Controlling Versus Enabling – Online Appendix Working Paper

advertisement

Controlling Versus Enabling –

Online Appendix

Andrei Hagiu

Julian Wright

Working Paper

16-004

January 31, 2016

Copyright © 2015, 2016 by Andrei Hagiu and Julian Wright

Working papers are in draft form. This working paper is distributed for purposes of comment and

discussion only. It may not be reproduced without permission of the copyright holder. Copies of working

papers are available from the author.

Controlling versus enabling — Online appendix

Andrei Hagiu∗ and Julian Wright†

January 31, 2016

This online appendix contains the proof of the technical Lemma (Lemma 1) used in the Proof of

Proposition 1 in the main paper, which states that Ω∗ (.) is continuous and differentiable at R∗ . It

also includes the derivations of the closed form solutions given in the main paper. It establishes the

result stated at the end of Section 7 of the main paper, that Proposition 5 continues to hold even if

the price is endogenous and there are production costs. It provides the proofs of some results stated

in the extensions section of the paper. It also details the numerical analysis performed to check the

robustness of the first part of Corollary 1 to the introduction of spillovers and private benefits.

1

Proof of Lemma 1

Suppose the contract Ω∗ offered by the firm is discontinuous at R∗ and limR→R∗− Ω∗ (R) > limR→R∗+ Ω∗ (R).

Then

Q∗ = arg max {N (R (a∗ , s (a∗ ) , q ∗ , Q) − Ω∗ (R (a∗ , s (a∗ ) , q ∗ , Q))) − C (Q)}

Q

implies Ω∗ (R∗ ) = limR→R∗+ Ω∗ (R), because otherwise Ω∗ (R∗ ) > limR→R∗+ Ω∗ (R), so the firm could

profitably deviate to Q∗ + ε, with ε sufficiently small. But then we must have q ∗ = 0, since otherwise

q ∗ > 0 and any agent could profitably deviate to q ∗ − ε with ε sufficiently small. If q ∗ = 0, then it

must be that Ω∗ (R∗ ) = 0 and therefore

(a∗ , Q∗ ) = arg max {N (R (a, s (a) , 0, Q) − f (a)) − C (Q)} .

a,Q

In this case the firm could switch to the following linear contract:

Ωε (R) = εR + c (q (ε)) − εR (a (ε) , s (a (ε)) , q (ε) , Q (ε)) ,

∗

†

Harvard Business School, Boston, MA 02163, E-mail: ahagiu@hbs.edu

Department of Economics, National University of Singapore, Singapore 117570, E-mail: jwright@nus.edu.sg

1

(1)

where ε > 0 is sufficiently small and (a (ε) , q (ε) , Q (ε)) is a solution to

a (ε) = arg maxa {(1 − ε) R (a, s (a) , q (ε) , Q (ε)) − f (a)}

q (ε) = arg maxq {εR (a (ε) , s (a (ε)) , q, Q (ε)) − c (q)}

Q (ε) = arg max {N (1 − ε) R (a (ε) , s (a (ε)) , q (ε) , Q) − C (Q)} .

Q

Denote the firm profits that result from offering contract Ωε by

ΠE (ε) ≡ N (R (a (ε) , s (a (ε)) , q (ε) , Q (ε)) − f (a (ε)) − c (q (ε))) − C (Q (ε)) .

Clearly, (a (0) , q (0) , Q (0)) = (a∗ , 0, Q∗ ) and ΠE (0) = ΠE ∗ . We can then use (1), the definition of

q (ε) and assumption (a2) to obtain

∗

∗

∗

∗

∗

∗

∗

∗

ΠE

ε (0) = N (Ra (a , s (a ) , 0, Q ) + sa (a ) Rσ (a , s (a ) , 0, Q ) − fa (a )) aε (0)

+N (Rq (a∗ , s (a∗ ) , 0, Q∗ ) − cq (0)) qε (0) + (N RQ (a∗ , s (a∗ ) , 0, Q∗ ) − CQ (Q∗ )) Qε (0)

Rq (a∗ , s (a∗ ) , 0, Q∗ )

> 0,

= N Rq (a∗ , s (a∗ ) , 0, Q∗ )

cqq (0)

where cqq =

d2 c

.

dq 2

Thus, if limR→R∗− Ω∗ (R) > limR→R∗+ Ω∗ (R), then the firm can profitably deviate to Ωε (R) for ε

small enough, which contradicts the optimality of Ω∗ (R).

The other possibility is limR→R∗+ Ω∗ (R) > limR→R∗− Ω∗ (R). Then

q ∗ = arg max {Ω∗ (R (a∗ , s (a∗ ) , q, Q∗ )) − c (q)}

q

implies Ω∗ (R∗ ) = limR→R∗+ Ω∗ (R), because otherwise Ω∗ (R∗ ) < limR→R∗+ Ω∗ (R), so any agent could

profitably deviate to q ∗ + ε, with ε sufficiently small. But then we must have Q∗ = 0, otherwise the

firm could profitably deviate to Q∗ − ε with ε sufficiently small.

If a is not price, then N R (a, s (a) , q ∗ , Q∗ ) is strictly increasing in a by assumption (a3), so the

same logic implies a∗ = 0. We must then have

ΠE ∗ = N (R (0, s (0) , q ∗ , 0) − c (q ∗ )) = N max {R (0, s (0) , q, 0) − c (q)} .

q

This cannot be optimal. Indeed, the firm could switch to the linear contract

e ε (R) = (1 − ε) R + c (e

e (ε) ,

Ω

q (ε)) − (1 − ε) R e

a (ε) , s (e

a (ε)) , qe (ε) , Q

2

(2)

e (ε) is a solution to

where ε > 0 is sufficiently small and e

a (ε) , qe (ε) , Q

n o

e (ε) − f (a)

e

a

(ε)

=

arg

max

εR

a,

s

(a)

,

q

e

(ε)

,

Q

a

n

o

e (ε) − c (q)

qe (ε) = arg maxq (1 − ε) R e

a (ε) , s (e

a (ε)) , q, Q

Q

e (ε) = arg max {N εR (e

a (ε) , s (e

a (ε)) , qe (ε) , Q) − C (Q)} .

Q

e ε by

Denote the firm profits that result from offering contract Ω

e E (ε) ≡ N R e

e (ε) − f (e

e (ε) .

Π

a (ε) , s (e

a (ε)) , qe (ε) , Q

a (ε)) − c (e

q (ε)) − C Q

Clearly,

e (0) = (0, q ∗ , 0) and Π

e E (0) = ΠE ∗ . Using (2), the definitions of e

e

a (0) , qe (0) , Q

a (ε) and

e (ε) and assumption (a2) and (a3), we obtain

Q

e E (0) = N (Ra (0, s (0) , q ∗ , 0) + sa (0) Rσ (0, s (0) , q ∗ , 0)) e

Π

aε (0) + N (Rq (0, s (0) , q ∗ , 0) − cq (q ∗ )) qeε (0)

ε

e ε (0)

+N RQ (0, s (0) , q ∗ , 0) Q

= N

where faa =

(RQ (0, s (0) , q ∗ , 0))2

(Ra (0, s (0) , q ∗ , 0) + sa (0) Rσ (0, s (0) , q ∗ , 0))2

+N

> 0,

faa (0)

CQQ (0)

d2 f

da2

and CQQ =

d2 C

.

dQ2

e ε (R) for ε small enough, which contradicts the optimality

Thus, the firm can profitably deviate to Ω

of Ω∗ (R).

If a is price, then f = 0 so we must have

ΠE ∗ = R (a∗ , s (a∗ ) , q ∗ , 0) − c (q ∗ ) ≤ max {R (a, s (a) , q, 0) − c (q)} .

a,q

e ε (R) for ε small

Once again, it is straightforward to verify that the firm could profitably deviate to Ω

enough.

We have thus proven that limR→R∗+ Ω∗ (R) = limR→R∗− Ω∗ (R), so Ω∗ is continuous at R∗ .

Suppose now that Ω∗ is non-differentiable at R∗ and limR→R∗+ Ω∗R (R) > limR→R∗− Ω∗R (R). This

implies q ∗ = 0, otherwise we must have

0 ≥

>

lim {Ω∗R (R (a∗ , s (a∗ ) , q, Q∗ )) Rq (a∗ , s (a∗ ) , q, Q∗ ) − cq (q)}

q→q ∗+

lim {Ω∗R (R (a∗ , s (a∗ ) , q, Q∗ )) Rq (a∗ , s (a∗ ) , q, Q∗ ) − cq (q)} ,

q→q ∗−

so setting q slightly below q ∗ would violate q ∗ = arg maxq {Ω (R (a∗ , s (a∗ ) , q, Q∗ )) − c (q)}. If q ∗ = 0,

3

then we must have Ω∗ (R∗ ) = 0 (recall c (0) = 0) and therefore

(a∗ , Q∗ ) = arg max {N (R (a, s (a) , 0, Q) − f (a)) − C (Q)} .

a,Q

But then we can apply the same reasoning as above to conclude that the firm could profitably deviate

to the linear contract Ωε (R) for ε small enough.

Suppose instead limR→R∗+ Ω∗R (R) < limR→R∗− Ω∗R (R). This implies Q∗ = 0, otherwise we must

have

0 ≤

<

lim {N RQ (a∗ , s (a∗ ) , q ∗ , Q) (1 − Ω∗R (R (a∗ , s (a∗ ) , q ∗ , Q))) − CQ (Q)}

Q→Q∗−

lim {N RQ (a∗ , s (a∗ ) , q ∗ , Q) (1 − Ω∗R (R (a∗ , s (a∗ ) , q ∗ , Q))) − CQ (Q)} ,

Q→Q∗+

so setting Q slightly above Q∗ would violate

Q∗ = arg max {N (R (a∗ , s (a∗ ) , q ∗ , Q) − Ω (R (a∗ , s (a∗ ) , q ∗ , Q))) − C (Q)} .

Q

If action a is not price, then f 6= 0 and N R (a, s (a) , q ∗ , Q∗ ) is strictly increasing in a by assumption

(a3), so that the exact same reasoning applies to a∗ and leads to a∗ = 0. This would mean that

ΠE ∗ = R (0, s (0) , q ∗ , 0) − c (q ∗ ) = max {R (0, s (0) , q, 0) − c (q)} .

q

We have already proven above that this cannot be optimal.

If action a is price, then f = 0 and

ΠE ∗ = R (a∗ , s (a∗ ) , q ∗ , 0) − c (q ∗ ) ≤ max {R (a, s (a) , q, 0) − c (q)} .

a,q

e ε (R)

In this case, we have proven above that the firm could do strictly better with the linear contract Ω

for ε small enough.

We conclude that Ω∗ (.) must be continuous and differentiable at R∗ .

2

Linear example

Consider first the E -mode. The payoff to agent i from working for the firm is

1

1

(1 − t) Ri − qi2 − T = (1 − t) (βai + x (a−i − ai ) + φqi + ΦQ) − qi2 − T,

2

2

4

which implies that the level of effort chosen by each agent in the second stage is

q E (t) = φ (1 − t) .

In E -mode, the firm sets a1 , ..., aN and Q to maximize its second stage revenues (wages are paid in

the first stage):

N X

1

1 2

t (βai + x (a−i − ai ) + φqi + ΦQ) − ai − Q2 ,

2

2

i=1

implying the firm’s optimal choices are

aE (t) = βt

QE (t) = N Φt.

The fixed fee T is set to render each agent indifferent between working for the firm and her outside

option, so the expression of E -mode profits as a function of t is

N

2

β 2 + N Φ2 t (2 − t) + φ2 1 − t2 .

(3)

Maximizing (3) with respect to t implies the optimal variable fee in E -mode is

tE ∗ =

β 2 + N Φ2

,

β 2 + φ2 + N Φ2

which is positive but smaller than 1. With this optimal fee, the resulting profits in E -mode are

N

ΠE ∗ =

2

φ4

β + NΦ + 2

β + φ2 + N Φ2

2

2

.

Consider next the A-mode. The payoff to an individual agent joining the firm is

1

1

(1 − t) (βai + x (a−i − ai ) + φqi + ΦQ) − a2i − qi2 − T.

2

2

Individual agents maximize their second stage payoff by choosing

q A (t) = φ (1 − t)

aA (t) = (β − x) (1 − t) .

5

(4)

The firm’s second stage profits in A-mode are

N

X

i=1

1

t (βai + x (a−i − ai ) + φqi + ΦQ) − Q2 ,

2

which the firm maximizes over Q, leading to

QA (t) = N Φt.

Stepping back to the first stage, the firm sets T to equalize the agents’ net payoff to their outside

option. Total firm profit in A-mode as a function of t is then

N

(β − x) (1 − t) (β + x + (β − x) t) + φ2 1 − t2 + N Φ2 t (2 − t) .

2

(5)

The optimal variable fee is

tA∗ =

N Φ2 − x (β − x)

.

(β − x)2 + φ2 + N Φ2

Resulting profits in A-mode are

ΠA∗

N

=

2

β 2 − x2 + φ2 +

N Φ2 − x (β − x)

2 !

(β − x)2 + φ2 + N Φ2

.

(6)

Comparing (4) with (6), the A-mode is preferred if and only if

2

φ +

N Φ2 − x (β − x)

2

(β − x)2 + φ2 + N Φ2

> N Φ2 + x2 +

φ4

.

β 2 + φ2 + N Φ2

If there are no spillovers, i.e. x = 0, then this condition simplifies to

φ2 > N Φ2 .

For x 6= 0, the condition can be re-written

2

φ x

p

2

2

2

2

2

2

4

+

β

+

N

Φ

β

≤ β (β + φ + N Φ ) + φ .

(7)

Finally, let us determine the effects of φ and Φ on the tradeoff between the two modes. To do so,

6

we apply the envelope theorem to expressions (3) and (5) and obtain

dΠE ∗

d (φ2 )

dΠA∗

d (φ2 )

=

=

2 dΠE ∗

N

N E∗ E∗

and

1 − tE ∗

=

t

2

−

t

2

d (N Φ2 )

2

A∗

2

N

N

dΠ

1 − tA∗

= tA∗ 2 − tA∗ .

and

2

2

d (N Φ )

2

Since 0 < tE ∗ , tA∗ < 1 and t (2 − t) is increasing in t for t ∈ [0, 1], we conclude that

3

d ΠA∗ − ΠE ∗

d (φ2 )

d ΠE ∗ − ΠA∗

d (N Φ2 )

> 0 if and only if tE ∗ > tA∗

> 0 if and only if tE ∗ > tA∗ .

Linear example: endogenous price and production costs

We now extend the linear example by allowing the firm to also set a price in the contracting stage,

along with the fees (t, T ), and by also adding a production cost. We will establish the result stated at

the end of Section 7 in the main paper, i.e. that Proposition 5 continues to hold in this case.

The revenue generated by agent i is now

R (p, ai , qi , Q) = (p − d) (D0 + βai + x (a−i − ai ) + φqi + ΦQ − p) ,

where d ≥ 0 is a constant marginal production cost, p is the price chosen by the firm and D0 is some

baseline level of demand. Fixed costs are still quadratic

1

f (a) = a2 ,

2

1

c (q) = q 2

2

1

and C (Q) = Q2 .

2

First, we show that whether the production cost is incurred by the firm or the agent does not

affect profits in either mode. In E -mode, if the firm incurs the production cost, then the maximization

7

problem is

1

eE∗ =

Π

max

p,t,a,q,Q

1 2

1 2 1 2

N (p − d) (D0 + βa + φq + ΦQ − p) − a − q − Q

2

2

2

s.t.

(tp − d) β = a

(1 − t) φp = q

(tp − d) N Φ = Q.

If instead the agent incurs the production cost, then the maximization problem is

eE∗ =

Π

max

p,e

t,a,q,Q

s.t.

1 2

1 2 1 2

N (p − d) (D0 + βa + φq + ΦQ − p) − a − q − Q

2

2

2

e

tpβ = a

1−e

t p−d φ=q

e

tpN Φ = Q.

By making the change of variables e

t ≡ t − dp , the second maximization problem becomes the same as

the first.

Similarly, in A-mode, if the firm incurs the production cost, then the maximization problem is

e A∗

Π

=

max

p,t,a,q,Q

1 2 1 2

1 2

N (p − d) (D0 + βa + φq + ΦQ − p) − a − q − Q

2

2

2

s.t.

(1 − t) p (β − x) = a

(1 − t) pφ = q

(tp − d) N Φ = Q.

1

Given symmetry across the N agents and the formulation of spillovers in this example, they have no impact on the

optimization problem in E -mode and only affect the first-order condition in a in A-mode. Furthermore, the analysis that

follows would be identical if we allowed for spillovers across the choices of prices. These spillovers would have no impact

on the resulting tradeoff because they are internalized in both modes by the firm when it sets prices in the contracting

stage.

8

If instead the agent incurs the production cost, then the maximization problem is

e A∗ =

Π

max

p,e

t,a,q,Q

1 2 1 2

1 2

N (p − d) (D0 + βa + φq + ΦQ − p) − a − q − Q

2

2

2

s.t.

1−e

t p − d (β − x) = a

1−e

t p−d φ=q

e

tpN Φ = Q.

Again, by making the change of variables e

t = t − dp , the second maximization problem becomes the

same as the first. Thus, in our setting it is irrelevant which party actually incurs the production cost.

Solving the program above in E -mode, we obtain

β 2 + N Φ2

φ2

E

∗

e

Π = N max (p − d) (D0 − p) +

(tp − d) ((2 − t) p − d) + p (1 − t) (p (1 + t) − 2d) .

p,t

2

2

Holding p fixed and optimizing over t, we obtain

2 + N Φ2 p + φ2 d

β

tE ∗ (p) =

.

(β 2 + N Φ2 + φ2 ) p

e E ∗ , the program becomes

Substituting this back into Π

n

o

e E ∗ = max N (p − d) (D0 − p) + (p − d)2 ΠE ∗ ,

Π

p

where ΠE ∗ is given by (4). Similarly, solving the program above in A-mode, we have

e A∗ = N max

Π

p,t

(p − d) (D0 − p) +

N Φ2

2

(tp − d) ((2 − t) p − d)

+ φ2 p (1 − t) ((1 + t) p − 2d) + 1 (1 − t) p (β − x) ((β + x + (β − x) t) p − 2βd)

2

2

Holding p fixed and optimizing over t, we obtain

tA∗ (p) =

N Φ2 p + φ2 d + (β − x) (βd − xp)

N Φ2 + φ2 + (β − x)2 p

e A∗ , the program becomes (after straightforward calculations)

Substituting this back into Π

n

o

e A∗ = max (p − d) (D0 − p) + (p − d)2 ΠA∗ ,

Π

p

9

.

where ΠA∗ is given by (6).

e A∗ and Π

e E ∗ , we can conclude that

Comparing the last expressions of Π

2

φ x

p

A∗

E

∗

A∗

E

∗

2

2

e

e

Π > Π ⇐⇒ Π > Π ⇐⇒ + β + N Φ ≤ β 2 (β 2 + φ2 + N Φ2 ) + φ4 ,

β

so the introduction of p and d does not affect the trade-off determined in Proposition 5 in the main

paper.

4

Robustness of Corollary 1 to spillovers

Corollary 1 in Section 4.3 of the main paper implies that if t∗ < 1/2 then the A-mode is optimal and

if t∗ > 1/2 then the E -mode is optimal. We wish to investigate the extent to which this prediction

still holds for the linear demand example once we add spillovers.

Using the linear demand example with spillovers from Section 7 in the main paper, for any set

of parameter values, we can calculate the optimal choice of model and the t∗ corresponding to the

optimal mode.

The following parameters need to be specified: β, N Φ2 , φ2 , x. We normalize β = 1 throughout.

We proceed in two steps:

• For a given value of N Φ2 , build the set of values of φ2 such that tE ∗ varies from 0.01 to 0.99 in

0.01 intervals (recall that tE ∗ does not depend on x), and the set of values of x from −0.99 to

0.33 in 0.01 intervals (this is the range of spillovers such that the cross-effect of the transferable

action is less than half as important in magnitude as the own effect of the transferable action).2

• Repeat the previous step for a range of different N Φ2 as reported in Table 1 below. For each

value of N Φ2 , record the average values of tE ∗ and tA∗ across all 13, 167 observations of φ2 , x

defined in the previous step and the fraction of these observations for which the prediction of

Corollary 1 is true.

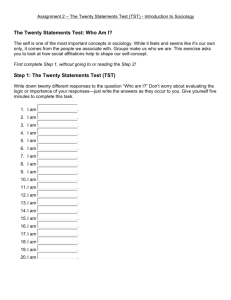

Table 1

2

Given that the own effect is β − x, the cross-effect is x and β = 1, this condition requires x < 21 (1 − x) for x > 0 and

|x| < 21 (1 + |x|) for x < 0, which is equivalent to −1 < x < 31 .

10

N Φ2

0.5

1

2

5

10

100

tA∗

0.213

0.238

0.257

0.273

0.280

0.286

tE ∗

0.883

0.848

0.818

0.793

0.782

0.771

% of obs. theory true

99.2%

98.2%

96.6%

94.3%

93.1%

92.1%

The higher the percentage of observations for which the prediction of Corollary 1 is true, the more

confident we can be in using the observed commissions received by agents (or variable fees charged to

agents) to infer which mode the firm operates in. Specifically, if we observe that agents receive more

than 50% of variable revenues, then the firm is most likely to be using A-mode; if we observe that

agents receive less than 50% of variable revenues, then the firm is most likely using the E -mode. The

values in Table 1 make it clear that this inference is remarkably accurate for low values of Φ2 .

5

Example with price as transferable decision and linear demand

Recall the revenue function

Ri pi , p−i , qi , Q = pi d + βpi + x p−i − pi + φqi + ΦQ

and the assumptions made on parameters in the main paper:

β < 0, φ > 0, Φ > 0

−2β + min {0, 2x} > max N Φ2 , φ2 .

The fixed costs of agents’ effort and firm’s investment are quadratic:

1

1

c (q) = q 2 , C (Q) = Q2 .

2

2

In E -mode, the payoff to agent i from working for the firm is

1

1

(1 − t) Ri pi , p−i , qi , Q − qi2 − T = (1 − t) pi d + βpi + x p−i − pi + φqi + ΦQ − qi2 − T,

2

2

which the agent optimizes over qi in the second stage (the fixed fee T is then taken as fixed).

The firm’s payoff in the second stage is

N

X

i=1

1

tpi d + βpi + x p−i − pi + φqi + ΦQ − Q2 ,

2

11

(8)

which the firm optimizes over pi and Q.

Evaluating the corresponding first-order conditions at the symmetric equilibrium, we have

−2βpE = d + φq E + ΦQE

q E = (1 − t) φpE

QE = tN ΦpE .

Solving, we obtain

pE (t) =

q E (t) =

QE (t) =

d

−2β−(1−t)φ2 −tN Φ2

d(1−t)φ

−2β−(1−t)φ2 −tN Φ2

dtN Φ

.

−2β−(1−t)φ2 −tN Φ2

Note that assumptions (8) ensure pE (t) > 0, q E (t) > 0 and QE (t) > 0.

The fixed fee T is just a transfer that renders each agent indifferent between working for the firm

and their outside option, so the firm’s profit is

1

1

ΠE (t) = N pE (t) d + βpE (t) + φq E (t) + ΦQE (t) − N q E (t)2 − QE (t)2 .

2

2

Plugging in the expressions of pE (t), q E (t) and QE (t) above, we obtain:

ΠE (t) = max

t

N d2 −2β − (1 − t)2 φ2 − t2 N Φ2

2 (−2β − (1 − t) φ2 − tN Φ2 )2

.

In A-mode, agent i joining the firm chooses (pi , qi ) to maximize his second stage payoff

1

(1 − t) pi d + βpi + x p−i − pi + φqi + ΦQ − qi2 ,

2

while the firm chooses Q to maximize its second stage revenues

N

X

i=1

1

tpi d + βpi + x p−i − pi + φqi + ΦQ − Q2 .

2

Evaluating the corresponding first-order conditions at the symmetric equilibrium, we have

(−2β + x) pA = d + φq A + ΦQA

q A = (1 − t) φpA

QA = tN ΦpA .

12

(9)

Solving, we obtain:

pA (t) =

q A (t) =

QA (t) =

d

−2β+x−(1−t)φ2 −tN Φ2

d(1−t)φ

−2β+x−(1−t)φ2 −tN Φ2

dtN Φ

.

−2β+x−(1−t)φ2 −tN Φ2

Assumptions (8) ensure pA (t) > 0, q A (t) > 0 and QA (t) > 0.

The fixed fee T renders each agent indifferent between joining the firm and his outside option, so

the firm’s profit in A-mode is

1

1

ΠA (t) = N pA (t) d + βpA (t) + φq A (t) + ΦQA (t) − N q A (t)2 − QA (t)2 .

2

2

Plugging in the expressions of pA (t), q A (t) and QA (t) above, we obtain:

ΠA (t) = max

t

N d2 2 (−β + x) − (1 − t)2 φ2 − t2 N Φ2

2 (−2β + x − (1 − t) φ2 − tN Φ2 )2

.

(10)

Comparing expressions (9) and (10), ΠE (t) is obtained from ΠA (t) simply by setting x = 0.

Therefore, we will focus on maximizing ΠA (t), from which we can easily derive the maximization of

ΠE (t).

The first-order derivative of ΠA (t) in t is proportional to (with a strictly positive multiplying

factor)

N Φ2 (−2β + 2x) − φ2 x − N Φ2 φ2 − t

N Φ2 + φ2 (−2β + x) − 2N Φ2 φ2 .

Since N Φ2 + φ2 (−2β + x)−2N Φ2 φ2 > 0 under assumptions (8), we obtain that the optimal variable

fee under the A-mode is

tA∗ =

0

if N Φ2 (−2β + 2x) − φ2 x − N Φ2 φ2 ≤ 0

N Φ2 (−2β+2x)−φ2 x−N Φ2 φ2

(N Φ2 +φ2 )(−2β+x)−2N Φ2 φ2

if 0 ≤ N Φ2 (−2β + 2x) − φ2 x − N Φ2 φ2

≤ N Φ2 + φ2 (−2β + x) − 2N Φ2 φ2

1

if N Φ2 (−2β + 2x) − φ2 x − N Φ2 φ2

≥ N Φ2 + φ2 (−2β + x) − 2N Φ2 φ2 .

13

Rewriting the conditions:

tA∗ =

0

N Φ2 (−2β+2x)−φ2 x−N Φ2 φ2

(N Φ2 +φ2 )(−2β+x)−2N Φ2 φ2

1

if x φ2 − 2N Φ2 ≥ N Φ2 −2β − φ2

if x φ2 − 2N Φ2 ≤ N Φ2 −2β − φ2

and x N Φ2 − 2φ2 ≤ φ2 −2β − N Φ2

if x N Φ2 − 2φ2 ≥ φ2 −2β − N Φ2 .

Suppose x is such that 0 < tA∗ < 1. Then the first-order condition of ΠA (t) in t evaluated at tA∗

implies:

1−t

A∗

A∗ φ2

A∗ 2 φ2

−2β

+

x

−

1

−

t

2

(−β

+

x)

−

1

−

t

= φ2 − N Φ2

,

φ2 − tA∗ N Φ2

2

A∗

2

−t N Φ

− tA∗ N Φ2

from which we can deduce:

ΠA =

=

=

Plugging tA∗ =

Π

A∗

2

2

N d2 2 (−β + x) − 1 − tA∗ φ2 − tA∗ N Φ2

2 (−2β + x − (1 − tA∗ ) φ2 − tA∗ N Φ2 )2

N d2 1 − tA∗ φ2 − tA∗ N Φ2

2 (φ2 − N Φ2 ) (−2β + x − (1 − tA∗ ) φ2 − tA∗ N Φ2 )

φ2 − tA∗ N Φ2 + φ2

N d2

.

2 (φ2 − N Φ2 ) −2β + x − φ2 + tA∗ (φ2 − N Φ2 )

N Φ2 (−2β+2x)−φ2 x−N Φ2 φ2

(N Φ2 +φ2 )(−2β+x)−2N Φ2 φ2

into the last expression, we obtain

(−2β + 2x) N Φ2 + φ2 − N Φ2 φ2

N d2

=

.

2 (N Φ2 + φ2 ) (−2β − N Φ2 + x) (−2β − φ2 + x) − x (N Φ2 − φ2 )2

From here, we can set x = 0 to obtain

tE ∗

=

ΠE ∗ =

−2β − φ2 N Φ2

∈ (0, 1)

−2β (N Φ2 + φ2 ) − 2N Φ2 φ2

−2β N Φ2 + φ2 − N Φ2 φ2

N d2

.

2 (N Φ2 + φ2 ) (−2β − N Φ2 ) (−2β − φ2 )

14

The complete characterization of profits in A-mode is:

ΠA∗ =

N d2 2(−β+x)−φ2

2 (−2β+x−φ2 )2

(−2β+2x)(N Φ2 +φ2 )−N Φ2 φ2

N d2

2 (N Φ2 +φ2 )(−2β−N Φ2 +x)(−2β−φ2 +x)−x(N Φ2 −φ2 )2

N d2 2(−β+x)−N Φ2

2 (−2β+x−N Φ2 )2

if x φ2 − 2N Φ2 ≥ N Φ2 −2β − φ2

if x φ2 − 2N Φ2 ≤ N Φ2 −2β − φ2

and x N Φ2 − 2φ2 ≤ φ2 −2β − N Φ2

if x N Φ2 − 2φ2 ≥ φ2 −2β − N Φ2 .

Suppose x φ2 − 2N Φ2 ≤ N Φ2 −2β − φ2 and x N Φ2 − 2φ2 ≤ φ2 −2β − N Φ2 , so that 0 <

tA∗ < 1. We have ΠA > ΠE if and only if

−2β N Φ2 + φ2 − N Φ2 φ2

>

,

(N Φ2 + φ2 ) (−2β − N Φ2 ) (−2β − φ2 )

(N Φ2 + φ2 ) (−2β − N Φ2 + x) (−2β − φ2 + x) − x (N Φ2 − φ2 )2

(−2β + 2x) N Φ2 + φ2 − N Φ2 φ2

which is equivalent to

>

(−2β + 2x) N Φ2 + φ2 − N Φ2 φ2 N Φ2 + φ2 −2β − N Φ2 −2β − φ2

2 −2β N Φ2 + φ2 − N Φ2 φ2

N Φ2 + φ2 −2β − N Φ2 + x −2β − φ2 + x − x N Φ2 − φ2

.

Recall the two sides are equal for x = 0, therefore we can eliminate all terms that are not factored by

x or x2 , so the inequality reduces to

2x N Φ2 + φ2

>

2

−2β − N Φ2 −2β − φ2

2

2 2

2

2

2

2

2

2

2

2

2

2 2

.

−x N Φ − φ

+ x NΦ + φ

−4β − N Φ + φ

+ x NΦ + φ

−2β N Φ + φ − N Φ φ

Rearranging, this can be rewritten

0 > −x

+x2

−2β

N Φ2

+

φ2

−

N Φ2 φ2

φ4

N Φ2

+

+ 4β

+2 N Φ2 + φ

−2β − N Φ2 −2β − φ2

−2β N Φ2 + φ2 − N Φ2 φ2 N Φ2 + φ2 .

2 2

2

N 2 Φ4

+

φ2

+

Simplifying, this leads to

0 > −2xN Φ2 φ2 2β N Φ2 + φ2 + 2N Φ2 φ2 + x2 −2β N Φ2 + φ2 − N Φ2 φ2 N Φ2 + φ2 ,

15

from which we conclude

!

2N Φ2 φ2 −2β N Φ2 + φ2 − 2N Φ2 φ2

+ x < 0.

(−2β (N Φ2 + φ2 ) − N Φ2 φ2 ) (N Φ2 + φ2 )

ΠA∗ > ΠE ∗ ⇐⇒ x

Both the numerator and the denominator of the large fraction are positive under assumptions (8).

We conclude that when 0 < tA∗ < 1:

Π

A∗

2N Φ2 φ2 −2β N Φ2 + φ2 − 2N Φ2 φ2

<x<0

ΠE ∗ ⇐⇒ −

(−2β (N Φ2 + φ2 ) − N Φ2 φ2 ) (N Φ2 + φ2 )

>

⇐⇒ −

2 φ2

4 NNΦΦ2 +φ

β+

2

2β +

N Φ2 φ2

N Φ2 +φ2

N Φ2 φ2

N Φ2 +φ2

<x<0

It remains to consider the cases x φ2 − 2N Φ2 ≥ N Φ2 −2β − φ2 (in which tA∗ = 0) and

x N Φ2 − 2φ2 ≥ φ2 −2β − N Φ2 (in which tA∗ = 1). It is easier to consider the following three

cases in turn.

Case I: φ2 > 2N Φ2 .

In this case, it is easily verified that assumptions (8) imply x N Φ2 − 2φ2 ≤ φ2 −2β − N Φ2 .

Therefore we have:

ΠA∗ =

N d2 2(−β+x)−φ2

2 (−2β+x−φ2 )2

(−2β+2x)(N Φ2 +φ2 )−N Φ2 φ2

N d2

2 (N Φ2 +φ2 )(−2β−N Φ2 +x)(−2β−φ2 +x)−x(N Φ2 −φ2 )2

The expression

2(−β+x)−φ2

(−2β+x−φ2 )2

N Φ2 (−2β−φ2 )

if x ≥ φ2 −2N Φ2

N Φ2 (−2β−φ2 )

−2β−max{φ2 ,N Φ2 }

if φ2 −2N Φ2 ≥ x ≥ −

.

2

is increasing in x for x ≤ 0 and decreasing in x for x ≥ 0, therefore

the maximum value attained by ΠA when x ≥

N Φ2 (−2β−φ2 )

φ2 −2N Φ2

is precisely when x =

N Φ2 (−2β−φ2 )

.

φ2 −2N Φ2

That

value is:

Π

A∗

N Φ2 −2β − φ2

x=

φ2 − 2N Φ2

!

=

<

φ2 φ2 − 2N Φ2

N d2

2 (−2β − φ2 ) (φ2 − N Φ2 )2

(−2β) N Φ2 + φ2 − N Φ2 φ2

N d2

= ΠE ∗ ,

2 (N Φ2 + φ2 ) (−2β − N Φ2 ) (−2β − φ2 )

where the inequality is straightforward to verify under assumptions (8). Thus, ΠE ∗ dominates ΠA∗

N Φ2 (−2β−φ2 )

for all x ≥ φ2 −2N Φ2 . Combining with the result above, we conclude that ΠE ∗ dominates ΠA∗ for

16

4

all x ≥ 0 and x ≤ −

N Φ2 φ2

N Φ2 +φ2

N Φ 2 φ2

N Φ2 +φ2

2 2

2β+ N Φ2 φ 2

N Φ +φ

β+

−

, whereas ΠA∗ dominates ΠE ∗ for all permissible x such that

2 φ2

4 NNΦΦ2 +φ

β+

2

2β +

N Φ2 φ2

N Φ2 +φ2

N Φ2 φ2

N Φ2 +φ2

≤ x ≤ 0.

Case II: N Φ2 > 2φ2 .

In this case, it is easily verified that assumptions (8) imply x φ2 − 2N Φ2 ≤ N Φ2 −2β − φ2 .

Therefore we have:

ΠA∗ =

φ2 (−2β−N Φ2 )

if x ≥ N Φ2 −2φ2

φ2 (−2β−N Φ2 )

−2β−max{φ2 ,N Φ2 }

.

if N Φ2 −2φ2 ≥ x ≥ −

2

N d2 2(−β+x)−N Φ2

2 (−2β+x−N Φ2 )2

(−2β+2x)(N Φ2 +φ2 )−N Φ2 φ2

N d2

2 (N Φ2 +φ2 )(−2β−N Φ2 +x)(−2β−φ2 +x)−x(N Φ2 −φ2 )2

The analysis is exactly the same as in Case I above (by symmetry in φ2 and N Φ2 ), therefore the

conclusion is exactly the same for this case as well.

Case III: φ2 ≤ 2N Φ2 and N Φ2 ≤ 2φ2 .

In this case, it is easily verified that assumptions (8) imply x N Φ2 − 2φ2 ≤ φ2 −2β − N Φ2 and

x φ2 − 2N Φ2 ≤ N Φ2 −2β − φ2 for all permissible x. Therefore we have:

Π

A∗

(−2β + 2x) N Φ2 + φ2 − N Φ2 φ2

N d2

=

2 (N Φ2 + φ2 ) (−2β − N Φ2 + x) (−2β − φ2 + x) − x (N Φ2 − φ2 )2

for all permissible x, so we already know that

ΠA∗ > ΠE ∗ ⇐⇒ −

2 φ2

β+

4 NNΦΦ2 +φ

2

2β +

6

N Φ2 φ2

N Φ2 +φ2

N Φ2 φ2

N Φ2 +φ2

< x < 0.

Cost asymmetries

Consider the linear example

R (ai , a−i , qi , Q) = βai + x (a−i − ai ) + φqi + ΦQ

and allow for different costs of the transferable action in the two modes:

F (a) =

F 2

f

1

a , f (a) = a2 , c (q) = q 2

2

2

2

17

1

and C (Q) = Q2 .

2

Let then3

β

βE ≡ √

F

β

and βA ≡ √ .

f

Straightforward calculations lead to

ΠE ∗

tE ∗

N

βE2 + N Φ2 t (2 − t) + φ2 1 − t2

= max

t

2

2

βE + N Φ2

=

βE2 + N Φ2 + φ2

and

Π

A∗

tA∗

N

= max

(βA − x) (1 − t) (βA + x + (βA − x) t) + φ2 1 − t2 + N Φ2 t (2 − t)

t

2

2

N Φ − x (βA − x)

=

.

(βA − x)2 + φ2 + N Φ2

Using the envelope theorem, it is then easily seen that

dΠE ∗

dΠA∗

< 0 and

< 0,

dF

df

so the respective costs of choosing the transferable action have the expected effect on the tradeoff.

7

Hybrid mode across agents

Suppose the firm functions in E -mode with respect to agents i ∈ {1, .., n} and in A-mode with respect

to agents i ∈ {n + 1, .., N }, where n ≤ N . Thus, the firm offers contract tE , T E to the n agents

that work in E -mode (employees) and contract tA , T A to the N − n agents that work in A-mode

(independent contractors). The n employees each choose a level of effort equal to 1 − tE φ, whereas

the N − n independent contractors each choose a level of effort equal to 1 − tA φ and a level of

the transferable activity equal to 1 − tA β. For the n employees, the firm chooses a level of the

transferable action equal to tE β. Finally, the level Q tE , tA chosen by the firm is Q tE , tA = tN Φ,

where

t≡

n E N −n A

t +

t

N

N

is the “average” transaction fee collected by the firm.

The fixed fees for employees and independent contractors are set to render both indifferent between

3

We could also allow for the impact β of the transferable action on revenue to differ depending on mode: βE and βA .

This would have the exact same effect as the difference in cost.

18

working for/through the firm and their outside option. Consequently, the total profit of the firm is

ΠH

2

E 2 φ2

A 2 φ2

A 2 β2

E

E

1

−

t

1

−

t

1

−

t

t 2−t β

+ (N − n)

tE , tA , n

= n

+

+

2

2

2

2

t 2 − t N 2 Φ2

+

.

2

Optimizing over the three variables tE , tA , n yields the following first-order conditions (assuming

interior solution in all three variables):

β 2 + N Φ2 − β 2 + φ2 + nΦ2 tE − (N − n) Φ2 tA = 0

N Φ2 − nΦ2 tE − β 2 + φ2 + (N − n) Φ2 tA = 0

β 2 tE 2 − tE − 1 + tA 2 + φ2 tA 2 − tE 2 + N Φ2 1 − t tE − tA = 0.

2

2

Solving the first two first-order conditions above for tE , tA as functions of n, we obtain:

tE =

tA =

(β 2 +N Φ2 )(β 2 +φ2 )+(N −n)Φ2 β 2

(β 2 +φ2 )(β 2 +φ2 +N Φ2 )

(N −n)Φ2 β 2 +N Φ2 φ2

.

(β 2 +φ2 )(β 2 +φ2 +N Φ2 )

This implies:

2

tE − tA = β 2β+φ2

−n)β 2 +N φ2

N 1 − t = (N

.

2

β +φ2 +N Φ2

We can now plug these expressions in the third first-order condition above, which becomes:

2 φ2

2 2

β2 E +

t 2 − tE − 1 + tA

+

tA − tE

2

2

β 2 + φ2 β 2 β2 E

E + tA +

2t − 1 −

t

2

2

β 2 + φ2

1 E

t − tA − 1 +

2

φ2

−

+

2 (β 2 + φ2 )

β 2 Φ2 (N − n) β 2 + N φ2

β 2 + φ2 β 2 + φ2 + N Φ2

β 2 Φ2 (N − n) β 2 + N φ2

β 2 + φ2 β 2 + φ2 + N Φ2

Φ2 (N − n) β 2 + N φ2

β 2 + φ2 β 2 + φ2 + N Φ2

Φ2 (N − n) β 2 + N φ2

β 2 + φ2 β 2 + φ2 + N Φ2

= 0

= 0

= 0

= 0.

The last expression is decreasing in n, which means the second-order condition is satisfied.

Solving for n yields

∗

n =N

φ2 β 2 + φ2 − N Φ2

1−

2N Φ2 β 2

19

!

.

This solution is valid if and only if

0 < φ2 β 2 + φ2 − N Φ2 < 2N Φ2 β 2 ,

i.e. if and only if

β 2 + φ2 > N Φ2 > φ2 −

β 2 φ2

.

2β 2 + φ2

If N Φ2 > β 2 + φ2 then n∗ = N (pure E -mode is optimal) and if N Φ2 < φ2 −

(pure A-mode is optimal). Note that φ2 −

8

β 2 φ2

2β 2 +φ2

β 2 φ2

2β 2 +φ2

then n∗ = 0

is increasing in φ2 .

Private benefits

Revenue generated by each agent is R (ai , qi , Q). For all i ∈ {1, .., N }, the firm derives private benefits

B (ai ), whereas agent i derives private benefits b (ai ). We can state a variant of Proposition 3 in the

main paper.

Proposition 1 Suppose R (ai , qi , Q) is supermodular in its arguments, B (ai ) = Bai and b (ai ) = bai ,

where B and b are positive constants. Then: (i) if B > b and tA∗ ≥ 1/2, then ΠE ∗ > ΠA∗ ; (ii) if

b > B and tE ∗ ≤ 1/2, then ΠA∗ > ΠE ∗ .

Proof. For any (τ1 , τ2 , τ3 , τ4 ) ∈ [0, 1]4 , let

Π (τ1 , τ2 , τ3 , τ4 ) ≡ N (R (a, q, Q) + (B + b) a − f (a) − c (q)) − C (Q) ,

where (a, q, Q) is the unique solution to the three equations

τ1 Ra (a, q, Q) + τ2 (B + b) = fa (a)

τ3 Rq (a, q, Q) = cq (q)

τ4 N RQ (a, q, Q) = CQ (Q) .

We first prove two preliminary lemmas.

Lemma 1 For all i ∈ {1, 2, 3, 4}, the solution (a, q, Q) to (11) is strictly increasing in τi .

20

(11)

Proof. Note that the solution (a, q, Q) corresponds to a game in which there are three players, which

seek to maximize respectively

f 1 (a) ≡ N (τ1 R (a, q, Q) + τ2 (B + b) a − f (a))

f 2 (q) ≡ N (τ3 R (a, q, Q) − c (q))

f 3 (Q) ≡ τ4 N R (a, q, Q) − C (Q) .

Since R is supermodular, it is easily seen that the game is supermodular with payoffs having strictly

increasing differences in the actions (a, q, Q) and the parameters (τ1 , τ2 , τ3 , τ4 ). From standard supermodularity results4 , we know that an increase in any of the parameters (τ1 , τ2 , τ3 , τ4 ) will increase each

of the solutions (a, q, Q) in a weak sense. To obtain the strict comparative static result, note that the

solution is defined by the set of equations defined in (11). This means that if τi increases for some

i ∈ {1, 2, 3, 4} and a, q or Q does not strictly increase, then neither a, q and Q can change since none

can decrease. But if (a, q, Q) all remain unchanged, then, since τi is higher, the first-order conditions

(11) can no longer hold. Thus, at least one among (a, q, Q) must strictly increase.

Lemma 2 When (τ1 , τ2 , τ3 , τ4 ) ∈ [0, 1)4 , the payoff function Π (τ1 , τ2 , τ3 , τ4 ) is strictly increasing in τi

for all i ∈ {1, 2, 3, 4}.

Proof. We have

dΠ

dτ1

= N (Ra (a, q, Q) + B + b − fa (a))

da

dτ1

dq

dQ

+ (N RQ (a, q, Q) − CQ (Q))

dτ1

dτ1

da

= N ((1 − τ1 ) Ra (a, q, Q) + (1 − τ2 ) (B + b))

dτ1

dQ

dq

+N (1 − τ3 ) Rq (a, q, Q)

+ N (1 − τ3 ) RQ (a, q, Q)

,

dτ1

dτ1

+N (Rq (a, q, Q) − cq (q))

where we have used (11) to replace fa (a), cq (q) and CQ (Q). By assumption, Ra > 0, Rq > 0 and

RQ > 0, and from Lemma 1, we know that

da

dτ1

≥ 0,

dΠ

dτ1 > 0 when

dΠ

that dτ

> 0 for i

i

inequality. Thus, we can conclude that

A very similar reasoning proves

dq

dτ1

≥ 0 and

dQ

dτ1

≥ 0, with at least one strict

(τ1 , τ2 , τ3 , τ4 ) ∈ [0, 1)4 .

= 2, 3, 4 when (τ1 , τ2 , τ3 , τ4 ) ∈ [0, 1)4 .

We can now use these lemmas to prove Proposition 1.

Suppose b > B and tE ∗ ≤ 1/2. Then the firm could strictly improve on E -mode profits ΠE ∗ by

giving up control over each transferable action ai to agent i and keeping the variable fee unchanged,

4

See, for instance, X. Vives (1999), Oligopoly Pricing: Old Ideas and New Tools, Cambridge, Mass.: MIT Press.

21

equal to tE ∗ . To see this, note that the change in profits is

Π

1 − tE ∗ ,

b

, 1 − tE ∗ , tE ∗

B+b

−Π

tE ∗ ,

B

E

∗ E∗

,1 − t ,t

.

B+b

If tE ∗ > 0, then this difference is positive by Lemma 2, because 0 < tE ∗ < 1/2 and b > B imply

B

b

B

, 1 − tE ∗ , tE ∗ ∈ (0, 1)4 and 1 − tE ∗ , B+b

, 1 − tE ∗ , tE ∗ > tE ∗ , B+b

, 1 − tE ∗ , tE ∗ . If tE ∗ =

tE ∗ , B+b

0, then the change in profits is

B

b

, 1, 0 − Π 0,

, 1, 0

Π 1,

B+b

B+b

=

max {N (R (a, q, 0) + (B + b) a − f (a) − c (q))} s.t. Ra (a, q, Q) + b = fa (a)

a,q

− max {N (R (0, q, 0) − c (q))} ,

q

which is positive due to assumptions (a1)-(a4).

Thus, in all cases we have

ΠE ∗ = Π

tE ∗ ,

B

, 1 − tE ∗ , tE ∗

B+b

<Π

1 − tE ∗ ,

b

, 1 − tE ∗ , tE ∗

B+b

≤ ΠA∗ .

Similarly, denote by tA∗ the optimal transaction fee in E -mode and suppose tA∗ > 1/2 and B > b.

Then the firm could strictly improve on A-mode profits by taking control over the transferable actions

ai and keeping the variable fee unchanged, equal to tA∗ . To see this, note that the change in profits is

A∗

Π t

B

,

, 1 − tA∗ , tA∗

B+b

− Π 1 − tA∗ ,

b

A∗ A∗

,1 − t ,t

.

B+b

If tA∗ < 1, then this difference is positive by Lemma 2, because 1 > tA∗ > 1/2 and B > b implies

b

B

b

1 − tA∗ , B+b

, 1 − tA∗ , tA∗ ∈ (0, 1)4 and tA∗ , B+b

, 1 − tA∗ , tA∗ > 1 − tA∗ , B+b

, 1 − tA∗ , tA∗ . If

tA∗ = 1, then the change in profits is

B

b

Π 1,

, 0, 1 − Π 0,

, 0, 1

B+b

B+b

=

max {N (R (a, 0, Q) + (B + b) a − f (a)) − C (Q)} s.t. Ra (a, q, Q) + B = fa (a)

a,Q

− max {N R (0, 0, Q) − C (Q)} ,

Q

which is positive due to assumptions (a1)-(a4).

22

Thus, in all cases we have

Π

A∗

= Π 1 − tA∗ ,

b

, 1 − tA∗ , tA∗

B+b

< Π tA∗ ,

B

, 1 − tA∗ , tA∗

B+b

= ΠE ∗ .

The claim of Proposition 1 says that when the transferable action has a higher impact on the

firm’s private benefits relative to the agents’ private benefits, the firm would never find it profitable to

function in A-mode and charge variable fees above 50%. Similarly, when the transferable action has

a higher impact on the agents’ private benefits relative to the firm’s private benefits, the firm would

never find it profitable to function in E -mode and pay a bonus above 50%.

This can be re-stated in a more empirically useful way. To do so, define

tE ∗ if ΠE ∗ ≥ ΠA∗

t∗ ≡

tA∗ if ΠE ∗ < ΠA∗ ,

which is the optimal variable fee charged by the firm in the optimal mode. We obtain the following

variant of Corollary 1 in the main paper.

Corollary 1 Suppose R (a, q, Q) is supermodular in its arguments, B (a) = Ba and b (a) = ba, where

B and b are positive constants. If b > B and t∗ ≤ 1/2, then the A-mode is optimal. If B > b and

t∗ ≥ 1/2, then the E -mode is optimal.

Thus, if the agents obtain more than 50% of variable revenues and the agents’ private benefits are

more important, then the firm should be functioning in A-mode, and not in E -mode. This suggests

that, other things being equal, organizations that leave larger shares of revenues to agents and where

agents’ have larger private benefits are more likely to have chosen the A-mode (and vice versa for the

E -mode).

Note that with private benefits, the result requires that the party receiving more than 50% of variable revenue also has the more important private benefits. In Section 8.2, we will explore numerically

what happens when this is not necessarily true.

23

8.1

Linear revenue function and linear private benefits

Again, we resort to the example with linear revenue function and quadratic cost functions:

R (a, q, Q) = βa + φq + ΦQ

1

1

1 2

a , c (q) = q 2 , C (Q) = Q2 .

f (a) =

2

2

2

Private benefits are also assumed to be linear:

B (a) = Ba

and b (a) = ba,

where B, b > 0.

In E -mode, the firm solves

ΠE ∗

1 2 1 2

1 2

= max N (β + B + b) a + φq + ΦQ − a − q − Q

t,a,q,Q

2

2

2

subject to

tβ + B = a

(1 − t) φ = q

tN Φ = Q

Straightforward calculations yield

ΠE ∗

N

2

2

2

(tβ + B) ((2 − t) β + B + 2b) + N Φ t (2 − t) + φ 1 − t

= max

t

2

N

2 (β + B + b) (tβ + B) − (tβ + B)2 + N Φ2 t (2 − t) + φ2 1 − t2

,

= max

t

2

which leads to

tE ∗ =

ΠE ∗

=

β 2 + βb + N Φ2

β 2 + N Φ2 + φ2

N

2

2 !

β 2 + βb + N Φ2

2B (β + B + b) + φ − B +

β 2 + N Φ2 + φ2

2

24

2

In A-mode, the firm solves

A∗

Π

=

max

t,a,q,Q

N

1

1

(β + B + b) a + φq + ΦQ − a2 − q 2

2

2

1

− Q2

2

subject to

(1 − t) β + b = a

(1 − t) φ = q

tN Φ = Q

Straightforward calculations yield

Π

A∗

N

((1 − t) β + b) ((1 + t) β + 2B + b) + N Φ2 t (2 − t) + φ2 1 − t2

= max

t

2

N

2

2

2

2

2

,

(β + B + b) − (tβ + B) + N Φ t (2 − t) + φ 1 − t

= max

t

2

which leads to

tA∗ =

Π

A∗

=

N Φ2 − βB

β 2 + Φ 2 + φ2

N

2

2 !

N Φ2 − βB

(β + B + b) + φ − B + 2

β + N Φ2 + φ2

2

2

2

Comparing the two profits, the A-mode is preferred to the E -mode if and only if

8.2

(β + b)2 − B 2 φ2 > (β + B)2 − b2 N Φ2 .

Robustness of Corollary 1 to private benefits

In this section we explore the robustness of Corollary 1 to private benefits. That is, we explore the

extent to which knowing whether agents receive more or less than 50% of variable revenues still allows

us to correctly predict the choice of mode when there are private benefits.

Using the linear example with linear private benefits from Section 8.1, for any set of parameter

values, we can calculate the optimal choice of model and the t∗ corresponding to the optimal mode.

The following parameters need to be specified: β, N Φ2 , φ2 , b and B. We normalize β = 1 throughout.

We proceed in three steps:

• For a given value of N Φ2 , set b = B = 0 and build the set of values of φ2 such that tE ∗ varies

from 0.01 to 0.99 in increments of 0.01.

25

• For each value of φ2 in the set defined in the previous step, consider 100 equally spaced values

of b from 0 to φ2 and 100 equally spaced values of B from 0 to N Φ2 . This range of b and B

ensures that tE ∗ , tA∗ ∈ [0, 1]2 .

• Repeat the previous two steps for a range of different N Φ2 as reported in Table 2 below. For

each value of N Φ2 , record the average values of tE ∗ and tA∗ across all 990, 000 observations

of φ2 , b, B defined in the previous steps and the fraction of these observations for which the

prediction of Corollary 1 is true.

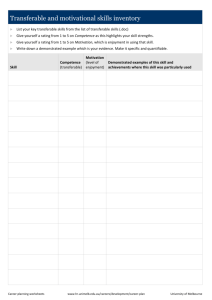

Table 2

N Φ2

0.5

1

2

5

10

100

tA∗

0.066

0.094

0.123

0.157

0.177

0.205

tE ∗

0.860

0.800

0.751

0.716

0.704

0.690

% of obs. theory true

100%

98.9%

96.0%

91.2%

88.5%

85.2%

The higher the percentage of observations for which the prediction of Corollary 1 is true, the more

confident we can be in using the observed commissions received by agents (or variable fees charged to

agents) to infer which mode the firm operates in. Specifically, if we observe that agents receive more

than 50% of variable revenues, then the firm is most likely to be using A-mode; if we observe that

agents receive less than 50% of variable revenues, then the firm is most likely using the E -mode. The

values in Table 2 make it clear that this inference is remarkably accurate for low values of N Φ2 .

8.3

Linear revenue function and private benefits proportional to demand

The revenue and cost functions remain the same, but suppose now private benefits are proportional

to the demand underlying the linear revenue function:

B (a) = B (βa + φq + ΦQ)

b (a) = b (βa + φq + ΦQ) ,

where βa + φq + ΦQ measures demand and the price is normalized to 1.

26

In E -mode, the firm solves

ΠE ∗

=

max

N

t,a,q,Q

1

1

(1 + B + b) (βa + φq + ΦQ) − a2 − q 2

2

2

1

− Q2

2

subject to

β (t + B) = a

φ ((1 − t) + b) = q

N Φ (t + B) = Q

Straightforward calculations yield

ΠE ∗ = max

t

N

2

2

β + NΦ

2

2

(t + B) (2 − t + B + 2b) + φ (1 − t + b) (1 + t + 2B + b)

,

which leads to

tE ∗

β 2 + N Φ2 (1 + b) − φ2 B

β 2 + N Φ2 + φ2

N (1 + B + b)2 2

2 2

2

2

2

4

2

2

2

β

+

N

Φ

β

+

N

Φ

+

2φ

+

φ

2β

+

2N

Φ

+

φ

2 (β 2 + N Φ2 + φ2 )2

=

ΠE ∗ =

In A-mode, the firm solves

ΠA∗ =

max

t,a,q,Q

N

1

1

(1 + B + b) (βa + φq + ΦQ) − a2 − q 2

2

2

1

− Q2

2

subject to

β ((1 − t) + b) = a

φ ((1 − t) + b) = q

N Φ (t + B) = Q

Straightforward calculations yield

Π

A∗

= max

t

N

2

2

2

N Φ (t + B) (2 − t + B + 2b) + β + φ (1 − t + b) (1 + t + 2B + b) ,

2

which leads to

A∗

t

=

ΠA∗ =

N Φ2 (1 + b) − β 2 + φ2 B

β 2 + N Φ2 + φ2

N (1 + B + b)2 2 4

2

2

2

2

2 2

2

2

2

N

Φ

2β

+

N

Φ

+

2φ

+

β

+

φ

β

+

2N

Φ

+

φ

2 (β 2 + N Φ2 + φ2 )2

27

Comparing the two profits, the A-mode dominates the E -mode if and only if

2 2

N 2 Φ4 2β 2 + N Φ2 + 2φ2 + β 2 + φ2

β + 2N Φ2 + φ2

2 2

> β 2 + N Φ2

β + N Φ2 + 2φ2 + φ4 2β 2 + 2N Φ2 + φ2 ,

which is equivalent to

N 2 Φ4 + β 2 + φ2

2

+ N Φ2 β 2 + φ2

2β 2 φ2 + N Φ2

>

β 2 + N Φ2

2

+ φ4 + β 2 + N Φ2 φ2

β 2 + φ2 > 2β 2 N Φ2 + β 2 + N Φ2 φ2

φ2 > N Φ2 .

Thus, with this specification of private benefits, they have no impact on the trade-off between E -mode

and A-mode. This result might seem surprising, particularly in the case when B > 0 and b = 0: one

would then expect the E -mode to always dominate because the firm takes the private benefit B into

account when setting a, whereas the agents do not. The reason this is not true is that in A-mode the

firm needs to provide the agents with sufficient incentives for choosing both a and q, so it sets tA∗

sufficiently low (specifically, 1 − tA∗ > tE ∗ + B) such that it compensates for the fact that the agents

do not internalize the firm’s private B when setting their ai ’s.

28