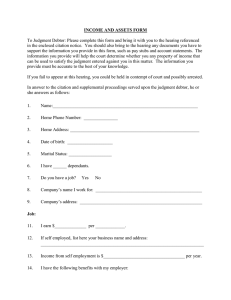

by

advertisement