Chapter 12 Stockholders Equity Stock and Treasury Stock Transactions

advertisement

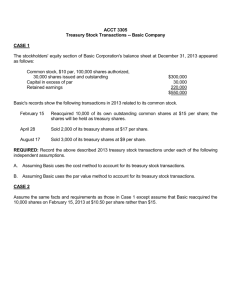

Chapter 12 Stockholders Equity Stock and Treasury Stock Transactions E12-3, E12-5, E12-6, E12-9 E12-3 Authorizing and Issuing Stock Prepare entries for each event: 1. Authorized to issue: (a) 100,000 shares of $100 par value , 8% preferred stock (b) 150,000 shares of no-par, $5 preferred stock; and (c) 250,000 shares of $5 par value common stock. 2. Issued 10,000 shares of $5 par value common stock for $30 per share. E12-3 Authorizing and Issuing Stock Prepare entries for each event: 3. Issued 25,000 shares of the $100 par value preferred stock for $150 per share. 4. Issued 50,000 shares of no-par preferred stock for $50 each. E12-5 Treasury Stock Company was incorporated on 4.1.12 and was authorized to issue 100,000 shares of $5 par value common stock and 10,000 shares of $8, no-par preferred stock. a. Record the following transactions: 1. Issued 25,000 shares of common stock in exchange for $500,000 cash. 2. Issued 5,000 shares of preferred stock in exchange for $60,000 cash. E12-5 Treasury Stock Company was incorporated on 4.1.12 and was authorized to issue 100,000 shares of $5 par value common stock and 10,000 shares of $8, no-par preferred stock. a. Record the following transactions: 3. Purchased 3,000 common shares for $15 per share and held them in the treasury. 4. Sold 1,000 treasury shares for $18 per share. 5. Issued 1,000 treasury shares to executives who exercised stock options for a reduced price of $5 per share. E12-5 Treasury Stock a. 1. 2. 3. 4. 5. b. Company was incorporated on 4.1.12 and was authorized to issue 100,000 shares of $5 par value common stock and 10,000 shares of $8, no-par preferred stock. T accounts: Issued 25,000 shares of common stock in exchange for $500,000 cash. Issued 5,000 shares of preferred stock in exchange for $60,000 cash. Purchased 3,000 common shares for $15 per share and held them in the treasury. Sold 1,000 treasury shares for $18 per share. Issued 1,000 treasury shares to executives who exercised stock options for a reduced price of $5 per share. Assume company generated $500,000 in net income in 2012 and did not declare any dividends. Prepare the stockholders’ equity section of the balance sheet as of 12.31.2012. E12-6 Treasury Stock 12.31.2011 Shareholders’ section Common stock $80,000 Additional paid-in capital 10,000 Retained earnings 60,000 Total shareholders’ equity $150,000 During 2012, the company entered into the following transactions. Provide the journal entries for each transaction: 1. Purchased 1,000 shares of treasury stock for $60 per share. 2. As part of a compensation package, reissued half of the treasury shares to executives who exercised stock options for $20 per share. 3. Reissued the remainder of the treasury stock on the open market for $66 per share. E12-6 Treasury Stock 12.31.2011 Shareholders’ section Common stock Additional paid-in capital 10,000 Retained earnings 60,000 Total shareholders’ equity During 2012, the company entered into the following transactions: 1. 2. 3. a. $80,000 Purchased 1,000 shares of treasury stock for $60 per share. As part of a compensation package, reissued half of the treasury shares to executives who exercised stock options for $20 per share. Reissued the remainder of the treasury stock on the open market for $66 per share. Prepare the shareholders’ equity section of the balance sheet as of 12.31.2012. Company generated $20,000 in net income and did not declare dividends during 2012. $150,000 E12-6 Treasury Stock 12.31.2011 Shareholders’ section Common stock $80,000 Additional paid-in capital 10,000 Retained earnings 60,000 Total shareholders’ equity $150,000 b. What portion of the additional paid-in capital account is attributed to treasury stock transactions? Sample Co. Shareholders’ Equity Common stock, $1 par value, 500,000 shares authorized, 80,000 shares issued, and 75,000 shares outstanding Common stock dividends distributable Preferred stock, $100 par value, 1,000 shares authorized, 100 shares issued and outstanding Paid in capital on common $ 20,000 Paid in capital on preferred 3,000 Paid in capital on treasury stock 2,000 Retained earnings: Unappropriated $18,000 Appropriated 4,000 Less: Treasury stock, 5,000 shares (at cost) Less: Other comprehensive income items (unrealized loss on AFS securities) Total Shareholders’ Equity $ 80,000 2,000 10,000 25,000 22,000 (6,000) (2,000) $131,000 Retained Earnings We will be expanding the basic retained earnings formula in this chapter. Now the Statement of Retained Earnings will include the following: RE, beginning (unadjusted) Add/Subtract: Prior period adjustment RE, beginning (restated) Add: net income Less dividends: Cash dividends-common Cash dividends - preferred Stock dividends Property dividends Less: Adjustment for TS transactions Appropriation of RE RE, ending xx xx xx xx xx xx xx xx xx xx xx E12-9 Inferring Transactions from SHE Preferred stock (no par) Common stock ($1 par value) 2012 2011 $ 700 $ 400 1,000 900 40 10 20 --- 130 150 Additional paid-in capital: Common stock Treasury stock Less Treasury stock Provide the journal entries for the following: a. Issuance of preferred stock during 2012. b.Issuance of common stock during 2012. c.Sale of treasury stock during 2012.