Investing in Entrepreneurship: A by

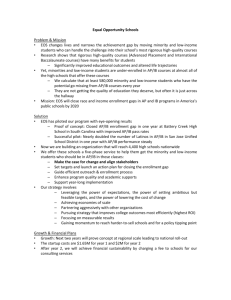

advertisement