Document 10311044

advertisement

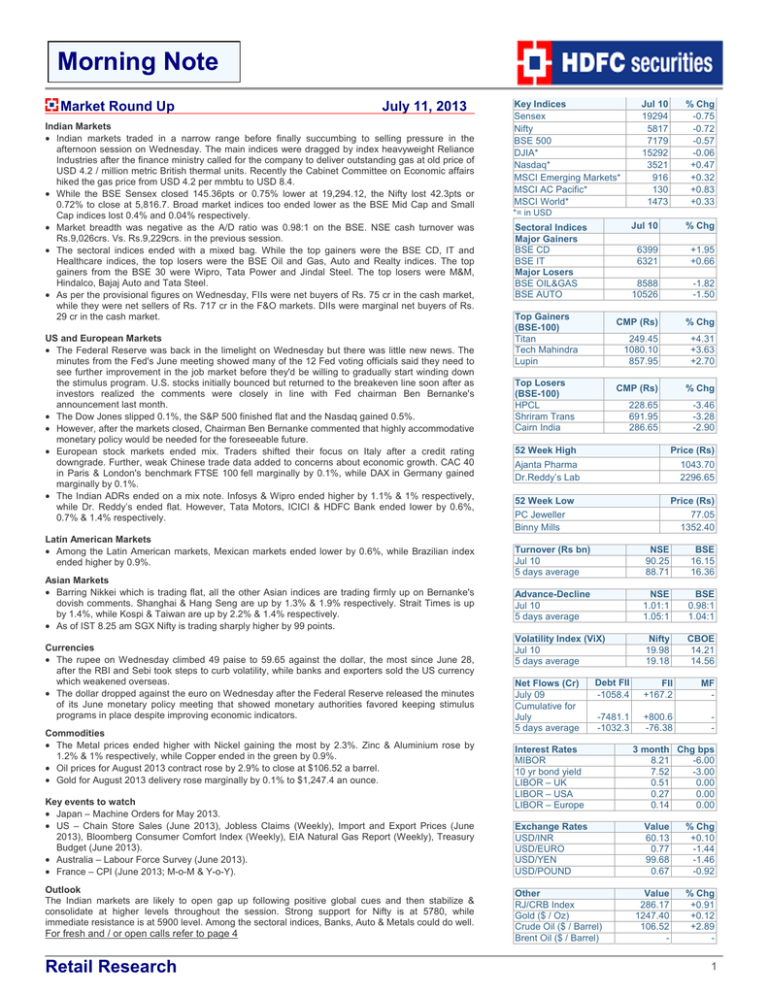

Morning Note Market Round Up July 11, 2013 Indian Markets • Indian markets traded in a narrow range before finally succumbing to selling pressure in the afternoon session on Wednesday. The main indices were dragged by index heavyweight Reliance Industries after the finance ministry called for the company to deliver outstanding gas at old price of USD 4.2 / million metric British thermal units. Recently the Cabinet Committee on Economic affairs hiked the gas price from USD 4.2 per mmbtu to USD 8.4. • While the BSE Sensex closed 145.36pts or 0.75% lower at 19,294.12, the Nifty lost 42.3pts or 0.72% to close at 5,816.7. Broad market indices too ended lower as the BSE Mid Cap and Small Cap indices lost 0.4% and 0.04% respectively. • Market breadth was negative as the A/D ratio was 0.98:1 on the BSE. NSE cash turnover was Rs.9,026crs. Vs. Rs.9,229crs. in the previous session. • The sectoral indices ended with a mixed bag. While the top gainers were the BSE CD, IT and Healthcare indices, the top losers were the BSE Oil and Gas, Auto and Realty indices. The top gainers from the BSE 30 were Wipro, Tata Power and Jindal Steel. The top losers were M&M, Hindalco, Bajaj Auto and Tata Steel. • As per the provisional figures on Wednesday, FIIs were net buyers of Rs. 75 cr in the cash market, while they were net sellers of Rs. 717 cr in the F&O markets. DIIs were marginal net buyers of Rs. 29 cr in the cash market. US and European Markets • The Federal Reserve was back in the limelight on Wednesday but there was little new news. The minutes from the Fed's June meeting showed many of the 12 Fed voting officials said they need to see further improvement in the job market before they'd be willing to gradually start winding down the stimulus program. U.S. stocks initially bounced but returned to the breakeven line soon after as investors realized the comments were closely in line with Fed chairman Ben Bernanke's announcement last month. • The Dow Jones slipped 0.1%, the S&P 500 finished flat and the Nasdaq gained 0.5%. • However, after the markets closed, Chairman Ben Bernanke commented that highly accommodative monetary policy would be needed for the foreseeable future. • European stock markets ended mix. Traders shifted their focus on Italy after a credit rating downgrade. Further, weak Chinese trade data added to concerns about economic growth. CAC 40 in Paris & London's benchmark FTSE 100 fell marginally by 0.1%, while DAX in Germany gained marginally by 0.1%. • The Indian ADRs ended on a mix note. Infosys & Wipro ended higher by 1.1% & 1% respectively, while Dr. Reddy’s ended flat. However, Tata Motors, ICICI & HDFC Bank ended lower by 0.6%, 0.7% & 1.4% respectively. Latin American Markets • Among the Latin American markets, Mexican markets ended lower by 0.6%, while Brazilian index ended higher by 0.9%. Asian Markets • Barring Nikkei which is trading flat, all the other Asian indices are trading firmly up on Bernanke's dovish comments. Shanghai & Hang Seng are up by 1.3% & 1.9% respectively. Strait Times is up by 1.4%, while Kospi & Taiwan are up by 2.2% & 1.4% respectively. • As of IST 8.25 am SGX Nifty is trading sharply higher by 99 points. Currencies • The rupee on Wednesday climbed 49 paise to 59.65 against the dollar, the most since June 28, after the RBI and Sebi took steps to curb volatility, while banks and exporters sold the US currency which weakened overseas. • The dollar dropped against the euro on Wednesday after the Federal Reserve released the minutes of its June monetary policy meeting that showed monetary authorities favored keeping stimulus programs in place despite improving economic indicators. Commodities • The Metal prices ended higher with Nickel gaining the most by 2.3%. Zinc & Aluminium rose by 1.2% & 1% respectively, while Copper ended in the green by 0.9%. • Oil prices for August 2013 contract rose by 2.9% to close at $106.52 a barrel. • Gold for August 2013 delivery rose marginally by 0.1% to $1,247.4 an ounce. Key events to watch • Japan – Machine Orders for May 2013. • US – Chain Store Sales (June 2013), Jobless Claims (Weekly), Import and Export Prices (June 2013), Bloomberg Consumer Comfort Index (Weekly), EIA Natural Gas Report (Weekly), Treasury Budget (June 2013). • Australia – Labour Force Survey (June 2013). • France – CPI (June 2013; M-o-M & Y-o-Y). Outlook The Indian markets are likely to open gap up following positive global cues and then stabilize & consolidate at higher levels throughout the session. Strong support for Nifty is at 5780, while immediate resistance is at 5900 level. Among the sectoral indices, Banks, Auto & Metals could do well. For fresh and / or open calls refer to page 4 Retail Research Key Indices Sensex Nifty BSE 500 DJIA* Nasdaq* MSCI Emerging Markets* MSCI AC Pacific* MSCI World* Jul 10 19294 5817 7179 15292 3521 916 130 1473 % Chg -0.75 -0.72 -0.57 -0.06 +0.47 +0.32 +0.83 +0.33 *= in USD Jul 10 % Chg 6399 6321 +1.95 +0.66 8588 10526 -1.82 -1.50 CMP (Rs) % Chg 249.45 1080.10 857.95 +4.31 +3.63 +2.70 CMP (Rs) % Chg 228.65 691.95 286.65 -3.46 -3.28 -2.90 Sectoral Indices Major Gainers BSE CD BSE IT Major Losers BSE OIL&GAS BSE AUTO Top Gainers (BSE-100) Titan Tech Mahindra Lupin Top Losers (BSE-100) HPCL Shriram Trans Cairn India 52 Week High Ajanta Pharma Dr.Reddy’s Lab Price (Rs) 1043.70 2296.65 52 Week Low PC Jeweller Binny Mills Price (Rs) 77.05 1352.40 Turnover (Rs bn) Jul 10 5 days average NSE 90.25 88.71 BSE 16.15 16.36 Advance-Decline Jul 10 5 days average NSE 1.01:1 1.05:1 BSE 0.98:1 1.04:1 Volatility Index (ViX) Jul 10 5 days average Nifty 19.98 19.18 CBOE 14.21 14.56 Net Flows (Cr) July 09 Cumulative for July 5 days average Debt FII -1058.4 FII +167.2 MF - -7481.1 -1032.3 +800.6 -76.38 - Interest Rates MIBOR 10 yr bond yield LIBOR – UK LIBOR – USA LIBOR – Europe Exchange Rates USD/INR USD/EURO USD/YEN USD/POUND Other RJ/CRB Index Gold ($ / Oz) Crude Oil ($ / Barrel) Brent Oil ($ / Barrel) 3 month Chg bps 8.21 -6.00 7.52 -3.00 0.51 0.00 0.27 0.00 0.14 0.00 Value 60.13 0.77 99.68 0.67 % Chg +0.10 -1.44 -1.46 -0.92 Value 286.17 1247.40 106.52 - % Chg +0.91 +0.12 +2.89 - 1 News Flash July 11 2013 Economy News • Government plans to announce the long-awaited mergers and acquisitions guidelines by this month end, paving the way for consolidation in the telecom sector. For forthcoming Board Meeting on Jul 12, 2013 click on the following link http://www.bseindia.com/mktlive/board_meeting.asp#1 • Factory production growth probably eased to a three-month low in May dampened by weak infrastructure sector output, as weak global demand and consumption weigh on a recovery in Asia's third-largest economy. • The International Monetary Fund (IMF) lowered growth forecast for India for the current fiscal and warned emerging economies face a longer growth slowdown and the euro zone a protracted recession. Corporate News • Tata Steel India reported over 26% jump in sales at 2.005 million tonnes (MT) in the first quarter of this fiscal ended June 30. • IndusInd Bank reported nearly 42% rise in net profit at Rs 334.84 crore for the first quarter ended June 30. • Malaysia's Petronas is in talks to sell 10 percent of its Canadian shale gas assets to Indian Oil Corp, mirroring a deal it signed earlier this year with a Japanese company. • After power plants, LPG producing units are the latest to face complete stoppage of natural gas supplies from Reliance Industries' KG-D6 block after output from the eastern offshore fields dropped to an all-time low. • In the first rumbling against India's most expensive LNG deal ever, GAIL has demanded renegotiation of price of gas from Australia's Gorgon project. • JSPL is in talks with global steel trader Stemcor for buying their pellet unit in Odisha, Global steel trading giant, Stemcor, which owns 80% stake in the unit along with an Indian promoter which owns 20% stake, is expecting a valuation of $300 million. Bulk Deals Scrip Name Quantity (in lakhs) Fund Name Aagam Cap Parikh Herbals Price +1.05 MONO HERBICIDES PVT. LTD. -6.00 CHP FINANCE PRIVATE LIMITED 100.95 25.45 Key Corporate Action SCRIP NAME ANDHRA BANK AUTOMOTIVE BIOCON LTD CINEMAX DFM FOODS ELF Trading EMPIRE IND JYOTI STRUCTURE KARUR VYSYA BANK KOVAI MEDICAL LARSEN & TOUBRO MAHINDRA HOLIDAY MAHINDRA FORGING MAHINDRA LIFE PIRAMAL GLASS RANE MADRAS RK FORGING RPG LIFESCIENCE SAINT GOBAIN SHANTI GEAR THERMAX LTD THINKSOFT UNICHEM LAB V GUARD INDS VATECH WABA WPIL LTD Retail Research BC/RD BC BC BC BC BC BC BC BC BC BC RD BC BC BC BC BC BC BC BC BC BC BC BC BC BC BC BC/RD FROM 15/07/2013 13/07/2013 13/07/2013 15/07/2013 15/07/2013 13/07/2013 13/07/2013 15/07/2013 15/07/2013 13/07/2013 13/07/2013 13/07/2013 15/07/2013 15/07/2013 15/07/2013 13/07/2013 13/07/2013 15/07/2013 15/07/2013 13/07/2013 15/07/2013 15/07/2013 15/07/2013 13/07/2013 13/07/2013 15/07/2013 EX-DATE 11/07/2013 11/07/2013 11/07/2013 11/07/2013 11/07/2013 11/07/2013 11/07/2013 11/07/2013 11/07/2013 11/07/2013 11/07/2013 11/07/2013 11/07/2013 11/07/2013 11/07/2013 11/07/2013 11/07/2013 11/07/2013 11/07/2013 11/07/2013 11/07/2013 11/07/2013 11/07/2013 11/07/2013 11/07/2013 11/07/2013 PURPOSE A.G.M., 50% Dividend A.G.M A.G.M., 50% Special Dividend, 100% Dividend A.G.M A.G.M., 25% Dividend A.G.M., 20% Final Dividend A.G.M., 240% Dividend A.G.M., 40% Dividend A.G.M., 140% Dividend A.G.M., 15% Dividend 1:2 Bonus Issue A.G.M., 40% Dividend A.G.M A.G.M., 60% Dividend A.G.M., 10% Dividend A.G.M., 50% Dividend A.G.M., 10% Dividend A.G.M., 15% Dividend A.G.M A.G.M., 60% Dividend A.G.M., 350% Dividend A.G.M., 30% Final Dividend A.G.M., 225% Dividend A.G.M., 35% Final Dividend A.G.M., 350% Dividend A.G.M., 20% Dividend 2 Stock Ideas July 11, 2013 Update of Index Future Calls: Date 10-Jul-13 10-Jul-13 9-Jul-13 9-Jul-13 9-Jul-13 8-Jul-13 8-Jul-13 B/S B B B S S B B Positional Call Bank Nifty Fut Bank Nifty Fut Bank Nifty Fut Nifty July Fut Bank Nifty Fut Bank Nifty Fut Bank Nifty Fut Entry at Sloss 11395.0 11330.0 11501.0 11455.0 11436.0 11380.0 5847.4 5880.0 11480.0 11550.0 11280.45 11236.0 11226.65 11149.0 Exit Price / Targets CMP Exit Date 11600.0 11355.0 11600.0 11549.0 10-Jul-13 11550.0 11487.0 9-Jul-13 5770.0 5824.6 10-Jul-13 11350.0 11426.7 9-Jul-13 11400.0 11368.0 8-Jul-13 11400.0 11266.0 8-Jul-13 % G/L Comments -0.4 Hold 0.4 Premature Profit Booked 0.4 Premature Profit Booked 0.4 Premature Profit Booked 0.5 Premature Profit Booked 0.8 Premature Profit Booked 0.4 Premature Profit Booked Time Horizon 2-3 days 2-3 days 2-3 days 1-5 days 2-3 days 2-3 days 2-3 days Abs. Avg. Gain/L Entry oss 11395.0 -40.0 11501.0 48.0 11436.0 51.0 5847.4 22.8 11480.0 53.3 11280.5 87.5 11226.7 39.4 Time Horizon 7 days 2-3 days 5 days 2 days 3-5 days 3-5 days 3-5 days 3-5 days 1-5 days 3 days 3-5 days 3-5 days 3-5 days 5 days 3 days 3 days 3-5 days 2 days 3 days 1-5 days Avg. Abs. Entry Gain/Loss 23.1 -2.6 1.0 -0.2 4.1 -0.5 44.7 -9.7 8.3 0.1 4.0 1.0 8.4 2.5 13.0 5.0 3.1 -1.0 10.5 -3.5 20.3 0.5 15.5 4.9 51.0 -10.0 2.2 1.1 6.9 -3.7 12.1 2.5 17.8 -5.8 9.1 -4.1 3.2 -0.2 28.5 -7.7 Update of Stock and Nifty Options Calls: Date 10-Jul-13 10-Jul-13 9-Jul-13 9-Jul-13 8-Jul-13 5-Jul-13 5-Jul-13 5-Jul-13 5-Jul-13 4-Jul-13 4-Jul-13 4-Jul-13 4-Jul-13 4-Jul-13 3-Jul-13 3-Jul-13 3-Jul-13 2-Jul-13 2-Jul-13 2-Jul-13 B/S Positional Call B ICICI Bank 1060 Call Option B JP Associates 60 Call Option B IDFC 130 Call Option B SBI 1950 Call Option B Tata Motors 280 Put Option B IB Real Estate July 65 Put Option B DLF July 180 Put Option B HUL July 610 Put Option B JP Associates July 55 Call option B Titan 225 Put Option B Yes Bank July 470 Call Option B Canara Bank July 350 Call Option B SBI July 1850 Put Option B Dena Bank 64 Put Option B Karnataka Bank 110 Put Option B Titan 225 Put Option B Reliance Ind July 840 Put Option B RCOM 130 Put Option B Apollo Tyres 62.5 Call Option B ICICI Bank July 1100 Call Option Entry at Sloss Targets 23.1 17.0 50.0 1.0 0.5 2.5 4.1 2.0 8.0 44.7 35.0 70.0 8.3 5.0 16.0 4.0 2.5 8.0 8.4 5.3 15.0 13.0 8.5 25.0 3.1 2.1 5.5 10.5 7.0 20.0 20.25 12.5 40.0 15.5 10.0 30.0 50.95 35.0 85.0 2.2 1.0 5.0 6.9-4 2.0 12.0 12.35-8 7.0 20.0 18.6-13.5 12.0 35.0 9.2-7 5.0 17.0 3.25-2 1.0 6.0 26-29.7 20.8 50.0 Exit Price / CMP Exit Date 20.5 0.8 3.7 35.0 10-Jul-13 8.5 5.0 8-Jul-13 10.9 5-Jul-13 18.0 5-Jul-13 2.1 8-Jul-13 7.0 8-Jul-13 20.8 5-Jul-13 20.4 4-Jul-13 41.0 4-Jul-13 3.3 4-Jul-13 3.2 9-Jul-13 14.6 3-Jul-13 12.0 5-Jul-13 5.0 8-Jul-13 3.0 20.8 5-Jul-13 % G/L Comments -11.3 Hold -15.8 Hold -11.0 Hold -21.7 Stop Loss Triggered 1.8 Hold 23.8 Premature Profit Booked 29.9 Premature Profit Booked 38.5 Premature Profit Booked -32.3 Stop Loss Triggered -33.3 Stop Loss Triggered 2.5 Premature Exit 31.6 Premature Profit Booked -19.5 Premature Exit 50.0 Premature Profit Booked -53.6 Premature Exit 20.7 Premature Profit Booked -32.6 Stop Loss Triggered -45.1 Stop Loss Triggered -4.8 Hold -27.0 Stop Loss Triggered Update of Intra Day / BTST / STBT/Futures Calls: Date 10-Jul-13 9-Jul-13 8-Jul-13 4-Jul-13 B/S B B B B Trading Call Lupin Oriental Bank United Phosphorous TCS Entry at Sloss 854.0 836.0 204.4 197.0 137.2 134.9 1534 1505.0 Targets 890.0 220.0 142.0 1595.0 Exit Price / CMP Exit Date 860.9 204.9 10-Jul-13 137.5 9-Jul-13 1558.0 5-Jul-13 % G/L Comments 0.8 Hold 0.2 Premature Exit 0.2 Premature Profit Booked 1.6 Premature Profit Booked Time Horizon 1 day 1-5 days 1 day 1 day Abs. Avg. Gain/L Entry oss 854.0 6.9 204.4 0.4 137.2 0.3 1534.0 24.0 Update of Trading/BTST/Futures Calls: Date 10-Jul-13 10-Jul-13 10-Jul-13 9-Jul-13 9-Jul-13 9-Jul-13 9-Jul-13 9-Jul-13 9-Jul-13 9-Jul-13 8-Jul-13 8-Jul-13 5-Jul-13 5-Jul-13 4-Jul-13 4-Jul-13 4-Jul-13 4-Jul-13 3-Jul-13 2-Jul-13 B/S Positional Call B Bajaj Financial Services B Sonata Software B Jai Corp B IDBI B Reliance Infra Fut B Titan Industries B SKS Micro Finance S Adani Ent Fut B Tilaknagar Industries B Anantraj Industries B PFC B Dishman Pharma B SBI B Uttam Steel B DLF B Autoline Industries S Raymond Fut B Polaris S Petronet Fut B TTK Healtcare Retail Research Entry at Sloss Targets 646.0 625.0 690.0 30.7 28.9 34.0 48.1 46.0 52.0 72.8 70.0 79.0 379.9 365.0 410.0 238.1 234.5 245.0 109.85 105.8 118.0 205.15 210.1 196.0 51.25 48.8 54.5 51.75 50.0 56.0 137.45 134.0 142.0 57.55 54.0 61.0 1916.8 1870.0 2015.0 59.7 57.3 65.0 180.25 176.5 189.0 73-77 72.0 86.0 237.5 248.0 215.0 116.75 110.0 126.0 122-125 128.0 110.0 510-520 500.0 570.0 Exit Price / CMP Exit Date 662.0 10-Jul-13 29.0 10-Jul-13 47.3 72.9 10-Jul-13 374.2 244.5 10-Jul-13 106.5 200.3 9-Jul-13 53.4 10-Jul-13 54.4 9-Jul-13 141.0 9-Jul-13 60.8 10-Jul-13 1870.0 8-Jul-13 57.3 8-Jul-13 176.5 4-Jul-13 79.4 4-Jul-13 234.5 8-Jul-13 110.9 8-Jul-13 127.0 5-Jul-13 524.1 9-Jul-13 % G/L Comments 2.5 Premature Profit Booked -5.5 Premature Exit -1.8 Hold 0.1 Premature Exit -1.5 Hold 2.7 Premature Profit Booked -3.0 Hold 2.4 Premature Profit Booked 4.2 Premature Profit Booked 5.1 Premature Profit Booked 2.5 Premature Profit Booked 5.6 Premature Profit Booked -2.4 Stop Loss Triggered -4.1 Stop Loss Triggered -2.1 Stop Loss Triggered 3.3 Premature Profit Booked 1.3 Premature Profit Booked -5.0 Premature Exit -3.7 Premature Exit 1.2 Premature Profit Booked Time Avg. Abs. Horizon Entry Gain/Loss 3-5 days 646.0 16.0 3-5 days 30.7 -1.7 2-3 days 48.1 -0.9 3-5 days 72.8 0.1 1-5 days 379.9 -5.7 2-3 days 238.1 6.3 3-5 days 109.9 -3.3 2-3 days 205.2 4.8 2-3 days 51.3 2.2 3-5 days 51.8 2.7 2-3 days 137.5 3.5 2-3 days 57.6 3.3 1-5 days 1916.8 -46.8 3-5 days 59.7 -2.5 2-3 days 180.3 -3.8 2-3 days 76.9 2.5 1-5 days 237.5 3.0 2-3 days 116.8 -5.8 1-5 days 122.3 -4.8 1-5 days 517.7 6.4 3 Daily Leverage July 11, 2013 Nifty Spot with Nifty Near Month Fut and Nifty Fut OI 1,00,000 Units Nifty Spot (L.H.S) Futures OI (R.H.S) Futures Near (R.H.S) Market Wrap & Outlook Markets traded in a narrow range before finally succumbing to selling pressure in the afternoon session. There was a build up of short positions as Nifty Fut OI increased by 3,977 contracts and the Nifty July Fut premium narrowed to 5.35pts. FIIs were unwinding their longs as they were net sellers to the tune of 173crs. in the index fut segment and their OI declined. Nifty IV increased to 20.29% while Nifty OI PCR gave weak signals as it slid to 1.23. In the index option segment, maximum OI continues to be seen in the 6000 calls and 5600 puts indicating this remains the expected trading range. Unwinding was seen in the 5800 calls and 5500-5400 puts. Technically, the Nifty could remain stuck within the 5760-5900 levels for the near term. Nifty Synopsis Nifty Index 10-Jul-13 Nifty Near Basis C-o-C Fut(OI)* Fut(Vol)* Fut(Vol)** OI/Vol * - contracts 5,816.70 5.35 2.24 349,988 212,133 6,206.65 1.65 ** - Crores Nifty Sentiment Indicators PCR OI 1.23 PCR Vol 1.12 IV Call 18.74 IV Put 21.84 21.21 Hist.Vot 9-Jul-13 8-Jul-13 5,859.00 9.35 3.64 346,011 186,593 5,470.66 1.85 5,811.55 17.70 6.54 331,997 270,759 7,862.64 1.23 1.31 1.10 18.11 21.48 20.75 1.32 1.00 18.26 21.41 20.65 3-Jul-13 5,770.90 -3.05 -0.88 324,779 266,826 7,712.04 1.22 1.19 1.00 17.14 19.46 26.15 12-Jun-13 Last Expiry Chg (T -(T-1)) 5,760.20 11.70 4.94 325,031 291,420 8,422.19 1.12 5,682.35 1.55 1.08 255,858 664,725 18,830.60 0.38 -42.30 -4.00 -1.65 3,977 25,540 735.99 -0.20 -0.72 -42.79 -42.36 1.15 13.69 13.45 -11.03 -0.08 0.03 0.63 0.35 0.46 -6.23 2.47 3.49 1.65 2.21 0.96 0.91 18.86 19.10 12.61 1.24 1.11 16.65 19.48 22.28 Chg (T -(T-1)) % Index Snapshots 10-Jul-13 10-Jul-13 OI (Cont) Index Auto Oil & Gas OI (Cont) 10-Jul-13 Vol (Crs.) 9-Jul-13 10-Jul-13 Vol (Crs.) OI (Crs) 9-Jul-13 OI (Crs.) Vol (Cont) 887.00 0.00 0.00 6.00 160.00 0.00 0.00 24.00 1,385.00 0.00 0.00 71.00 957.00 0.00 0.00 71.00 36.49 0.00 0.00 0.19 6.58 0.00 0.00 0.78 57.02 0.00 0.00 2.30 39.37 0.00 0.00 2.31 0.00 78,570.00 123.00 1.00 63,151.00 81.00 1,003.00 55,991.00 279.00 1,003.00 54,301.00 266.00 0.00 2,256.14 4.11 0.03 1,808.75 2.70 28.96 1,594.43 9.33 28.96 1,559.05 8.84 Sectoral Build up Sector 9-Jul-13 Vol (Cont) S&P500 CNXINFRA CNXPSE FTSE100 NFTYMCAP50 BANKNIFTY CNXIT 9-Jul-13 Price Price Volume Volume %Chg %Chg 1,646.75 0.08 887 454.38 901.90 -2.54 6,906 30.77 297.65 -2.02 4,601 52.10 Retail Research OI 1,385 10,310 9,286 Sectoral Unwinds OI Price Price %Chg %Chg Sector 44.72 Retail 886.60 -0.90 377.55 -1.31 15.20 Banking & Finance Power 375.40 -1.51 8.41 Utilities Volume %Chg 2,709 21.64 17,027 -13.25 10,335 -2.15 Volume OI OI %Chg 1,667 -12.31 8,348 -9.26 5,368 -8.10 Institutional Flows (Rs.Crs.) as On 10-07-2013 Institutional flows Stock Opt Cash Mutual Fund Cash -172.88 236.09 -651.30 -128.82 0.00 0.00 339.28 10,609.76 10,616.30 -371.32 27,226.77 27,401.69 659.68 48,623.21 47,782.84 -63.19 2,054.18 1,803.40 167.20 0.00 -6.54 -174.92 840.37 250.78 Net Buy (10 - Jul) Net Buy (9 - Jul) OI (10 - Jul) OI (9 - Jul) FII Index Opt Stock Fut Index Fut Chg in OI Vol and OI Analysis 10-Jul-13 Vol Breakup Index Fut Stock Fut Index Opt Stock Opt Total 8,503.58 13,755.40 76,791.00 9,781.10 108,831.08 OI Breakup (In cr.) 10-Jul-13 Index Fut Stock Fut Index Opt Stock Opt Total 11,885.12 28,458.21 58,862.90 11,413.11 110,619.34 9-Jul-13 8-Jul-13 3-Jul-13 7,289.49 9,906.39 9,712.27 12,834.42 13,765.30 15,083.53 60,952.33 84,662.22 77,943.17 7,969.87 9,070.25 8,216.64 89,046.11 117,404.16 110,955.61 9-Jul-13 8-Jul-13 11,795.72 11,258.09 28,701.11 28,109.36 57,999.94 56,563.13 9,396.04 10,248.68 108,745.44 105,326.61 TITAN TECHM TATAGLOBAL HCLTECH Price % Chg 4.60 3.51 2.76 2.05 OPTOCIRCUI JPPOWER IGL ASHOKLEY 10,943.43 26,629.57 49,524.17 7,172.90 94,270.07 10,999.13 29,635.20 68,104.89 10,239.90 118,979.12 8,626.25 24,002.19 35,892.67 3,156.25 71,677.36 Chg (T -(T-1)) Chg (T -(T-1)) % 1,214.09 920.98 15,838.67 1,811.23 19,784.97 16.66 7.18 25.99 22.73 72.54 Chg (T-(T-1)) 89.40 -242.90 862.96 1,164.44 1,873.90 Chg (T-(T-1)) % 0.76 -0.85 1.49 11.36 12.76 Stocks With Negative Bias OI % Chg 2.31 1.73 2.63 7.49 Vol % Chg 38.07 97.43 45.96 15.12 DelVol % Chg 29.50 260.22 28.52 64.92 Scrip HINDPETRO TATAMTRDVR BPCL NHPC Price % Chg -3.50 -3.26 -3.05 -2.65 OI % Chg 7.00 5.54 4.52 0.99 Vol % Chg 63.30 160.38 13.74 147.83 DelVol % Chg 97.83 64.31 8.25 8.06 Lowest C-O-C Cash Futures C-O-C% 22.80 16.65 279.90 18.40 22.95 16.75 281.55 18.50 16.01 14.61 14.34 13.22 Most Active Nifty Options (Contracts) Retail Research 23,236.50 34,736.11 237,079.33 10,760.35 305,812.28 12-Jun-13 Last Expiry Highest C-O-C Scrip 11,369.47 14,908.29 112,123.39 7,712.90 146,114.06 Last Expiry 3-Jul-13 Stocks With Positive Bias Scrip 12-Jun-1 3 Scrip Cash ANDHRABANK JSWENERGY TATASTEEL MCLEODRUSS 85.90 45.05 256.20 280.20 Futures 80.95 43.25 248.80 273.45 C-O-C% -140.22 -97.23 -70.28 -58.62 Most Active Stock Options (Contracts) Call Options Scrip UNITECH RCOM IFCI Put Options Strike Vol OI Chg In OI 23 150 30 954 2,370 1,261 1,113 935 909 31 74 1 Scrip JPASSOCIAT RCOM UNITECH Strike Vol OI Chg In OI 50 598 1,037 87 130 1,151 703 13 20 202 486 2 Nifty Spot with IV and HV Nifty Spot (L.H.S) Nifty IV (R.H.S) Most Active Near Month Futures Scrip JPASSOCIAT UNITECH IFCI GMRINFRA RENUKA Derivatives Research Nifty HV (R.H.S) Above Average Deliveries OI Chg In OI(%) 13,703 9,044 6,766 6,171 4,473 -1.45 0.40 -2.80 0.02 -1.00 Scrip HDFC BHARATFORG EXIDEIND HINDUNILVR POWERGRID Price % Chg %Del 5DMA 827.50 216.75 121.90 594.95 108.15 -0.31 -0.09 -0.57 -1.65 -1.55 84.12 83.83 81.68 78.50 77.12 75.89 52.38 63.82 63.38 73.63 Email: Primer of terms used:Open Interest (OI) - The total number of futures and/or options contracts that are open, undelivered or unsettled on a particular day. Basis - The difference between the futures price and the spot price of the underlying expressed in terms of basis points i.e. bps.Put Call Ratio (PCR) -.The ratio of the trading volume or OI of put optionsto call options. A high volume of puts compared to calls indicates a bearish sentiment in the market and vise-versa.Cost of Carry (CoC) - It explains the relationship between the futures price and the spot price. It can be defined as interest + storage cost - income earned.It is calculated as an annualised percentage. Implied Volatility (IV) Implied volatility (IV) measures the market's expected best guess of future volatility of the underlying. It is calculated using the market price of an option, along with other inputs used in price models, and then solving for volatility.Historical Volatility (HV) - The realized volatility of the underlying over a given time period. It can be calculated simply by taking the past prices and price changes (from close to close), then taking an average of those price changes in percentage terms over a period of time, and subtracting the daily percentage price changes from this average change to derive deviations from the daily average change for a period. Moving Average - The average price of a security over a specified time period (the most common being 5,13, 34, 89 and 200 days), used in order to spot pricing trends by flattening out large fluctuations." HDFC Securities Limited, I Think Techno Campus, Building -B, ”Alpha”, Office Floor 8, Near Kanjurmarg Station, Opp. Crompton Greaves, Kanjurmarg (East),Mumbai 400 042. Disclaimer: This document has been prepared by HDFC Securities Limited and is meant for sole use by the recipient and not for circulation. This document is not to be reported or copied or made available to others.It should not be considered to be taken as an offer to sell or a solicitation to buy any security. The information contained herein is from sources believed reliable.We do not represent that it is accurate or complete and it should not be relied upon as such. We may have from time to time positions or options on, and buy and sell securities referred to herein. We may from time to time solicit from, or perform investment banking, or other services for, any company mentioned in this document. This report is intended for Retail Clients only and not for any other category of clients, including, but not limited to, Institutional Clients. Retail Research