Demand, price effects, income effects income effects

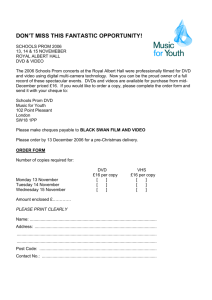

advertisement

Demand, price effects, income effects income effects Demand more ! 1 Demand • Back to preferences p • Price effects – Normal goods – Perfect complements – Perfect substitutes • Income effects Income effects – Normal goods – Giffen goods (?) • intervention • Observable implications 2 Price effects (for standard goods) Price effects (for standard goods) • ∂X(p,M)/ ∂p<0. (p, )/ p – Changes in demand with respect to own price is negative. • Elasticity ‐ (in this case its positive but it can be either greater or smaller than 1 ih ll h 1 • Who cares about this? – Consumer? – Producers? • Revenue – Government? • Think of taxes to discourage behavior • Think of taxes to raise revenue 3 Back to Cobb‐Douglas Back to Cobb Douglas u x, y x y 1 M (1 ) M X ( pX ) , Y pX pY 20 800 P elasticitiy dX/dp 15 10 600 400 5 200 0 0 0 50 100 150 200 250 Cobb-Douglass Cobb Douglass very practical because it’s a one parameter per good, constant elasticity demand curve. It a very good place to start. 300 ‐5 ‐200 ‐10 ‐400 4 y Decomposition into Substitution and Income Effects ff Substitution Effect Total or Observed Effect Income Eff t Effect x 5 Demand and Compensated demand • Cobb‐Douglas U u x, y x y 1 • Demand for good x is X(p,M). – Cobb‐Douglas bb l X ( pX , M ) M pX • e(p,u) is the expenditure function e(p u) is the expenditure function – minimum income to reach a given level of utility. – Min – Notice we get back the homothetic property (to double utility you must double expenditures) you must double expenditures) 6 Demand and Compensated demand Demand and Compensated demand M • Demand for good x Demand for good x X ( pX , M ) pX • e(p,u) Expenditure function • Compensated demand • So we can now find Slutzky So we can now find Slutzky’ss equation 7 Slutzky’ss equation Slutzky • Lets evaluate this Lets evaluate this 8 Pratical value of Slutzky’s equation • You can’t measure • So figuring out how to compensate people say for a sudden shock to heating oil…may be difficult. Except for Slutzky’s equation. • You can observe x* you can measure the total y effect and the income effect So you can figure out by the formula g y 9 Substitutes • Blu‐ray vs DVD • Blu‐ray is better but DVD is cheaper. They are used for Blu ray is better but DVD is cheaper They are used for the exact same thing. • Fix the price of DVD player $32 (amazon p p y ( sells a Sony y DVD • Assume rentals of disc cost the same (Netflix $2 more per month rather than 8.99, so we are not too far off) th th th 8 99 tt f ff) • Now lets worry about how to price a Blu‐ray player • Clearly if we sell it at $31, No one buys a DVD player . Clearly if we sell it at $31 No one buys a DVD player • Clearly if we sell it at $3000 on those who really care q y g g y about the increased quality are going to buy it. 10 Substitutes • So U(X, DVD, BR) where X depends on everything else BR is whether one has Blu‐ray and DVD is y whether one has DVD. y , • Because they are substitutes no one wants both, for now assume they are a small part of the budget. So we can simply consider that choice • U(BR,DVD)= DVD+αBR – What do indifference curves look like? • Max U(BR,DVD)= DVD+αBR sbjt to PD DVD+PBBR<M So buy Blu‐ray if PB<αPD 11 Consumer choice BR Budget set when BR is expensive Budget set when BR is Cheap Indifference curves Slope -1/α DVD 12 Individual Demand PBR QBR Buy Blu-ray Blu ray α*31 *31 1 Buy DVD 31 α*31 PBR 1 QBR 13 Aggregte Demand PBR Customers with α>10 310 Customers with α=1 31 BR 14 Complements • Normal goods ∂X/∂p g / px<0, ∂X/∂p , / py≥0 • Substitutes goods changes are non linear • Complements goods ∂X/∂px<0, ∂X/∂py<0 • Example DVD players and DVD rentals – U=(DVD, DISC)= DVD*DISC – But does that quite capture the idea? • Strict complement X=βY Strict complement X=βY – So by definition ∂X/∂px = β∂Y/∂px <0 – and ∂X/∂py = β∂Y/∂py<0 15 Summary of Price effects Summary of Price effects • Expect own price effect to be negative Expect own price effect to be negative • Expect responses to other prices to vary quite a bit – Some Some cases you buy more (because this good has become cases you buy more (because this good has become relatively cheaper) – Some cases you buy less (because you need to reallocate to afford the complement). ff d h l ) • Figuring these characteristics of demand is critical for businesses and government businesses and government • The other argument from the budget set is income. 16 Income effect Income effect • Normal goods ∂X/∂M>0, Normal goods ∂X/∂M>0 • Inferior goods ∂X/∂M<0, • Standard empirical case S d d ii l – Up to some income M ∂X/∂M>0, then past M ∂ /∂ ∂X/∂M<0, as you switch to higher quality goods. h h h l d 17 Demand for calories as calories as function of income Trevon Logan JEH Logan JEH 2007 These are annual per person 13=442 000 calories 13=442.000 calories a year (1212 year) Range 12=572/day 14 3300/d 14=3300/day 18 From Logan JEH 2009, Note that this elasticity is declining over time So there is both cross sectional Note that this elasticity is declining over time. So there is both cross sectional and time variation 19 Energy consumption and Birth rates over time 70 60 50 40 30 20 10 0 0 1000 2000 1956 1986 Poly. (1976) 3000 4000 5000 1966 1996 Poly. (1996) 6000 7000 8000 9000 10000 11000 1976 Poly. (1956) 20 Income Effect Income Effect • Engel Engel curve traces consumption as income curve traces consumption as income rises y x 21 Inferior Good Inferior Good y x 22 Intertemporal Choice Intertemporal Choice • First two slides from last time First two slides from last time • u(x1, x2) = v(x1) + v(x2) • Budget (1+r)x d ( ) 1 + x2 = (1+r)M ( ) 1 + M2 • FOC 0 v ( x1 ) (1 r )v x 2 23 Intertemporal Optimization Intertemporal Optimization x2 In this case you are poor when young rich when old (M1,M M2) Repayment Period 1 B Borrowing i x1 24 Interest Rate Increase Borrower’s Income Falls x2 (M1,M2) x1 25 Interest Rate Increase Creditor’s Income Rises x2 (M1,M2) x1 26 Neither Borrower Nor Lender Be Differences in Borrowing/Lending Rates x2 (M1,M2) x1 27 100% propensity to consume 100% propensity to consume x2 ((M1,,M2) x1 28 Conclusion From Week 2 Conclusion From Week 2 • Demand framework useful for a variety of purposes y p p • We did the basics – No asymmetric information (you always know everything about the market and the goods) b h k d h d) – No risk (you are sure what you want and what you get) – Continuity Continuity – NO TRANSACTION COSTS • More of this in most Econ classes – But EC121ab, EC 106 come back heavily to those topics 29