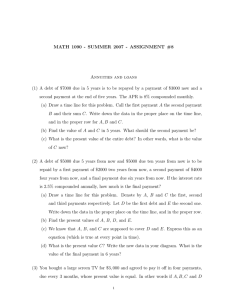

MATH 141-501 Section 5.2 and 5.3 Lecture Notes Annuities

advertisement

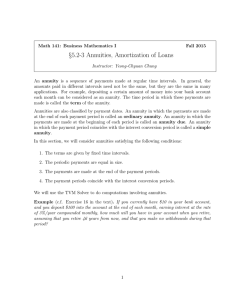

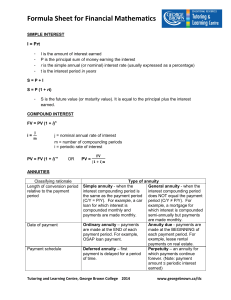

MATH 141-501 Section 5.2 and 5.3 Lecture Notes Annuities An annuity is a sequence of payments made regularly. There are many different kinds of annuities. In this class, we will study annuities that have the following properties: 1. Payments occur at fixed time intervals. 2. Periodic payments are all the same amount. 3. Payments are end of made at the payment period. 4. Payment periods are the same as interest conversion periods. In this class, problems about annuities will be solved using the TPM SOLVER program in the calculator. We will input the information we have, then either solve for PV (present value - initial amount) or FV (future value - accumulated amount at the end of some time period). 1 Example: (from textbook) Find the amount of an ordinary annuity of 36 quarterly payments of $220 each that earn interest at the rate of 10% per year compounded quarterly. N= I% = PV = PMT = FV = P/Y = C/Y = PMT: END Example: (from textbook) Find the present value of an ordinary annuity consisting of 48 monthly payments of $300 each and earning interest at the rate of 9% per year compounded monthly. N= I% = PV = PMT = FV = P/Y = C/Y = PMT: END 2 One of the most useful examples of annuities is for retirement funds. Example Pam opens an IRA on January 1, 2014 with a contribution of $3000. She plans to contribute $3000 every January 1st for the next 20 years, until retirement. The IRA earns interest at a rate of 6% a year compounded yearly, how much will be in the IRA when she retires? 3 Amortization of Loans Since loan payments are made regularly, we can think of loans as a type of annuity. Example: A group of investors purchases an apartment complex for 1 million dollars, with an initial down payment of 10% and financing the rest with a 15-year loan. The interest rate of on the loan is 6.5% per year, and the interest is compounded quarterly. What is the required quarterly payment? Example: Lily bought a new car, making a down payment of 2000andf inancingtherestataninterestrateof 11%/yearcom for 48 months. What is the cash price of the car? Sinking Funds A sinking fund is an account that is intended to hold a specific amount at some specific point in the future. If we think of this amount as the future value of an annuity, it allows us to solve sinking fund problems using the techniques from annuities. Example A company decides to set aside a sinking fund to replace its computer equipment in 3 years. The company’s analysts determine that $10,000 will be needed. If the company can obtain an account which pays an interest rate of 4.5% per year, compounded quarterly, how much do they need to invest each month in the sinking fund? 4