World A Decentralized

advertisement

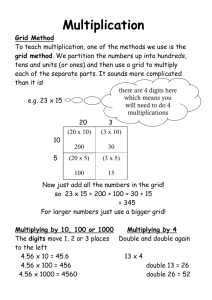

Decentralized Energy Decentralized Energy A Decentralized World The growing importance of distributed power generation means utilities must adapt their business models. Four executives from around the globe talk about how decentralized energy is affecting their business. Text: Ed Targett Illustrations: Matthew Billington Portraits: Elliot Beaumont U A new world of energy: The one-way street of centralized power supply is being replaced by a complex system of “give and take,” with a multiplicity of feedin points. tilities face significant challenges and regulatory environments in integrating distrib­ ­ ower generation into their uted p portfolios and business practices. One thing is clear, however: The industry is evolving; a simple return to purely centralized plants will not happen. But how to juggle supply ­security, ­assess demand curves with intermittent production, and – amid shifting load factor patterns on thermal plants – guarantee market transparency and meet environmental ­obligations? Conversations between Living Energy and forward-thinking chief executives from utilities across the globe suggest there is no single specific ­answer to meeting these challenges and ensuring commercial success – or at least stability – whilst doing so; but it is increasingly clear that in a liberalized market, there is likely to be a business case for prosumers who switch between consuming and producing power according to their needs. Whilst in developed countries, regu­ latory positioning driven by carbon reduction targets can seem the ultimate driver of the shift, policy makers in less developed countries are a ­ lso increasingly asking themselves whether it is worth establishing a transmission grid just to put a unidirectional plant at one end of it, in view of energy losses during the transmission and the huge investments required. These concerns are compounded by uncertainty regarding the security of fuel supplies, and, among the utilities, the fear that they will no longer have guaranteed returns on investment as was the case before liberalization. Living Energy joined four leading CEOs to hear their thoughts on the future of distributed energy. Ed Targett is a freelance journalist based in London. His news reports have been published and broadcast in a number of media outlets, including the BBC, the Daily Mail, South Korea’s Yonhap News Agency, Yahoo! Asia, and others. Living Energy · No. 11 | December 2014 17 Decentralized Energy Decentralized Energy “A fully digitized distribution network has been a very important enabling factor in the change toward distributed generation.” Francesco Starace, CEO and General Manager, Enel Enel CEO Francesco Starace has had a sweeping view of the electricity market, having started his career in nuclear engineering before holding a high-profile role in the gas turbine business and, most recently, successfully presiding over the creation and the IPO of Enel’s renewable division, Enel Green Power, of which he was the CEO since 2008, prior to landing the top job at the parent company ­Enel last May. The head of the major Italian utility tells Living Energy that Enel has a head start in handling distributed generation, owing to Italy’s fully digitized distribution network and, as an early adopter of distributed generation, is successfully exploiting its business opportunities. Government support for photovoltaics in recent years has triggered a boom in the country in rooftop installations (in the first eight months of the year, 9.68 percent of Italy’s total net generation came from PV plants), and ­Starace acknowledged that that had been both a challenge and an opportunity: “A fully digitized 18 Living Energy · No. 11 | December 2014 distribution network has been a very important enabling factor in the change toward distributed generation,” he says, ­explaining how Italy is the first and, to date, possibly the ­only country in the world to have a fully digitized ­distribution network, thanks to an extensive rollout of smart meters and ­other automation systems by E ­ nel in the 2000s. “There are two aspects to the boom in distributed generation for Enel; on the one hand, you have an overall reduction in the absorption from the grid and, therefore, an impact on consumption. On the other hand, you have an increase in business in the distributed network division, as thousands of installations ask for connection to the grid. Right off the bat, you have a benefit, although the two ­impacts don’t entirely balance out.” He adds: “There are issues with a grid designed over the past 40 years to work from high voltage to low voltage, which now works in the opposite direction many times during the year. We will not have a problem if we keep adding flexibility to the system by providing additional connections and better software to manage the grid at a local level, plus additional storage capabilities across the network, which is something we are studying very carefully. On top of this, nowadays, the flexibility gap between thermal generation and large renewable ­generation in the portfolio is proving to be a lot less than earlier studies suggested.” Enel is approaching the changing market in two ways, Starace h ­ igh­lights: “On customer-based ­distributed ­generation, if you take a leading role, and Enel is by far the largest player in this field, you get close to the most advanced and technologically savvy customers; you have to stay close to them and supply services such as installing, maintaining, and providing additional improvements to their panels and other equipment. Then, there are the u­tility-scale distributed generation plants. Here, we have an interest as an investor and are active particularly in mini hydro and biomass generation.” There are a number of areas where R&D efforts should be focused in the meantime, the company’s CEO tells Living Energy: “I’d like to see more ­research in the hardware-software combinations that are needed in ­order to have existing renewable i­nstallations all over the world behaving as thermal generation, a technically achievable solution on which we are also working. I would also like to see more research in network digitization to make it more flexible, as well as ­research in marine energy and superconductor technology.” Gaetan Thomas, CEO, NB Power NB Power, the electricity utility for the Canadian province of New Brunswick, sees power demand double from approximately 1,500 megawatts in summer to over 3,000 megawatts in the region’s harsh winter. Publicly owned and vertically integrated, NB Power has a 4,000-megawatt system generating C$1.6 billion revenue through a nuclear plant, a coal-fired plant, hydropower, wind power purchase agreements, and a large oil peaking plant. CEO Gaetan Thomas, 54, points to new generation costs as a key driver of the company’s ambitious Reduce and Shift Demand initiative in New Brunswick: “In the 1970s before the oil crisis, we had no gas supply here, only oil. Now, due to our high electric heat load, the oil is only used for peaking power, often during just two weeks in the winter; but there’s just no business case for building a gas plant to run for two to three weeks,” Thomas notes. He is focused on demand-side management: “Our winter peak loads occur twice a day, and those peaks can add 700 to 800 megawatts, which is the equivalent of our nuclear plant. Our long-term goal is to avoid about 630 megawatts of generation; within the next five years, about 150 megawatts. That capacity will be made available to the market. That’s extremely valuable in the winter in this part of the world.” The CEO is frank about the opportunities and challenges when it comes to decentralized generation, especially since falling costs are making solar energy a real competitor: “We see that as an opportunity for us. To back up decentralized generation, you still need an integrated grid to ensure safe and reliable operation on the customer side.” That process requires careful attention: “When you integrate decentralized generation, it is very hard to exactly match the load requirement. An “When you integrate decentralized generation, it is very hard to exactly match the load requirement.” exchange of energy must occur when the decentralized power generators produce more than what the customer can use, so the grid has to accept that. And vice versa, when there is no sun and no wind. Until you get good storage, it will be very tricky for utilities to manage reliability with hundreds or thousands of decentralized generators.” The answers are out there, though: “Grid integrity and the need for twoway metering mean that smart metering will become a must. You can’t deal with just one reading a month anymore, you have to deal with peaking power, and the cost of meeting demand has to be shared equitably between people using decentralized power generators and the ones that want to remain on the grid. The minute you have a hybrid system, the complexity becomes considerable. A smart grid is the key to tying all this together and ensuring these customers get cost-effective, reliable power for a long time. If you have a good phased-in approach with a smart grid, you can optimize and also allow more renewable energy on the grid. We already have 300 megawatts of intermittent wind on our grid, and to optimize that requires us to use customer loads to ­actually put more on the grid. If not, it becomes so expensive, because you now have a nuclear plant or a coal plant only coming to back up wind. That means you need both, and then you have the cost of maintaining two sources of energy to meet the needs of the customers. If you can do that by changing the load patterns, you can actually supply more renewable ­energy without needing that backup.” He concludes: “Our plan is worth C$1.4 billion net present value over time for us in New Brunswick. It avoids the need to build new generation in the future, and allows us to optimize the existing infrastructure to get more value for money for our customers.” Living Energy · No. 11 | December 2014 19 Decentralized Energy Decentralized Energy Karim Garcia, Vice President, Trans-Asia Oil and Energy Development Ingo Luge, CEO, E.ON Germany Former oil trader and power developer Karim Garcia has recently taken the lead on strategic planning as Vice President of the Philippines’ Trans-Asia Oil and Energy Development utility. Distributed generation is expected to play a significant role in powering the archipelago nation forward, he says: “The Philippines with its over 7,100 islands faces some unique challenges. The electricity grid is not fully connected, so decentralized power is essential in providing power to stand-alone grids, often serving populations of just a few thousand people, serviced and subsidized by the Small Power Utilities Group (SPUG). These stand-alone grids are largely powered by smaller diesel generators.” A new feed-in tariff (FIT) means a ­significant expansion of hydro, wind, and solar is likely, he adds: “My company, Trans-Asia, is developing a 54-megawatt wind farm on the Visayan island of Guimaras.” Energy security is a key driver, along with a better balance of payments and a cleaner environment for the country, but Germany’s E.ON has witnessed the impact of one of the world’s most significant national shifts in energy policy, and as one of the country’s leading utilities – though with a major international presence – it has been working on some of the most innovative responses. E.ON Germany CEO Ingo Luge has studied at first hand the impact of widespread distributed generation and has a clear vision as to what constitutes the best approach forward for companies in the energy space. He tells Living Energy: “We believe that the best approach is to go to a ­location where the best technology is applicable in the most efficient way; where the sun shines and the wind blows. We are currently experiencing a large influx into demand-side management. However, we can’t rely on asking customers to lower their load to supply the grid with flexibility. Combined heat and power (CHP) is a large area of distributed energy that is of real interest to us, although it is not applicable for every customer. You need customers who have a high need for heat, either for heating of rooms or factory buildings, or for ­industry processes.” Investment in storage will be vital, and that is where R&D funding should be concentrated, Luge suggests. “We at E.ON undertake significant research on battery storage and power-to-gas storage, to get costs down, so that on an industrial scale, large-sized storage becomes viable; to my mind, this is the most promising way to replace conventional generation in the long run. To integrate the increasing number of different participants in the energy market into one stable and well-functioning system is worth a lot of effort, but it is also a significant challenge,” he adds. “A key question is how you finance renewables production and less how you finance network extensions, ­because the latter are operating in a “In the Philippines, ­decentralized power is essential in providing power to stand-alone grids.” 20 Living Energy · No. 11 | December 2014 challenges remain in terms of public acceptance of a subsidized regime. “Unfortunately, many consumers in the Philippines simply look at the price of power (pesos per kilowatt-hour) and do not really care about their sources of power. Since renewable energy is subsidized with a FIT rate, many consumers fear their power rates will go up. Regardless, hundreds of megawatts’ worth of renewable energy is currently being developed in the Philippines. The biggest challenge is developing these projects with ambiguous policy on FIT megawatt allocations and electricity tariffs. And as in any other business, uncertainty brings challenges and added risk. To encourage investment in renewable energy projects, clear and unwavering policy needs to be in place.” In terms of the business opportunities with regard to distributed generation, he notes: “For more variable renewable energy, grid impact is a major factor, and obtaining grid impact assessment for larger renewable projects can be challenging, which is why the Philippines needs a better energy mix policy, particularly in terms of improving our mid-merit and peaking power capabilities.” Combined cycle gas turbines (CCGT), which are cleaner, have a smaller footprint, and are faster to construct and highly efficient, could do the job well, and liquefied natural gas imports are under consideration in the country. With the growth in distributed and variable renewables, rapidly available megawatts will be all the more urgently needed, as Garcia highlights: “An effective and reliable electricity grid cannot and should not be built solely on base-load, large-scale coal plants that cannot be cycled and very expensive diesel plants. While coal plants definitely have a role as a baseload electricity provider, the grid also needs hydro and CCGT to provide clean and cost-effective peaking power. Meanwhile, in terms of R&D, technologies that can make renewable energy more predictable are vital, so improvements in battery technology would be very helpful, as would even greater gas turbine efficiency.” “A strong influx of variable production creates a challenge in terms of system stability and ensuring security of supply.” regulated market. Network extensions can be delivered through new technologies that can lower your additional investment costs and additional grid fees, although public ­acceptance of the need for increased networks is not always easy to secure. We e ­ xpect that smart grid innovations will help to ease the burden.” He sees a major challenge on this front, though: “A strong influx of variable production into the system – and we are a distribution system ­operator as well – creates a challenge in terms of keeping the system stable and at the same time ensuring s­ ecurity of supply. Moreover, there are a vast number of ideas around how to develop the market, and even a big company cannot tackle every one of them. What we can do is single out technologies where we think there is a good future economic opportunity. So we see ourselves more and more as a special energy solutions provider. For example, we have started to move into energy efficiency for buildings, as well as industry processes.” Living Energy · No. 11 | December 2014 21