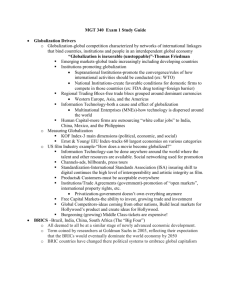

Globalization from a World-System Destiny for Brazil and the Semiperiphery?*

advertisement