Chapter 12 1) Ludwig von Mises The Theory of Money and Credit

advertisement

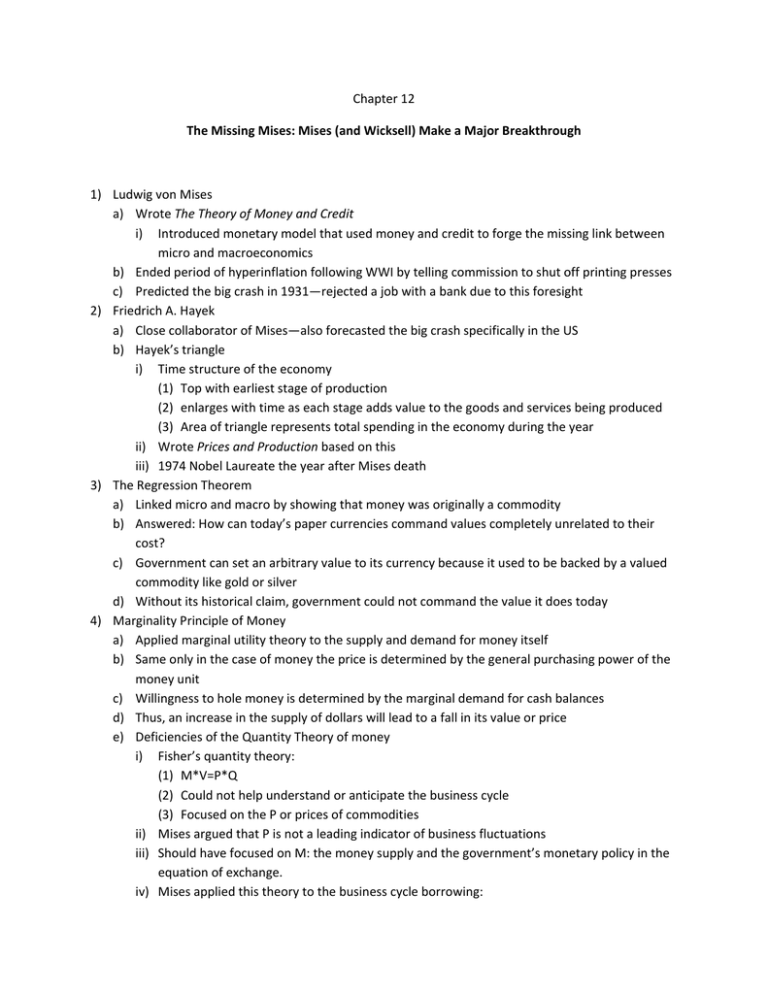

Chapter 12 The Missing Mises: Mises (and Wicksell) Make a Major Breakthrough 1) Ludwig von Mises a) Wrote The Theory of Money and Credit i) Introduced monetary model that used money and credit to forge the missing link between micro and macroeconomics b) Ended period of hyperinflation following WWI by telling commission to shut off printing presses c) Predicted the big crash in 1931—rejected a job with a bank due to this foresight 2) Friedrich A. Hayek a) Close collaborator of Mises—also forecasted the big crash specifically in the US b) Hayek’s triangle i) Time structure of the economy (1) Top with earliest stage of production (2) enlarges with time as each stage adds value to the goods and services being produced (3) Area of triangle represents total spending in the economy during the year ii) Wrote Prices and Production based on this iii) 1974 Nobel Laureate the year after Mises death 3) The Regression Theorem a) Linked micro and macro by showing that money was originally a commodity b) Answered: How can today’s paper currencies command values completely unrelated to their cost? c) Government can set an arbitrary value to its currency because it used to be backed by a valued commodity like gold or silver d) Without its historical claim, government could not command the value it does today 4) Marginality Principle of Money a) Applied marginal utility theory to the supply and demand for money itself b) Same only in the case of money the price is determined by the general purchasing power of the money unit c) Willingness to hole money is determined by the marginal demand for cash balances d) Thus, an increase in the supply of dollars will lead to a fall in its value or price e) Deficiencies of the Quantity Theory of money i) Fisher’s quantity theory: (1) M*V=P*Q (2) Could not help understand or anticipate the business cycle (3) Focused on the P or prices of commodities ii) Mises argued that P is not a leading indicator of business fluctuations iii) Should have focused on M: the money supply and the government’s monetary policy in the equation of exchange. iv) Mises applied this theory to the business cycle borrowing: (1) Natural interest rate hypothesis of Knut Wicksell (2) The capital theory of Eugen Böhm‐Bawerk (3) The Hume‐Ricardo specie‐flow mechanism 5) Wicksell’s Natural Interest Rate Hypothesis a) Clear distinction between the natural rate of interest and the market rate i) Natural: the interest rate that equalizes the supply and demand for saving ii) Market: interest banks charge for loans to individual customers and businesses if the market rate is less than the natural rate, a cumulative process of price inflation occurs iii) Means for policy: government should maintain a cycle‐neutral policy whereby the market rate is always equal to the natural rate to avoid artificial easy‐money inflation 6) Böhm‐Bawerk’s Capital Theory a) A government‐induced inflationary boom would inevitably cause the roundabout production process to lengthen, especially in the capital‐goods industries, a process that could not be reversed easily during a slump 7) The Gold Standard a) International gold standard was disciplinarian that would cut short any inflationary boom b) Mises outlined series of events whereby an inflationary boom would quickly come to an end under gold: i) Under inflation, domestic incomes and prices rise ii) Citizens buy more imports than exports, causing a trade deficit iii) The balance of payments deficit causes gold to flow out iv) The domestic money supply declines, causing a deflationary collapse

![+A.A. Popovici - Critical comments on the philosophical context of Ludwig von Mises’s ‘Human action’ (Journal of philosophical economics, XII [2018], 1, p. 112-125)](http://s2.studylib.net/store/data/026084351_1-7fa0d0bff1da84f3b0434cc8b2a999d1-300x300.png)