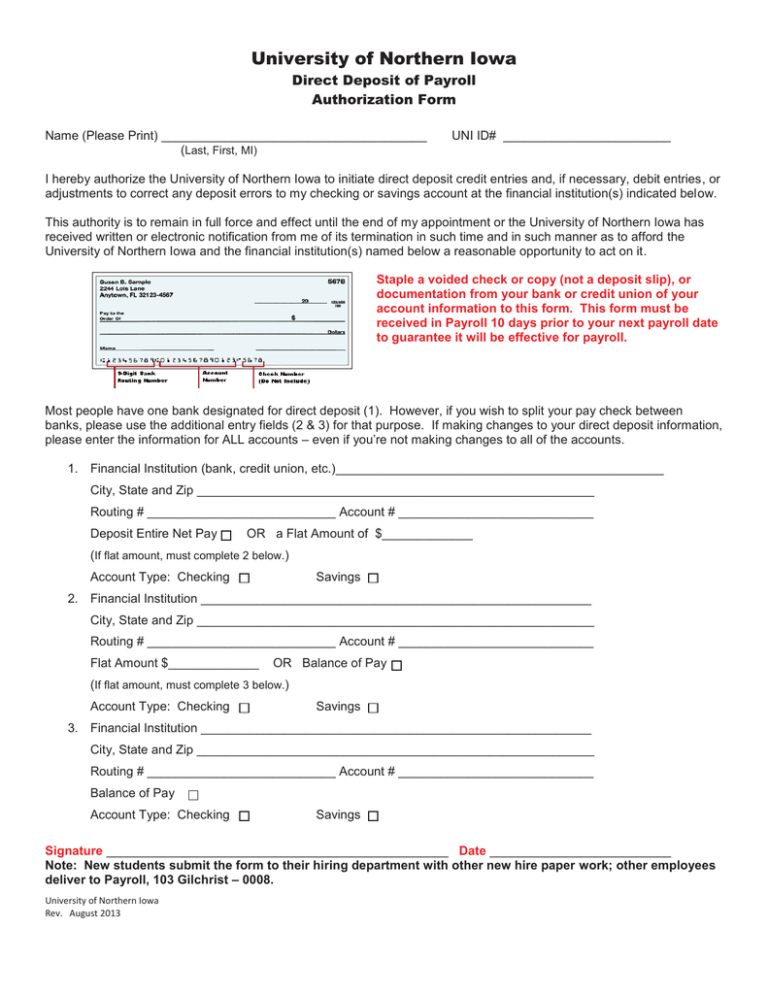

Staple a voided check or copy (not a deposit slip), or

documentation from your bank or credit union of your

account information to this form. This form must be

received in Payroll 10 days prior to your next payroll date

to guarantee it will be effective for payroll.

Most people have one bank designated for direct deposit (1). However, if you wish to split your pay check between

banks, please use the additional entry fields (2 & 3) for that purpose. If making changes to your direct deposit information,

please enter the information for ALL accounts – even if you’re not making changes to all of the accounts.

1. Financial Institution (bank, credit union, etc.)_______________________________________________

City, State and Zip _________________________________________________________

Routing # ___________________________ Account # ____________________________

Deposit Entire Net Pay

OR a Flat Amount of $_____________

(If flat amount, must complete 2 below.)

Account Type: Checking

Savings

2. Financial Institution ________________________________________________________

City, State and Zip _________________________________________________________

Routing # ___________________________ Account # ____________________________

Flat Amount $_____________

OR Balance of Pay

(If flat amount, must complete 3 below.)

Account Type: Checking

Savings

3. Financial Institution ________________________________________________________

City, State and Zip _________________________________________________________

Routing # ___________________________ Account # ____________________________

Balance of Pay

Account Type: Checking

Savings

Signature _________________________________________________ Date __________________________

Note: New students submit the form to their hiring department with other new hire paper work; other employees

deliver to Payroll, 103 Gilchrist – 0008.

University of Northern Iowa

Rev. August 2013

Form W -4 (2016)

Purpose.C om plete Form W -4 so thatyourem ployer

can w ithhold the correctfederalincom e tax from your

pay.C onsidercom pleting a new Form W -4 each year

and w hen yourpersonalorfinancialsituation changes.

Exem ption from w ithholding.Ifyou are exem pt,

com plete only lines 1,2,3,4,and 7 and sign the form

to validate it.Yourexem ption for2016 expires

February 15,2017.See Pub.505,Tax W ithholding

and Estim ated Tax.

N ote:Ifanotherperson can claim you as a dependent

on his orhertax return,you cannotclaim exem ption

from w ithholding ifyourincom e exceeds $1,050 and

includes m ore than $350 ofunearned incom e (for

exam ple,interestand dividends).

Exceptions.An em ployee m ay be able to claim

exem ption from w ithholding even ifthe em ployee is a

dependent,ifthe em ployee:

• Is age 65 orolder,

• Is blind,or

• W illclaim adjustm ents to incom e;tax credits;or

item ized deductions,on his orhertax return.

The exceptions do notapply to supplem entalw ages

greaterthan $1,000,000.

B asic instructions.Ifyou are notexem pt,com plete

the PersonalAllow ances W orksheetbelow .The

w orksheets on page 2 furtheradjustyour

w ithholding allow ances based on item ized

deductions,certain credits,adjustm ents to incom e,

ortw o-earners/m ultiple jobs situations.

C om plete allw orksheets thatapply.H ow ever,you

m ay claim few er(orzero)allow ances.Forregular

w ages,w ithholding m ustbe based on allow ances

you claim ed and m ay notbe a flatam ountor

percentage ofw ages.

H ead ofhousehold.G enerally,you can claim head

ofhousehold filing status on yourtax return only if

you are unm arried and pay m ore than 50% ofthe

costs ofkeeping up a hom e foryourselfand your

dependent(s)orotherqualifying individuals.See

Pub.501,Exem ptions,Standard Deduction,and

Filing Inform ation,forinform ation.

Tax credits.You can take projected tax credits into account

in figuring yourallow able num berofw ithholding allow ances.

C redits forchild ordependentcare expenses and the child

tax creditm ay be claim ed using the PersonalAllow ances

W orksheet below .See Pub.505 forinform ation on

converting yourothercredits into w ithholding allow ances.

N onw age incom e.Ifyou have a large am ountof

nonw age incom e,such as interestordividends,

considerm aking estim ated tax paym ents using Form

1040-ES,Estim ated Tax forIndividuals.O therw ise,you

m ay ow e additionaltax.Ifyou have pension orannuity

incom e,see Pub.505 to find outifyou should adjust

yourw ithholding on Form W -4 orW -4P.

Tw o earners or m ultiple jobs.Ifyou have a

w orking spouse orm ore than one job,figure the

totalnum berofallow ances you are entitled to claim

on alljobs using w orksheets from only one Form

W -4.Yourw ithholding usually w illbe m ostaccurate

w hen allallow ances are claim ed on the Form W -4

forthe highestpaying job and zero allow ances are

claim ed on the others.See Pub.505 fordetails.

N onresident alien.Ifyou are a nonresidentalien,

see N otice 1392,Supplem entalForm W -4

Instructions forN onresidentAliens,before

com pleting this form .

C heck your w ithholding.AfteryourForm W -4 takes

effect,use Pub.505 to see how the am ountyou are

having w ithheld com pares to yourprojected totaltax

for2016.See Pub.505,especially ifyourearnings

exceed $130,000 (Single)or$180,000 (M arried).

Future developm ents.Inform ation aboutany future

developm ents affecting Form W -4 (such as legislation

enacted afterw e release it)w illbe posted atw w w .irs.gov/w 4.

PersonalAllow ances W orksheet(Keep foryourrecords.)

A

Enter“1” foryourselfifno one else can claim you as a dependent . . . . . . . . . . . . . . . . . . A

• You are single and have only one job;or

• You are m arried,have only one job,and yourspouse does notw ork;or

. . . B

Enter“1” if:

• Yourw ages from a second job oryourspouse’s w ages (orthe totalofboth)are $1,500 orless.

Enter“1” foryourspouse.But,you m ay choose to enter“-0-” ifyou are m arried and have eithera w orking spouse orm ore

than one job.(Entering “-0-” m ay help you avoid having too little tax w ithheld.) . . . . . . . . . . . . . . C

Enternum berofdependents (otherthan yourspouse oryourself)you w illclaim on yourtax return . . . . . . . . D

Enter“1” ifyou w illfile as head ofhousehold on yourtax return (see conditions underH ead ofhousehold above) . . E

Enter“1” ifyou have atleast$2,000 ofchild or dependent care expenses forw hich you plan to claim a credit . . . F

(N ote:D o notinclude child supportpaym ents.See Pub.503,C hild and D ependentC are Expenses,fordetails.)

C hild Tax C redit(including additionalchild tax credit).See Pub.972,C hild Tax C redit,form ore inform ation.

• Ifyourtotalincom e w illbe less than $70,000 ($100,000 ifm arried),enter“2” foreach eligible child;then less “1” ifyou

have tw o to foureligible children orless “2” ifyou have five orm ore eligible children.

• Ifyourtotalincom e w illbe betw een $70,000 and $84,000 ($100,000 and $119,000 ifm arried),enter“1” foreach eligible child . . G

Add lines A through G and entertotalhere.(N ote:This m ay be differentfrom the num berofexem ptions you claim on yourtax return.) H

{

B

C

D

E

F

G

H

Foraccuracy,

com plete all

w orksheets

thatapply.

{

}

• Ifyou plan to item ize orclaim adjustm ents to incom e and w antto reduce yourw ithholding,see the D eductions

and Adjustm ents W orksheeton page 2.

• Ifyou are single and have m ore than one job orare m arried and you and your spouse both w ork and the com bined

earnings from alljobs exceed $50,000 ($20,000 ifm arried),see the Tw o-Earners/M ultiple Jobs W orksheet on page 2

to avoid having too little tax w ithheld.

• Ifneither ofthe above situations applies,stop here and enterthe num berfrom line H on line 5 ofForm W -4 below .

Separate here and give Form W -4 to your em ployer.K eep the top part for your records.

Form

W -4

D epartm entofthe Treasury

InternalRevenue Service

1

Em ployee's W ithholding Allow ance Certificate

O M B N o.1545-0074

W hether you are entitled to claim a certain num ber ofallow ances or exem ption from w ithholding is

subject to review by the IR S.Your em ployer m ay be required to send a copy ofthis form to the IR S.

Yourfirstnam e and m iddle initial

Lastnam e

H om e address (num berand streetorruralroute)

2

3

Single

M arried

2016

Your socialsecurity num ber

M arried,butw ithhold athigherSingle rate.

N ote: Ifm arried,butlegally separated,orspouse is a nonresidentalien,check the “Single” box.

C ity ortow n,state,and ZIP code

4 Ifyour lastnam e differs from that show n on your socialsecurity card,

check here.You m ust call1-800-772-1213 for a replacem ent card.

5

6

7

Totalnum berofallow ances you are claim ing (from line H above or from the applicable w orksheeton page 2)

5

Additionalam ount,ifany,you w antw ithheld from each paycheck . . . . . . . . . . . . . .

6 $

Iclaim exem ption from w ithholding for2016,and Icertify thatIm eetboth ofthe follow ing conditions forexem ption.

• LastyearIhad a rightto a refund ofallfederalincom e tax w ithheld because Ihad no tax liability,and

• This yearIexpecta refund ofallfederalincom e tax w ithheld because Iexpectto have no tax liability.

Ifyou m eetboth conditions,w rite “Exem pt” here . . . . . . . . . . . . . . .

7

U nderpenalties ofperjury,Ideclare thatIhave exam ined this certificate and,to the bestofm y know ledge and belief,itis true,correct,and com plete.

Em ployee’s signature

(This form is notvalid unless you sign it.)

8

Em ployer’s nam e and address (Em ployer:C om plete lines 8 and 10 only ifsending to the IRS.)

For Privacy Actand Paperw ork R eduction Act N otice,see page 2.

D ate

9 O ffice code (optional) 10

C at.N o.10220Q

Em ployeridentification num ber(EIN )

Form

W -4 (2016)

Iowa Department of Revenue

https://tax.iowa.gov

201 IA W-4

Employee Withholding Allowance Certificate

To be completed by the employee

Marital Status: Single (if married but legally separated, check Single)

܆Married ܆

Print your full name:

Social Security Number:

Home Address:

City:

State:

ZIP:

EXEMPTION FROM WITHHOLDING

If you do not expect to owe any Iowa income tax this year, and expect to have a right to a full refund of ALL income tax withheld, enter

“EXEMPT” here:

and the year effective here:

.Nonresidents may not claim this exemption.

Check this box if you are claiming an exemption from Iowa tax based on the Military Spouses Residency Relief Act of 2009 ........................... ܆

If claiming the military spouse exemption, enter your state of domicile here:

IF YOU ARE NOT EXEMPT, COMPLETE THE FOLLOWING:

1.

Personal allowances ..........................................................................................................................................................1.

2.

Allowances for dependents ................................................................................................................................................2.

3.

Allowances for itemized deductions ...................................................................................................................................3.

4.

Allowances for adjustments to income ...............................................................................................................................4.

5.

Allowances for child and dependent care credit .................................................................................................................5.

6.

Total allowances. Add lines 1 through 5 ........................................................................................................................6.

7.

Additional amount, if any, you want deducted each pay period .........................................................................................7.

Employee: I certify that I am entitled to the number of withholding

allowances claimed on this certificate, or if claiming an exemption from

withholding, that I am entitled to claim the exempt status.

Employee Signature:

Date:

Employers: Detach this part and keep in your records. However, if the

employee is claiming more than 22 withholding allowances or an exemption

from withholding when wages are expected to exceed $200 per week,

complete the section below and send it to the Iowa Department of Revenue.

See Employer Withholding Requirements on the back of this form.

Employer Name:

Employer Address:

FEIN:

44-019a (07/24/15)