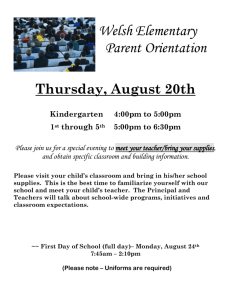

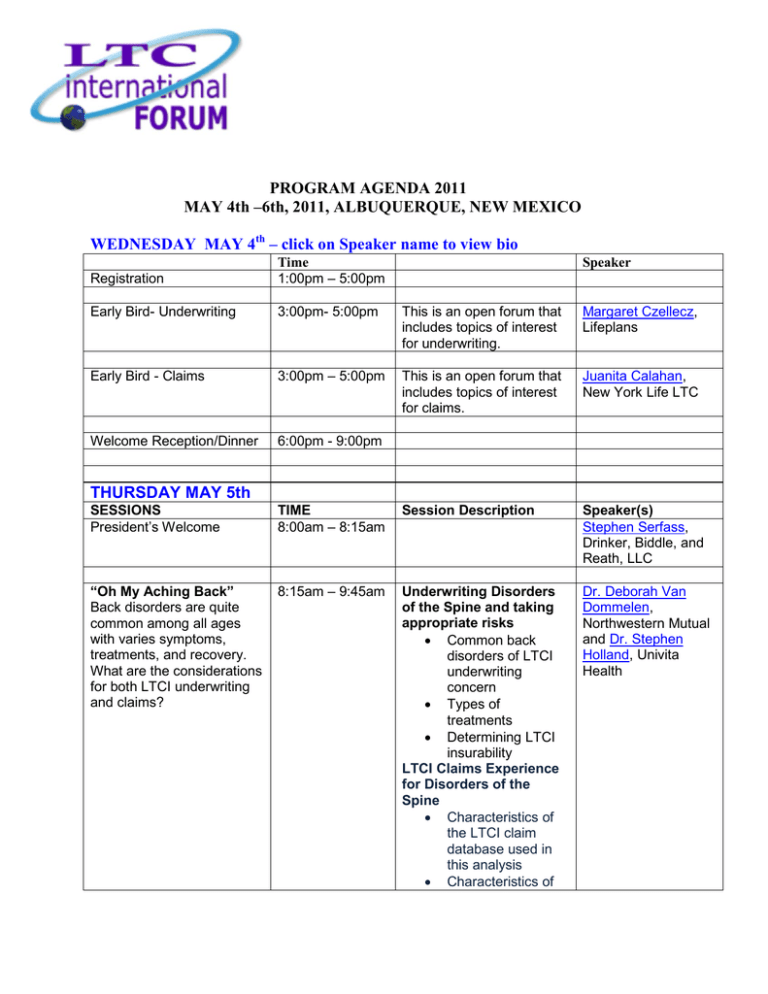

PROGRAM AGENDA 2011 MAY 4th –6th, 2011, ALBUQUERQUE, NEW MEXICO

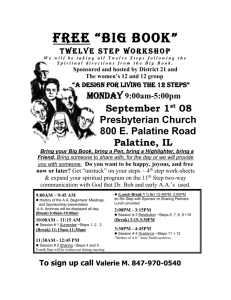

advertisement

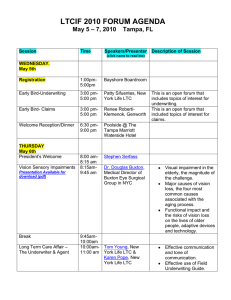

PROGRAM AGENDA 2011 MAY 4th –6th, 2011, ALBUQUERQUE, NEW MEXICO WEDNESDAY MAY 4th – click on Speaker name to view bio Registration Time 1:00pm – 5:00pm Speaker Early Bird- Underwriting 3:00pm- 5:00pm This is an open forum that includes topics of interest for underwriting. Margaret Czellecz, Lifeplans Early Bird - Claims 3:00pm – 5:00pm This is an open forum that includes topics of interest for claims. Juanita Calahan, New York Life LTC Welcome Reception/Dinner 6:00pm - 9:00pm THURSDAY MAY 5th SESSIONS President’s Welcome TIME 8:00am – 8:15am Session Description Speaker(s) Stephen Serfass, Drinker, Biddle, and Reath, LLC “Oh My Aching Back” Back disorders are quite common among all ages with varies symptoms, treatments, and recovery. What are the considerations for both LTCI underwriting and claims? 8:15am – 9:45am Underwriting Disorders of the Spine and taking appropriate risks • Common back disorders of LTCI underwriting concern • Types of treatments • Determining LTCI insurability LTCI Claims Experience for Disorders of the Spine • Characteristics of the LTCI claim database used in this analysis • Characteristics of Dr. Deborah Van Dommelen, Northwestern Mutual and Dr. Stephen Holland, Univita Health • • • • Break 9:45am – 10:00am “LTC Underwriting to 10:00amClaims – Objects in the 11:00am rear view mirror are not always as they may appear” We may wonder at the time of claim, just how this person was approved by the underwriter. We will get an opportunity to understand both perspectives • • • • “Market Conduct Exams” Unravel the mystery of Market Conduct Examinations: why they are performed and what role ERM (Enterprise Risk Management) is playing in today's exams. those claiming for disorders of the spine Significant comorbidity Claims duration and expenditures (open and closed) Opportunities for recovery Intervention strategies 11:00am – 12:00 noon An interactive panel discussion in review of case studies connecting underwriting determinations to claims administration High risk yet favorable factors at underwriting that lead to claims risk administration Risk factors on both sides that make it reasonable yet very real Market Conduct Examinations: • What are they? • Why are they done? • What can a company learn from preparing for them? • What is ERM (Enterprise Risk Management) and what role is it playing in today's market conduct exams? • Success strategies / best practices Pam Kreager, Univita Health, Joann Masters, Metlife Angela Hoteling, Compliance Officer, MedAmerica and Mike Rafalko, Drinker, Biddle & Reath, LLP LUNCH 12:00 – 1:00pm “ LTC Future Challenges and Solutions” Come listen to two experts share information on the exploration of the hopes, worries, and needs of families impacted by a family member’s need for long term care. 1:00pm- 2:00pm “Long Term Care Claims: Past and Future” This presentation will address what we have observed in existing long term care claims and how we expect future long term care claims to emerge. 2:00pm – 3:00pm • People greatly underestimate the impact that a family member’s long term care needs have on their own lives; their marriages, work commitments, care giving abilities, financial stability and future financial security. • Claims associates’ awareness and understanding of the impact of a long term care event on not only the Insured but their families and friends creates compassion which is at the heart of providing greater Claims service. • • • • • BREAK 3:00pm – 3:15pm "ABANDON HOPE ALL YE WHO ENTER HERE”, This interactive session is designed to equip you, the 3:15pm – 4:30pm • What is a typical duration of claim? How many policyholders will exhaust their benefit period, and how much time will they have left? What are the top 3 claim events – frequency vs. cost? What are existing problems with coding Long Term Care claims? What are the projections and expectations as the US population ages The phrase once identified by Dante as being inscribed Kathy O’Brien, R.N., M.S. Senior Gerontologist, Mature Market Institute, MetLife and Janet Gale, Marketing, Genworth Juliet Spector, FSA, MAAA, Consulting Actuary, Milliman Mike Rafalko, Drinker, Biddle & Reath, LLC, Peter Smalbach, Genworth underwriter and claims professional, with the most important rules you can implement to avoid a lawsuit and to mitigate the harm to your company in the event that an action is filed. • • • • FRIDAY May 6th Breakfast 7:30am – 8:25am on the gates of hell, might just as appropriately appear on the doors of our modern courthouses -- at least from the perspective of an insurance carrier Insurance carriers have never been popular defendants LTCI carriers, with their aged and infirm client base, represent a particularly vulnerable target from the perspective of an opportunistic plaintiff attorney The LTCI carrier's best defense is often the preventative measures it implements to avoid litigation long before a legal action is ever filed And few employees are better situated to influence the outcome of a legal dispute than those in underwriting and claims and Karen Smyth, Prudential “COPD And Other Lung Disorders” This is an educational session to better understand respiratory disorders 8:30am – 9:30am • • BREAK 9:30am-9:45am “Communicating with agents” An interactive session with a focus on maximizing communication, education, and training for agents 9:45am – 11:00am • • • Wrap-up 11:00am 11:30am - COPD as well as other frequentlyencountered lung conditions (e.g. bronchiectasis, pulmonary nodules etc.) are common with LTCI. The latest developments with respect to diagnostics, treatment, prognosis and morbidity implications associated with respiratory conditions. Define ‘people styles’ in communication Objective is an ease of doing business with the agents and company Presenting sensitive matters especially related to declines. Dr. Trevor Rabie M.D, Intercede Health Rob Brown, Mass Mutual Ann-Marie Salmon, Mass Mutual, Elizabeth Roberge, Mass Mutual, Jim Barrett, Underwriting Assist Demerri Bond, Mutual of Omaha