Midland College Syllabus Spring 2010 ACCT 2401

advertisement

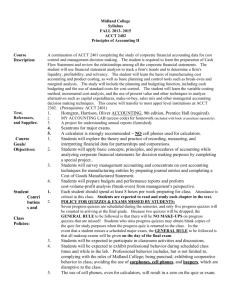

Midland College Syllabus Spring 2010 ACCT 2401 PRINCIPLES OF ACCOUNTING 4 semester credit hours (3 hours lecture and 1 hour lab) Course Description: This course is designed to present a general knowledge of accounting principles and procedures for the sole proprietorship and partnership forms of business organization. Topics and problems include the complete accounting cycle; accounting systems and special purpose journals; internal controls and merchandising transactions; and the preparation of general external financial statements in accordance with generally accepted accounting principles. The students will study short-term liquid assets including uncollectible accounts and notes receivable; several methods of inventory valuation and their affect upon operations; current liabilities and payroll accounting including employer payroll taxes; and the acquisition, depreciation (several methods), and the disposal of plant, property, and equipment; intangible assets; and natural resources. Also studied is the owner’s equity section of a Balance Sheet for a corporation–Paid in Capital and Retained Earnings.. This course will transfer to upper level institutions. (Prerequisites: None.) Text, References, and Supplies: 1. 2. 3. 4. 5. Horngren, Harrison, & Oliver; ACCOUNTING 8th edition, Prentice Hall (required). Working papers which accompany MY ACCOUNTING LAB (with access code) Scantrons for major exams. A calculator is strongly recommended – NO cell phones may be used as a calculator. A capstone project is required to pass this class–furnished after chapter 5 Course Goals/ Objectives: 1. Students will explore the theory and practice of recording, measuring, and interpreting financial data for sole proprietorships, partnerships, and corporations. Students will apply basic concepts, principles, and procedures of accounting (GAAP) while analyzing the operating cycle, adjusting entries, financial statements, internal controls, receivables, inventory, long-term assets, and current and long-term liabilities. 2. Student Contributions and Class Policies: Each student will spend at least 8 hours per week preparing for class. Attendance is critical in this class. Students are expected to read and study each chapter in the text. POLICY FOR QUIZZES & EXAMS MISSED BY STUDENTS: Seven progress quizzes are scheduled during the semester, and only five progress quizzes will be counted in arriving at the final grade. Because two quizzes will dropped the GENERAL RULE to be followed is that there will be NO MAKE-UPS on progress quizzes that are missed! Students who miss progress quizzes may obtain blank copies of the quiz for study purposes after the progress quiz has been returned to the class. In the event that a student misses a scheduled major exam, the GENERAL RULE to be followed is that NO MAKE-UP exam will be allowed; however, the grade made on the comprehensive final examination will be substituted for the missed exam. Students will be expected to participate in classroom activities and discussions. Students will be expected to exhibit professional behavior during scheduled class times and while in the lab. Professional behavior includes, but is not limited to, the following: 1. 2. Complies with the rules of Midland College Is punctual Evaluation of Students: 3. 4. 5. Exhibits cooperative behavior in class Earphones, cell phones, and beepers are disruptive to the class and should be avoided. Please do not work homework for this class or another other class during class time. 1. Performance will be measured according to established grading standards by student testing, including exams consisting of true-false; multiple-choice, matching; fill-in-the-blanks; shortanswer; essays; and problems; or any combination. Grading for this course will be as follows: 2. Best 5 Progress Quizzes (20 points each) All 4 Major Exams (100 points each) Homework (My Accounting Lab-exercises & problems) Comprehensive Problem (required to pass course) Final Examination (comprehensive) Maximum Points Grade A B C D F 100 points 400 points 100 points 100 points 100 points 800points Points 720+ 640-719 560-639 480-559 less than 480 A grade of W will only be given at the request of the student. Please review the withdrawal policy in the Midland College Catalog. Course Schedule: The class meets for 3 lecture hours per week. A tentative course schedule will be provided to the student during the first class meeting. SCANS Information: 1. 2. 3. 4. 5. Identifies, organizes, and allocates resources. Student will: develop time management skills completing assignments by established deadlines and taking quizzes and tests within time frames. Information: Acquires and uses information. Students will: select appropriate data from assignment material to measure business activities, process information into reports, and communicate findings to decision makers in the form of written reports. Locates, understands, and interprets written information in prose and documents. Reading: Accounting has a highly technical vocabulary. Students must read and assimilate data from the text and narrative assignment material in order to understand and to communicate information to managers and decision makers. Arithmetic/ Mathematics: Performs basic computations. Students will: perform basic operations of addition, subtraction, multiplication, and division; use light algebra for solving various equations; calculate percentages, discounts, payroll, and many other everyday business and consumer applications problems. Thinks creatively, makes decisions, solves problems, knows how to learn and Thinking: reason. Students will: develop critical thinking skills (analysis, interpretations, and determining a course of action) and challenge ethical issues of the profession through participating in problem solving exercises. Resources: Instructor Information: Dale Westfall Office Phone: Office: Office Hours: Note: 685-4658 Room 158 TC See below Students are encouraged to contact the instructor at any time; however, making an appointment will guarantee the instructor’s availability at a specific time. Division Dean: Division Secretary: Division Office: Division Telephone: Business Studies Division Information Gavin Frantz Lisa Hain Room 142 TC 685-6447 Dale Westfall 685-4658 office 689-9929 home 158 TC picnic@midland.edu SPRING 2010 OFFICE HOURS 10:30 a.m. - 11:00 a.m. Monday & Wednesday 4:00 p.m. - 5:30 p.m. Monday & Wednesday 8:30 a.m.- 10:30 a.m. Friday 8:30 a.m. - 9:30 a.m. Tuesday & Thursday 2:00 p.m. - 3:00 p.m. Tuesday & Thursday Afternoons by appointment. SPRING TEACHING SCHEDULE ACCT 2401.220 (11:00 a.m. - 12:20 p.m.) MW room 146 TC ACCT 2401.610 (9:30 a.m. - 10:50 p.m.) TR room 146 TC ACCT 2401.670 (7:00 p.m. - 8:20 p.m.) MW room 146 TC ACCT 2402.205 (9:00 a.m. - 10:20 p.m.) MW room 146 TC ACCT 2402.620 (11:00 a.m. - 12:20 p.m.) TR room 146 TC ACCT 2402.518 (5:30 p.m. - 6:50 p.m.) MW room 146 TC ACNT 2382.760 (TBA) ACCOUNTING LAB The accounting lab is located in room 170 TC (432-686-4212) and will be open approximately 12 hours a day, Monday through Thursday, and 3 hours on Friday mornings. More definite hours will be posted in the lab after the first week of class. ACCT 2401 - Principles of Accounting I HOMEWORK ASSIGNMENTS - (ACCOUNTING, eighth edition, Horngren, Harrison, and Oliver). At the end of each chapter in your textbook, you will find a glossary of terms, Quick Check test, Short Exercises, Exercises, and Problems. SHORT EXERCISES generally review concepts and terminology. You may be assured that a significant number of questions concerning concepts and terminology will appear on both progress quizzes and major exams. Therefore, students are advised to study and be able to answer these short exercises. EXERCISES represent short applications of the concepts contained in the chapter (usually covering one or two chapter objectives). Often a student can work an exercise in his head or on scratch paper — although some exercises are more detailed and require more thought and concentration. PROBLEMS are a bit longer and more complex than exercises, often involving several chapter objectives. This semester students will complete selected exercises and problems for a homework grade. CHAPTER HOMEWORK --EXERCISES and PROBLEMS ONE E1-14; E1-16; E1-19; P1-30 A; P1-34A TWO E2-16; E2-17; E2-22; P2-31A THREE E3-14; E3-18; P3-29A; P3-32A FOUR P4-23A; P4-25A FIVE E5-17; E5-21; P5-29A; P5-30A SIX E6-15; E6-16; E6-17; E6-22 E6-26 SEVEN E7-14; E7-15; E7-17; P7-25A; P7-27A; P7-30A EIGHT E8-15; E8-16; P8-25A; P8-27A, P8-30A NINE E9-13; E9-14; E9-17; E9-21; E9-24 TEN E10-26; E10-27; E10-28; P10-34A ELEVEN P11-28A; P11-29A; P11-33A TWELVE P12-26A; P12-27A Competencies Purpose and/or Sample of Real Life Applications Assignments Used Through-out the Course Build a vocabulary of accounting terminology To understand the importance of accounting and how the profession affects internal and external users of accounting information Write answers to select questions and short exercises Yes Construct the accounting equation To reflect the fact that both insiders and outsiders have claim to the assets of a business Input data into the equation format Yes Use T-accounts to analyze the affects of transactions in debit and credit format To visualize double-entry accounting and reinforce the rules of debits and credits Enter transactions into Taccounts Foot and balance accounts Prepare a trial balance proving equality Yes Record information in a general journal and special journal format To provide a day-to-day record of transactions using exact account titles Journalize transactions in general journal format Yes Post to general and subsidiary ledgers To determine the correct balance of a specific account Post entries into 4-column ledger or T- accounts. Yes Prepare financial statements for service and merchandising businesses from a worksheet To communicate financial information in acceptable format recognized by the accounting and business community To report net income To show changes in owner’s equity To verify balance of the equation Prepare several financial statements Yes Identify effective internal control procedures To illustrate the importance of internal control To identify those who are responsible To develop internal control procedures To make ethical business decisions Evaluate strengths and weaknesses in internal control by reviewing several scenarios To illustrate how businesses handle minimum expenditures even though they make most payments by check Make journal entries to establish and replenish a petty cash fund To illustrate how critical this internal control feature is to small businesses and to individuals Prepare a bank reconciliation Identify where common reconciliation items appear on the bank reconciliation Create and use the petty cash fund Reconcile a bank statement Record related journal entries Competencies Purpose and/or Sample of Real Life Applications Yes Assignments No No Used Through-out the Course Estimate uncollectible accounts by the allowance method using the percent of sales and the aging of accounts methods. To learn how businesses estimate for bad debts using two acceptable GAAP preferred methods. To apply generally accepted accounting principles (GAAP) To match revenues with expenses in a given time period To more accurately reflect the collectible amount of accounts receivable Calculate the estimate using the percent of sales and the aging methods Make journal entries to estimate for potential losses Reinstate previously written off customers Calculate simple interest Determine maturity value of Notes Receivable To identify the maturity date of a note receivable To compute interest on shortterm Notes Receivable Determine maturity date and maturity value on several Notes Receivable Make journal entries for accrued interest revenue Yes Determine inventory values using FIFO, LIFO, weighted average and specific unit cost methods To demonstrate the effects of various inventory valuation methods on the income statement and balance sheet using the four different costing methods Compute ending inventory and cost of goods sold using all four acceptable methods Compute gross profit under each method No Record purchasing, cost recovery, depreciation, and sale of plant assets Calculate depreciation by various methods Calculate book value To calculate the original cost of plant assets To determine how plant assets are expensed over time Calculate the book value to determine the value of a plant asset at a given time To record sales and exchanges of plant assets To select the best depreciation method for tax purposes Calculate original cost of a plant asset Calculate depreciation expense using the straight line, units of production, and doubledeclining methods of depreciation Calculate the book value of a plant asset Record journal entries to dispose of plant assets by selling or trading the asset No Classify current liabilities into two categories – known and estimated amounts To distinguish liabilities that are known and that must be estimated. To show how these liabilities affect the balance sheet and the income statement Determine the estimated amount of the liability Record journal entries to account for estimated current liabilities No Calculate basic payroll information Prepare a payroll register Record journal entries for the employer’s records To identify the components of a payroll system To explain the importance of accuracy and timeliness of payroll accounting Calculate weekly gross and net pay for seven employees Prepare a payroll register Record journal entries for weekly payrolls and for the employer’s payroll taxes No Competencies Purpose and/or Sample of Real Life Applications Assignments No Used Through-out the Course Record the creation, operation and liquidation of partnership business entity To illustrate some characteristics and complexities of business form that proprietorships avoid. To show how disolution and liquidation of a partnership are different Make journal entries for the initial investment in a partnership Calculate the sharing of income Make journal entries for the admission of a new partner Make journal entries for the withdrawal of an existing partner Show how to account for the liquidation of a partnership No Build a vocabulary of accounting terms as it relates to corporations. To understand the difference in accounting for sole proprietorships and corporations. Write answers to select questions and sort exercises.. No Recognize two ways to internally finance a corporation–selling stock or profitable operations and how to display these sections on a Balance Sheet for corporations. To distinguish the owner’s equity section of a Balance Sheet of a sole proprietorship from that of a corporation. Record transactions to sell common stock, declare and pay/distribute cash and stock dividends and prepare the Stockholder’s Equity Section of a Balance Sheet for Corporations. No