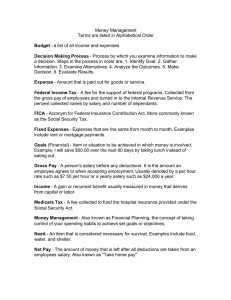

GLOSSARY

advertisement

GLOSSARY Actual Budget Final actual dollar amount spent in each budget category Beneficiary A person that receives the benefits of something Budget A plan on how to spend your money Budget Guidelines Used to record the minimum and maximum spending for each budget category Challenge Card A card which describes an unexpected expense that has occurred Compound Interest Interest paid on both the principal and the accrued interest Cooperative Learning Method of learning which allows students to work together in small groups Credit The amount of financial trust extended to a person by a lender. It is a loan Credit Card A card with which one can buy things now and pay for them later Debit Card A card which looks like a credit card but money for purchases is withdrawn from the holders bank account at the time of sale EBT The Electronic Benefits Transfer Card is an electronic method for distributing federal Food Stamp Program benefits which replaced paper food stamps FICA Federal Insurance Contribution Act is a US payroll tax used to fund Social Security and Medicare , federal programs that provide benefits for retirees, the disabled, and children of deceased workers Financial Institution Facilitate the flow of money through the economy by holding cash reserves, investing and making loans Fixed Expenses Expenses for which you pay a fixed monthly amount Death Benefit The amount of money paid by an insurer to a beneficiary after a death occurs Gross Annual Income (GAI) The total amount of income that one earns in a year before deductions Gross Monthly Income (GMI) The total amount of income that one earns in a month before deductions Insurance A contract by which someone guarantees for a fee to pay someone else for the value of property if it is lost, stolen or damaged or to pay a specific amount for injury or death Interest A charge for borrowed money that is generally a percentage of the amount borrowed Life Situation Card Life scenario given to you indicating your income, occupation, marital status, number of children and ages and other information necessary to begin your budget Liquidity Easily turned into cash Medicare A program which provides medical care for the elderly Mortgage A temporary and conditional pledge of property to creditor as security for payment of a debt Net Annual Income (NAI) An amount of earned income that one has to spend in a year after deductions. Net Monthly Income (NMI) An amount of earned income that one has to spend in a month after deductions Occupation An activity that serves as one’s regular source of livelihood or income Opportunity Card A card which describes unexpected extra income that may be added to your NMI Opportunity Cost What you give up in order to get what you want Premium A specific amount of money charged by the insurance company for coverage PYF “Plan Your Future” by saving and investing Stock Tables Daily charts which keep investors up to date on the activity of the investment markets Stock Parts or shares of a company that can be bought or sold Transportation Fixed Expenses Fixed automotive expenses which may include monthly payment and insurance costs for a car Tax A charge of money imposed by the government for support of the government and/or services that you could not afford individually Tax Deferred Delay of tax payment until a future date Transportation Variable Expenses Variable automotive expenses including fuel, oil and maintenance Utilities Water, Garbage/Sewer/Recycling, and Electricity Variable Expenses Expenses which monthly payments vary depending on usage