FOREST SERVICE HANDBOOK INTERMOUNTAIN REGION (REGION 4) OGDEN, UT

advertisement

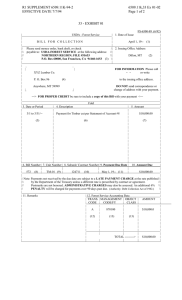

6509.11k_30 Page 1 of 7 FOREST SERVICE HANDBOOK INTERMOUNTAIN REGION (REGION 4) OGDEN, UT FSH 6509.11k – SERVICE-WIDE FINANCE AND ACCOUNTING HANDBOOK CHAPTER 30 – COLLECTIONS Supplement No.: r4_6509.11k-2003-1 Effective Date: April 18, 2003 Duration: This supplement is effective until superseded or removed. Approved: JACK G. TROYER Regional Forester Date Approved: 04/04/2003 Posting Instructions: Supplements are numbered consecutively by Handbook number and calendar year. Post by document; remove entire document and replace it with this supplement. Retain this transmittal as the first page(s) of this document. The last supplement to this Handbook was 6509.11k-97-1 to 6509.11k_32. New Document(s): 6509.11k_30 7 Pages Superseded Document(s) by Issuance Number and Effective Date 6509.11k,30-31 (6509.11k-95-3, 12/29/1995) 6509.11k,32 (6509.11k-97-1, 3/17/1997) 2 Pages 7 Pages Digest: 31.27a – Removes obsolete direction on LOCKBOX. 32.41 – Updates direction to include FFIS terms and direction. R4 SUPPLEMENT 6509.11K-2003-1 EFFECTIVE DATE: 04/04/2003 DURATION: This supplement is effective until superseded or removed. 6509.11k_30 Page 2 of 7 FSH 6509.11k – SERVICE-WIDE FINANCE AND ACCOUNTING HANDBOOK CHAPTER 30 - COLLECTIONS 32.41 - Transfer of Earned Timber Sale Deposit Fund Receipts Use form R4-6500-41, Timber Sale Deposit Fund Reconciliation, to prepare each month's timber transfer reconciliation between the Financial Statements of the Foundation Financial Information System (FFIS) at the National Finance Center (NFC) and the ATSA Cash Balance (ex. 01) in accordance with instructions following example of form. Submit a copy of form R4-6500-41 to the Timber Sale Accounting and Reporting Officer, c/o Fiscal and Accounting, 324 25th Street, Ogden, UT 84401 by the 30th of each month. Also include copies of the following documents: 1. Cash Balance Statement of Deposit and Trust Funds (CBSA) for the reporting month. 2. Transaction Register, Billings and Collections (TRBC) for the reporting month. 3. 55-1 Status of Suspense and Deposit Funds Report or, in lieu of paragraphs 2 and 3 above the Doc List for TDTD for the reporting month. 4. ATSA worksheets prepared at reporting month-end closure as follows: a. National Forest Summary – Month’s Activity. b. National Forest Summary – Charge Distribution. 5. Print screen of accepted Balance Voucher (BV) document transfer for the reporting month. BV document must be processed within a timeframe to ensure processing in current month. R4 SUPPLEMENT 6509.11K-2003-1 EFFECTIVE DATE: 04/04/2003 DURATION: This supplement is effective until superseded or removed. 6509.11k_30 Page 3 of 7 FSH 6509.11k – SERVICE-WIDE FINANCE AND ACCOUNTING HANDBOOK CHAPTER 30 - COLLECTIONS 32.41 - Exhibit 01 USDA - Forest Service R4-6500-41 (1/2003) TIMBER SALE DEPOSIT FUND RECONCILIATION (Ref. FSH 6509.11k, 32) Unit Name (a) Proclaimed Unit No. (b) Month Ending (c) Reconciliation of ATSA Timber Purchaser Records with Timber Sale Deposit Fund (TDTD) in the Financial Reports of the Foundation Financial Information System (FFIS). 1. Timber Sale Deposit Fund from Cash Balance Statement of Deposit and Trust Funds (CBSA) of a. Rptg Cat (Proc Unit) Total from CBSA.. b. +/- Net Amount of Adjustments from Worksheet of Unprocessed and Incorrect Transactions from Adjustment Worksheet, Page 2 c. d. (d) (Date) $ (e) (+/-) (f) Adjustment for amount of prior month's transfers not processed. (list BV Doc IDs) (-) (g) Adjustment for current month transfer to charge TSDF for amount of Earnings (871XXX) (BV Doc ID ) (-) (h) 2. True TSDF Balance (a, +/-b), -c, -d) $ (i) 3. ATSA Ending Cash Balance on the Total Deposited Basis, Worksheet for Transfer of Earned Timber Receipts, NF Summary - Month's Activity $ (j) Line 2 must equal line 3 Prepared By: (k) Date: Approved By: (l) Date: Page 1 of 2 R4 SUPPLEMENT 6509.11K-2003-1 EFFECTIVE DATE: 04/04/2003 DURATION: This supplement is effective until superseded or removed. 6509.11k_30 Page 4 of 7 FSH 6509.11k – SERVICE-WIDE FINANCE AND ACCOUNTING HANDBOOK CHAPTER 30 - COLLECTIONS 32.41 - Exhibit 01--Continued ADJUSTMENT WORKSHEET (Unprocessed and Incorrect Transactions) Month Ending (m) COLLECTIONS/TRANSFERS IN (n) IN TSA, NOT IN TSDF (+) RD Contract No. Bill No. $ Amount COLLECTIONS/TRANSFERS IN (o) IN TSDF, NOT IN TSA (-) RD Contract No. Bill No. $ Amount REFUNDS/TRANSFERS OUT (p) IN TSA, NOT IN TSDF (-) RD Contract No. Vchr No. $ Amount REFUNDS/TRANSFERS OUT (q) IN TSDF, NOT IN TSA (+) RD Contract No. Vchr No. $ Amount Total Adjustment, to be entered On Line 1b, Page 1 (+/-) $ (r) Page 2 of 2 R4 SUPPLEMENT 6509.11K-2003-1 EFFECTIVE DATE: 04/04/2003 DURATION: This supplement is effective until superseded or removed. 6509.11k_30 Page 5 of 7 FSH 6509.11k – SERVICE-WIDE FINANCE AND ACCOUNTING HANDBOOK CHAPTER 30 - COLLECTIONS 32.41 - Exhibit 01--Continued Form R4-6500-41 Instructions (a) Enter the name of the forest. (b) Enter the Proclaimed Unit No. Note: For units with multiple proclaimed units, reconciliations are prepared separately for each. (c) Enter the month and year of reporting period. (d) Enter the date of the Cash Balance Statement of Deposit and Trust Funds (CBSA). (e) Enter the Account Total balance in TDTD from the CBSA Report for the reporting month. For units with more than one proclaimed unit, use the Account Total specific to each account. Note: Address and resolve an account from another unit appearing on the financial statement due to error. (f) Enter the net amount (+ or -) of adjustments from Worksheet of unprocessed and incorrect transactions on page 2. This amount is a net total of all the reconciling differences. Refer to further discussion included in instructions for m, n, o, p and q. (g) Enter total of any prior month's timber transfers not processed at NFC. Each month’s Balance Voucher Document must be processed in FFIS within the same month. List BV document ID numbers. (h) Enter the total amount of current month timber transfers processed on Balance Voucher (Total Deposited Basis) which is charged to 871___. Identify the BV Document ID numbers. (i) Enter the sum total of a. (Account Total from CBSA), plus or minus b. (Net Amount of Adjustment Worksheet, Page 2), minus c. (Adjustment for amount of unprocessed prior month's transfers), minus d. (Adjustment for current month transfer). (j) Enter the ATSA Ending Cash Balance on the Total Deposited Basis, from National Forest Summary - Month's Activity. LINE 2 MUST EQUAL LINE 3 to reflect a true reconciliation between the Timber Sale Deposit Fund (TDTD) in the Unit Financial Statement and the ATSA Cash Balance. (k) Enter the name of individual preparing the reconciliation. (l) Enter the name of individual reviewing and approving the reconciliation. (m) Enter month, year of reporting period. R4 SUPPLEMENT 6509.11K-2003-1 EFFECTIVE DATE: 04/04/2003 DURATION: This supplement is effective until superseded or removed. 6509.11k_30 Page 6 of 7 FSH 6509.11k – SERVICE-WIDE FINANCE AND ACCOUNTING HANDBOOK CHAPTER 30 - COLLECTIONS 32.41 - Exhibit 01--Continued Prior to proceeding with the following instructions for identifying unprocessed or incorrect transactions, complete the reconciliation using lines 1.a (account total from CBSA), 1.c (adjustment for amount of prior month's transferred not processed, if any), 1.d. (adjustment for current month transfer) to determine line 2. (true TSDF balance). If line 2. equals line 3. (ATSA Ending Cash Balance), the ATSA records and FFIS are in balance. Therefore, it is not necessary to complete the individual transaction comparison process. If line 2. does not equal line 3., the individual transactions causing the difference must be identified. Entries in the quadrant including n. Collections in TSA, Not in TSDF Account; o. Collections in TSDF Account, Not in TSA; p. Refunds/Transfers in TSA, Not in TSDF Account; and q. Refunds/Transfers in TSDF Account, Not in TSA; are those transactions unprocessed or incorrect at the time of reconciliation. They are identified in the process of matching each individual transaction for all deposits, transfers and refunds for inclusion and correctness in both the ATSA and FFIS. The tools used in this reconciliation and how they relate are discussed below: 1. ATSA Worksheets of District Sale Detail - Month's Activity. Information noted on this report is the district number, contract number, amount of transaction, and if it is a deposit, refund or transfer. These reports are produced with each month-end closure and included in the TSA477-01 file. 2. Transaction Register Billings and Collections. This report is a detailed listing of bills for collection included in the TSDF balance for the month. The job codes involved are 870XXX and 871XXX. This report is created for each month and resides in the FDW. 3. 55-1 Status of Suspense and Deposit Funds Report. This report reflects the refund and transfer transactions. In lieu of using the TRBC and 55-1, the doc list for TDTD that is generated at the Regional Office and posted to R4 fsweb page may be used. R4 SUPPLEMENT 6509.11K-2003-1 EFFECTIVE DATE: 04/04/2003 DURATION: This supplement is effective until superseded or removed. 6509.11k_30 Page 7 of 7 FSH 6509.11k – SERVICE-WIDE FINANCE AND ACCOUNTING HANDBOOK CHAPTER 30 - COLLECTIONS 32.41 - Exhibit 01--Continued The process of reconciliation requires a comparison of transactions on the ATSA worksheets and the subunit transaction register. Note: when multiple payments are received on a contract or permit each will appear on the TRBC, 55-1, or TDTD report, however, the ATSA worksheet displays a total of all payments for the month. This comparison effort will match those transactions included in both TSA and the TSDF Account. The unmatched transactions remaining on either the ATSA worksheet or the subunit transaction register will be included as adjustments on the worksheet according to their status. The four options are: (n) Collections in TSA, Not in TSDF Account. These transactions will be listed individually identifying the ranger district, contract/permit number, bill for collection number and amount. The total of these transactions are added in calculating the total adjustment. (o) Collections in TSDF Account, not in TSA. These transactions will be listed individually identifying the ranger district, contract/permit number, bill for collection number and amount. The total of these transactions are subtracted in calculating the total adjustment. (p) Refunds/Transfers in TSA, Not in TSDF Account. These transactions will be listed individually identifying the ranger district, contract/permit number, voucher number and amount. The total of these transactions are subtracted in calculating the total adjustment. (q) Refunds/Transfers in TSDF Account, Not in TSA. These transactions will be individually listed identifying the ranger district, contract/permit number, bill for collection number and amount. The total of these transactions are added in calculating the total adjustment. Each transaction listed as an adjustment must be evaluated to determine the reason the transaction is not included in both TSA and the TSDF Account. Any required action needed to correct the deficiency must be taken during the current month. (r) Enter the total Adjustment to be entered on Line lb, Page 1.