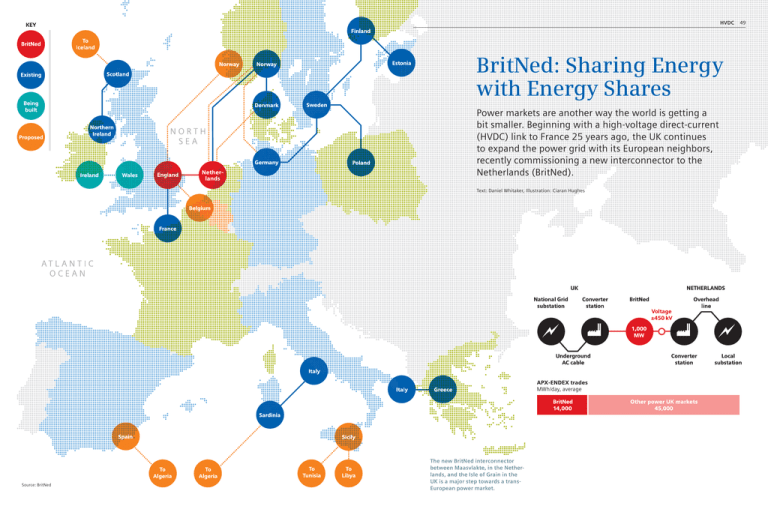

BritNed: Sharing Energy with Energy Shares

advertisement

HVDC BritNed: Sharing Energy with Energy Shares Netherlands Power markets are another way the world is getting a bit smaller. Beginning with a high-voltage direct-current (HVDC) link to France 25 years ago, the UK continues to expand the power grid with its European neighbors, recently commissioning a new interconnector to the Netherlands (BritNed). Text: Daniel Whitaker, Illustration: Ciaran Hughes APX-ENDEX trades MWh/day, average Source: BritNed The new BritNed interconnector between Maasvlakte, in the Netherlands, and the Isle of Grain in the UK is a major step towards a transEuropean power market. 49 HVDC “ BritNed’s benefits include greater efficiency, help to integrate wind power, and improved security of supply.” René Kerkmeester, Commercial Director of BritNed HVDC The British and Dutch transmission system operators National Grid and TenneT have taken a major step forward in the process of establishing a single physical power market by building an interconnector between the Netherlands and the UK. BritNed, as it is known, was agreed upon in 2007, with cable manufacture starting the following year, and an intensive two years of construction before its commissioning ceremony took place in April 2011. The interconnector runs 260 kilometers from Maasvlakte, a port district near Rotterdam reclaimed from the North Sea in the 1960s. “The link doesn’t follow the shortest path to the UK,” says Nigel Wood, BritNed’s Head of Technical Operations, “since the Essex/Suffolk landfall this would deliver is fast eroding and prone to seabed subsidence.” Instead, BritNed begins stretching north, but then turns in towards the northwest. The cable meets the UK at the Isle of Grain, the end of a peninsula by the mouth of the River Thames in the English coastal county of Kent. Grain (originally meaning “gravel”) is a marshy area, now dominated by two large oil- and gas-fired power stations. “We worked ankle-deep in mud,” recalls Wood of construction there. While the twin copper cable normally operates bipolar at 1,000 MW, if need be, BritNed’s powerful HVDC link – the brain and the heart of the system – can switch them to monopolar operation at reduced power of 500 MW within two seconds to provide the right amount of energy needed at the right time. For Global Marine Systems, the cable layer, burying the cable was a challenge. For a start, seven other utility cables (principally telephone and gas) had to be crossed. Also, while the cables are mainly buried in solid clay on the UK side, at Maasvlakte it is mostly sand, which could easily shift and leave the cable uncovered and vulnerable. “To deal with this,” says Wood, “a mass float excavator was needed. That’s basically a 5-tonne vacuum cleaner hanging off the back of a boat.” The excavator blew any covering sand off the cable, so that it could be safely covered with stones. The British and Dutch grids transmit using alternating current (AC), but the BritNed interconnection allows power transmission of 1,000 MW using a direct-current (DC) transmission voltage of 450 kV. This means converter stations are needed at each end. Siemens has provided both. Within the valve hall of each of the 282-tonne units, 12-pulse direct-light triggered thyristor valves are attached to each end of the cables to transform the power. Beyond them, AC switchyards act as interfaces with the two countries’ transmission systems. A short underground AC cable system links the UK converter station to National Grid’s 400-kV Grain substation. At Maasvlakte, there is a short overhead line to connect with TenneT’s local 380-kV substation. Each converter station uses six 210-MVA transformers to feed the AC power into the thyristor-based AC-to-DC conversion. Describing the converter stations, Wood praises Siemens’ “efficiency and ability to act as a team player.” There are two ways to buy or sell electricity through BritNed and elsewhere in Europe. In either case, power suppliers will do so in conjunction with contracts with end users. Cheaper electricity in one country can meet demand and reduce prices in another country. Prices will become equal across adjacent countries as long as there is sufficient transmission capacity. The first way, “explicit” trading, involves the suppliers buying capacity on the BritNed interconnector (in either direction) for a certain period and then separately purchasing the power itself to run over that capacity from traders. BritNed holds auctions for capacity across different time scales, i.e., annually, seasonally, quarterly, monthly, multiday and intraday. In order to help guarantee future access, BritNed won’t sell capacity any further out than a year ahead. One example of the monthly auctions was the first explicit auction, held on March 24, 2011. In it, 300 MW were offered for April 2011. In the direction Netherlands to Great Britain, the price was €2.56 per MWh, Security Aspects a High Priority BritNed’s goal is to have the highest security standard possible to achieve zero incidents. In order to comply with all regulations in the UK and the Netherlands, they strictly follow the guidelines of the SHESQ policy: safety, health, environment, security, and quality. The focus is on critical areas of business where safe behavior by managers, employees, contractors, and agency staff is essential to safeguard employees and the public. Strong security guidelines have been developed, and the design of the HVDC arrangement was considered with these aspects in mind. Local Siemens experts are well versed in the security aspects and worked with National Grid and TenneT from the very beginning to realize their concepts and ideas. But while suppliers come from all over Europe, BritNed is very much Living Energy · Issue 6/February 2012 51 How European Electricity is Traded over BritNed Photo: Detlef Schneider 50 a British-Dutch partnership, following in the path of corporate success stories such as Shell and Unilever. There is no single leader above Operations Director Philip O’Gorman in the UK (Nigel Wood’s boss) on the engineering side and René Kerkmeester in the Netherlands, its Commercial Director, who steer the limited company in tandem. “Coalitions are in fashion,” points out Nigel Wood, referring to the fact that both the British and Dutch governments currently operate on this basis. Kerkmeester and Wood agree that the two nationalities have strengths and weaknesses, but the team knows this well enough to play to the former. Wood describes the Dutch as “quickly responsive” and the British as “good at meeting deadlines.” Kerkmeester lived long enough in London working before in telecoms to have skill at blending “Dutch directness and British diplomacy.” Living Energy · Issue 6/February 2012 and in the direction Great Britain to Netherlands, the price was €0.39 per MWh. A total of twelve customers took part and ten were successful in purchasing capacity. BritNed’s explicit trading is facilitated by an innovative trading software platform, known as Kingdom, provided by partner organization Unicorn Systems, based in Prague. Nineteen traders – large utilities and financial institutions – currently participate. The alternative is “implicit” trading, which takes place at APX. In implicit auctions, the transmission capacity is auctioned together with the electricity. Capacities and flow direction are determined during the combined electricity trading and transmission capacity auctions so that the electricity, usually to the greatest extent possible, flows to the market region with the highest price – and the higher demand for power. This approach is also known as “market coupling,” as it involves linking two national markets together. Trilateral market coupling has taken place between France, Belgium, and the Netherlands since 2006. In keeping with its shareholders’ role, BritNed is a “shipper” rather than a supplier of power. This means its key objectives must be physical reliability and a focus on giving interested suppliers – wherever they are – whatever they could possibly need. Equipment from Siemens and other suppliers to BritNed helps to ensure reliability. Delivering whatever is needed is achieved through a customer-focused attitude rare among interconnectors. “Were more customer driven than other cables [interconnectors],” says Kerkmeester. “It’s unusual that we have a customer relations team.” For those wishing to trade power over BritNed, there is a choice of two trading formats (see sidebar on Electricity Trading), either through an explicit trading system developed by BritNed and its partner Unicorn Systems hosted in Prague or via APX-ENDEX in Amsterdam (see APX sidebar). An- drew Claxton, Director of Business services at APX, thinks they are succeeding: “BritNed is at the forefront of innovation; they’re creative at finding the best ways to sell capacity.” A Matter of Social Importance In an article in the Guardian (UK) in April 2011, Wilfried Breuer, Head of Power Transmission Solutions at Siemens, commented on the idea of a European supergrid, which gained momentum in December 2010 with the signing of an agreement by all ten countries bordering the North Sea to coordinate deployment of new HVDC cables that would maximize the use and sharing of renewable energy between them, including wind power from the UK, solar power in Germany, and hydropower from Scandinavia. Said Breuer: “The supergrid will be built, but gradually. It’s not one u 52 HVDC HVDC 53 APX-ENDEX: a Hub of Activity APX-ENDEX is another Anglo-Dutch venture with Belgian participation. It has evolved from the Amsterdam Power Exchange, launched in 1999 as the first place on the European mainland where power could be bought and sold. Since then, APX has grown to encompass six spot markets and four futures markets, trading gas and electricity. As with BritNed, APX is owned only by transmission companies, keeping it independent of those who trade and supply power. The exchange group has grown at a double-digit rate over the last three years, and looks set to keep thriving. Paul Groes, an APX Account Manager, who comes from a utility background, relishes the “diversity” of APX. “Here, I deal with a wide range of companies, from many countries,” he says. Communications Officer SannaMaaria Mattila from Finland agrees, adding, “APX has a young dynamic, with 15 nationalities represented between 150 of us.” The staff works in an efficient, modern building, opposite the great Arena Stadium of Amsterdam’s Ajax football club. As we pass the bank of 30 computer screens that makes up the spot price trading floor, there is an Facts BritNed is a €600 million joint venture between two electricity transmission companies, Dutch TenneT and British National Grid. The joint venture has developed, built, and commercially operates the 260-km-long high-voltage direct-current (HVDC) electricity interconnector, 1,000 MW , with a capacity of between Great Britain and the Netherlands (operational since April 2011). The interconnector has ± 450 kV DC ; voltage levels of 400 kV, 50 Hz AC (UK); 380 kV, 50 Hz AC (Netherlands) and 6 x 210 MW transformers. BritNed offers a blend of implicit and explicit auctions. APX-ENDEX is the central counterparty to all implicit trades. Trades automatically match across borders to the extent capacity is available. investment like a highway. It will develop over 10 to 15 years, leg by leg.” For René Kerkmeester, though only two months into his job, this is one part of what makes working at BritNed so satisfying. The electricity sector involves complex, long-run investment decisions: BritNed cost €600 million to build. And Kerkmeester notes that this combines with a day-to-day environment in which anything can happen – a case in point being the German “Energiewende,” a rapid policy shift towards renewables. Another source of reassurance to Kerkmeester is that with so many connections from energy to the economy and to people’s lives, he believes BritNed’s activities also have social importance. BritNed’s social value is particularly clear in the case of renewable generation – a point emphasized by UK Energy Minister Chris Huhne at BritNed’s opening ceremony. Britain has a growing portfolio of wind generation in the North Sea (14 GW are planned, much of it connected to the UK grid by Siemens), but a much-com- Living Energy · Issue 6/February 2012 Photos: APX-ENDEX, Detlef Schneider No ordinary office: Simple surroundings belie the critical power trading going on at APX-ENDEX. mented weakness of such power is its “feast/famine” intermittent nature. With BritNed, gale-driven excess UK power can be passed to the mainland. When the same weather system then moves over to northern Germany (as often happens), the new German excess can be passed back to Britain. Thus, the interconnector makes renewables a far less volatile form of generation. BritNed’s benefits, says Kerkmeester, “include greater efficiency, help to Living Energy · Issue 6/February 2012 atmosphere of relative calm. But this changes abruptly at noon each day as bids and offers stream in to set the prices for the next day’s megawatt-hours of electricity and thermal units of gas. Activity is more steady on the neighboring floor, where a dozen screens reflect futures prices, though on average, more volume is transacted here. Andrew Claxton, APX’s Director of Business Services, highlights APX’s role in helping move the EU towards a single set of prices for power. “During 2011, for 55–75 percent of hours, there was a single price across France, Belgium, the Netherlands, and Germany. Once you allow for transmission costs, natural losses, and import charges, the same was true for Britain and the Netherlands over 75–85 percent of hours.” This means optimal usage of transmission capacity for grid operators and more efficient energy prices for users. “BritNed is an important part of this convergence,” Claxton continues. “It has added 10,000 to 15,000 MWh/day via auction to the 40,000–45,000 MWh/day APX trades in other UK power markets. Over in Britain (where other exchanges operate), they no longer feel they are an integrate wind power, and improved security of supply.” One still evolving area of interconnection is its regulation. BritNed offers guaranteed third-party access in return for exemptions from some tariff regulation. Regulators are currently proposing a “cap and collar” regime that allows prices to vary between fixed minimum and maximum levels. René Kerkmeester sees this as “a fair compromise, sharing risks between Communications Officer Sanna-Maaria Mattila typifies the young, international dynamic of APX-ENDEX. APX Account Manager Paul Groes enjoys the diversity of both his work and his client base. island system. BritNed has created a reference price for their daily power auctions, which previously lacked liquidity – with Europe acting as a giant market maker.” consumers, investors, users, and traders. We just want a level playing field.” If the regulation is right, then there will certainly be additional interconnectors across the North Sea. In the meantime, those on the BritNed team appear to relish their pioneering role. p Daniel Whitaker is a freelance technology and business writer who divides his time between the UK and Spain. His work has appeared in the Financial Times, the Times and the Economist, among others.