6509.11k, 56.3-57 Page 1 of 19 FOREST SERVICE HANDBOOK

6509.11k, 56.3-57

Page 1 of 19

FOREST SERVICE HANDBOOK

Portland, Oregon

FSH 6509.11K - SERVICE-WIDE FINANCE AND ACCOUNTING HANDBOOK

R6 Supplement No. 6509.11k-93-2

Effective June 11, 1993

POSTING NOTICE. Supplements to this handbook are numbered consecutively.

Check the last transmittal received for this handbook to see that the above supplement number is in sequence. If not, order intervening supplement(s) at once from the Information Center. Do not post this supplement until the missing one(s) is received and posted. After posting, place the transmittal at the front of the title and retain until the first transmittal of the next calendar year is received.

The last R-6 Supplement to this handbook was 6509.11k-93-1 (6509.11k,90).

Document Name

Superseded New

(Number of Sheets)

6509.11k,56.3-57 14 20

Digest:

56.3 - This supplement reissues section 56.3 with minor editorial changes.

57.1 - Adds exhibits that define transaction codes used in obligation reporting, describe transaction codes used for specific types of obligations, and clarify how various transactions are obligated by the Forest Service and the National Finance

Center.

/s/ John E. Lowe

JOHN E. LOWE

Regional Forester

R6 SUPPLEMENT 6509.11k-93-2

EFFECTIVE 06/11/93

6509.11k, 56.3-57

Page 2 of 19

FSH 6509.11k - SERVICE-WIDE FINANCE AND ACCOUNTING HANDBOOK

R6 SUPPLEMENT 6509.11k-93-2

EFFECTIVE 06/11/93

56 - ACCOUNTING INSTRUCTIONS.

56.3 - Real Property Accounting. The objective of Region 6 real property accounting shall be to maintain records in a way that displays the representative values and related statistics for all the fixed assets (real property) that exist on each National

Forest and their related administrative sites. The information recorded shall be summarized and reconciled annually. The results of this information are then sent through the RO and to the General Services Administration (GSA) by GSA Form

1166. In addition, the records shall be available for the use of the Forest's property management officer. Additional requirements to be served by the keeping of real property records are to be imposed at the election of each individual Forest.

56.31 - Accounting Basis for Real Property.

56.31b - Value To Be Capitalized. Improvements meeting the definition of real property will only be capitalized if the acquisition cost or value on the date of acquisition is $1,000 or more. Values to be recorded on each Forest's records should also be rounded to the nearest $1,000 per annual transaction per asset.

Use the following as guidelines to determine the value to be capitalized:

- A Forest expended $1,200 on a range fence for 5 consecutive years. The real property records would reflect a $5,000 value for this improvement, even though the actual accumulative value of expenditures for the fence would be $6,000.

- A Forest expended $455 for stream improvements for 10 consecutive years. The real property records would reflect a zero value, since the cost incurred per year is less than $1,000. If the Forest was aware this situation had occurred, such as when an inventory was taken, they should prepare a journal voucher so the real property records can be updated to reflect $5,000 ($4,550 is rounded to $5,000).

- A Forest expended $157,555 on a building. The real property records would reflect

$158,000.

- A Forest expended $900 on a wildlife structure. The real property records would reflect zero value, since the cost is less than $1,000.

In addition, any journal voucher prepared to capture nonfunded values (see item 2, below) should be rounded to the nearest $1,000 per item. For example, if a Forest had to capitalize an item that was donated to them, and the appraised value of the property was $24,500, the Forest would prepare a journal voucher for $25,000 and reflect the same amount in real property records. Each year's expenditures are to remain independent from prior years' expenditures, as far as determining if values are to be captured in the records when values are rounded. Values on a Forest's

R6 SUPPLEMENT 6509.11k-93-2

EFFECTIVE 06/11/93

6509.11k, 56.3-57

Page 3 of 19 form FS-6500-53 should be shown in thousands of dollars. For example, $1,489,254 of accumulated asset values would be shown as $1,489 on the Forest's records.

Asset values are recorded at the end of the fiscal year in which the asset began its physical existence. Values that are to be captured originate from two major sources of transactions:

1. Funded Transactions. These are year-to-date (YTD) accrued expenditures generated when a management code is established that is coded to record expenditures and delivered obligations to any of the real property asset numbers identified in the "other" field of accounting. See section 56.32 for the identification of "other" field numbers to use when establishing a management code that involves real property expenditures. To ensure the Central Accounting System captures the maximum real property values, Forests should establish a process to review work plans and the resultant management codes used for each; therefore, when real property costs are involved, they are properly coded.

2. Nonfunded transactions. These are transactions that result in a real property improvement or the elimination of an existing asset recorded on the books, yet the values (all, or part of) have not been captured in the Forest Service's accounting system (item 1). Examples of these transactions would be donations or contributions of fixed assets that cost the government nothing (do not appear as expenditures or delivered obligations in the Central Accounting System), but do constitute a real property improvement under the definition of section 56.31.

Nonfunded transactions should also include items that should have been coded to a valid "other" field symbol through the accounting system when, for some reason, the management code was not properly set up. In addition, these transactions include the elimination of any asset that must be removed from the records because it no longer exists.

An example that would involve both a funded and nonfunded transaction would be a trail bridge that is constructed using materials paid for by the Forest Service with the labor provided by volunteers. The cost of materials would be captured in the

Forest's expenditure records (funded transaction); yet, the cost of labor would need to be determined (since it did not appear in the expenditure records). The sum of the two would be the value that should be carried in the property records.

All nonfunded transactions require the capturing of values by use of a document that represents a "journal voucher." This is the only way, or only source document, a property clerk has to post to the Forest's property records. (See section 56.33 for posting procedures and establishing property values.) Other examples of nonfunded transactions that must be captured, at least annually, are: a. The removal of the original value of roads or other improvements that have been reconstructed. See section 56.33e, items 1 and 2, for directions to perform this on an annual basis.

b. Timber-purchaser roads involving timber sales. See section 56.33e,

R6 SUPPLEMENT 6509.11k-93-2

EFFECTIVE 06/11/93

6509.11k, 56.3-57

Page 4 of 19 item 3, for directions to perform this on an annual basis.

c. Roads constructed under the provisions of Road Right-of-Way Construction and Use Agreements. Include only the value the cooperator has constructed that has not been offset by payments from the Forest Service. See section 56.33e, item 4, for directions to perform this on an annual basis.

d. Roads not constructed by the Forest Service or timber purchaser, or for roads abandoned (including those constructed by timber purchasers). Values will be determined using engineering-appraised values if the actual cost of the road segment is not identified in the records. e. The elimination of any previously recorded asset by abandonment, destruction, demolition, or dilapidation to the point it no longer maintains its identity. Existing values for each asset must be written off the records using a properly approved form AD-112 (Report of Unserviceable, Lost, or Damaged

Property). f. Trails not constructed by Forest Service funds or personnel. Use an engineering appraisal to determine the value at the time of construction.

g. The value of abandoned trails. Use engineering-appraised values if the actual cost of the trail cannot be determined.

h. Special program work accomplished as a result of improvements by YCC,

YACC, and volunteers. Identify the source of the acquired value on a journal voucher by itemizing the total amount attributable to each program. Do not duplicate values that may have been previously capitalized. Current appraised values will be used for posting purposes.

i. Job Corps work projects. Normally, the salary and other costs that may be associated with a corpsman improvement project are not charged to an asset accounting code in the Central Accounting System due to the nature of the appropriations involved. As such, improvement values should be capitalized at the value shown on the annual Human Resource Programs Accomplishment Report, form FS-1800-16, which is prepared at the end of each program year.

j. Improvements made by a Forest Service cooperator that become property of the Forest Service when completed. Use appraised values for determining the amount needed for posting. k. Additions or improvements made by permittees. This includes new construction and improvements by permittees of range fences, corrals, and stockwatering facilities. It does not include repairs to, or maintenance of, these facilities.

l. Additions or improvements made by other Federal agencies on land owned by the Forest Service (other than those the Forest Service is paying for). This would include new construction and materials, as well as supplies or labor other agencies contribute.

R6 SUPPLEMENT 6509.11k-93-2

EFFECTIVE 06/11/93

6509.11k, 56.3-57

Page 5 of 19 m. Additions and/or changes to acquired lands as a result of a tripartite land exchange. In a tripartite exchange, receipts from a Forest Service timber sale may be used to pay for a portion of the exchange. Funds from the timber sale are placed in suspense (fund code SDSD) and paid to the other land owner. Since the management codes for fund code SDSD are pre-structured, Forests cannot code the payment to an asset code as shown in section 56.32. As such, Forests must complete a journal voucher to record the value of the payment made to the other landowner.

56.31c - Inventories. Any change found during the inventory process, such as improvement that physically exists at the time the inventory was taken--yet is not on the real property records--or the destruction of any asset still included on the real property records, must be properly documented on a journal voucher (or a properly prepared property management form) so it can be used for doing the necessary updating and posting of the property ledgers.

56.32 - Real Property Accounts. The following numbers will be used in the last two digits of the "other" field when establishing management codes for capturing improvements, additions, and so forth, that meet real property definitions:

Land (General Ledger Account 150)

12--Land Acquisition and Related Costs

Buildings (General Ledger Account 152)

01--Construction of Office Buildings

02--Construction of Employee Housing

03--Construction of Storage Buildings

04--Construction of Service Buildings

05--Construction of Research and Development Buildings

06--Construction of Other Types of Buildings

Other Structures and Improvements (General Ledger Account 154)

07--Utility Systems

08--Communication Systems (Radio and Telephone)

09--Construction and Reconstruction of Roads, Including Bridges

10--Construction and Improvement of Other Facilities (not covered by any

other item shown here)

13--Construction of Cooperative Project Assets (do not use this code)

R6 SUPPLEMENT 6509.11k-93-2

EFFECTIVE 06/11/93

6509.11k, 56.3-57

Page 6 of 19

Leasehold Improvements (General Ledger Account 159)

11--All Leasehold Improvements (Improvements and additions made to

facilities that are on land leased by the Forest Service.)

If NFC's Table 15 (listing of valid Forest Service fund code/work activity combinations) requires the use of the "other" field to meet a real property requirement, yet Forests find the expenditures they will be incurring do not meet the definition of real property items, use the number 99 in the last two digits of the

"other" field. This will assist Forests in meeting the Table 15 edit and, yet, bypass the need to post funded transactions from the BUDG 4Y-1, Accrued real property

Unit Summary.

56.33 - Real Property Accounting Procedures.

56.33a - Regional and Station Headquarters Procedures. After the close of each fiscal year, RO Fiscal and Public Safety (F&PS) will prepare journal vouchers to transfer costs incurred by the RO to the applicable Forest that actually has the improvement in place. This includes land-acquisition accrued expenditures that have been charged to the RO because the funds were held in the RO, yet the improvement actually belongs to a given Forest unit.

56.33b - Unit Procedures. Generally speaking, Forests must maintain records by designated administrative site, with the remaining records designated as a National

Forest site.

1. General Ledger Account 150 - Land. Maintain a summary sheet of dollars and acres for each owned administrative site, with the balance of land values and acres showing on one National Forest summary sheet. If more than one State is involved, maintain a separate ledger sheet also within the above criteria.

2. General Ledger Account 152 - Buildings. Record only costs and square footage on each ledger sheet. Identify whether each is an administrative site or belongs in the National Forest total.

3. General Ledger Account 154 - Other Structures and Improvements. As a minimum, maintain a separate ledger summary sheet of dollars only (by administrative site or National Forest) for: a. Utility Systems (code 07). Statistics equals number of systems.

b. Communications Systems, Radio, and Telephone (code 08). Statistics equals number of systems.

c. Construction and Reconstruction of Roads, Including Bridges (code 09).

Statistics equals miles of roads.

d. All Other Facilities (code 10). Statistics equals number of improvements.

R6 SUPPLEMENT 6509.11k-93-2

EFFECTIVE 06/11/93

6509.11k, 56.3-57

Page 7 of 19

If a Forest would like a further breakdown of assets, such as by District or by type of improvement, they can do so at their management option. Statistics to support the above item 3 costs shall be maintained; however, the Forest has the option of either maintaining them as part of the ledgers or as part of the various resourceinventory systems that exist on most Forests. There is no need to duplicate the statistical records both in the property and resource-inventory systems. Forests need to ensure coordination between the various resource groups and Budget and

Finance (B&F); therefore, if costs are desired by specific item in order to match with a given statistic, the ledgers are posted accordingly. It is permissible for a Forest to maintain detailed statistics through its resource-inventory systems, yet only maintain a lump sum dollar amount on the ledgers. Forests need to make the conscious effort to determine what data is essential for meeting its own objectives, and B&F should annually verify that the records are being kept up-to-date, for control purposes.

4. General Ledger Account 159 - Leasehold Improvements. Maintain only a summary sheet for each administrative site and remaining National Forest totals.

Statistics need only indicate which lease is involved, not the number of improvements.

56.33c - Posting Procedures. All postings are to be done in thousands of dollars.

(For example, $1,000 of accrued expenditures would be posted as $1, $500 would be posted as $1, $400 would not be posted, $51,099 would be posted as $51.) Footnote the form FS-6500-53 to indicate dollars are rounded to the nearest thousand so that anyone looking at the ledgers can understand them.

Posting to form FS-6500-53 shall be done annually, as a minimum. Posting will be done for funded transactions (see 56.31b, item 1.) from accrued real property listings. Nonfunded transactions (see 56.31b, item 2.) will be posted from other property documents prepared to capture real property improvements, additions, and deletions, such as journal vouchers. Journal vouchers should be prepared as changes are encountered involving real property; however, they need only be posted to the ledgers annually in conjunction with the annual reports.

The sum of all ledger cards must agree with the real property Summary Journal

Voucher report balances, referred to in 56.34, and is a check that should be done prior to sending in the report.

56.33e - Adjustments to Form FS-6500-53, Real Property Ledger.

1. Annually, for road reconstruction, Forests will need to write off a portion of the original road value because a new value is being posted as an accrued expense for the new road. To determine the value to write off, perform the following computation: a. Obtain from Engineering the number of miles of roads reconstructed by either Forest Service appropriated funds or timber purchasers.

R6 SUPPLEMENT 6509.11k-93-2

EFFECTIVE 06/11/93

6509.11k, 56.3-57

Page 8 of 19 b. Multiply the miles in item a. by the current average cost-per-mile for roads constructed. (Compute the average cost-per-mile by dividing the total value of your forms FS-6500-53 by the number of miles of system roads on the Forest.) c. From the value in item b., subtract the local Forest engineer's estimate of the residual value of those roads (prior to the actual reconstruction) being reconstructed. For example, if Engineering believed 70 percent of the original road was still in place prior to reconstruction, deduct 70 percent from the value in item b.

The remaining value (in the example, 30 percent of item b.) is what the annual journal voucher will be prepared to write off the dollars and miles for.

2. For all items of renovation or rebuilding (other than roads) that are not considered a maintenance item, such as upgrading a roof or telephone system,

Forests need not attempt to determine the original value to be written off. New costs will be capitalized, but the old item does not need to be written off.

3. Annually, Forests must establish the value of roads constructed and/or reconstructed by timber purchasers through timber sales. The value will be taken from the Timber Sale Accounting System's Road Credit Authority (RCA) Report's established column. Prepare an annual journal voucher to record these values in the records, using the September 30 RCA report.

4. Annually, Forests must determine the value of cost-share roads that have been constructed by other than the Forest Service under Road Right-of-Way

Construction and Use Agreements. Values will be computed using the Annual

Status Report of Cost Share Balances, item 1c (Cooperator to Construct), item 3c

(Construct Value), item 3d (When Constructor is Cooperator), and item 4f (FY

Collections), as follows: a. From the current report, take the value of item 1c, subtract the value in item 3c when item 3d is Coop, and subtract the value of any appropriated funds paid to the cooperator during the year. (This will show on the balance sheet of the

Road Right-of-Way Construction and Use Agreements.) b. From the previous year's report, take the value of item 1c, subtract the value in item 3c when item 3d is Coop, and subtract the value of any appropriated funds paid to the cooperator during the year. (This will show on the balance sheet of the Road Right-of-Way Construction and Use Agreements.) c. Determine the sum of item 4f for all timber sales shown on the current year's report.

d. Subtract the amount computed in step b. from the amount computed in step a.

e. Subtract the value in step c. from the value computed in step d. The result is the value that will be used to prepare an annual journal voucher to record cost-share values. These values can be either debit or credit amounts for any given agreement area.

R6 SUPPLEMENT 6509.11k-93-2

EFFECTIVE 06/11/93

6509.11k, 56.3-57

Page 9 of 19

56.34 - Real Property Reports. At prescribed annual intervals, Forests will prepare the following reports. These reports are designed to ensure proper posting has been done to the Forest ledgers and the GSA Form 1166 can be prepared for forwarding to the Chief.

1. Summary Real Property Journal Voucher. This is a worksheet designed to summarize all property transactions that have taken place since the last reporting cycle (exhibit 01). It starts with last year's ending property balances, adds current-year accruals (funded transactions), then adjusts for nonfunded transactions to arrive at an ending property balance as of the end of the current reporting cycle. This worksheet should be prepared concurrently with postings that are done per section 56.33c. See item 3., this section, for special procedures to use when PNW improvements are involved in a Forest's real property.

Units will audit the Summary Journal Voucher to ensure it reflects a complete summary of all individual journal vouchers prepared during the year. Use the following as guidelines in preparing the Summary Journal Voucher (exhibit 01):

Column 1 - These represent nonfunded transactions (see section 56.31) that have occurred to real property not processed through the Central Accounting System.

Amounts being adjusted in WCF also require an AD-742 be prepared and submitted to the National Finance Center (NFC) so the WCF balance sheets can be updated through the WCF system. Summarize by general ledger symbol and post the totals to column 4.

Column 2 - These are the ending balances from last year's Summary Journal

Voucher. It must equal the amounts shown in YTD amount column 5 from the prior fiscal year's report.

Column 3 - These are funded transactions for the reporting period. Post accrued expenditures from report BUDG 4Y-1, Accrued Real Property Unit Summary,

"Amount all object classes" column, for all valid asset codes. Column 3 of the

Summary Journal Voucher must agree with the column labeled "Amount all object classes" on the 4Y-1 report for all valid asset codes for the reporting fiscal year.

Column 4 - Taken directly from column 1 line items (nonfunded items).

Column 5 - This is the new YTD total. Add columns two, three, and four. Transfer these totals onto the GSA Form 1166 (see item 2), except for accounts 159, 175, and construction work in progress. For WCF, the amounts in accounts 151, 152, and

153, column 5, should agree with the amounts shown on the September 30 WCF balance sheets.

Send the Summary Journal Voucher to RO F&PS by the prescribed due date. Be sure to include copies of each journal voucher referred to in column 1.

2. General Services Administration Form 1166, Annual Report of

Real Property Owned or Leased by the United States. Before preparing GSA

R6 SUPPLEMENT 6509.11k-93-2

EFFECTIVE 06/11/93

6509.11k, 56.3-57

Page 10 of 19

Form 1166 (for owned property only), Forests should prepare the following reconciliations to ensure the Summary Journal Voucher amounts and land acres are properly transferred to form 1166: a. Reconciliation to Land Area Status (LARS) report. The LARS report is published by the Lands and Minerals staff in the RO. Each Forest should have a copy. Acres for each applicable National Forest should be posted to block 29 and 30 on GSA Form 1166 by either code 1 acres (public domain) or code 2 acres (exchange, donation). The code 1 or 2 is entered in block 27.

Acres

(1) Column 13 acres per LARS

(2) Column 14 acres per LARS

(3) Total (1+2) = Acquisition Code 1 acres

(MUST AGREE WITH CODE 1 ACRES POSTED TO TOTAL

OF ALL GSA FORM 1166'S UNLESS PNW ACRES

INVOLVED. SEE ITEM (10) BELOW IF PNW ACRES

INVOLVED.)

(4) Column 15 acres per LARS

(5) Column 16 acres per LARS

(6) Column 17 acres per LARS

(7) Column 18 acres per LARS

(8) Total (4+5+6+7) = Acquisition Code 2 acres

(MUST AGREE WITH CODE 2 ACRES POSTED TO TOTAL

OF ALL GSA FORM 1166'S UNLESS PNW ACRES

INVOLVED. SEE ITEM (14) BELOW IF PNW ACRES

INVOLVED.) b. Exclusion of PNW acres. Forests having Experiment Station land will not report either acreages or values. Report your GSA Form 1166 acreages as follows:

(9) Total NF Code 1 acres per item (3) above

(10) Less Experiment Station Code 1 acres

(11) Equals Total NF Code 1 acres to be

reported on all GSA Form 1166's*

(12) Total NF Code 2 acres per item (8) above

(13) Less Experiment Station Code 2 acres

Acres $

-0-

-0-

R6 SUPPLEMENT 6509.11k-93-2

EFFECTIVE 06/11/93

6509.11k, 56.3-57

Page 11 of 19

(14) Equals Total NF Code 2 acres to be

reported on all form 1166's*

*Post acres to block 29 or 30 and dollars to block 31.

Any accrued values for building construction not yet completed are to be excluded from your GSA

Form 1166. This value is not to be reported separately by letter to F&PS, but shown on the following real property verification that is sent to F&PS. This should be completed as a final step in verifying that the sum of all the values on all the 1166's agrees with the values on the Summary Journal

Voucher.

(1) Totals on all GSA Form 1166's

Land

$

Buildings All Other

$ $

(2) Plus column 5 YTD amount of accts. 159 and

175 on Summary Journal Voucher

(3) Plus value of construction work in progress

(4) Sum (1+2+3)

(5) Summary Journal Voucher Totals

(6) Difference (4-5; if other than zero, explain)

B&F Officer Date

The above approval is verification of the data in the three reconciliations that are to be sent to

F&PS.

R6 SUPPLEMENT 6509.11k-93-2

EFFECTIVE 06/11/93

6509.11k, 56.3-57

Page 12 of 19

Guidelines for Preparing GSA Form 1166:

Blocks 1 through 10 - Leave blank.

Block 12 - Name assigned to the installation. (Separate GSA Form 1166 for NF and each administrative site, as previously reported.)

Blocks 13 through 26 - Leave blank.

Block 27 - Indicate method through which land was acquired (that is 1 or 2).

Block 28 - Enter the same data shown on the previous fiscal year copy of the report; however, extend the acquisition date to the current year if additional land is acquired in current year. If you change the dates without changing the acres or value, explain in block 58.

Blocks 29 and 30 - Complete.

Block 31 - The total cost on all GSA Form 1166's must agree with the column 5 YTD amount for account 150 from the real property Summary Journal Voucher.

Blocks 32 through 34 - Leave blank.

Blocks 37 through 40 - Complete these blocks. Total cost on all GSA Form 1166's must agree with the column 5 YTD amount for account 152 and account 151 (WCF) from real property Summary Journal Voucher, except for construction work in progress. Explain in block 58 changes in the number of buildings and/or values without changes in square footage.

Blocks 41 through 43 - Leave blank.

Block 46 - Complete. The total cost on all GSA Form 1166's must agree with the column 5 YTD amount for accounts 154, 152 (WCF), and 153 (WCF) from the real property Summary Journal Voucher.

Blocks 47 and 48 - Leave blank.

Block 49 - Complete.

Blocks 50 through 57 - Leave blank.

Block 58 - Enter any notation necessary to clarify or expand any entry on the report.

Block 59 - Preparer must sign.

Block 60 - Signature of B&F officer who approves form.

Block 61 - Enter date which the report was prepared.

R6 SUPPLEMENT 6509.11k-93-2

EFFECTIVE 06/11/93

6509.11k, 56.3-57

Page 13 of 19

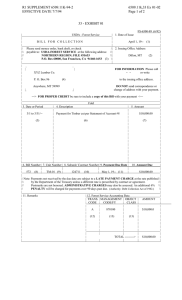

56.34 - Exhibit 01

SUMMARY JOURNAL VOUCHER COVERING FISCAL YEAR

Unit:

Journal Voucher Transactions

Date:

(Col 1)

JV's included

General Ledger

Symbol

150

Debit or

Credit

152

154

159

175

151 (WCF)

152 (WCF)

153 (WCF)

Total

Form FS-6500-53, Real Property Balances - Period ending:

General Ledger

Acct., Title,

& 'Other' Code

150 Land

(12)

(Col 2)

Amount Prior

Fiscal Year

$

(Col 3)

Accrued

Expenditures

$

(Col 4)

J. V.

$

Adjustments

152 Buildings

(01-06)

154 Other Structures

& Improvements

(07-10, 13)

159 Leasehold

Improvements

(11)

Subtotal

WCF

151 Buildings

$

$

$

$

$

$

152 Other Structures

& Improvements

153 Refrigeration

Plant

& Equipment

Subtotal $ $ $

$

(Col 5)

YTD

$

$

$

$

Amount

R6 SUPPLEMENT 6509.11k-93-2

EFFECTIVE 06/11/93

6509.11k, 56.3-57

Page 14 of 19

GRAND TOTAL $ $ $ $

Approved Date

57 - REPORTING PROCEDURES.

57.1 - Obligation Reporting.

It is important that obligations are correctly reported and properly classified as delivered or undelivered. Proper entry and review in validating the obligation report each month is essential in order to have quality financial statements. Refer to exhibits 01, 02, and 03 for information to help accomplish proper obligation reporting.

Obligating another Unit's Funds. The National Obligation Program allows one unit to obligate the management codes and funds of other units. This feature greatly enhances the efforts of assuring proper obligations each month when funds are to be paid by one location, yet the payment is being made from the funds of several participating Forests.

To fully utilize the advantages of this option, the unit responsible for processing payments to vendors, institutions, and so forth, should monthly obligate against all units and management codes that apply to that obligation source document. The

"responsible paying unit" is that unit having primary responsibility for processing payments against the procurement source document. For example, if the RO has awarded a contract for tree seedlings to be funded by several Forests, and the RO is designated as the unit to process payments, the RO will obligate and make payments against all the Forests who are to receive orders.

If there is any doubt between units as to who is the responsible paying unit, contact the contracting officer or the other Forests involved. Contracting offices should send the procurement source documents to the office that will be responsible for processing payments, with a courtesy copy of the award letter to all participating units.

Obligations that one unit reports on the behalf of another unit will show on the transaction register on the other unit and be identified with the Region and unit that reported the obligation. For example, if the Okanogan NF reported obligations on behalf of the Olympic NF, the Olympic would see "06 08" as a portion of the identification field on the transaction register. This assists units in knowing how their obligations are created when another unit is obligating for them.

R6 SUPPLEMENT 6509.11k-93-2

EFFECTIVE 06/11/93

6509.11k, 56.3-57

Page 15 of 19

57.1--Exhibit 01

TRANSACTION CODE DEFINITIONS

CODE 3 - Accounts Payable And Accrued Liabilities - Within Government

(Delivered)--Procurements or services from any Federal source that have been received but not paid.

CODE 4 - Accounts Payable And Accrued Liabilities - Other (Delivered) --

Procurements or services from non-Federal source that have been received but not paid.

CODE 5 - Undelivered - Customer Orders--This is used by WCF shops or similar

WCF facilities that provide services or products.

CODE 7 - Undelivered Orders - Within Government--Procurements or service from a Federal agency that have not been received and have not been paid.

CODE 8 - Undelivered Orders - Other --Procurements or services from a non-

Federal agency that have not been received and have not been paid.

CODE 9 - Commitments--This is used for In-Service Authorizations, Requests for

Contract Action, and other transactions where no procurement document or written binding agreement exists that has obligated the Government to pay for a service or product. Do not use a transaction Code 9 on the year-end obligation report.

R6 SUPPLEMENT 6509.11k-93-2

EFFECTIVE 06/11/93

6509.11k, 56.3-57

Page 16 of 19

57.1--Exhibit 02

TRANSACTION CODES FOR SPECIFIC OBLIGATIONS

What to Report

Blanket purchase invoices

Transaction Codes:

During year Year-end

4 4

Contracts (those not sent to NFC on P.O.'s)

Credit card invoices

*FTS 2000

GSA rental vehicles

Government Bills of Lading

Government Print Office (GPO) orders

4 or 8

3 or 4

3 or 9

3 or 9

4 or 8

3 or 7

4 or 8

3 or 4

3 or 7

3 or 7

4 or 8

3 or 7

Government Transportation Requests

Imprest

In-Service Authorizations (Ordering unit)

Inter-Agency Agreements

Metered mail

Relocation services costs

4,8 or 9

3 or 4

9

3 or 7

3 or 9

4 or 8

4 or 8

3 or 4

3 or 7

3 or 7

3 or 7

4 or 8

Requests for contract action

RIT claims

Third Party Drafts

Training

Transfer of station

Travel vouchers

Unemployment costs

United Parcel Service (UPS)

9

4 or 8

3 or 4

3,4,7 or 8

4 or 8

4 or 8

3

4 or 9

4 or 8

3 or 4

3, 4, 7 or 8

4 or 8

4 or 8

3

4 or 8

R6 SUPPLEMENT 6509.11k-93-2

EFFECTIVE 06/11/93

6509.11k, 56.3-57

Page 17 of 19

*Utility & Telephone (if annual costs justify)

Worker's Compensation costs (OWCP)

4 or 9

3

4

3

* NFC obligates these for part of the year and makes payments for these items also.

Watch the unit transaction registers and prepare obligations so they do not duplicate NFC's obligations.

R6 SUPPLEMENT 6509.11k-93-2

EFFECTIVE 06/11/93

6509.11k, 56.3-57

Page 18 of 19

57.1--Exhibit 03

OTHER OBLIGATION INFORMATION

Accounting Adjustments & Fund Transfers

Accounting adjustments may be obligated as appropriate, such as for financial review months and at year-end, using T/C 3. Do not obligate Timber Sale Deposit

Fund Transfers being processed (and do not report the collection portion as an accounts receivable).

Department Computer Center - Kansas City

A funding agreement is established each fiscal year between each unit and the

Kansas City computer center through an AD-672. The AD-672 establishes account numbers and management codes to be charged. Kansas City transmits billing information to NFC, and NFC processes the charges. Kansas City also transmits billing information to each unit monthly itemizing charges by account number.

Unit obligates best estimate for charges to date, T/C 3. The remainder of the fiscal year's estimated charges may be carried as a commitment (T/C 9).

FTS-2000

Each Region's estimated charges are listed in the Chief's PBMI. Each unit's estimated charges are listed in the R-6 PBMI. Management codes and percentage distribution are provided to WO who provides to NFC. GSA bills NFC. NFC obligates. Until NFC picks up the obligation, the unit should carry an

obligation on the month-end obligation report. Monitor the monthly subunit transactions registers to ascertain when NFC picks up the obligation. This may result in a duplicate obligation for one month. The obligation should be modified monthly to reflect the delivered services (T/C 3) versus undelivered services (T/C 7).

Do not confuse FTS-2000 with FTSP - commercial telephone accounts billed by GSA through SIBAC. They are separate services and separate charges. See FSH

6509.31, NFC Procedures Voucher and Invoice Payments Manual for more information on FTSP.

GPO

Government Printing Office (GPO) orders (SF-1 Forms) should be obligated at NFC.

There are problems with missed or invalid obligations for these items since this system is completely manual at NFC. There is no way to match an SF-1 obligation document to the GPO billing if the jacket number is not recorded on the obligation document. Therefore, there is no way to drop the obligation once payment is made since it cannot be identified. Also, NFC cannot enter an obligation if the Agency does not enter a cost estimate on the SF-1. Be sure the Obligation Document has the Jacket Number (assigned by GPO), a cost estimate, fund and unit code, management code, and a contact's name and phone number. A unit

requisition number is helpful also. It is not recommended that units obligate

GPO documents.

57.1 - Exhibit 03 -- Continued

R6 SUPPLEMENT 6509.11k-93-2

EFFECTIVE 06/11/93

6509.11k, 56.3-57

Page 19 of 19

GPO has a history of being slow in submission of the billings to NFC so these documents may be obligated a long time.

Metered Mail

The Post Office bills the WO for postage purchased for all meters registered to the

Forest Service. The Post Office provides a tape listing purchases by meter number.

The WO pays the bills and charge the costs to the Units quarterly using management codes provided. Unit obligates until billed. Watch the transaction registers for payments and obligate the entire amount due, based on Post Office receipts using T/C 3.

NFC

The National Finance Center is a Working Capital Fund entity. All of NFC's costs must be covered through charges for services. Each Region's estimated charges are listed in the Chief's PBMI. Region 6 covers these costs off the top, so obligations need not be reported by the units.

Standard Level User Charges (SLUC)

GSA-owned building rents are billed by GSA through SIBAC. The WO pays the bill for all Forest Service occupied buildings, and bills units using management codes provided. Unit obligates until billed. The obligation should be modified monthly to reflect the delivered services (T/C 3) versus undelivered services (T/C 7).

Unemployment Costs

When a former employee is eligible for unemployment benefits, they file a claim with their respective state unemployment agency and receive authorized payments from the state. The state in turn bills the Department of Labor, which then bills the responsible government agencies. The time lapse from initial claim to final billing of the agency may be about 2 years.

The Frick Company was awarded a contract to perform the administrative functions in managing unemployment compensation claims for most of the USDA agencies and several other Federal agencies. The contract specifies that The Frick

Company shall provide management reports quarterly to each agency listing charges to the agency during that quarter. These reports are to be used to

estimate the charges which will ultimately be passed on to each unit, and to determine the funding distribution of the charges.

The Chief's PBMI includes an estimate of each Region's charges. The R-6 PBMI lists an estimate of each unit's charges. The WO bills each Region for their percentage of the total estimated charges, based on the Frick management reports.

Region 6 passes a percentage of the Regional charge on to each unit, based on the

Frick management reports. Unit obligates as a delivered order (T/C 3) based on

PBMI estimate until billed. At year end, units should not obligate unemployment costs since they will be obligated by the RO if not already

charged out by NFC.

57.1- Exhibit 03 -- Continued

R6 SUPPLEMENT 6509.11k-93-2

EFFECTIVE 06/11/93

6509.11k, 56.3-57

Page 20 of 19

Utility and Telephone

Phone and utility obligations are generated by NFC for those accounts that had payments in the current month. NFC does not obligate through to the end of the fiscal year. It is up to the Units to determine if there is value in entering an obligation for the remaining months. If so, use transaction code 9. At year end,

NFC would obligate based on the prior month's payments so units need not obligate utilities at year end except for those not obligated by NFC.

Worker's Compensation Costs (OWCP)

These are payments made to the Office of Workers Compensation (OWC) for reimbursement of compensation payments made to Department of Agriculture employees. Reimbursement payments to OWC are made two years after OWC pays employee claims. For example, OWC payments to employees in FY 1990 are reimbursed to OWC by employing agencies in FY 1992, and are chargeable to FY

1992 appropriations.

Management codes and percentage distribution are provided to NFC through WO.

NFC pays the Office of Workers Compensation. Each Region's estimated charges are listed in the Chief's PBMI. Each unit's estimated charges are listed in the R-6

PBMI.

Units should obligate until billed by the RO. Record the entire fiscal year's estimated amount as transaction code (T/C) 3. At year end, units should not obligate OWCP costs since they will be obligated by the RO if not already charged out by NFC.

WCF Software

National software has been capitalized into the Working Capital Fund. The Chief's

PBMI lists each Region's share of the software charges. Region 6's portion is distributed to units based on information provided by MS, and published in the

Region 6 PBMI. The WO bills the Region, and the charges are distributed to the units. Unit obligates until billed. The obligation should be modified monthly to reflect the delivered services (T/C 3) versus undelivered services (T/C 7).

WCF Hardware

Computer hardware shall be capitalized into the Working Capital Fund. FOR rates are established and published. An FOR budget is prepared by each unit and submitted to the RO. The FOR charges are processed monthly by the EMIS system.

No obligations are necessary.