HARFORD COMMUNITY COLLEGE COMPONENT UNIT FINANCIAL STATEMENTS AND

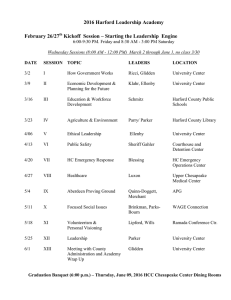

advertisement