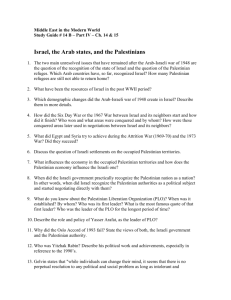

The economic dimensions of prolonged occupation: the Palestinian economy

advertisement