AN PRICING MECHANISM FOR BELOW-MARKET HOMEOWNERSHIP PROGRAMS MARCUS B.A., Hampshire College

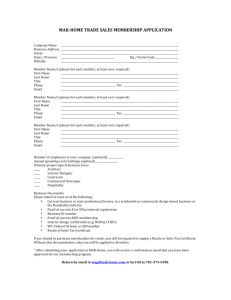

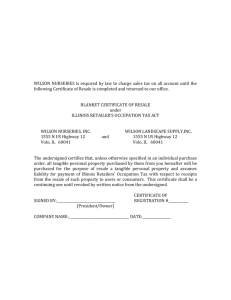

advertisement