METROPOLITAN STATE UNIVERSITY FINANCIAL ACCOUNTING QUIZ #2 SUMMER 2001

advertisement

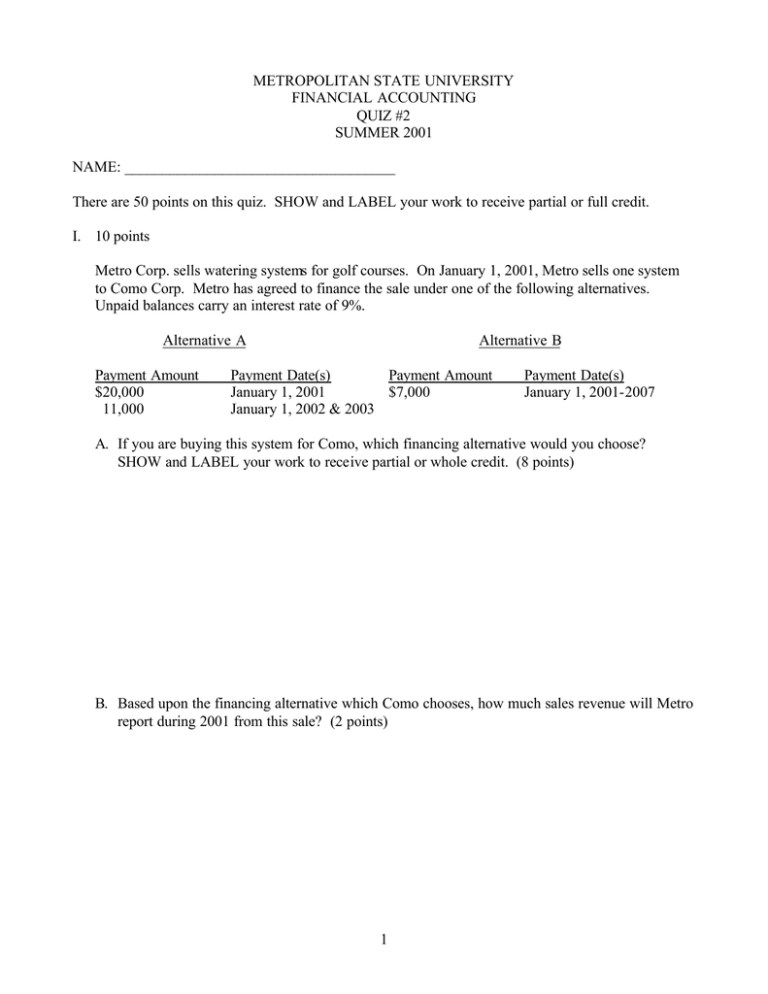

METROPOLITAN STATE UNIVERSITY FINANCIAL ACCOUNTING QUIZ #2 SUMMER 2001 NAME: ____________________________________ There are 50 points on this quiz. SHOW and LABEL your work to receive partial or full credit. I. 10 points Metro Corp. sells watering systems for golf courses. On January 1, 2001, Metro sells one system to Como Corp. Metro has agreed to finance the sale under one of the following alternatives. Unpaid balances carry an interest rate of 9%. Alternative A Payment Amount $20,000 11,000 Alternative B Payment Date(s) Payment Amount January 1, 2001 $7,000 January 1, 2002 & 2003 Payment Date(s) January 1, 2001-2007 A. If you are buying this system for Como, which financing alternative would you choose? SHOW and LABEL your work to receive partial or whole credit. (8 points) B. Based upon the financing alternative which Como chooses, how much sales revenue will Metro report during 2001 from this sale? (2 points) 1 II. 4 points – Please circle the correct response. A. Which of the following is violated when a firm accelerates the recognition of depreciation expense during good years and decreases depreciation expense during lean years? 1. Consistency 2. Matching principle 3. Objectivity principle 4. Revenue recognition principle B. Recognizing the societal cost of pollution as an expense on the income statement of the polluting firm violates which of the following? 1. Economic entity 2. Fiscal period 3. Going concern 4. Stable dollar III. 3 points LaPorte, Ltd. owns a number of upscale shops which specialize in beauty care products. When LaPorte receives a shipment of its merchandise, accounting principles/assumptions require it to record the items as an asset, inventory, and not as an expense, cost of goods sold. A. Please identify the accounting principle/assumption which caused management to adopt this treatment. (1 point) B. Explain the reasoning for this result. (2 points) IV. 3 points “The company’s reporting period ends on the Saturday closest to January 31.” This excerpt was taken from a recent annual report. A. Please identify the accounting principle/assumption which caused management to make this statement. (1 point) B. Explain the reasoning for this result. (2 points) 2 V. 16 points How would the following items impact Regis if it would undertake the events listed below. For each one, indicate what specific accounts are affected as well as the direction and amount of the effect. Also, indicate the direction and amount of impact (“+” increase, “-“ decrease, or “NE” no effect) the transaction would have on net income and net cash flow. The first event is completed for you. EVENT Paid Account Payable for a utility bill of $1,000 ACCOUNTS Cash Accounts Payable Incurred and paid a utility bill of $25,000 Acquired a warehouse with a payment of $250,000 and a 12%, ten year note of $1,750,000 One day’s cash sales of $10,000 and charge sales of $1,490,000 3 IMPACT NET INCOME NET CASH FLOW -1,000 -1,000 NE -1,000 VI. 14 points During your review of Trudeau Company’s year-end books for December 31, 2000, you notice that the following adjustments were not made for the current year. A. On November 1, 2000, Trudeau purchased and properly recorded $2,000,000 of 9% bonds. Interest should be received every six months, beginning May 1, 2001. B. Assume that for the current year that Trudeau’s year-end (December 31) is on a Wednesday. Its normal weekly payroll is $50,000 for a five day work week, beginning on Monday. It is usually paid on Friday. C. On June 1, 2000, Trudeau paid $48,000 for twelve months of insurance on its manufacturing plant. Trudeau’s accountant properly recorded the payment as an asset. REQUIRED: Determine the effect of making each adjustment, considering each item independently, on the financial statements prepared on December 31, 2000. Use the table provided below. Indicate BOTH (1) the dollar amount and (2) if the adjustment causes the financial measure to Increase “+”, Decrease “-“, or has No Effect “NE”. The first item has been completed for you. ACCOUNTS 1. Interest Receivable Interest Revenue AMOUNT +/+30,000 +30,000 CURRENT ASSESTS +30,000 CURRENT LIABILITIES NE 2. 3. 4 NET INCOME +30,000 WORKING CAPITAL +30,000 NET CASH FLOW NE

![. e l]niversity](http://s2.studylib.net/store/data/014466794_1-e3716b019524687fdc0e70dc52976105-300x300.png)