Developing the Small, Mixed-Use Urban Project: U I A

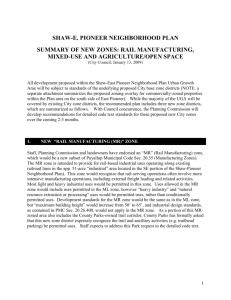

advertisement