Looking from the herd Do we love the wrong stories?

advertisement

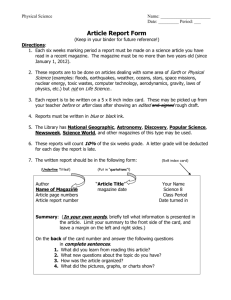

Looking from the herd Do we love the wrong stories? As a reaction to all the attention given to the economic crisis, one question for me is still not solved. Why did the press and business schools not warn us for an economic collapse? Didn’t they know? Or is the public not eager enough to be well informed and are we therefore deprived of a market for adequate news? And what lessons can we draw with the readers of Asset Magazine, most of them students in Business Administration at Tilburg University? TEXT: HENRI GEERTS & ANNEMARIE HINTEN A few days before New Years’ Eve, at a Christmas ball, I met a Japanese on far too much risk in the interests of trying to juice their profits” she woman who works for a huge bank in London. In between some dances writes. “Often one of the results of juiced profits is higher pay”. we had a conversation about the London public transport system in comparison to the subways in Tokyo (she tended to consider the one in And her own newspaper did not do that bad. In the five years before the London quite inferior). And she gave me a few insights in her work. She downfall of two Bear Stearns hedge funds that held a lot of mortgage- wrote a lot of documents before the financial crises started, about risks – backed securities in June 2007 the NYT published more than 100 articles too large risks. Risks involved in mortgage securitizations. Nobody in the including some version of the terms “collateralized debt obligation” or higher ranks of the bank read her work and the conclusions involved, very “securitization”. Some of these hinted at possible difficult times to come. carefully – so she told me. But none of these landed on the front-page. It is always nice to talk to a person who speaks with a dissonant voice And there were a lot of articles on the front page telling stories of the big about the vulnerabilities of the system we are in. Especially afterwards, financial firms: Bear Stearns, Citigroup, Goldman Sachs and all the others. when a crisis did become obvious… Without mentioning the grave risks these firms were taking. But before – that is different. And with good reasons as Gretchen Morgen- Things happened to look completely different in January 2009. But even son, a Pulitzer Prize-winning business columnist for The New York Times then, when there was a feeling of a serious crisis, most of the business explains: “So, as long as the stock market is going up, people don’t really editors in America would have stepped back if their reporters turned in pay attention to a lot of other things. The fact is many, many banks took copy that mentioned the word ‘depression’. At the beginning of 2010 we 34 Asset Magazine are all definitely optimistic again; so why mock just a year later, about What I would like to stress in this small essay is that news and papers are those editors who were afraid to let their reporters call the crisis, though not only about data and facts. We try to put data and facts together in a “unprecedented”, a depression? coherent and consistent meaningful entity: a story. Our culture is made It is important for people to remember that Krugman fulfills a far different role than the business reporter at a small paper. of the stories we tell and these stories fit in a culture. To be more aware From the start onwards, one of the more well-known commentators on and-concrete-world of real estate. In the field of economics the two best the crisis was professor Krugman. A recent Nobel Prize Winner who open- works of investigative journalism in the Netherlands are retrospective. ly stated: “This looks an awful lot like the beginning of a second Great These two stories are “De Prooi” i.e. the Prey written by Jeroen Smit and about knowing what is fundamental to an economic crisis, we need a cultural view on human behaviour – and misbehaviour. And to get a good grip on that we have to tell stories like historians. Trace back the trail from a certain point. For example, the implosion of one of our biggest banks, or the end of some criminal careers in the brick- Depression.” He was deeply convinced about the urgency of the situation. “De Vastgoedfraude” (real property fraud) by Vasco van der Boon and Ger- His character and moral values were quite obvious. And he considers ben van der Marel. himself a liberal intellectual. Which makes him deeply convinced of one fundamental truth: “So, all around, honesty is the best policy”, he stated, These are two wonderful books, about greed, about going for the top – “and if the truth is scary, so be it.” and ending up in jail. Maybe it is not possible to look into the future – but It is important for people to remember that Krugman fulfills a far different it is certainly important to be aware of the culture that carries our future. role than the business reporter at a small paper. He is a commentator, Read the papers, read the books. one of the few in the mainstream media, who has spent years delving deep into macroeconomic theory. His recent Nobel Prize in economics confirms his stature. And even if the public would not listen to him, the new Obama administration does. The quest for truth is the core business of journalism and science. And some of it might have political and economical influence. The Centre for Science and Values (CSV) explores the limits of science: where science meets moral issues, religious belief and social responsibility. It challenges people to discuss cultural and religious values, personal inspiration and fundamental presuppositions by organizing conferences, building networks and publishing articles. For the actual programme see www.uvt.nl/cwl Asset Magazine 35