Agri News, MN 03/07/06

advertisement

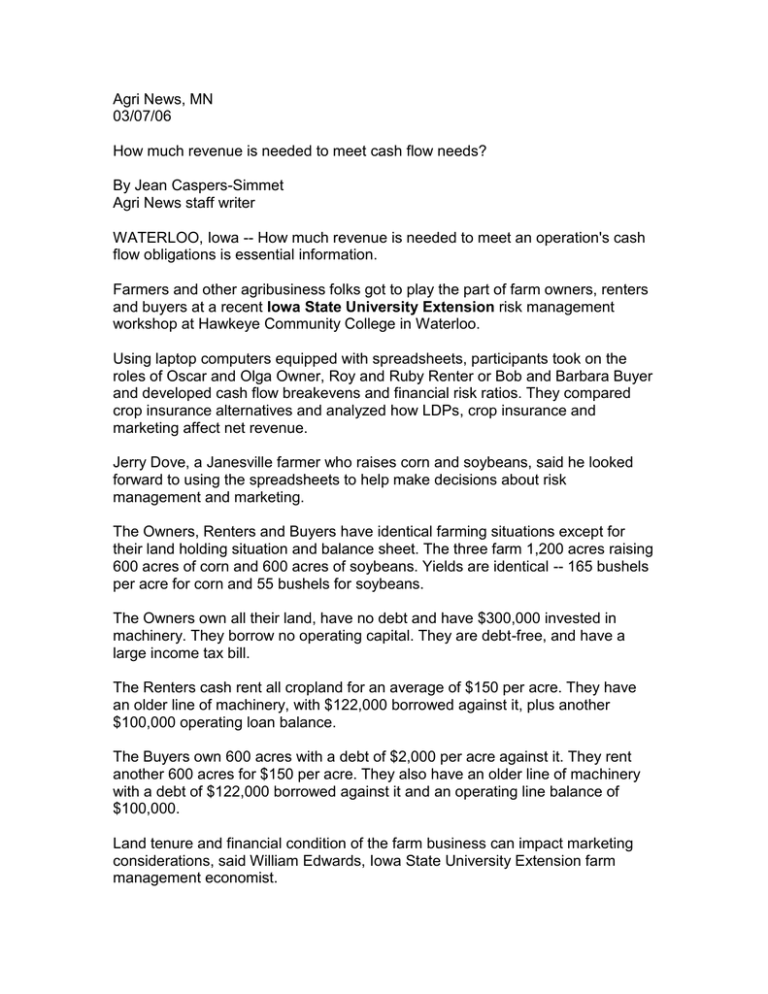

Agri News, MN 03/07/06 How much revenue is needed to meet cash flow needs? By Jean Caspers-Simmet Agri News staff writer WATERLOO, Iowa -- How much revenue is needed to meet an operation's cash flow obligations is essential information. Farmers and other agribusiness folks got to play the part of farm owners, renters and buyers at a recent Iowa State University Extension risk management workshop at Hawkeye Community College in Waterloo. Using laptop computers equipped with spreadsheets, participants took on the roles of Oscar and Olga Owner, Roy and Ruby Renter or Bob and Barbara Buyer and developed cash flow breakevens and financial risk ratios. They compared crop insurance alternatives and analyzed how LDPs, crop insurance and marketing affect net revenue. Jerry Dove, a Janesville farmer who raises corn and soybeans, said he looked forward to using the spreadsheets to help make decisions about risk management and marketing. The Owners, Renters and Buyers have identical farming situations except for their land holding situation and balance sheet. The three farm 1,200 acres raising 600 acres of corn and 600 acres of soybeans. Yields are identical -- 165 bushels per acre for corn and 55 bushels for soybeans. The Owners own all their land, have no debt and have $300,000 invested in machinery. They borrow no operating capital. They are debt-free, and have a large income tax bill. The Renters cash rent all cropland for an average of $150 per acre. They have an older line of machinery, with $122,000 borrowed against it, plus another $100,000 operating loan balance. The Buyers own 600 acres with a debt of $2,000 per acre against it. They rent another 600 acres for $150 per acre. They also have an older line of machinery with a debt of $122,000 borrowed against it and an operating line balance of $100,000. Land tenure and financial condition of the farm business can impact marketing considerations, said William Edwards, Iowa State University Extension farm management economist. The Owners net cash flow break-even is $295 acre or $1.79 per bushel for corn and $182 per acre or $3.31 per bushel for soybeans. For the Renters the net cash flow break-even is $404 per acre or $2.45 per bushel for corn and $312 per acre or $5.67 per bushel for soybeans. For the Buyers it's $429 per acre or $2.60 per bushel for corn and $336 per acre or $6.12 per bushel for soybeans. All three families would like to pay their bills from crop sales and USDA payments, Edwards said. Some years, market prices may not be high enough to cover their commitments. In that case they may need to liquidate some working capital to meet payments. The three families could stand to lose 10 percent of their net worth in one year without jeopardizing their operation, but that represents many fewer dollars for the Renters and Buyers than the Owners, so they need to pay more attention to limiting their downside risk, Edwards said. The Owners net worth to risk per acre is $346. For the Renters it's just $32, and for the Buyers it is $72. The Owners could lose their entire crop and still be back the next year, said Kelvin Leibold, ISU Extension farm management field specialist. The Buyers and Renters can shoulder far less risk. The Renters and Buyers need to look at aggressive forward selling backed up with crop revenue coverage to meet cash flow needs.