1 Choose at most one From the Set

advertisement

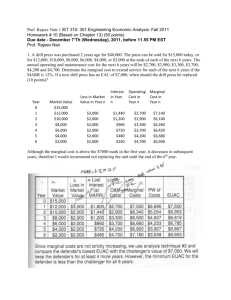

1 Mutually Exclusive Choose at most one From the Set This lecture addresses an issue that is confusing to many users of the rate of return method. When choosing among mutually exclusive alternatives, never compare the individual rates of the alternatives. The selection can only be made by evaluating the rates of return of the incremental investments. 2 This Lecture With a given set of solutions Mutually Exclusive: only one of the set may be selected one and only one must be chosen at most one may be chosen Use Incremental Analysis The phrase mutually exclusive means that the selection of one solution excludes the selection of any other. This is the usual decision situation. We have a set of alternatives and we must select one, or perhaps none. We cannot choose more than one. The rate of return method requires that we use incremental analysis. All other solution methods are incorrect. 3. Incremental Analysis The alternative with the smaller initial investment is the defender. The alternative with the greater initial investment is the challenger. Subtract the defender cash flow from the challenger cash flow to find the incremental cash flow. Find the IRR of the incremental cash flow. If IRR ≥ MARR accept the increment and choose the challenger. Otherwise reject the increment and choose the defender. With incremental analysis, we do not evaluate the individual alternatives directly. Rather we compare alternatives in pairs and accept or reject the increment of investment of one over the other. With two alternatives, we identify the one with the smallest initial investment as the defender. The other is the challenger. We say that the defender is the incumbent, and ask whether the extra investment of the challenger over the defender is justified. For the rate of return method we evaluate the internal rate of return of the increment and compare it to the MARR to make the decision. 1 4. Example Two machines are being considered to manufacture some product. The first machine costs $1100 initially and has a $100 salvage value after ten years. It costs $200 a year to operate. The second costs $1300 initially. It has a salvage value of $100 after ten years and costs $150 per year to operate. At the minimum rate of return of 15%, which machine should you select? We've seen this example before. We are comparing two machines for the same purpose. One has a higher initial cost but lower operating costs. Both have the same life and the same salvage value. With the MARR equal to 15%, which is the most economic choice? 5. First Machine (F) This is the cash flow for the first machine. Since it has the lower initial cost we call this the defender. There is no way to evaluate the rate of return of this machine because the total costs far exceed the small return provided by the salvage. The machine has no positive IRR. 6. Second Machine (S) The second cash flow is like the first except the initial investment is larger and the operating costs are smaller. Again there is no positive IRR for this cash flow. We call this cash flow the challenger. 7. Incremental Analysis To find the incremental cash flow we subtract the defender from the challenger. The result is an investment of $200 with annual returns of $50. $50 is the savings obtained by the $200 incremental investment of the challenger over the defender. The difference between the salvage values is zero indicating that the salvage has no relevance to the decision. 2 8. Evaluate the Increment The increment is a simple investment with a cost of $200 followed by total revenues of $500. The investment yields a profit. To discover the rate of return we set the net present worth equal to zero. Since the equivalence formula involves only one factor, we solve for the value of that factor. Using trial and error we discover that the IRR of the incremental investment is between 21 and 22%. This is certainly greater than the MARR so we accept the incremental investment. This means we accept the challenger, the more expensive machine. 9. Several Alternatives Rank the alternatives in increasing order of investment. Select as the defender the alternative with the smallest investment. This is the first incumbent. Let the challenger be the alternative with the next higher investment. Accept or reject the challenger on the basis of the return on the extra investment. The winner becomes the incumbent and the defender for the next step. If the highest level of investment has been reached, stop. The incumbent wins. Otherwise go to step 3. Incremental analysis only works with pairs of alternatives. When there are several alternatives, the procedure must be adapted to compare two at a time. The slide shows the procedure for selecting the best solution from a set of mutually exclusive alternatives. First rank the alternatives in order of increasing investment. Call the alternative with the smallest investment the defender. It is the first incumbent. The challenger is the alternative with the next greater investment. The difference between the challenger and the incumbent is the incremental investment. Compute the rate of return of the incremental investment. If the IRR is greater than the MARR accept the increment and the challenger. Discard the defender. The challenger becomes the incumbent and the defender in the next comparison. If the IRR is less than the MARR, reject the increment and discard the challenger. The defender remains the defender for the next comparison. The process continues until the highest level of investment has been considered. The remaining incumbent is the selected alternative. 3 10 Comparing cost alternatives MARR = 15% All have a five-year life and no salvage value. To illustrate the process we use an example with four alternatives to accomplish some purpose. They are mutually exclusive and we must choose one. They all have the same life and no salvage value. Any revenues are the same for the alternatives, so revenue is neglected. Only the investment and annual costs are relevant. The MARR is 15%. Individual alternatives do not have an IRR because there are no revenues. The IRR has meaning only when considering incremental investments. 11 Ranked Alternatives Ranked Alternatives : Rank by order of increasing investment: D, B, C, A. D is the incumbent. The first step is to rank the alternatives in order of increasing investment. The first defender is D and the first challenger is B. The initial incumbent is D. 12 Increment 1 NPW(B-D) = -500 + 125(P/A, i, 5) = 0 (P/A, i, 5) = 500/125 = 4 IRR(B-D) = 8% Since IRR(B-D) < MARR, reject B-D. Discard B. D remains the incumbent. 12 a. The difference between B and D is an incremental investment of $500 resulting in annual savings of $125. 12b. We discover the IRR of the incremental investment is 8%. Since this is less than the MARR, we discard B and D remains the incumbent. 4 13 Increment 2 NPW(C-D) = -1500 + 500(P/A, i, 5) = 0 (P/A, i, 5) = 1500/500 = 3 IRR(C-D) = 20% Since IRR(C-D) > MARR, accept C-D. Discard D. C becomes the incumbent. 13 a. The next challenger is C. The difference between C and D is an incremental investment of $1500 resulting in annual savings of $500. 13b. The IRR of this incremental investment is 20%. Since it is greater than the MARR, we discard D and C becomes the incumbent and defender. 14 Increment 3 NPW(A-C) = -1000 + 260(P/A, i, 5) = 0 (P/A, i, 5) = 1000/260 = 3.846 IRR(A-C) = 9% Since IRR(A-C) < MARR, reject A-C. Discard A C is the incumbent and the final selection. 14 a. The next challenger is A. The difference between A and C is an incremental investment of $1000 resulting in annual savings of $260. 14b. Evaluating the IRR of the incremental investment we discover it is 9%. Since this is less than the MARR, we discard A and C remains the incumbent. Since there are no more alternatives to consider, the selection is alternative C. 15 Summary of Example Ranked Alternatives : D, B, C, A. Increment B-D: IRR(B-D) < MARR, reject B-D. Increment C-D: IRR(C-D) > MARR, accept C-D. Increment A-C: IRR(A-C) < MARR, reject A-C. The Final Incumbent is C In summary, we first ranked the alternatives in order of increasing investment. Evaluating B over D, we rejected the incremental investment and discarded B Evaluating C over D, we accepted the incremental investment and discarded D Evaluating A over C, we rejected the incremental investment and discarded A. The final incumbent is the winner of the competition, alternative C. 5 16 To Select or Not Some problems do not require a selection. An option may be select none of the alternatives. Include the null investment as the first option with zero investment and zero return. The incremental method assures that the final selection has IRR ≥ MARR. Some problems call for the selection of one or none from the set of alternatives. The easiest way to handle this is to include the null investment in the set. The null investment is the defender for the first comparison. If all non-null alternatives have individual IRR values less than the MARR, the null alternative wins the competition. 17 Computational Difficulties IRR values must be computed by trial and error. With k alternatives, the number of IRR evaluations is k-1. The cash flow for the difference between two alternatives with different lives is often a non-simple investment. The rate of return method is difficult computationally since k-1 evaluations must be made for the comparison of k alternatives. When alternatives have different lives, incremental investments often turn out to be non-simple investments. The possible existence of multiple roots complicates the decision process. 18 Summary When using the ROR method to compare alternatives you must use incremental analysis. Alternatives are considered in pairs and the IRR of incremental investment of the challenger over the defender must be greater than or equal to the MARR in order for the challenger to become the incumbent. The final incumbent is the winner. The main lesson of this lecture is that you must use incremental analysis with the rate of return method. Any other method will most likely lead to the wrong decision. 6