17 Financial Reporting & Analysis Chapter Solutions

advertisement

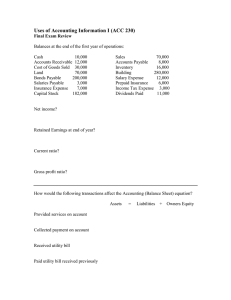

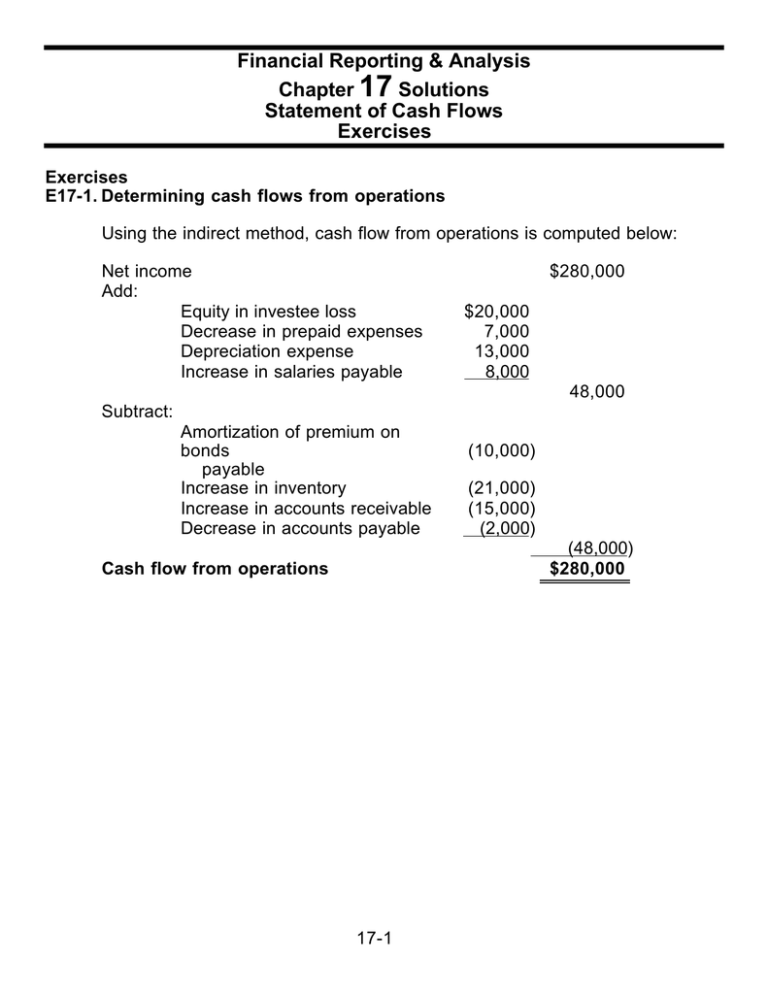

Financial Reporting & Analysis Chapter 17 Solutions Statement of Cash Flows Exercises Exercises E17-1. Determining cash flows from operations Using the indirect method, cash flow from operations is computed below: Net income Add: Equity in investee loss Decrease in prepaid expenses Depreciation expense Increase in salaries payable $280,000 $20,000 7,000 13,000 8,000 48,000 Subtract: Amortization of premium on bonds payable Increase in inventory Increase in accounts receivable Decrease in accounts payable (10,000) (21,000) (15,000) (2,000) (48,000) $280,000 Cash flow from operations 17-1 E17-2. Determining cash flows from operations (AICPA adapted) Lino’s net cash from operating activities is calculated below: Net income Increase in accounts receivable1 Decrease in prepaid rent Increase in accounts payable Cash flow from operations 1 $150,000 (5,800) 4,200 3,000 $151,400 The increase in accounts receivable is net of the allowance for doubtful accounts: Beginning accounts receivable Less: Beginning allowance for doubtful accounts Beginning net accounts receivable $23,000 (800 ) $22,200 Ending accounts receivable Less: Ending allowance for doubtful accounts Ending net accounts receivable $29,000 (1,000) $28,000 Increase in net accounts receivable: Ending net accounts receivable Beginning net accounts receivable Increase in net accounts receivable $28,000 (22,200 ) $ 5,800 E17-3. Cash flows from operations (AICPA adapted) Requirement 1: Calculate accrual basis net income for December: Sales revenue Cost of goods sold (70% of sales) Gross profit (30% of sales) Selling, general, and administrative expenses Fixed portion = $35,000 Variable portion = 15% ´ $350,000 = 52,500 Net income (accrual basis) 17-2 $350,000 (245,000) 105,000 (87,500) $17,500 Requirement 2: Adjust accrual basis income to obtain cash flows from operations: Accrual basis net income - Increase in gross trade accounts receivable* - Increase in inventory + Charge for uncollectible accounts (1% ´ $350,000) + Depreciation expense included in S, G&A Cash flows from operating activities $17,500 (13,500) (5,000) 3,500 20,000 $22,500 * ($10,500 + $3000 write-off of uncollectable accounts receivable) E17-4. Analysis of changes in balance sheet accounts (AICPA adapted) Requirement 1: Determining depreciation on machinery for 2001: Step 1: Determine the amount of accumulated depreciation on equipment sold during 2001: Cost of machine sold (given) Less: Accumulated depreciation Book value of equipment sold Less: Cash received from sale Loss on sale (given) $40,000 ? ? 26,000 $4,000 Working backwards, the book value of equipment sold is $30,000 and the accumulated depreciation is $10,000. Step 2: Analyze the accumulated depreciation account to determine the amount credited to this account when depreciation expense was recorded for the year: Accumulated Depreciation $102,000 Beginning balance Accumulated depreciation on $10,000 ? Depreciation expense for the year equipment sold (see above) $120,000 Ending balance 17-3 From the T-account analysis, we can determine that depreciation expense for the year is $28,000. Requirement 2: To determine machinery purchases, the solutions approach is to set up a T-account for machinery and solve for the missing debit for equipment purchases: Beginning balance Purchases Ending balance Machinery $250,000 ? $40,000 $320,000 Cost of equipment sold The T-account can by analyzed to determine that 2001 machinery purchases totaled $110,000. E17-5. Cash flows from investing and financing activities (AICPA adapted) Requirement 1: Net cash flows from operating activities are computed as follows: Net income + Depreciation - Gain on sale of equipment Cash flows from operating activities $300,000 52,000 (5,000) $347,000 Requirement 2: Below is the computation for cash flow from investing activities: Sale of equipment1 Purchase of equipment2 Cash outflow from investing activities 1 2 $18,000 (20,000) ($ 2,000) Computation of cash from sale of equipment: Cost of equipment Accumulated depreciation Book value of equipment sold Gain on sale of equipment Amount of cash received in exchange for equipment $25,000 (12,000 ) 13,000 5,000 $18,000 Computation of cash paid for equipment: Cost of new equipment Less: amount paid with note payable Cash paid for equipment $50,000 (30,000 ) $20,000 17-4 E17-6. Cash flows from investing and financing activities (AICPA adapted) Requirement 1: Cash flow from investing activities: Sale of equipment Purchase of A.S., Inc., bonds Net cash used in investing activities $ 10,000 (180,000) ($170,000) Requirement 2: Cash flow from financing activities: Dividends paid Proceeds from sale of treasury stock Net cash provided by financing activities ($38,000) 75,000 $37,000 E17-7. Cash flows from investing activities (AICPA adapted) Purchase of stock in Maybel Sale of investment in Rate Motors Purchase of 4-year certificate of deposit Net cash used in investing activities ($26,000) 35,000 (50,000) ($41,000) E17-8. Cash flows from investing and financing activities (AICPA adapted) Requirement 1: Cash flows from investing activities: Sale of investment Purchase of equipment Purchase of real estate Net cash used in investing activities $500,000 (125,000) (550,000) ($175,000) Requirement 2: Cash flows from financing activities: Dividends paid Issue of common stock Bank loan for real estate purchase Paid toward bank loan Net cash used in financing activities 17-5 ($600,000) 250,000 550,000 (450,000) ($250,000) E17-9. Determining operating cash flows (AICPA adapted) Net Income Increase in investment in Videogold, Inc. Increase in deferred income tax liability Decrease in premium on bonds payable Net cash provided by operating activities $150,000 (5,500) 1,800 (1,400) $144,900 E17-10. Determining operating, investing, and financing cash flows (AICPA adapted) Requirement 1: Net cash provided by operating activities: Net income Gain on sale of long-term investment Increase in inventory Depreciation expense Decrease in accounts payable and accrued liabilities Net cash provided by operating activities $790,000 (35,000) (80,000) 250,000 (5,000) $920,000 Requirement 2: Net cash used in investing activities: Purchase of short-term investments ($ 300,000) Sale of long-term investments 135,000 Sale of plant assets 350,000 Purchase of plant assets (see T-account which follows) (1,190,000) Net cash used in investing activities ($1,005,000) Cost of equipment acquired Cost of plant assets purchased Net increase Plant Assets $110,000 $600,000 Cost of building sold X $700,000 $110,000 + X - $600,000 = $700,000 X = $1,190,000 17-6 Requirement 3: Net cash provided by financing activities: Payment of dividends ($500,000 - $160,000) Issuance of short-term debt Issuance of common stock (10,000 ´ $22) Net cash provided by financing activities Check: (Not required) Cash provided by operating activities Cash used in investing activities Cash provided by financing activities Increase in cash and cash equivalents 17-7 ($340,000) 325,000 220,000 $205,000 $920,000 (1,005,000) 205,000 $120,000 Financial Reporting & Analysis Chapter 17 Solutions Statement of Cash Flows Problems Problems P17-1. Determining cash provided (used) by operating, investing and financing activities (AICPA adapted) Requirement 1: Cash flows provided by operating activities: Net Income $690,000 Increase in inventory Increase in accounts payable Gain on sale of investment1 Goodwill amortization2 Depreciation expense3 ($80,000) 105,000 (35,000) 10,000 250,000 250,000 $940,000 Cash flows from operations 1 Gain on sale of investment is determined as follows: Proceeds from sale of investments (given) Less: Book value of investment sold ($300,000 - $200,000) Gain on sale of investment $135,000 (100,000 ) $ 35,000 2 Goodwill amortized is equal to change in the goodwill account for the year = $100,000 - $90,000 = $10,000 3 Depreciation expense recorded in year 2001 is determined from an analysis of the accumulated depreciation T-account. 17-8 Accumulated Depreciation $450,000 Beginning balance Accumulated depreciation X Depreciation expense for year on equipment sold* $250,000 $450,000 Ending balance *Cost of equipment sold = Less: Carrying value Accumulated depreciation $400,000 (150,000 ) $250,000 Solving for depreciation expense amount X in T-account $450,000 + X - $250,000 = $450,000 X = $250,000 = Depreciation expense for year 2001 Requirement 2: Cash flows used in investing activities: Sale of equipment Sale of long-term investment Purchase of plant assets 4 Purchase of short-term investments Cash outflows from investing activities $ 150,000 135,000 (1,100,000) (300,000) ($1,115,000) 4 Cash payments for plant assets is obtained from an analysis of the plant assets T-account: Plant Assets Beginning balance Purchase of additional assets $1,000,000 X Ending balance $1,700,000 Solve for X: $1,000,000 + X - $400,000 = $1,700,000 X = $1,100,000 = Purchase of plant assets 17-9 $400,000 Cost of equipment sold Requirement 3: Cash flows provided by financing activities: Dividends paid Sale of common stock5 Short-term debt Cash flows from financing activities 5 ($240,000) 220,000 325,000 $305,000 10,000 shares @ $22/sh. = $220,000 Proof: (Not required) Cash from operating activities Cash used for investing activities Cash from financing activities Net increase in cash 17-10 $940,000 (1,115,000) 305,000 $130,000 P17-2. Comparing direct and indirect methods of determining cash flows from operations (CMA adapted) Requirement 1: The statement of cash flows for Spoke Company, for the year ended May 31, 2001, using the direct method is presented below: Spoke Company Statement of Cash Flows For the Year Ended May 31, 2001 Cash Flows from Operating Activities: Cash received from customers1 Cash paid to suppliers2 to employees3 for other expenses4 for interest5 for income taxes6 Net cash provided by operating activities $1,235,250 $664,000 276,850 10,150 73,000 43,000 1,067,000 $168,250 Cash Flows from Investing Activities: Purchase of plant assets Cash Flows from Financing Activities: Cash received from common stock issue Cash paid for dividends to retire bonds payable Net cash used for financing activities Net increase in cash Cash, May 31, 2000 Cash, May 31, 2001 (40,000) $40,000 (115,000) (30,000) (105,000) $ 23,250 20,000 43,250 Note 1: Schedule of noncash investing and financing activities. Issuance of common stock for plant assets 17-11 $50,000 Supporting calculations: 1 2 3 4 5 6 Collections from customers: Sales Less: Increase in accounts receivable Cash collected from customers $1,255,250 (20,000) $1,235,250 Cash paid to suppliers: Cost of merchandise sold Less: Decrease in merchandise inventory Increase in accounts payable Cash paid to suppliers $712,000 (40,000) (8,000) $664,000 Cash paid to employees: Salary expense Add: Decrease in salaries payable Cash paid to employees $252,100 24,750 $276,850 Cash paid for other expenses: Other expense Add: Increase in prepaid expenses Cash paid for other expenses $8,150 2,000 $10,150 Cash paid for interest: Interest expense Less: Increase in interest payable Cash paid for interest $75,000 (2,000) $73,000 Cash paid for income taxes: Income tax expense (given) $43,000 17-12 Requirement 2: The calculation of the cash flow from operating activities for Spoke Company, for the year ended May 31, 2001, using the indirect method, follows: Spoke Company Statement of Cash Flows For the Year Ended May 31, 2001 Cash Flows from Operating Activities: Net income Adjustments to reconcile net income to cash Provided from operations: Depreciation expense $25,000 Decrease in merchandise inventory 40,000 Increases in: Accounts payable 8,000 Interest payable 2,000 Accounts receivable (20,000) Prepaid expenses (2,000) Decrease in salaries payable (24,750) Net cash provided by operating activities $140,000 28,250 $168,250 Requirement 3: Both the direct method and the indirect method for reporting cash flows from operating activities are acceptable in preparing a statement of cash flows according to SFAS 95; however, the FASB encourages the use of the direct method. Under the direct method, the statement of cash flows reports the major classes of cash receipts and cash disbursements and discloses more information; this may be the statement’s principal advantage. Under the indirect method, net income on the accrual basis is adjusted to the cash basis by adding or deducting noncash items included in net income, thereby providing a useful link between the statement of cash flows and the income statement and balance sheet. 17-13 P17-3. Determining amounts reported on statement of cash flows (AICPA adapted) Requirement 1: Cash collections from customers can be determined by examining the accounts receivable T-account, shown below: Beginning balance Sales Ending balance Accounts Receivable $24,000 155,000 X $34,000 Cash collections We can find the amount of cash collections from customers by solving for X. $24,000 + $155,000 - X = $34,000; X = $24,000 + $155,000 - $34,000; X = $145,000 Cash collections from customers would appear in cash flows from operating activities as $145,000. Requirement 2: Cash payments for purchase of property, plant, and equipment are calculated as follows: Beginning balance Acquired from bond refinancing Cash purchases Ending balance Property, Plant, & Equipment $247,000 $40,000 Sale of equipment 20,000 X $277,000 Solving for X: $247,000 + $20,000 + X - $40,000 = $277,000; X = $50,000 Purchases of PP&E would be classified as cash flows from investing activities. 17-14 Requirement 3: Proceeds from sale of equipment can be found by first looking at the accumulated depreciation account: Accumulated Depreciation $167,000 Beginning balance 33,000 Depreciation on equipment sold Depreciation expense X $178,000 Ending balance By solving for X , we can find the depreciation on the equipment that was sold. $167,000 + $33,000 - X = $178,000; $167,000 + $33,000 - $178,000 = X X = $22,000 Since we know the accumulated depreciation on the equipment sold, we can determine its carrying value or book value as follows: Cost of equipment Accumulated depreciation on equipment Carrying value of equipment sold $40,000 (22,000) $18,000 Now that we know the carrying value of the equipment that was sold, we can determine the proceeds from sale of equipment. Carrying value (book value) of equipment sold Gain on sale of equipment Proceeds from sale of equipment $18,000 13,000 $31,000 This amount would be classified as cash flows from investing activities. 17-15 Requirement 4: To find dividends paid, we need to first determine dividends declared by analyzing retained earnings: Dividends declared Retained Earnings $91,000 28,000 X $104,000 Beginning balance Net income Ending balance Solving for X, we get: $91,000 + $28,000 - X = $104,000 X = $91,000 + $28,000 - $104,000 X = $15,000 = dividends declared The amount of cash dividends paid can be determined by T-account analysis of dividends payable: Cash dividends paid Dividends Payable $5,000 Beginning balance 15,000 Dividends declared X $8,000 Ending balance Solving for X, we get: X = $5,000 + $15,000 - $8,000 X = $12,000 = Cash dividends paid $12,000 should be reported on the statement of cash flows as a financing activity. 17-16 Requirement 5: Redemption of bonds payable can be found by using the bonds payable T-account: Redemption of bonds Bonds Payable $46,000 20,000 X $49,000 Beginning balance Bonds issued in 2001 Ending balance Solve for X: $46,000 + $20,000 - X = $49,000; $46,000 + $20,000 - $49,000 = X X = $17,000 Redemption of bonds payable is $17,000 reported under cash flows from financing activities. P17-4. Determining amounts reported on statement of cash flows (AICPA adapted) Requirement 1: Cash collections from customers can be determined by examining the accounts receivable T-account below: Beginning balance Sales Ending balance Accounts Receivable $30,000 538,800 X Cash collections $33,000 We can find cash collections from customers by solving for X. $30,000 + $538,800 - X = $33,000; $30,000 + $538,800 - $33,000 = X X = $535,800 Cash collections from customers are $535,800. 17-17 Requirement 2: To solve for cash paid for goods sold, we must first determine how much was purchased. We can do this by first looking at the inventory account to determine total purchases for the period: Beginning balance Purchases Ending balance Inventory $47,000 X $250,000 $31,000 Cost of goods sold To find purchases, solve for X. $47,000 + X - $250,000 = $31,000 X = $250,000 + $31,000 - $47,000 X = $234,000 Next, to find out how much cash was paid on accounts payable, we plug the purchases number into the accounts payable T-account and solve for cash payments on account: Cash paid Accounts Payable $17,500 234,000 X $25,000 Beginning balance Purchases Ending balance Again, we can solve for X. $17,500 + $234,000 - X = $25,000 X = $17,500 + $234,000 - $25,000 X = $226,500 Cash paid for goods to be sold is $226,500. Requirement 3: We can determine cash paid for interest as follows: Interest expense (2001) Less: Amortization of bond discount in 2001 Cash paid for interest 17-18 $4,300 (500) $3,800 Requirement 4: Cash paid for income taxes: Income taxes paid Income Taxes Payable $27,100 Beginning balance 20,400 Income tax expense X $21,000 Ending balance Solving for X: $27,100 + $20,400 - X = $21,000 X = $27,100 + $20,400 - $21,000 X = $26,500 Next, we must take into account deferred income taxes. Ending balance Beginning balance Change in deferred income taxes payable $ 5,300 (4,600) $ 700 Income taxes paid Change in deferred income taxes Cash paid for income taxes $26,500 (700) $25,800 Requirement 5: Cash paid for selling expenses: One third of the depreciation expense has been allocated to selling expenses. This is a noncash expense and should be subtracted from selling expenses to find the answer. Selling expenses Depreciation allocated to selling1 Cash paid for selling expenses 1 $141,500 (500) $141,000 Depreciation expense calculated: Ending balance in accumulated depreciation Beginning balance in accumulated depreciation Depreciation expense for 2001 One third allocated to selling expense 17-19 $16,500 (15,000 ) $ 1,500 $1,500/3 = $500 P17-5. Preparation and analysis of cash flow statement Requirement 1: Statement of cash flows under indirect method: Global Trading Company Statement of Cash Flows For the Year Ended December 31, 2001 Cash flow from operations Net loss for the year + Depreciation expense + Goodwill written off + Decrease in net accounts receivable + Decrease in inventory + Decrease in prepaid insurance + Increase in accounts payable + Increase in salaries payable Cash flow from operations ($279,500) 50,000 70,000 240,000 170,000 20,000 78,000 6,000 $354,500 Cash flow from financing activities Repayment of bank loan Dividends paid1 Cash flow from financing activities ($307,500) (35,000) ($342,500) Net increase in cash $ 12,000 1 Calculation of dividends Beginning retained earnings - Net loss for the year - Ending retained earnings = Dividends paid $320,000 (279,500) (5,500) $35,000 17-20 Requirement 2: Assessment of financial performance of Global: · Net loss for the year is an indication of poor operating performance. · Positive cash flow may be misleading since cash flow does not do a good job of matching revenues and expenses. · Goodwill written off is from an acquisition made last year indicating that the potential benefits from the acquisition have been exhausted. · Decrease in accounts receivable coupled with a decrease in inventory is an indication of decreasing demand. A mere change in the collection policy cannot explain the reduction in inventory. · Increase in accounts payable could indicate that the company is not paying off its suppliers because of the constraint on bank loan. · The repayment of the bank loan probably is not voluntary but enforced by the debt covenants. · Payment of dividends when the company is incurring substantial losses is not a sign of prudent financial management and drains the cash reserves of the company. · Ratio of accumulated depreciation to property, plant, and equipment of 0.9 (last year was 0.8) implies that, on average, the life of the fixed assets is one year and the company needs to invest in these assets immediately. 17-21 Requirement 3: Determination of bad debts written off can be obtained from T-account analysis of the allowance for doubtful accounts: Accounts written off Allowance for Doubtful Accounts $30,000 Beginning balance 55,000 Bad debt expense X $20,000 Ending balance Solve for X: $30,000 + $55,000 - X = $20,000 X = $65,000 = accounts written off in 2001. Determination of credit sales for the year can be obtained from T-account analysis of accounts receivable: Accounts Receivable Beginning balance $300,000 Sales on account Ending balance $65,000 X 1,250,000 $50,000 Bad debts written off (see preceding page) Collections on account Solve for X: $300,000 + X - $65,000 - $1,250,000 = $50,000 X = $1,065,000 = sales on account. Requirement 4: Effect of omission of inventory purchase: Income Statement No effect. (Purchases are understated, and ending inventory is understated by equal amounts. Thus, net effect on income is zero.) Statement of Cash Flows No effect. (Purchase was on account for credit.) Balance Sheet The balance sheet balances, but the year-end amounts for both accounts payable and inventory are understated by $35,000. 17-22 P17-6. Preparation of cash flow statement and balance sheet Requirement 1: Statement of cash flows under the direct method: JKI Advertising Agencies Statement of Cash Flows for the Year Ended 12/31/01 Direct Method Operating Activities: Cash collected from clients Rent collected Salaries paid Cash paid for insurance Cash paid for interest Cash paid for customer lawsuit Cash paid for taxes Cash flows from operations $215,000 50,000 (130,000) (12,000) (9,000) (32,000) (31,000) $_51,000 Investing Activities: Proceeds from sale of land Purchase of office equipment Cash flows from investing activities $150,000 (20,000) $130,000 Financing Activities: Borrowing from TownBank Repayment of building loan Issuance of capital stock Dividends declared & paid Cash flow from financing activities $50,000 (85,000) 35,000 (18,000) ($18,000) Increase in cash for the year $163,000 17-23 Requirement 2: December 31, 2000 balance sheet The figures for the 12/31/00 balance sheet can be attained by T-account analysis of the relevant accounts: Balance as of 12/31/00 Advertising revenue Balance as of 12/31/01 Accounts Receivable X $250,000 $215,000 Cash collected from clients $80,000 Solve for X: $80,000 = X + $250,000 - $215,000 X = $45,000 Balance as of 12/31/00 Cash paid for insurance Balance as of 12/31/01 Prepaid Insurance X $12,000 $12,000 $3,000 Insurance expense Solve for X: $3,000 = X + $12,000 - $12,000 X = $3,000 Land Balance as of 12/31/00 X $150,000 Balance as of 12/31/01 $0 Solve for X: $0 = X - $150,000 X = $150,000 17-24 Sale of land (cash received = book value) Accumulated Depreciation–Building X Balance as of 12/31/00 $20,000 Depreciation expense - building $380,000 Balance as of 12/31/01 Solve for X: X = $380,000 - $20,000 X = $360,000 Balance as of 12/31/00 Purchase of office equipment Balance as of 12/31/01 Office Equipment X $20,000 $80,000 Solve for X: X = $80,000 - $20,000 X = $60,000 Accumulated Depreciation–Office Equipment X Balance as of 12/31/00 $8,000 Depreciation expense– office equipment $39,000 Balance as of 12/31/01 Solve for X: X = $39,000 - $8,000 X = $31,000 Salaries paid Salaries Payable X $130,000 $126,000 $7,000 Solve for X: X = $130,000 - $126,000 + $7,000 X = $11,000 17-25 Balance as of 12/31/00 Salaries expense Balance as of 12/31/01 Cash paid for interest Interest Payable X $9,000 $10,000 $3,500 Balance as of 12/31/00 Interest expense Balance as of 12/31/01 Solve for X: X + $10,000 - $9,000 = $3,500 X = $2,500 Liability for Customer Lawsuit X Cash paid for customer lawsuit $32,000 $0 Balance as of 12/31/00 Balance as of 12/31/01 Solve for X: X - $32,000 = 0 X = $32,000 Rent revenue Rent Received in Advance X Balance as of 12/31/00 $36,000 $50,000 Rent collected $14,000 Balance as of 12/31/01 Solve for X: X = $50,000 - $36,000 - $14,000 X = $0 Bonus Payable X $25,200 $25,200 Balance as of 12/31/00 Employee incentive bonus Balance as of 12/31/01 Solve for X: X + $25,200 = $25,200 X = $0 Cash paid for taxes Taxes Payable X $31,000 $33,920 $2,920 Solve for X: $2,920 = X + $33,920 - $31,000 X = $0 17-26 Balance as of 12/31/00 Income tax expense Balance as of 12/31/01 Borrowing from TownBank X Balance as of 12/31/00 $50,000 Borrowing from TownBank $50,000 Balance as of 12/31/01 Solve for X: X + $50,000 = $50,000 X = $0 Building Loan X Repayment of building loan $85,000 $35,000 Balance as of 12/31/00 Balance as of 12/31/01 Solve for X: $35,000 = X - $85,000 X = $120,000 Capital Stock X $35,000 $135,000 Balance as of 12/31/00 Issuance of capital stock Balance as of 12/31/01 Solve for X: $135,000 = X + $35,000 X = $100,000 Dividends declared & paid Retained Earnings X $18,000 $50,880 $264,380 Solve for X: $264,380 = X + $50,880 - $18,000 X = $231,500 17-27 Balance as of 12/31/00 Net income Balance as of 12/31/01 JKI Advertising Agencies Balance Sheet as of 12/31/00 Cash Accounts receivable Prepaid insurance Land Building Less: Accumulated depreciation Office equipment Less: Accumulated depreciation Total assets Salaries payable Interest payable Liability for customer lawsuit Rent received in advance Bonus payable Taxes payable Borrowing from TownBank Building loan Capital stock Retained earnings Total of liabilities and equities 17-28 2000 $ 30,000 45,000 3,000 150,000 600,000 (360,000) 60,000 (31,000) $497,000 $ 11,000 2,500 32,000 120,000 100,000 231,500 $497,000 Requirement 3: Operating section of cash flow statement under indirect approach: JKI Advertising Agencies Statement of Cash Flows for the Year Ended 12/31/01 Net income + Depreciation expense–building + Depreciation expense–office equipment - Increase in accounts receivable - Decrease in salaries payable + Increase in interest payable - Decrease in liability for customer lawsuit + Increase in rent received in advance + Increase in bonus payable + Increase in taxes payable Cash flow from operations $50,880 20,000 8,000 (35,000) (4,000) 1,000 (32,000) 14,000 25,200 2,920 $51,000 Requirement 4: Evaluation of statements: a) Depreciation is a noncash charge, and therefore, by adding depreciation to net income we, in effect, eliminate this noncash item from the net income figure. b) Note that while depreciation expense is subtracted in determining net income, the cost of long-lived assets is not subtracted from the cash flow from operations. Consequently, net income over the entire life of a company would be equal to the sum of cash flow from operations and cash flow from investing. Requirement 5: Effect of revised bonus formula on operating cash flows: Cash flow from operations for the year 2001 would remain unchanged since this is merely an accrual entry (i.e., liability increases and retained earnings decreases). However, when the incentive bonus is paid in cash, say, in 2002, it will show up as operating outflow. 17-29 The operating section of the cash flow statement under the indirect approach demonstrates the main point. The three italicized items change when the incentive bonus is increased from 20% to 25%. However, because this is an accrual entry, the net effect of these three on the cash flow from operations is zero. Since the net income is different and since it is the beginning point for calculating the cash flow from operations, it might be tempting to say that the cash flow from operations will be lower. JKI Advertising Agencies Statement of Cash Flows for the Year Ended 12/31/01 Net income (see below) + Depreciation expense–building + Depreciation expense–office equipment - Increase in accounts receivable - Decrease in salaries payable + Increase in interest payable - Decrease in liability for customer lawsuit + Increase in rent received in advance + Increase in bonus payable (see below) + Increase in taxes payable (see below) Cash flow from operations $47,100 20,000 8,000 (35,000) (4,000) 1,000 (32,000) 14,000 31,500 400 $51,000 Supporting computations for revised cash flow statement: Revised bonus expense (.25 x 126,000) = Previous bonus expense Before-tax increase in bonus expense Times (1 - .4)1 After-tax decrease to net income Previous net income Revised net income 1 $31,500 25,200 $ 6,300 .6 $ 3,780 50,880 $47,100 Tax rate is Income tax expense / Income before taxes = $33,920 / $84,800 = 40% 17-30 T-account to support change in taxes payable: Cash paid for taxes Taxes Payable 0 $31,000 $31,400 $400 Revised tax expense: Before-tax increase in bonus expense Times tax savings Decrease in income tax expense Previous income tax expense Revised income tax expense Balance as of 12/31/00 Income tax expense Balance as of 12/31/01 $ 6,300 .4 $ 2,520 33,920 $31,400 P17-7. Reconciliation of changes in balance sheet accounts with amounts reported in cash flows statement Requirement 1: Reconciling changes in accounts receivable reported on the cash flow statement with change in receivables shown on the balance sheet: Briggs & Stratton Corp. For Briggs & Stratton, the decrease in receivables of $2,384,000 reported in the Year 2 cash flow statement is equal to the change in the net receivables as reported in the balance sheet ($122,597,000 - $124,981,000). Ramsay Health Care, Inc. Here, the decrease in receivables of $3,677,000 from the balance sheet (i.e., $23,019,000–$26,696,000) is different from the increase in the patient accounts receivables of $2,169,000 reported in the cash flow statement. Learning Objective The purpose of this exercise is to present the two different reporting practices commonly adopted by companies and illustrate how both approaches lead to the same cash flow numbers. 17-31 Requirement 2: Explanation of different reporting practices with respect to receivables: It is instructive to discuss initially the mechanics of converting sales or service revenue to cash collected from customers. We reconstruct the Taccounts of Ramsay Health Care to figure out the cash collected from customers. Although one can arbitrarily choose any sales number to get the intuition, let us pick the actual Year 2 revenue of $137,002,000 (not provided in the problem). We first need to calculate the amount of receivables written off during the year from an analysis of the "Allowance for doubtful accounts" T-account. Bad debts written off Allowance for Doubtful Accounts $4,955,000 Beginning balance 5,846,000 Provision for bad debts X $3,925,000 Ending balance Solve for X: $4,955,000 + $5,846,000 - X = $3,925,000 X = $6,876,000 Plugging this number into the "Patient accounts receivable" account allows us to solve for cash collected: Beginning balance Revenue Ending balance Patient Accounts Receivable $31,651,000 137,002,000 $6,876,000 Bad debts written off (from previous page) X Cash collected $26,944,000 Solve for X: $31,651,000 + $137,002,000 - $6,876,000 - X = $26,944,000 X = $134,833,000 The figure for cash collected can be determined using either one of the two reporting practices. For instance, if Ramsay had followed Briggs & Stratton’s reporting practice, the adjustment for change in receivables would be as follows: 17-32 Ramsay Health Care, Inc., and Subsidiaries Using Briggs & Stratton’s Reporting Strategy Revenue $137,002,000 - Provision for doubtful accounts (5,846,000) + Decrease in Net A/R 3,677,000 Cash collected from customers $134,833,000 Obviously, revenue less the provision for doubtful accounts is already reflected in the net income figure. It is important to understand that the net accounts receivable balance (gross A/R minus allowance for doubtful accounts) is affected by revenue as well as provision for doubtful accounts. Consequently, to figure out the cash collected from customers, we should jointly consider revenue, provision for doubtful accounts and change in receivables. The intuition behind the above table can be clarified by examining the reporting practice adopted by Ramsay Health Care, which follows. Ramsay Health Care, Inc. and Subsidiaries Revenue $137,002,000 - Provision for doubtful accounts (5,846,000) Adjustments to reconcile net income to cash flows + Provision for doubtful accounts 5,846,000 + Decrease in gross A/R* $4,707,000 - Bad debts written off* (6,876,000) - Decrease in patient accounts receivable Cash collected from customers (2,169,000) $134,833,000 Note: The two * items were not separately reported by Ramsay Health Care. Instead, it reported the sum of the two items, i.e., ($2,169,000) = $4,707,000 - $6,876,000 17-33 Under this reporting practice, firms first add back the provision for doubtful accounts which, in essence, eliminates the noncash accrual expense. The remainder of the adjustments (revenue + decrease in gross accounts receivable - bad debts written off) represent all the items in the T-account for patient accounts receivable (i.e., gross accounts receivable) except for cash collected from customers which is being solved. Another way to provide the intuition is to focus on the two possible reasons for the decrease (in this example) in accounts receivable, i.e., (1) cash collections and (2) bad debts written off. By adding the decrease in gross accounts receivable, we attribute the entire decrease to cash collections. However, by subtracting the bad debts written off, we adjust for any decreases in accounts receivable that merely represent bad debts. 17-34 P17-8. Preparation of cash flow statement–indirect method (AICPA adapted) Cash flow for 2001 using the indirect method: Bergen Corporation Statement of Cash Flows For the Year Ended December 31, 2001 Operating Activities: Net income Adjustments for noncash items: +Depreciation - Amortization of bond premium +Increase in deferred income taxes payable - Gain on sale of securities - Gain on sale of equipment - Increase in accounts receivable, net - Increase in inventories - Decrease in accounts payable and accrued expenses Net cash flow provided by operations Investing Activities: Sale of securities Sale of equipment Purchase of equipment Net cash outflow from investing activities Financing Activities: Proceeds from long-term note payable Cash dividends Payment of tax assessment from prior period Payment under capital lease Net cash flow provided by financing activities Net increase in cash Beginning balance in cash Ending balance in cash 17-35 $253,000 149,000 (2,000) 15,000 (20,000) (5,000) (90,000) (115,000) (63,000) 122,000 95,000 33,000 (392,000) (264,000) 450,000 (30,000) (20,000) (25,000) 375,000 233,000 308,000 $541,000 P17-9. Preparing an income statement from statement of cash flows and comparative balance sheets Kang-Iyer Financial Consultants Statement of Cash Flows for the Year Ended 12/31/01 Cash Flow from Operations: Cash collected from customers Cash paid to employees Cash paid for interest Cash flow from operations $250,000 (70,000) (50,000) $130,000 Cash Flow from Investing: Land purchased Building acquired Cash flow from investing ($200,000) (500,000) ($700,000) Cash Flow from Financing: Dividends paid Additional borrowings from village bank Proceeds from share issue (capital contributions) Cash flow from financing ($ 15,000) 500,000 45,000 $530,000 Change in cash Beginning cash balance Ending cash balance ($ 40,000) 70,000 $ 30,000 17-36 Kang-Iyer Financial Consultants Income Statement for the Year Ended 12/31/01 Consulting revenue $356,500 Less: Expenses Depreciation–building Salaries expense Interest expense Bad debts expense Rent expense Net income Beginning balance Consulting revenue Ending balance $10,000 150,000 65,000 48,000 30,000 303,000 $ 53,500 Accounts Receivable $15,000 X $41,500 Bad debts written off 250,000 Cash collected $80,000 Solve for X: $80,000 = $15,000 + X - $41,500 - $250,000 X = $356,500 Allowance for Doubtful Accounts $1,500 Beginning balance Bad debts written off $41,500 X Provision for doubtful accounts $8,000 Ending balance Solve for X: $8,000 = $1,500 + X - $41,500 X = $48,000 17-37 Salaries Payable $20,000 $70,000 X $100,000 Cash paid Beginning balance Salaries expense Ending balance Solve for X: $100,000 = $20,000 + X - $70,000 X = $150,000 Interest Payable $5,000 $50,000 X $20,000 Cash paid Beginning balance Interest expense Ending balance Solve for X: $20,000 = $5,000 + X - $50,000 X = $65,000 Beginning balance Cash paid Ending balance Prepaid Rent $30,000 X 0 $0 Rent expense Solve for X: $0 = $30,000 + $0 - X X = $30,000 Accumulated Depreciation–Building $0 Beginning balance X Depreciation expense $10,000 Ending balance Solve for X: $10,000 = $0 + X X = $10,000 17-38 P17-10. Determining components of cash flow statement (AICPA adapted) Requirements 1–3: Cash provided by operating, investing, and financing activities: Best Corporation Statement of Cash Flows For the Year Ended December 31, 2001 Cash Flow from Operating Activities: Net income $700,000 Add (Subtract): Depreciation expense $130,000 Increase in accounts receivable (280,000) Increase in inventory (290,000) Increase in accounts payable 390,000 Increase in accrued expenses 170,000 Loss on sale of fixtures 10,000 130,000 Cash provided by operating activities 830,000 Cash Flow from Investing Activities: Sale of fixtures Purchase of fixtures Cash used in investing activities 20,000 (630,000) Cash Flow from Financing Activities: Issuance of common stock Cash paid for dividends1 Cash provided by financing activities 125,000 (85,000) Net change in cash balance 1 Dividends declared - Increase in dividends payable Cash dividends paid 17-39 (610,000) 40,000 $260,000 $125,000 (40,000) $ 85,000 Fair market value of Best Corporation’s common stock. The debit to retained earnings for the fair market value of the stock dividend can be found by an analysis of the retained earnings T-account: Dividends declared Stock dividend Retained Earnings $330,000 $125,000 700,000 X $630,000 Beginning balance Net income Ending balance Solve for X: $630,000 = $330,000 + $700,000 - $125,000 - X X = $275,000 = fair market value of stock dividend On a per-share basis, Best’s common stock has a value of $275,000/20,000 shares = $13.75 17-40 P17-11. Analysis of statement of cash flows Requirement 1: Statement of cash flows for the year ended 12-31-2001: Cavalier Toy Stores Statement of Cash Flows For the Year Ended December 31, 2001 Cash Flow from Operating Activities: Net loss Add: Depreciation expense $75,000 Decrease in accounts receivable 405,000 Decrease in prepaid insurance 30,000 Decrease in inventory 500,000 Increase in salaries payable 20,000 Increase in accounts payable 188,000 Less: Decrease in interest payable Cash flow from operating activities ($250,000) 1,218,000 (8,000) $960,000 Cash Flow from Investing Activities: Purchase of building Cash flow from investing activities (900,000) ($900,000) Cash Flow from Financing Activities: Loan from Thrifty Bank Dividends Decrease in dividends payable Cash paid for dividends Cash flow from financing activities 140,000 (300,000) (50,000) ($350,000) ($210,000) Net change in cash balance ($150,000) 17-41 Requirement 2: (a)Bad debts written off during the year: Beginning balance in allowance for doubtful accounts $ 30,000 Add: Bad debt expense 100,000 Less: Ending balance in allowance for doubtful accounts (10,000) Bad debts written off during the year $ 120,000 (b)Cash collected from customers: Beginning balance in accounts receivable Add: Credit sales Less: Bad debts written off Less: Ending balance in accounts receivable Cash collected from customers $ 525,000 1,500,000 (120,000) (100,000) $1,805,000 (c) Purchases made during the year: Beginning inventory Add: Purchases Less: Ending inventory Cost of goods sold Purchases $550,000 ? (50,000) 1,200,000 $700,000 (d)Cash paid to the suppliers for purchases of inventory: Beginning balance in accounts payable Purchases Less: Ending balance in accounts payable Cash paid for inventory purchases $ 64,000 700,000 (252,000) $512,000 (e)Cash paid for insurance: Beginning balance in prepaid insurance Add: Cash paid for insurance Less: Ending balance in prepaid insurance Insurance expense Cash paid for insurance 17-42 $35,000 ? (5,000) 30,000 $0 Requirement 3: Thrifty Bank should be concerned about renewing the loan or increasing the credit limit for the following reasons: (a)Depletion of accounts receivable and inventory and increase in accounts payable to boost cash flow from operations–this cannot be done every year to increase cash flow from operations. (b)Use of working capital (accounts receivable and inventory and increase in accounts payable) to finance building–a nonproductive asset (c) Very large dividend in a loss year. (d)Decreasing gross margins (from letter) from competitive pressures. (e)Net loss. 17-43 P17-12. Preparation of cash flow statement (AICPA adapted) Farrell Corporation Statement of Cash Flows For the Year Ended December 31, 2001 Operating Activities: Net income Add (Deduct): Depreciation Amortization of goodwill Loss on sale of equipment Equity in net income of Hall, Inc. Increase in deferred income tax payable Decrease in accounts receivable Increase in inventories Increase in accounts payable and accrued expenses Net cash provided by operating activities $141,000 $53,000 4,000 5,000 (13,000) 11,000 10,000 (118,000) 41,000 Investing Activities: Sale of equipment Purchase of equipment Net cash provided from investing activities 19,000 (63,000) Financing Activities: Sale of common stock Sale of treasury stock Cash dividends paid Net cash provided by financing activities 23,000 25,000 (43,000) (7,000) 134,000 (44,000) 5,000 Simultaneous Financing and Investing Activity Not Affecting Cash: Purchase of land with long-term note 150,000 Net increase in cash Beginning balance in cash account Ending balance in cash account 17-44 $ 95,000 180,000 $275,000 P17-13. Statement of cash flows—indirect method (AICPA adapted) Omega Corporation Statement of Cash Flows For the Year Ended December 31, 2001 Cash Flow from Operating Activities: Net income Adjustments to reconcile net income to cash provided by operating activities: Depreciation1 $150,000 2 Gain on sale of equipment (5,000) 3 Undistributed earnings of Belle Co. (30,000) Changes in assets and liabilities: Decrease in accounts receivable 40,000 Increase in inventories (135,000) Increase in accounts payable 60,000 Decrease in income taxes payable (20,000) Net cash provided by operating activities Cash Flows from Investing Activities: Proceeds from sale of equipment Loan to Chase Co. Principal payment of loan receivable Net cash used in investing activities 40,000 (300,000) 30,000 Cash Flows from Financing Activities: Dividends paid Net cash used in financing activities (90,000) Net increase in cash Cash at beginning of year Cash at end of year $360,000 60,000 420,000 (230,000) (90,000) $100,000 700,000 $800,000 17-45 1 2 3 Depreciation Net increase in accumulated depreciation for the year ended December 31, 2001 Accumulated depreciation on equipment sold: Cost Carrying value Depreciation for 2001 Gain on sale of equipment Proceeds Carrying value Gain $125,000 $60,000 (35,000) 25,000 $150,000 $40,000 35,000 $ 5,000 Undistributed earnings of Belle Co. Belle’s net income for 2001 Omega’s ownership Undistributed earnings of Belle Co. 17-46 $120,000 25% $ 30,000 Financial Reporting & Analysis Chapter 17 Solutions Statement of Cash Flows Cases Cases C17-1. Q-Mart Retail Stores, Inc. (KR): Analysis of statement of cash flow Requirement 1: Q-Mart Retail Stores, Inc. Statement of Cash Flows for the Year Ended 12/31/01 Cash Flow from Operating Activities: Net income + Depreciation expense–building + Depreciation expense–computer Increase in net accounts receivable Increase in inventory Increase in prepaid insurance Decrease in salaries payable Decrease in accounts payable + Increase in income tax currently payable Cash flow from operations $ 81,250 25,000 35,000 (361,000) (275,000) (20,000) (32,000) (5,000) 7,000 ($544,750) Cash Flow from Investing Activities: Additions to building Purchase of computer equipment Cash flow from investing activities ($250,000) (140,000) ($390,000) Cash Flow from Financing Activities: Borrowing from Upstate Bank Proceeds from stock issuance Dividends paid Cash flow from financing activities $200,000 390,000 (40,000)1 $550,000 Change in cash balance + Beginning cash balance Ending cash balance (384,750) 504,750 $120,000 17-47 1 Calculation of dividends: Beginning balance of retained earnings Add: Net income Less: Ending balance of retained earnings Dividends paid $341,750 81,250 -383,000 $ 40,000 Requirement 2: Bad debts written off = beginning balance of allowance for doubtful accounts + bad debts expense - ending balance of allowance for doubtful accounts = $11,000 + $50,000 - $50,000 = $11,000 Requirement 3: Cash collected = beginning balance of accounts receivable + sales - bad debts written off (from above) - ending balance in accounts receivable = $100,000 + $1,500,000 - $11,000 - $500,000 = $1,089,000 Requirement 4: Purchases of inventory = ending balance of inventory + cost of goods sold beginning balance of inventory = $350,000 + $1,050,000 - $75,000 = $1,325,000 Requirement 5: Cash paid = beginning balance of accounts payable + purchases (from above) - ending balance of accounts payable = $17,000 + $1,325,000 - $12,000 = $1,330,000 Requirement 6: Cash flow from operations is the main reason for the decline. The increase in accounts receivable is a good signal if it is commensurate with growth in sales. On the other hand, it could suggest collection problems as well as inadequate provision for doubtful accounts. There is also an increase in inventory. This could be positive news if the buildup is in anticipation of demand. Again, this could be negative if the obsolete items have not been written down. The investment in property, plant, and equipment is financed by loan and equity. 17-48 Additional information required: · · · · What is the sales increase over last year? By how much have the purchases increased over the last year? Why haven’t the suppliers extended credit with the rise in purchases? What is the change in net income over last year? Requirement 7: If the sales had been stopped, the net income would be lowered, and, therefore, the cash flow from operations would decline ultimately. What is necessary is to reduce the average collection period for accounts receivable and speed up the collection process. Requirement 8: Depreciation is a noncash item and is added back to the net income. Therefore, even if higher depreciation had been provided, the amount that is added to the net income would have been originally subtracted from revenues to determine net income and, consequently, would not affect the cash flow. Requirement 9: Matching is an important feature of accrual accounting that is lacking in the cash flow statements. However, accruals are subject to greater managerial discretion. See answer to “reasons for decline” as an example of jointly analyzing the two statements. 17-49 C17-2. Vulcan Corporation: Understanding cash flow statements Requirement 1: Vulcan’s net income can be determined by adding the unrealized loss on investments to total comprehensive income reported for the year ended October 31, 2000. Vulcan Corporation Computation of Net Income Year Ended October 31, 2000 ($ in thousands) Comprehensive income as reported $ 336 Plus: Unrealized loss on investments classified as available-for-sale 286 Net income $ 622 17-50 Requirement 2: In order to prepare Vulcan’s income statement at October 31, 2000, the following items must be determined: sales, cost of goods sold, depreciation expense, general & administrative expense, interest expense and tax expense. These items can readily be determined from the information provided (see below—Calculation of revenues and expenses). Vulcan Corporation Statement of Income and Comprehensive Income Year Ended ($ in thousands) October 31, 2000 Net sales $40,455 Cost of goods sold 28,598 Gross profit 11,857 General and administrative expense 8,690 Depreciation expense 1,322 Operating income 1,845 Interest expense 888 Income before income taxes 957 Income tax expense 335 Net income 622 Other comprehensive loss Unrealized loss on investments classified as available-for-sale (286) Comprehensive income $ 336 17-51 Calculation of income statement revenues and expenses: Note all amounts are in thousands Sales Cash collected from customers Plus increase in accounts receivable Net sales $ 37,378 3,077 $ 40,455 Cost of goods sold Cash paid to suppliers Plus decrease in inventories Plus increase in accounts payable Cost of goods sold $ 26,884 333 1,381 $ 28,598 General and administrative expense Cash paid for general and administrative expense Plus increase in accrued general and administrative expense General and administrative expense Depreciation expense Plant, property & equipment at October 31, 2000 Plant, property & equipment (PP&E) at October 31, 1999 Decrease in PP&E Decrease in PP&E comprised of Equipment purchases Equipment retirements at net book value Depreciation expense (plug number) Decrease in PP&E Interest expense Cash paid for interest expense Plus increase in interest payable Interest expense $ 8,002 $ 688 8,690 $ 10,707 11,523 (816) $ $ $ Income tax expense Cash paid for income taxes Plus increase in deferred taxes Income tax expense $ $ 17-52 854 (348) (1,322) (816) 810 78 888 74 261 335 Requirement 3: Vulcan’s net cash provided by operating activities, using the indirect method, would be $1,608,000. Vulcan Corporation Cash Flow From Operating Activities Year Ended October 31, 2000 ($ in thousands) Net income $ 622 Adjustments to net income: Depreciation $ 1,322 Deferred taxes 261 1,583 2,205 Changes in current assets and liabilities: Increase in accounts receivable (3,077) Decrease in inventories 333 Increase in accounts payable 1,381 Increase in interest payable 78 Increase in accrued general and administrative expense 688 (597) Net cash provided by operating activities $ 1,608 17-53 C17-3. Fillio Corporation (KR): Comprehensive statement of cash flows Requirement 1: Fillio Corporation Statement of Cash Flows for the Year Ended 12/31/01 Operating Activities: Net loss ($11,403) + Dividend in kind 162 + Depreciation 8,330 + Loss on write-off of machinery & equipment 227 + Non-cash portion of settlement with Sitco 1,775 + Bad debt expense 238 + Decrease in gross accounts receivable 13,782 - Bad debts written off (315) + Decrease in income tax receivable 6,731 + Decrease in inventory 22,459 - Increase in prepaid expenses (835) - Decrease in trade accounts payable (22,725) - Decrease in accrued payroll (1,259) + Increase in accrued interest 33 - Decrease in other payables (19) - Decrease in accrued settlement ($2,432) - Decrease in long-term accrued settlement (1,500) (3,932) - Increase in deferred financing costs + Increase in owners’ equity for these costs Cash flow from operations Investing Activities: Purchase of property, plant, and equipment Cash flow from investing activities (413) 400 (13) $13,236 (1,085) ($1,085) (continued) 17-54 Financing Activities: Increase in preferred stock - Dividend in kind - Noncash settlement with Sitco Repayment of principal on IDR bonds Retired revolving line of credit Retired equipment line of credit Borrowing on new revolving line of credit Borrowing on new equipment line of credit Repayment of notes secured by equipment 2001 bank loan secured by real property (i) Borrowing (ii) Repayment 2001 equipment loan at 9% (i) Borrowing (ii) Repayment Increase in common stock + paid-in capital - Non-cash stock for financing charges Cash flow from financing activities Change in cash Beginning cash balance Ending cash balance $1,937 (162) (1,775) ($ 320) (19,973) (15,762) 21,006 6,000 (3,982) 3,000 (1,500) 1,500 200 (97) 103 526 (400) 126 ($11,302) $ 17-55 849 48 897 Details of selected T-accounts: Accumulated Depreciation $18,630 Beginning balance 8,330 Depreciation expense Acc. dep. on asset written off $633 $26,327 Ending balance Beginning balance Purchase of PP&E Ending balance 1 Property, Plant and Equipment $55,574 $8601 Original cost of asset written off 1,085 $55,799 Book value of asset written off + Acc dep. on asset written off = Original cost of asset written off Bad debts written off Beginning balance $227 633 $860 Allowance for Doubtful Accounts $608 Beginning balance 238 Bad debt expense $315 $531 Ending balance Accounts Receivable $32,803 Sales revenue 184,137 Ending balance $19,021 $315 197,604 17-56 Bad debts written off Cash collected Requirement 2: Fillio Corporation Statement of Cash Flows for the Year Ended 12/31/01 Operating Section under the Direct Method Cash collected from customers: Sales revenue + Decrease in gross accounts receivable - Bad debts written off $184,137 13,782 (315) $197,604 (181,010) 8,330 22,459 (22,725) (172,946) Cash paid for marketing, etc., expenses: Marketing, general & admin. expenses + Bad debt expense - Increase in prepaid expenses - Decrease in accrued payroll (7,227) 238 (835) (1,259) (9,083) Cash paid for interest: Interest expense + Increase in accrued interest (5,417) 33 (5,384) Cash paid to suppliers: Cost of sales + Depreciation + Decrease in inventory - Decrease in trade accounts payable Interest income on income tax refund Cash paid for Sitco settlement: Settlement with Sitco + Noncash portion of settlement with Sitco Cash paid for other expenses: Other expenses + Loss on write-off of machinery & equipment - Decrease in other payables - Increase in deferred financing costs + Increase in owners’ equity for these costs 1,048 (1,837) 1,775 (62) (935) 227 (19) (413) 400 (740) Income tax refund received Cash paid for accrued settlement costs: - Decrease in accrued settlement - Decrease in long-term accrued settlement Cash flow from operations 17-57 6,731 (2,432) (1,500) (3,932) $ 13,236 C17-4. Lucky Lady, Inc. (KR): Comprehensive statement of cash flows Requirement 1: Lucky Lady, Inc. Statement of Cash Flows For the Year Ended 12/31/01 Cash Flows from Operating Activities: Net loss + Depreciation expense + Aircraft carrying value adjustment + Loss on sale of property, plant & equip. (book value $2,501–cash received $684) - Increase in net accounts receivable - Increase in prepaid expenses - Increase in inventories + Decrease in pre-opening costs - Increase in other operating assets + Increase in accounts payable + Increase in accrued salaries & wages + Increase in accrued interest on LT debt + Increase in other accrued liabilities + Increase in deferred revenue Cash flow from operations Cash Flows from Investing Activities: Sale of property, plant & equipment Purchase of PP&E and cost of building + Increase in construction payables1 Cash flow from investment activities 1 ($117,586) 8,018 68,948 1,817 (29,869) (10,536) (12,508) 10,677 (5,485) 9,859 7,249 43 23,758 10,784 ($ 34,831) 684 ($480,054) 64,548 (415,506) ($414,822) Cash Flow from Financing Activities: Repayment of principal in capital lease Additional borrowing (laundry loan) Issuance of additional common stock Cash flow from financing activities (1,564) 10,000 72,559 $ 80,995 Total change in cash Cash at 12/31/00 Cash at 12/31/01 (368,658) 579,963 $211,305 Alternatively, this could be shown as a financing activity cash inflow. 17-58 Note on significant non-cash transaction: The Company entered into a capital lease agreement and recorded an asset and a corresponding liability for $16,987. Property, Plant and Equipment Beginning balance $471,506 New capital lease 16,987 $14,751 Cost of asset sold (net book value $2,501 + Acc. dep. $12,250) Other new additions X Ending balance $953,796 Solve for X: $953,796 = $471,506 + $16,987 + X - $14,751 X = $480,054 Accumulated Depreciation $21,796 Acc. depr. on asset sold X 8,018 68,948 $86,512 Beginning balance Depreciation expense Carrying value adjustment Ending balance Solve for X: $86,512 = $21,796 + $8,018 + $68,948 - X X = $12,250 Capital Lease Obligation (including current maturities) $451 Beginning balance Repayment of principal X 16,987 New capital lease $15,874 Ending balance Solve for X: $15,874 = $451 + $16,987 - X X = $1,564 17-59 Lucky Lady, Inc.–Alternative Approach Statement of Cash Flows For the Year Ended 12/31/01 Cash Flows from Operating Activities: Net loss + Depreciation expense + Aircraft carrying value adjustment + Loss on sale of property, plant & equip. (Book value $2,501 - Cash received $684) + Bad debt expense - Increase in gross accounts receivable ($33,071) - Bad debts written off (653) - Increase in prepaid expenses - Increase in inventories + Decrease in pre-opening costs - Increase in other operating assets + Increase in accounts payable + Increase in accrued salaries & wages + Increase in accrued interest on LT debt + Increase in other accrued liabilities + Increase in deferred revenue Cash flow from operations Cash Flows from Investing Activities: Sale of property, plant & equipment Purchase of PP&E and cost of building + Increase in construction payables Cash flow from investment activities Cash Flow from Financing Activities: Repayment of principal in capital lease Additional borrowing (laundry loan) Issuance of additional common stock Cash flow from financing activities Total change in cash Cash at 12/31/00 Cash at 12/31/01 ($117,586) 8,018 68,948 1,817 3,855 (33,724) (10,536) (12,508) 10,677 (5,485) 9,859 7,249 43 23,758 10,784 (34,831) 684 (480,054) 64,548 (415,506) (414,822) (1,564) 10,000 72,559 80,995 (368,658) 579,963 $211,305 17-60 Under the alternative approach, we are merely breaking down the change in net accounts receivable into three components which are italicized. This is done in order to convert the indirect statement to a direct statement. Of course, this step can be omitted. Gross Accounts Receivable Beginning balance Revenue Ending balance $2,178 57,800 $35,249 $653 X Bad debts written off Cash collected Solve for X: $35,249 = $2,178 + $57,800 - $653 - X X = $24,076 Bad debts written off Allowance for Doubtful Accounts $1,531 Beginning balance X 3,855 Bad debt expense $4,733 Ending balance Solve for X: $4,733 = $1,531 + $3,855 - X X = $653 Note: These T-accounts may be useful when preparing the direct cash flow statements. Note that we have to consider the change in deferred revenue to calculate the “correct” amount of cash collected from customers. 17-61 Requirement 2: Lucky Lady, Inc. Direct Method Cash Flow from Operations Cash collected from customers: Total revenue - Increase in gross A/R - Bad debts written off +Increase in deferred revenue $57,800 (33,071) (653) 10,784 $34,860 Cash paid for direct operating expense (approx.): Direct operating expense (casino + ... + airline) (39,262) - Increase in prepaid expenses (10,536) - Increase in inventories (12,508) - Increase in other operating assets (5,485) +Increase in accounts payable 9,859 +Increase in accrued salaries & wages 7,249 +Increase in other accrued liabilities 23,758 (26,925) Cash paid for SG&A expenses: SG&A expenses +Bad debt expense (19,679) 3,855 (15,824) Cash paid for hotel pre-opening expenses: Hotel pre-opening expenses (45,130) +Decrease in pre-opening costs 10,677 (34,453) Interest income 12,231 Cash paid for interest expense: Interest expense + Increase in accrued interest on LT debt (6,596) 43 Cash received from other non-operating items: Other, net 16 +Loss on sale of PP&E 1,817 Cash flow from operations (6,553) 1,833 ($34,831) Note: The direct approach obviously requires assumptions regarding which operating assets and liabilities pertain to which revenue and expense items. 17-62 C17-5. Opus One, Inc. (KR): Preparation and analysis of the cash flow statement Requirement 1: Notes: 1) Since the company did not declare or pay any cash or stock dividends during the year, the change in the retained earnings of $1,127,664 must be the net income for the year. 2) The T-accounts for property and equipment and accumulated depreciation are prepared to solve for the new acquisitions of property and equipment during the year. Accumulated Depreciation $6,822,553 Acc. dep. on scrapped asset $57,107 2,265,735 $9,031,181 Balance as of 6/30/00 New acquisitions Balance as of 6/30/01 Balance as of 6/30/00 Depreciation expense (given) Balance as of 6/30/01 Property and Equipment $20,637,912 1,608,943 $64,484 Orig. cost of the scrapped asset ($57,107 + $7,377) $22,182,371 First, by crediting the accumulated depreciation T-account with the depreciation expense for the year, we find that the accumulated depreciation on the scrapped asset must have been $57,107 (the plug number). Since the book value of the scrapped asset was $7,377, the original cost of the asset must have been $64,484 ($57,107 + $7,377). This amount would have been credited to the property and equipment T-account. The resulting plug number of $1,608,943 must be the cost of new property and equipment acquired during the year. 3) The change in the accumulated amortization of $24,450 must represent the non-cash amortization expense for the year. 4) The words “deferred credits” suggest that the liability account “Other liabilities & deferred credits” must be an operating liability rather than a financial liability. 5) To calculate the financing cash flows from long-term debt, it is useful to focus on the total long-term rather than split them into current and long-term portions. 17-63 6/30/01 6/30/00 Borrowing Long-Term Debt: Term loan $3,420,000 – $3,600,000 534,475 555,455 – Mortgage note Total $3,954,475 $555,455 $3,600,000 - Current installments (681,716) (21,348) Long-term debt (less) $534,107 current installments $3,272,759 Repayments ($180,000) (20,980) ($200,980) 6) Although revolving credit agreements appear as a current liability, they are a financing liability. Consequently, they will be reflected in the financing section of the cash flow statement. 17-64 Opus One, Inc. Statement of Cash Flows For the Year Ended 6/30/2001 Operating Activities: Net income for the year + Amortization of goodwill + Depreciation expense + Loss on disposition of equipment Decrease in net receivables Decrease in inventories Decrease in prepaid expenses Decrease in income tax receivable Increase in deferred tax asset Decrease in pre-opening costs Increase in accounts payable Increase in accrued liabilities Increase in other liabilities & deferred credits Cash flow from operations $ 1,127,664 24,450 2,265,735 7,377 1,540,275 815,162 254,183 1,500,482 (511,600) 506,721 3,102,873 768,144 763,872 $12,165,338 Investing Activities: Purchase of property and equipment Cash flow from investing activities ($ 1,608,943) ($ 1,608,943) Financing Activities: Issuance of new shares 8,998 Borrowing on term loan 3,600,000 Repayment of term loan (180,000) Repayment of mortgage note (20,980) Repayments under revolving credit agreement (13,933,009) Cash flow from financing activities ($10,524,991) Change in cash Cash balance as of 6/30/00 Cash balance as of 6/30/01 17-65 $31,404 19,481 $50,885 Requirement 2: Caveat: The analysis is handicapped by the limited amount of information available in the problem. The learning objective of this assignment is to enable the students to evaluate the cash flow statement rather than perform a comprehensive analysis of the financial performance of Opus One, Inc. The cash flow from operations (CFO) of Opus One, Inc., is almost 11 times the net income of the company. Given the Wall Street adage that “Cash Flow is King and Earnings Don’t Matter,” does this mean that the financial performance of Opus One is really 11 times better than that indicated by its net income? Let us examine the sources of the high CFO to see whether Opus One can sustain this level of cash flows in the future. First of all, the company’s receivables decreased by more than $1.5 million. Roughly, the company collected that much more cash than the revenue booked in the accrual accounting income statement. This might be good news if the company has improved its collection efforts. Even so, this is unlikely to happen year after year if a company is growing, i.e., collecting more cash than the accrual revenue. Consequently, this is likely to be a temporary phenomenon. A second source of the higher cash flow is the drop in the level of inventory. One possibility is that the drop is due to an unexpected sale at the end of the year. However, this is unlikely since the company experienced a drop in the receivables also; i.e, if there were unexpectedly large sales at the end of the year, we might expect the accounts receivable to go up. More importantly, inventory level provides a signal about future demand; i.e, companies are likely to build up (decrease) inventories when they expect a surge (fall) in demand. Therefore, another possibility is that the company saved some cash in the current year by buying less inventory, but it might generate less cash during the next year by selling less inventory. In any case, it is unlikely that inventory levels can continue to decrease when companies are growing. In fact, in the following year, the company built up almost $10 million of inventory which resulted in a negative CFO. The main message here is that neither cash flows nor accounting income by itself can tell the whole story. A joint examination of the two is likely to be constructive. A third factor is the increase in accounts payable by more than $3 million. More credit from suppliers is not necessarily a bad sign; i.e, suppliers are unlikely to extend credit when they believe their customers have impending financial difficulties. However, an increase in accounts payable usually happens when there is a buildup in the inventory level. Consequently, one should examine why Opus One's accounts payable are increasing when its inventory level is falling. One possibility is that the company was “forced” to pay off its revolving credit under the current agreement (see financing cash flow). This might have delayed the payment to the suppliers. 17-66 A fourth item is the cash received from the decrease in the income tax refund receivable. When is it likely for a company to have an asset called income tax refund receivable? There are two possibilities. First, the company paid more taxes during a year when compared to what it owed the IRS based on its actual taxable income; i.e, the actual income was less than the anticipated income. A second possibility is that the company incurred a net loss in the recent past, and, using the loss carryback provision, the company is expecting to receive a tax refund. Either scenario suggests that the company has encountered difficulties in the recent past. In fact, Opus One incurred a net loss of almost $2.5 million during the fiscal year 2000. Similar comments can be made on other operating assets and liabilities. The fact that the company arranged a term loan of $3.6 million is a positive signal. First of all, the company has convinced a creditor to lend it money. Secondly, the loan is a long-term one, and therefore, a substantial portion of the principal payments are unlikely to be due in the near term. The company has paid back about 5% of the term over a 4-month period. On an annual basis, this translates into 15% of the loan; i.e, the company has the potential to use the term loan to finance a part of its working capital needs over the next several years. Collaborative Learning Case C17-6. Best Buy Company: Analysis of financial performance from the cash flow statement and other information Caveat: Due to limited information available in the problem, our analysis cannot provide a complete picture of the financial performance of the company over the three-year period. The learning objective for this problem is to enable the student to examine the items that cause net income to be different from the cash flow numbers. Requirement 1: Comparison of earnings and operating cash flows: The company’s net income has consistently increased over the three-year period, from almost $82 million during the fiscal year 1998 to more than $347 million during 2000. Likewise, the cash flow from operations (CFO) experienced year-to-year increases during this period from $450 million in fiscal 1998 to $760 million in 2000. During this three-year period, operations have been the primary source of the company’s cash flows. How might an analyst interpret the company’s increase in CFO? Recall that when operating assets increase (or decrease), they are a use of (or a source of) operating cash flows. The opposite is true for the operating liabilities. An 17-67 examination of the operating section of the cash flow statements suggests that Best Buy has been building receivables during the three-year period ending 2000. In addition, inventories increased dramatically during 2000 when compared to 1999 and 1998’s decreasing inventory levels. Upon closer examination, we see that from 1998 to 2000 Best Buy actually experienced year-to-year inventory builds. One more important fact to note is that the increase each year in accounts payable more than offset any perceived cash flow deterioration resulting from an inventory build. An important task is for the analyst to understand whether these trends signify positive or negative news about the company. To understand the change in inventories, let us focus on the statistics on new store openings: Number of stores at the end of year Number of new stores opened during the year 2000 357 1999 311 1998 284 46 27 12 1997 272 When retail companies such as Best Buy expand by acquiring or building new stores, they experience a sudden demand for new working capital. This is clearly communicated by Best Buy in its annual report. Each new store requires working capital of approximately $4 million for merchandise inventory (net of vendor financing), leasehold improvements, fixtures and equipment. Note that the words “net of vendor financing” suggests that the $4 million is for the investment in inventory and other assets minus the credit extended by the suppliers through accounts payable. It is quite likely that these new stores will not yet have reached their annual revenue projections during the first year of operations. Consequently, the increase in accounts receivable and inventory will result in a drain on the operating cash flows until the new stores reach their annual sales targets. 17-68 Requirement 2: Analysis of working capital needs: Let us try to calculate the expected increase in the working capital during each of the three years due to new store openings: 2000 Need for working capital per new store $ 4,000 Number of new stores opened during the year 46 Total working capital needed for the new stores $184,000 1999 $ 1998 4,000 $ 4,000 27 12 $108,000 $48,000 Now, let us compare these figures with the actual change in the working capital during the same period: Changes in Working Capital For the fiscal year ended 2/26/2000 Receivables $ 56,900 Merchandise inventories 137,315 Other assets 11,005 Accounts payable (302,194) Other liabilities (108,829) Accrued income taxes (97,814) Net decrease in the working capital $ (303,617) 2/27/1999 36,699 (14,422) 4,251 (249,094) (82,544) (62,672) $ (367,782) $ 2/28/1998 16,121 (71,271) 3,278 (147,340) (63,950) (33,759) $ (296,921) $ Note that each of the figures in the above table are taken from the operating section of the statement of cash flows. However, their signs have been reversed since working capital is defined as current assets (-) current liabilities. Consequently, increases in assets and liabilities have the positive and negative signs, respectively. The opposite is true for the decreases in assets and liabilities. Given the significant growth during the three-year period ended 2000 (adding a total of 85 new stores), it is surprising that Best Buy's working capital requirements appear to have decreased. Looking at fiscal 2000, in which 46 stores were opened, we see that working capital requirements were negative; however, they increased by more than $64 million when compared to 1999. This is considerable less than the $184 million that was expected based on the working capital requirements of the new stores for 2000. Consequently, an analyst is likely to conclude that Best Buy’s growth strategy is conservative and can be easily financed through existing operations. 17-69 However, an analyst must carefully follow up to examine how well the new stores are doing. Requirement 3: Analysis of year-to-year changes in inventory and how these changes were financed: During 2000, although the company added another 46 stores, their working capital decreased about $304 million compared to the expected increase of $184 million. This is primarily the result of increased vendor financing of inventory. Increase in merchandise inventory Increase in accounts payable % of increase in inventory financed by accounts payable 2000 $ 137,315 302,194 220% Suppliers financed the entire growth in inventory during 2000. Similar vendor financing was achieved in fiscal 1999 and 1998. The question the analyst will ask is whether this type of financing is sustainable in the long run. Fiscal 2000 was good year for Best Buy. The company’s profits increased over 60% from 1999 (which was 164% more than fiscal 1998). Operating cash flows indicate that the company has made substantial efforts to improve its financial position by using vendor financing to offset increased inventory levels in 2000. During 1999 and 1998 inventory levels decreased, which appears to be inconsistent with operating results. That is, Best Buy experienced tremendous growth in revenue during this period. As a result, inventory levels would have been expected to increase in order to support this growth. The fact that they did not indicates that management has implemented programs to improve inventory management and control inventory levels. Accounts receivable experienced year-to-year increases, which is consistent with growth in sales. However, the analyst will want to follow up with the company to insure that the increase in receivables is due to increased sales volume versus a change in credit policy or credit terms. Requirement 4: Insights from the “Investing” and “Financing” sections of the cash flow statement. The "Investing" section of the cash flow statement suggest that the company has substantially increased its capital expenditures during 2000 to more than $361 million from around $166 million and $72 million in 1999 and 1998, 17-70 respectively. It appears that Best Buy is planning to continue its expansion program. Finally, let us focus on the financing cash flows. The most important issue is how the business expansion was financed: · In 1998 borrowings and proceeds from issuing common stock were virtually offset by long-term debt repayments. · In 1999 and 2000 Best Buy used cash to reduce its long-term debt and repurchase its common stock. Based on the above, we can conclude that Best Buy is financing its growth through operations (that is through increased earnings, improved inventory management and extensive use of vendor financing). An analyst may want to ask the question “Is it smart to finance long-term needs (permanent increases in working capital for new store openings) and business expansion with short-term financings.” The following are selected excerpts from the management discussion and analysis section of the 2000 fiscal year 10-K report of the company. The management discusses many of the issues that were brought out in our analysis of the cash flows of Best Buy. 17-71 Liquidity and Capital Resources Excerpts Record financial performance enabled the Company to internally fund its business expansion and repurchase approximately $400 million of the Company's common stock, while maintaining its liquidity and strong financial position. Cash flow from operations increased $98 million in fiscal 2000, to $760 million, driven by earnings growth and continued improvement in inventory management. Inventories at the end of fiscal 2000 were $1.2 billion, up only 13% compared with one year ago, even with a 24% sales increase, due to faster inventory turns. The increase in inventories was fully funded by an increase in accounts payable. Trade receivables, mainly credit card and vendor-related receivables, increased $57 million from one year ago. The increase was primarily due to higher business volumes resulting from a 25% increase in fourth-quarter sales and amounts due from ISP promotion subsidies. Receivables from sales on the Company's private-label credit card are sold to third parties, without recourse, and the Company does not bear any risk of loss with respect to these receivables. Accounts payable and accrued liabilities increased compared with fiscal 1999, due to higher business volume. Accrued compensation and related liabilities increased versus one year ago as a result of expenses associated with the expanding employee base supporting the Company's growth. Debt declined $30 million in fiscal 2000 due to the repayment of an $18 million note and scheduled maturities of capital leases and other loans. Capital spending in fiscal 2000 was $361 million, compared with $166 million and $72 million in fiscal 1999 and fiscal 1998, respectively. The Company expanded its store base by investing in 47 new stores and 13 remodeled or relocated stores during fiscal 2000, compared with 28 new stores and five remodeled or relocated stores in fiscal 1999, and 13 new stores and five remodeled or relocated stores in fiscal 1998. The Company increased its expansion program in fiscal 1999 after the initiatives to improve operations resulted in an enhanced operating model and improved profitability. Capital spending in fiscal 2000 also included the initial development for some of the stores scheduled to open in fiscal 2001. Additionally, the Company expanded its corporate facilities to support the growth of the business, the most significant investment being the purchase of an additional office building to supplement the Company's corporate office. The Company also continued to invest in new systems and technology to better position it for continued growth and to generate improvements in its existing business. 17-72