Document 10711884

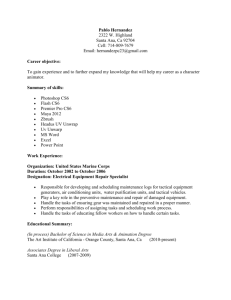

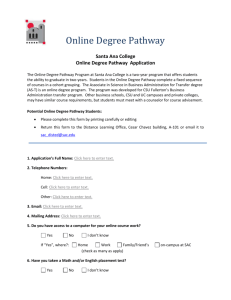

advertisement