Using @RISK in Project Risk Assessments at Infineon Dr. Martin Erdmann

advertisement

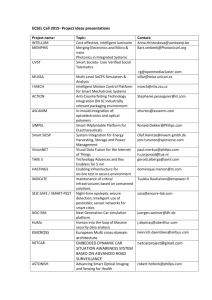

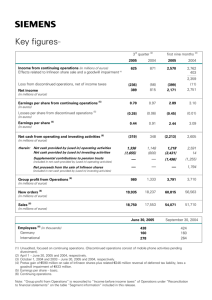

Using @RISK in Project Risk Assessments at Infineon Dr. Martin Erdmann Director Risk Management Why Risk Management? 2-May-07 Copyright © Infineon Technologies 2006. All rights reserved. Page 2 Agenda Intro on Infineon Risk Management at Infineon Risk Analysis in R&D Projects Risk Analysis of Business Plans Roll out Experience 2-May-07 Copyright © Infineon Technologies 2006. All rights reserved. Page 3 The "New" Infineon at a Glance More than EUR 4 bn in revenues in the fiscal year 2006, EUR 958 m in the first quarter of the fiscal year 2007 Approx. 30,000 employees (incl. 6,000 R&D staff) as of December 31, 2006 Strong technology portfolio with about 22,900 patents and applications; more than 35 major R&D locations worldwide Focus on Energy Efficiency, Mobility & Connectivity, Security & Safety Majority holding of Qimonda 2-May-07 Copyright © Infineon Technologies 2006. All rights reserved. Page 4 Our "New" Infineon Competencies Core Competencies 2-May-07 Analog/Mixed Signal Power Broadband Access RF Solutions Mobile Phone Platforms Chipcard & Security Industrial Electronics Automotive Application Fields Energy Efficiency, Mobility & Connectivity, Security & Safety RF Embedded Control Copyright © Infineon Technologies 2006. All rights reserved. Page 5 Organizational Structure Infineon Technologies Central Functions LP COM LP LP LP LP LP LP LP LP IT Qimonda LP LP LP 2-May-07 AIM LP LP AP LP Copyright © Infineon Technologies 2006. All rights reserved. AC Page 6 The Base: Risk Management (sub-) process Risk Reporting 1. Risk Identification Aggregation of risks Creation of Top10 report Annual report on Form 20F Management Discussion Creation of summary report for supervisory board 4. Risk Controlling Control effectiveness of measures Take time and think! Ask the experts Check history Compare with predefined categories Use Risk data base Risk workshops Use FMEA sheets Risk Management 2. Risk Analysis 2-May-07 Define measures to mitigate or eliminate Define effort of measures Prepare and execute 3. Risk Handling/Steering Copyright © Infineon Technologies 2006. All rights reserved. Define impact Define probability Analyze dependencies Create Risk Model Sensitivity Analysis Decision Tree Usage of MCS (e.g. @RISK) Real Option Analysis Page 7 Infineon’s expectation towards Risk Management Legal Compliance KonTraG (1998) TransPubG (2002) Risk Reporting 1. Risk Identification BilReG (2004) SOX (2002) @RISK 4. Risk Controlling 2. Risk Analysis 3. Risk Handling/Steering Risk Management = Management of a Decision under uncertainty Management Methodology 2-May-07 Copyright © Infineon Technologies 2006. All rights reserved. Page 8 Risk Management System AR RM responsibility BG responsibility Definition of objectives and rules IFX Risk Reporting Support on process implementation Details on Risk Reporting BG Risk Reporting BG related process implementation – Risk Assessments Risk Management Objectives and Corporate Rules Risk Internal & External Communication (Reporting) Risk Management Process 2-May-07 Risk Identification Risk Analysis Risk Controlling Risk Handling Risk Management System Analysis Copyright © Infineon Technologies 2006. All rights reserved. Page 9 Quantification of Risk Events Probability 0,7 Medium= 30% 0,3 Deviation from plan -50’ 2-May-07 0 Copyright © Infineon Technologies 2006. All rights reserved. Page 10 Decision Making Process Using PrecisionTree: Risks are described as good case or bad case Uncertain outcomes 2-May-07 Copyright © Infineon Technologies 2006. All rights reserved. Page 11 Risk Analysis: @RISK 1.0 0.8 1.0 0.6 0.8 0.4 0.6 0.6 0.00000 0.0 -1.16315 0.8 0.4 CoS 2.32630 Revenues 0.2 1.16315 1.0 2.32630 0.2 Monte Carlo simulations are used to aggregate and analyze effects on a certain parameter R&D MCS 1.0 Application fields for Infineon: Schedule analysis in MSP Financial calculations 0.8 0.6 0.4 0.2 2-May-07 Copyright © Infineon Technologies 2006. All rights reserved. 2.32630 1.16315 0.00000 -1.16315 -2.32630 In 2002 Infineon selected @RISK because of the product “@RISK for Project” 0.0 EBIT Page 12 2.32630 1.16315 -2.32630 0.0 0.00000 0.00000 -1.16315 1.16315 0.4 0.0 -2.32630 Uncertainty is defined by a range of values and associated estimated probabilities -1.16315 0.2 -2.32630 A more sophisticated evaluation technique by using probability distributions Risk Analysis in Projects (1) Methodology: STEP1 Identification of Top 10-20 Risks within a project No specific tool STEP2 Mapping of the risk’s to the project documentation of implemented risks STEP3 MS project Modeling & Simulation using @Risk for MSP @Risk STEP4 Involve the team to check your first estimates and refine these Prepare the transparent management presentation 2-May-07 Copyright © Infineon Technologies 2006. All rights reserved. No specific tool Page 13 Workflow: STEP 1 3 7 3 4 2 5 0.25 0.5 0.75 1.0 Effort of Measures 0 1 2 0 1 6 2 0 1 Severity 3 Identification of Top 10-20 Risks within your project and map these on a high level to your project 1 5 6 2 0 4 1 2 3 F(P;S) Probability 1: Team not fully staffed 4: Analog Expert not avail. 7: GOX reliability 2-May-07 7 3 2: IP delivery delayed 5: Design errors 3: bottleneck in verification equipment 6: Testing not possible (Probe card) Copyright © Infineon Technologies 2006. All rights reserved. Page 14 Workflow: STEP 2 Create a Mapping chart for your MSP plan 3 k s Ri A11 Design 90% Synthesis + Layout M6 Design Analysis 10% Redesign A12 needed • Redesign • Fab • Design analysis M7 Qualification … M9 1 sk i R Procedure 1) Draw only the work package structure necessary to how you want to model 2) Map the risks to the work packages add additional work packages if required 3) Quantify risks 2-May-07 [x,y,z]d [best case duration, likely Copyright © Infineon=Technologies 2006. All rightsmost reserved. 2 k s Ri T9 Technology Qualification delayed [0,40,100]d duration, worst case duration] in days Page 15 Workflow: STEP 3 is in Projects Risk 2 Task A Task B 1.0 1.0 Risk 1 0.8 0.8 0.6 0.6 1.0 0.4 0.4 0.8 0.2 0.2 1.16315 2.32630 0.4 0.00000 1.16315 -1.16315 0.00000 -2.32630 -1.16315 -2.32630 0.0 2.32630 0.6 0.0 0.2 max 2.32630 1.16315 0.00000 -1.16315 0.0 -2.32630 min Employ uncertainties in the project plan by using @Risk’s distributions M3 M4 M5 M6 M7 M9 M8 t A single milestone date gets a distribution of possible finalization dates 1.0 0.8 0.6 0.4 0.2 2-May-07 Copyright © Infineon Technologies 2006. All rights reserved. 2.32630 1.16315 0.00000 -1.16315 -2.32630 0.0 Page 16 Workflow: STEP 4 Involve the team to check your first estimates and rework the model Prepare the Risk Presentation Tracking of risks (i.e. Risk Lite) Explanation of modeling Separation of committed and target date List of measures/ decisions to make 2-May-07 Copyright © Infineon Technologies 2006. All rights reserved. Page 17 Main Objective Target Separation of Date committed to the customer Internal target dates ..by using explicit numbers of likelihood 2-May-07 Copyright © Infineon Technologies 2006. All rights reserved. Commitment t Keep customer committed date (Delay=0) Page 18 Infineon regulations Distributionprobability for M9 - activities/Finish Cumulated of reaching the M9 date 1,000 Mean=19.09.2004 P80 = 0,800 Customer commitment 80% 0,600 P30 = 0,400 Internal Target 0,200 0,000 22.06.2004 30% 28.08.2004 03.11.2004 P30 date P80 date 5% 28.07.2004 90% 09.01.2005 M9 date 5% 24.11.2004 Mandatory Mandatory for for important important R&D R&D projects projects 2-May-07 Copyright © Infineon Technologies 2006. All rights reserved. Page 19 I. R e v e n u e Standard Product Plan (PPL) Y e a r e n d d a te S a le s p ric e S a le s V o lu m e R evenue 0 3 /0 4 3 0 .0 9 .0 4 0 4 /0 5 3 0 .0 9 .0 5 8 ,3 0 800 6 .6 4 0 0 5 /0 6 3 0 .0 9 .0 6 8 ,5 0 1800 1 5 .3 0 0 0 3 /0 4 0 4 /0 5 0 5 /0 6 € /p c kpc k€ II. C o S / P r o d u c t io n C o s t s W a fe r P ro d u c tio n (F A B ) C o s ts p e r W a fe r W a fe r d ia m e te r C h ip a re a C h ip s /W a fe r YF W a fe r T e s tin g (S O R T ) T e s te r c o s ts p e r s e c F E T e s t tim e F E T e m p e ra tu re F a c to r F E YFB YB A s s e m b ly (A S S Y ) P a c k a g e c o s ts YM B a c k e n d T e s tin g (T E S T ) T e s te r c o s ts p e r s e c B E T e s t tim e B E T e m p e ra tu re F a c to r B E YP1 M a rk /S c a n /P a c k (M S P ) C o s ts M S P p e r c h ip T o ta l P ro d u c tio n C o s t Z U K F a c to r T o ta l P ro d u c tio n C o s t in c l. Z U K Discrete numbers for • Revenue (S x V) • CoS •wafer cost •chip area •yield € /w a fe r m m 2 m m 1 5 0 0 ,0 0 200 30 911 100% 1 4 0 0 ,0 0 200 30 911 100% % % 0 ,0 4 2 1 100% 7 0 ,0 0 % 0 ,0 4 2 1 100% 7 5 ,0 0 % € % 1 ,8 0 100% 1 ,7 0 100% 0 ,0 1 6 1 95% 0 ,0 1 6 1 95% 0 ,0 1 4 ,5 6 1 ,1 5 5 ,2 5 0 ,0 1 4 ,1 3 1 ,1 5 4 ,7 5 0 3 /0 4 50 80 4 .0 0 0 100 0 4 /0 5 40 80 3 .2 0 0 0 5 /0 6 30 80 2 .4 0 0 100 0 4 .1 0 0 3 .2 0 0 2 .4 0 0 0 3 /0 4 0 ,0 0 0 ,0 0 0 0 ,0 0 0 0% 0 4 /0 5 5 ,2 5 4 1 9 9 ,5 1 6 .6 4 0 3 ,0 5 2 .4 4 0 37% 0 5 /0 6 4 ,7 5 8 5 5 3 ,6 8 1 5 .3 0 0 3 ,7 5 6 .7 4 6 44% 1 ,5 1 ,5 % € /s e c se c € /s e c se c % € € € III. R & D C o s t s M a n m o n th s A v g . C o s t p e r M a n m o n th R & D M a n m o n th C o s ts T a p e -o u t C o s ts R e d e s ig n C o s ts S u b to ta l M a s k s + W a fe r E x te rn a l M a te ria l C o n s u ltin g R & D C o s ts T o ta l •package costs •R&D costs m m o k € /m m o k€ k€ k€ k€ k€ k€ k€ IV . G r o s s M a r g in N Σ n=0 “NPV” = 2-May-07 T o ta l P ro d u c tio n C o s ts p e r U n it in c l. T o ta l P ro d u c tio n C o s ts S a le s IF X G ro s s M a rg in p e r u n it G ro s s M a rg in to ta l G ro s s M a rg in in % o f s a le s Ebitn (1+15%) € /p c k€ k€ € /p c k€ % F a c to r O v e rh e a d C o s ts V . E B IT , N P V & P a y o f f P e r io d n 0 3 /0 4 C o u n te r Y e a rs E B IT C u m u la tiv e E B IT P a y -o ff Y e a r D is c o u n t R a te % P a y - o f f p e r io d NPV N P V ta rg e t yr M€ M€ Copyright © Infineon Technologies 2006. All rights reserved. M € M € 1 -4 ,1 0 -4 ,1 0 0 15% 0 4 /0 5 2 -2 ,8 6 -6 ,9 6 0 0 5 /0 6 3 0 ,0 7 -6 ,8 9 0 5 0 ,2 4 2 ,0 0 Page 20 Quantitative Risk Analysis of Business Plans Details Uncertainties in sales price, volume, R&D and production costs are defined by using @Risk’s distribution functions The EBIT is changing from a single number to a certain distribution Predefined templates visualize the probability function of the Net Present Value (NPV) 2-May-07 Copyright © Infineon Technologies 2006. All rights reserved. Page 21 “Financial @RISK” Standardized Outputs 90% 80% Probability of NPV of at least x NPV 100% 70% 60% 50% 40% 30% 20% 10% POP 0% -6,0 -4,0 -2,0 0,0 2,0 4,0 6,0 8,0 10,0 NPV, million euro probability 60% Regression coefficients (impact of each input on NPV distribution) 40% 20% 0% 1 2 3 4 5 6 7 8 pay off period Regression Coefficient (absolute value) 0,00 0,05 0,10 0,15 0,20 0,25 0,30 0,35 0,40 0,45 area €/wafer / 07/08 €/wafer / 08/09 €/pc / 07/08 kpc / 07/08 €/wafer / 09/10 €/pc / 08/09 €/wafer / 10/11 kpc / 09/10 Package costs / 07/08 2-May-07 Copyright © Infineon Technologies 2006. All rights reserved. Page 22 Templates provided by Central Risk Management 2-May-07 Copyright © Infineon Technologies 2006. All rights reserved. Page 23 Rules & Guidelines within Infineon (1) R&D projects whose budget exceed given limit Project Plan Analysis – A quantitative risk analysis of the project schedule has to be applied using "@Risk for Project". Financial Analysis – profitability to be assessed using “released Excel-Templates” based on @Risk for Excel Investment projects (above given limit) Before those investments can be approved, a quantitative risk analysis using the “Investment template” has to be applied 2-May-07 Copyright © Infineon Technologies 2006. All rights reserved. Page 24 Rules & Guidelines within Infineon (2) 1-day training is mandatory @RISK @RISK for Project – – – – – – – – – – Basics on Statistics @ RISK First Steps @RISK Advanced Features Business Plan Analysis @RISK for Project Risk Management Methodology Basics on Statistics @RISK Demonstration & Exercise Case Study Project Business Plan Analysis Training organization Bi-monthly courses in Munich (Headquarter) – 2-May-07 Successful cooperation with Palisade since 2005 E-Learning courses for APAC and US Courses for sites on demand Copyright © Infineon Technologies 2006. All rights reserved. Page 25 Experience with QRA in projects and @Risk for MSP Pros – – – – – – – – – Basic features of the tool easy to use For basic features similar user interface compared to @RISK Existing project plans could be used Applying Risk Management in projects improved planning accuracy More objective decisions („kill-rate“) Less fire fighting Improved communication in project team More efficient management of defined mitigation activities Culture, sharpened awareness Cons – – – – Tool performance Tool stability in early versions Some resistance due to obligation to use @RISK No structured process, just tool usage – Too many risks – No follow up – Sometimes no serious usages (“change the inputs until it fits”) 2-May-07 Copyright © Infineon Technologies 2006. All rights reserved. Page 26 Experience with QRA for finance applications and @Risk for Excel Pros – – – – – – – Perfect integration into MS Excel Easy to understand user interface “Viewer” concept Tool performance Applying Risk Management improved planning accuracy More objective decisions („kill-rate“) Culture, sharpened awareness Cons – – – – 2-May-07 More guidance which pdf to choose Some resistance due to obligation to use @RISK No structured process, just tool usage Low quality inputs destroy good projects - or vice versa Copyright © Infineon Technologies 2006. All rights reserved. Page 27 Biggest Difficulties Culture Training as prerequisite Quality of inputs 2-May-07 Copyright © Infineon Technologies 2006. All rights reserved. Page 28 Advanced Risk Analysis: Real Option Analysis Decision Analysis 1.0 Risk Analysis 0.8 0.6 0.4 0.2 2.32630 1.16315 0.00000 -1.16315 -2.32630 0.0 Real Option Analysis: Value of flexibility Value of P2? 2-May-07 Copyright © Infineon Technologies 2006. All rights reserved. Page 29 Managing Uncertainty at Infineon … … is being done sucessfully with @RISK ! 2-May-07 Copyright © Infineon Technologies 2006. All rights reserved. Page 30 THANK YOU ! Questions? -> martin.erdmann@infineon.com 2-May-07 Copyright © Infineon Technologies 2006. All rights reserved. Page 31 Backups 2-May-07 Copyright © Infineon Technologies 2006. All rights reserved. Page 32 “Financial @RISK” (1) Pert(7,2000; 8,0000; 10,000) 0,8 Sales price and volume uncertainties are defined by their minimum, most likely and maximum values using PERT distributions * 0,7 0,6 0,5 0,4 0,3 0,2 7,452 Year end date Sales price Min (P95 on Timeline) Most likely (P80 on Timeline) Max (P30 on Timeline) Sales Volume Min (P95 on Timeline) Most likely (P80 on Timeline) Max (P30 on Timeline) Revenue €/pc €/pc €/pc €/pc kpc kpc kpc kpc k€ 10,5 10,0 9,5 9,0 8,5 90,0% I. Revenue 2-May-07 8,0 7,0 0,0 7,5 0,1 5,0% 9,110 03/04 04/05 05/06 06/07 07/08 08/09 09/10 10/11 Total Years 30.09.04 30.09.05 30.09.06 30.09.07 30.09.08 30.09.09 30.09.10 30.09.11 8,20 7,06 6,50 5,95 4,96 4,96 4,46 7,20 6,30 5,85 5,40 4,50 4,50 4,05 8,00 7,00 6,50 6,00 5,00 5,00 4,50 10,00 8,05 7,15 6,30 5,25 5,25 4,73 21 98 1.967 9833,33 9833,33 7866,67 7866,67 37.486 18 60 1.200 6.000 6.000 4.800 4.800 22.878 20 100 2.000 10.000 10.000 8.000 8.000 38.120 25 130 2.600 13.000 13.000 10.400 10.400 49.555 168 694 12.783 58.508 48.757 39.006 35.105 195.021 * Prices and volumes could be correlated Copyright © Infineon Technologies 2006. All rights reserved. Page 33 “Financial @RISK” (2) Wafer costs are defined by a trend and a deviation over time using PERT distributions Yield Area Chip area is uncertain in the first year and kept for the next years Chip area distribution is negative correlated to yield II. CoS / Production Costs 03/04 Wafer Production (FAB) Costs per Wafer Most likely Change of most likely ("trend") Min in % w.r.t. most likely value Max in % w.r.t. most likely value Wafer diameter Chip area Min Most likely Max 2-May-07 €/wafer €/wafer % % % mm 2 mm 2 mm 2 mm 2 mm 1587 04/05 05/06 06/07 07/08 08/09 1460,04 1460,04 -8% 10% 10% 200 32 29 32 33 1343,24 1343,24 -8% 12% 12% 200 32 1235,78 1235,78 -8% 14% 14% 200 32 1136,92 1136,92 -8% 16% 16% 200 32 1045,96 1045,96 -8% 20% 20% 201 32 Copyright © Infineon Technologies 2006. All rights reserved. 09/10 962,29 962,29 -8% 25% 25% 202 32 10/11 885,30 885,30 -8% 30% 30% 203 32 Page 34 “Financial @RISK” (3) back Package costs and R&D costs are defined by their minimum, most likely and maximum values using PERT distributions Gross Margin calculation based on sampled data during simulation NPV and POP distributions are created V. EBIT, NPV & Payoff Period 03/04 Counter Years EBIT Cumulative EBIT Pay-off Year Discount Rate Pay-off period NPV NPV target 2-May-07 M€ M€ % yr M€ M€ 1 -10,10 -10,10 0 15% 04/05 2 -5,98 -16,08 0 05/06 3 -1,93 -18,01 0 06/07 4 1,75 -16,26 0 07/08 5 11,38 -4,88 0 08/09 6 6,61 1,73 6 09/10 7 10,66 12,38 0 10/11 8 8,75 21,13 0 6 1,81 2,00 Copyright © Infineon Technologies 2006. All rights reserved. Page 35 Risk Reporting principle Risk Identification Risk Analysis Risk Controlling Risk Handling Risk Report AIM Executive Board Risk Identification Risk Analysis Risk Controlling Risk Handling Risk Identification Risk Analysis Risk Controlling Risk Handling Risk Report COM Supervisory Board Shareholder Risk Report Summary Risk Report as part of “Management Disc.” Risk Report Infineon Risk Report as part of “20-F” Risk Reports Central Functions Central Risk Management 2-May-07 Copyright © Infineon Technologies 2006. All rights reserved. Page 36 “ROIMT2” 2-May-07 Copyright © Infineon Technologies 2006. All rights reserved. Page 37 Exported Risk Reports confidential Business Group: Period: IFX (AIM) 2005/07 - 2006/09 previous Report 2005/04 R-No. Cat Cross Ref. (1) (2) (3) 17862 18498 18460 1.4 3 4.2 RID Risks PL (4) (5) xx' Mio € Sales Risk Additional cost for xx project xy AIM MC AP Total Total RID O-No. Cat 17868 18558 7.1 2.2 18579 4 Total Total Cross Ref. Opportunities PL Net exchange rate effect Project win AIM PMD Various improvements (product mix) 32 FY Month of first rep. Measures (6) (7) (8) Impact on EBIT Probability R in FC, ytd. Impl. Status (12) (13) (10) (11) 05/06 2005/04 Improve xx 04/05 2004/07 Reduce efforts of xx 04/05 2003/10 reduce feature set -10,0 -5,0 -3,0 medium low very low 04/05 05/06 -8,0 -10,0 Month of first rep. Probability 05/06 2005/04 hedging 04/05 2004/04 Customer engagement xx Optimize product mix. 04/05 2004/04 Shrinks. 10,0 2,0 medium medium 2,0 medium 04/05 05/06 4,0 10,0 Measures Impact on EBIT Probability R in FC ytd. Impl. Status (17) (14) (15) (16) -5,0 medium -5,0 low -6,0 -6,0 -5,0 Impact on EBIT FY actual Report 2005/07 O in FC, ytd. Impl. Status 5,3 high -5,0 Impact on EBIT Probability O in FC ytd. 5,0 2,0 medium medium 5,0 5,3 Impl. Status high high 5,3 2,0 5,0 5,3 5,0 back 2-May-07 Copyright © Infineon Technologies 2006. All rights reserved. Page 38