IV EVALUATION OF A SINGLE PROJECT 91 METHODS FOR EVALUATION

91

IV

EVALUATION OF A SINGLE PROJECT

4.0

METHODS FOR EVALUATION

This chapter deals with commonly used methods for evaluating a single project. These methods are: the Equivalent Worth, the Rate of return and the Payback Period. Equivalent worth methods include: the present worth (PW), the annual worth (AW) and the future worth (FW). Several different types of rates or return are used but most common is the internal rate of return (IRR). Many variations of payback period method are available but the simple payback or just the payback period is widely used. Equivalent worth methods are simple to use but physical meaning of these methods is not easily understood. Internal rate of return method is preferred by many as its perceived meaning is straight forward. Pay back period method, unless modified, is theoretically incorrect and in general should not be used.

4.1 INVESTMENT PROJECTS

In engineering economy, a project is considered as an opportunity for investment. A project can be classified as an investment or a divestment type project. An investment project is a project where money is invested now for possible future monetary benefits. Recall that from corporate viewpoint, investment is a negative cash flow and income is positive cash flow. A typical investment project is shown in Fig. 4.1.1. In this project an investment of $1,000 is made now and it is expected the corporation will receive $1,200 at the end of the first year. The life of the project is one year. All the projects undertaken by corporations or businesses are not necessarily investment type. Some projects may be divestment projects.

92

1,200

1

1,000

Figure 4.1.1: An Investment

Project

In a divestment project, income is realized before an investment is needed. An example of a divestment project is shown in Fig. 4.1.2. We will focus our attention only on investment projects. However, the methods developed in this chapter are easily applicable to the evaluation of divestment type projects.

1,400

1

1,200

Figure 4.1.2: A Divestment

Project

4.2 THE PRESENT WORTH METHOD

Present worth (PW) is an equivalent cash flow at present, generally at t =0, to all the cash flows associated with a project. Methods for finding equivalent cash flows are discussed in Chapter III.

Let us suppose a corporation is considering investment in a project. It requires an investment of $500 at the start of the first year. The life of the project is one year and the net cash flow expected at the end of the first year is $600. Should this investment be made?

For the project under consideration, PW(i) or the net equivalent cash flow at time t=0 is:

PW(i) = -500 + 600 (P/F, i, 1)

93

It is worth mentioning that PW(i) or the present worth represents the wealth (dollar) increment if investment in the project is made. This means that if the investment is undertaken then wealth (dollars) of the corporation, at time t=0, will increase by PW(i). As one of the major goals of corporations is to maximize wealth, the following decision rule is used for evaluating a single project.

IF PW(i) > 0 ; Invest

OTHERWISE: Do not invest

Let us further assume this corporation has only one project for investment. Now if this is the only project available for investment then it makes sense to invest if PW(i) > 0 as wealth (dollars at t =0) will increase and maximized. Also, if PW(i) < 0 wealth will decrease and it is not profitable to invest in a project which produces negative PW(i). If PW(i) is zero, theoretically, one should be indifferent as this means there is no change in wealth whether the investment is made or not made. However, in real life, the appropriate decision if PW(i) is zero is "do not invest" in the project. The meaning of wealth increment is further explained in detail later on in this section.

Calculation of PW(i) is rather straight forward. However, one must choose an appropriate value of interest rate, i, which should be used in calculating the present worth. The principle of opportunity cost is used for determination of this interest rate. Using this principle, we consider what else can be done with the money needed for the investment, i.e., $500. For example, the corporation may be able to deposit the money in an account which pays interest at the rate of 10% compounded annually. If this is the only option available, the opportunity cost of capital for this corporation is 10%. Most corporations have many different options for investing their unused money. The interest rate at which a corporation can invest all unused money is called

"Minimum Attractive Rate of Return" or MARR. MARR can be calculated from financial data. However, methods for determination of MARR will not be discussed here. We will assume corporation knows or has established a value of MARR. Thus MARR is an interest rate at which all unused money can be invested by a corporation.

94

With known value of MARR, the decision rule is modified as follows:

IF PW(MARR) > 0 ; Invest in the project

OTHERWISE: Do not invest

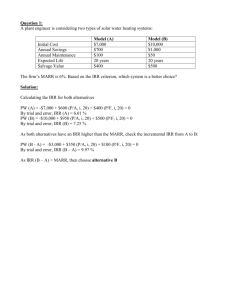

Example 4.2.1

A corporation can buy a machine for $15,000 with life of five years and a salvage value (selling price of the machine at end of life of the project) of $1,500. Net revenues, {revenues

- (O+M) expenses}, per year are expected to be $5,000. MARR for this corporation is 15%. Should the corporation invest in this machine?

1,500

5,000

1 2 3 4 5

15,000

Figure 4.2.1 Cash Flow Digram for Example 4.2.1

Solution: A cash flow diagram for investment in this project is shown in Fig. 4.2.1. Recall that PW(i) is an equivalent cash flow (at t =0) to the cash flows associated with the project. Present worth of the project using MARR or i = 15% is calculated as follows:

PW(0.15) = -15,000 + 5,000(P/A, 15, 5) + 1,500(P/F, 15,5)

= -15,000 + 5,000(3.352) + 1,500(0.4972)

= $2,505.80

As PW(MARR) = PW(0.15) > 0, the corporation should invest in this machine.

As stated earlier, PW(MARR) of $2,505.80 means that if the corporation invests $15,000 in this machine then its wealth (dollars at t = 0) will increase by $2,505.80. It should be pointed out that corporation

95 will not actually realize a positive cash flow of $2,505.80 at time t=0. The amount $2,505.80 or PW(0.15) is the equivalent cash flow at t = 0 to all the cash flows associated with the project .

It should be noted that PW(MARR) represents the wealth increment over the decision 'not to invest' in the machine. There are two choices; one to invest and other do not invest. If money ($15,000) is invested,

PW(MARR) is $2,505.80. If the decision is 'do not invest' in the machine then $15,000 will earn interest at the rate of MARR or 15% for five years which is the life of the project. The cash flows associated with the option 'do not invest' in the machine are shown in Fig.4.2.2. As the corporation can earn 15% interest on this $15,000 it will have $15,000 (F/P, 15, 5) = (15,000)(2.011) or $30,165 at the end of the 5th year.

30,165

1

15,000

2 3 4 5

Figure 4.2.2 Cash Flows

Associated with the "Do Not

Invest" Option

The present worth, PW(MARR), for this decision (do not invest) is calculated as follows:

PW(0.15) = -15,000 + 30,165(P/F, 15, 5)

= -15,000 + 30,165(0.4972)

= 0

The difference in the PW(MARR) for 'invest' and 'do not invest' is $2,505.80. This is why the

PW(MARR) for the project (investment) represents the wealth (dollar) increment at t = 0 over 'not investing' in the project.

It is important to understand the rational behind the present worth method. Present worth is the wealth (dollars) increment if the investment is made. For our example if the investment is made then

PW(MARR) is $2,505.80. As we have only one project and two choices, invest or do not invest, the option

96 to invest will increase wealth at t = 0 by $2,505.80.

The application of the present worth method in evaluating the desirability of a single project is rather straight forward provided that MARR is known. However, the meaning and interpretation of PW(MARR) is not obvious. The reason for this is that PW(MARR) is not an actual cash flow. It is an equivalent cash flow at t=0 to all the cash flows associated with a project.

It is important to understand the rational behind the present worth method. Recall, it was stated that

PW(MARR) represents the wealth increment. This wealth increment is the difference between PW(MARR) for the 'invest' and 'do not invest' options. For our example, Example 4.2.1, if we invest $15,000 in the machine the PW(MARR) is $2505.80. If we choose 'do not invest' option then PW(MARR) is zero. The difference between the two options is $2505.80. We refer to this difference as the wealth increment. Also, since there is only one project and two choices, 'invest' or 'do not invest', the option to invest will increase the wealth, at t = 0, by $2505.80.

4.3 THE ANNUAL WORTH METHOD

The annual worth method is a variation of the present worth method. In the present worth method equivalent cash flow (a single cash flow) is calculated at t = 0. In the annual worth method, equivalent cash flow is an EPS for the life of the project. The annual worth, AW, can be calculated either directly or using the present worth of a project. Example 4.2.1 will be used to illustrate the calculation of annual worth using the two methods.

The annual worth, AW(i), can be determined directly by finding an equivalent EPS (A) to all the cash flows associated with a project for the life of the project.

AW(0.15) = A = -15,000(A/P, 15, 5) + 5,000 + 1,500(A/F, 15, 5)

= -15,000(0.2983) + 5,000 + 1,500(0.1483) or AW(0.15) = $747.95

Note that $15,000 investment is a single cash flow at t = 0 and therefore the factor A given P is used

97 in calculation of an equivalent EPS. Similarly, as $1,500 salvage value is a single cash flow at t = 5 the factor A given F is used. Net revenues of $5,000 per year are already an EPS and no factor is needed to convert these to EPS.

In the second method for finding annual worth, the present worth is determined first. Then the value of A or EPS for the life of the project, five years, which is equivalent to the present worth is calculated. The present worth is calculated as follows:

PW(0.15) = -15,000 + 5,000(P/A, 15, 5) + 1,500(P/F, 15, 5)

= $2,505.80

and AW(0.15) = PW(0.15) {(A/P, 15, 5)}

= 2505.80(0.2983) or AW(0.15) = $747.48

It should be noted that the annual worth is same regardless of the method used. The small difference in two values (747.95 and 747.48) is due to round-off in the factors from the interest tables.

The annual worth, just like the present worth, is the wealth increment if investment in the project is made. The only difference is that present worth represents wealth increment at t=0 while annual worth represents wealth increment which is distributed uniformly (an EPS) over the life of the project. As annual worth represents wealth increment, the following decision rule is used.

IF AW(MARR) > 0; Invest

OTHERWISE: Do not invest

Recall that this decision rule is based on the primary goal of corporations which is to maximize wealth.

For our example AW(0.15) = 747.95 > 0. Therefore, the corporation should invest in this project.

Note that same decision was obtained by using the present worth method.

It should be noted that for a given project, the annual worth is proportional to the present worth. This

98 can be seen from the following equation.

AW(MARR) = PW(MARR) {(A/P, i, N)}

For a given project, the values of i or MARR and N are fixed and therefore the factor (A/P, i, N) is constant. The relationship between present worth and annual worth for a project can be rewritten as

AW(MARR) = PW(MARR) (Constant)

As AW(MARR) is proportional to PW(MARR), both methods should yield the same decision.

4.4 THE FUTURE WORTH METHOD

The future worth method is another variation of the present worth method. In this method, an equivalent cash flow to all the cash flows associated with a project is obtained at t = N where N is the life of the project. Example 4.2.1, will be used to illustrate calculation of the future worth. Future worth for the project is determined as follows:

FW(0.15) = -15,000(F/P, 15, 5) + 5,000(F/A, 15, 5) + 1,500

or worth.

= -15,000(2.011) + 5,000(6.742) + 1,500

FW(0.15) = $5,045.00

Alternatively, we can first find the present worth and then use this present worth to find the future

PW(0.15) = -15,000 + 5,000(P/F, 15, 5) + 1,500(P/F, 15, 5)

= $2,505.80

and FW(0.15) = 2505.80(F/P, 15, 5)

= 2505.80(2.011) or FW(0.15) = $5,039.16

The slight difference in the two calculated values of future worth is due to round-off in the factors from the interest tables.

99

The decision rule for the future worth method is similar to the decision rules used for the present worth and the annual worth methods.

IF FW(MARR) > 0; Invest

OTHERWISE: Do not invest

Recall, this decision rule is based on the primary goal of corporations which is to maximize wealth.

For our example, FW(MARR) = FW(0.15) = 5,045.0 > 0. Therefore the corporation should invest in this project. Note that same decision was obtained using the present worth and annual worth methods.

It should be pointed that , for a given project, future worth is proportional to present worth and annual worth. This can be seen from the following equations.

FW(MARR) = PW(MARR) {(F/P, i, N)}

FW(MARR) = AW(MARR) {(F/A, i, N)}

For a given project, as i or MARR and N are fixed, the two factors (F/P, i, N) and (F/A, i, N) are simply constants. Therefore future worth of a project is proportional to its present worth and annual worth.

It is, therefore, not surprising that all the three methods result in the same decision, i.e., invest in the project.

4.5 THE INTERNAL RATE OF RETURN METHOD

4.5.1 Determination of Internal Rate of Return (IRR)

Internal rate of return (IRR) of a project is defined as the interest rate, i, which makes

PW(i) = 0. Internal rate of return (IRR) for a project is determined by setting PW(i) equal to zero and solving for the unknown value of i. Example 4.2.1, will be used to illustrate calculation of the IRR for this project.

PW(i) for this investment can be written as follows:

PW(i) = -15,000 + 5,000(P/A, i, 5) + 1,500(P/F, i, 5)

We set the above PW(i) equal to zero and solve for i. The value of i can be obtained by trial and error method.

or

100

PW(i) = -15,000 + 5,000(P/A, i, 5) + 1,500(P/F, i, 5) = 0

Let i = 15%, the present worth at i =15% is calculated as follows:

PW(0.15) = -15,000 + 5,000(P/A, 15, 5) + 1,500(P/F, 15, 5)

= -15,000 + 5,000(3.352) + 1,500(0.4972) or = 2,505.80

As PW(0.15) is not zero, try i = 20%

PW(0.20) = -15,000 + 5,000(P/A, 20, 5) + 1,500(P/F, 20, 5)

= -15,000 + 5,000(2.991) + 1,500(0.4019)

PW(0.20) = 557.85

Since PW(i) is not zero, try i = 25%

PW(0.25) = -15,000 + 5,000(P/A, 25, 5) + 1,500(P/F, 25, 5)

= -15,000 + 5,000(2.689) + 1,500(0.3277)

= -1063.45

An examination of PW(0.20) and PW(0.25) shows that the value of i which will make PW(i) equal to zero is between 20% and 25%. Using linear interpolation, an approximate value of i is 21.72%. Therefore,

IRR or the internal rate of return for this project is 21.72%. It should be pointed out that this value of i or IRR can also be determined by using computer programs for solving polynomials (See Section 4.5.4).

The following decision rule is used for the IRR method.

IF IRR > MARR ; Invest

OTHERWISE: Do not invest

As IRR for the project is greater than MARR (15%), the decision is to invest in the project.

Decision rule for the IRR method is based on the fact that if investment in the project is not made then $15,000 (unused money) will earn interest at a rate of MARR or 15%. If the investment is made then the $15,000 will earn 21.72% or the IRR. As IRR is greater than MARR it is better to 'invest' in the project

101 then 'not to invest' or invest it somewhere else at 15%.

4.5.2 Meaning of Internal Rate of Return (IRR)

The determination of IRR and the application of the decision rule for establishing whether investment should be made or not is rather straight forward. However, the meaning of the IRR should be clearly understood. IRR is the interest rate which is earned on unrecovered investments in a project such that unrecovered investment at the end of the life of a project is zero.

Note that an initial investment in a project (at t = 0) is recovered entirely over the life of an investment (no remaining investment at t = N).

This implies that investment in a project is being reduced each year so that it is zero at t = N.

For project in Example 4.2.1 IRR is 21.72%. Table 4.5.1 shows that for each year of the project life,

21.72% interest (profit or return) is earned on unrecovered investment and there is no unrecovered investment at the end of the life of the project (five years). Column 2 shows the unrecovered investment at the start of a year. In the first year, unrecovered investment at the start of the first year is $15,000 which is the first cost or the entire investment in the machine. Interest earned in the first year is 15,000(0.2172) =

$3,258 and is contained in column 4. Revenues generated by this investment in the first year are $5,000 and are shown in column 3. Column 5 contains remaining revenues. Remaining revenue for a year is the difference between revenues generated and interest earned. For first year, remaining revenues are (5,000 -

3,258) or $1,742. This remaining revenue is used to reduce the investment in the project. In the first year, investment (or unrecovered investment) at the start is $15,000. The unrecovered investment or the remaining investment in the project at the end of the first year or start of the second year is $15,000 - $1,742 = $13,258.

An initial investment of $15,000 is reduced to $13,258 in the first year.

Similar calculations can be carried out for the remaining four years and all the results are shown in

Table 4.5.1. Unrecovered investment the end of the fifth year is $1,592 (column 5). Recall that this machine has a salvage value of $1,500. The machine will be sold for $1,500 and unrecovered

Table 4.5.1 Profits (Returns) and Unrecovered Investments

Year

(1)

Unrecovered

Investment at the

Start of a Year

(2)

Net

Revenue

(3)

Interest earned

(Profit or return)

(4)

1

2

3

4

5

15,000

13,258

11,138

8,557

5,416

5,000

5,000

5,000

5,000

5,000

15,000(.2172)

= 3,258

13,258(.2172)

= 2,880

2,419

1,859

1,176

Remaining

Revenue

(5)

5,000 - 3258

=1,742

5000 -2880

= 2,120

2,581

3,141

3,824

Unrecovered

Investment at the

End of a Year

(6)

15,000 - 1,742

= 13,258

13,258 - 2,120

= 11,138

8,557

5,416

1,592

102 investment is only $92 (1,592 - 1,500). According to the definition of IRR, this amount should be zero. This discrepancy of $92 is primarily due to the fact that whole dollars are used in Table 4.5.1.

Unrecovered investments (column 2) for any year can be easily calculated using the concept of equivalence. We simply equate the values of negative cash flows (investments) to positive cash flows

(revenues) at any point in time. For example, let X be the unrecovered investment at the start of the 3 rd year

(or end of the 2 nd year). Using and i = 21.72% and equating values at t = 0, we get or

15,000 = 5,000(P/F, 21.72, 2) + X(P/F, 21.72,2)

X = 11,136

Unrecovered investment at the start of 3 rd year is 11,136. Interest earned in the 3 rd year is

11,136(0.2172) or 2,418.73. Note that these values slightly different than value shown in Table 4.5.1.

An alternate way of explaining the meaning of IRR is to assume that the project will borrow money needed for investment from the corporation for the duration of the project. Investment is, therefore, a loan

103 from corporation. IRR is the interest rate charged by the corporation for this loan. For our example, a loan of $15,000 must be paid back in five years and interest rate is IRR or 21.72%. Table 4.5.1 shows how this fictitious loan is retired in five years.

The meaning of IRR should be clearly understood. Interest (profit) is earned at the rate of IRR only on unrecovered investments in a project. Sometimes, this fact is ignored and many assume that interest (profit) is earned on the initial investment.

4.5.3 The Trial and Error Method

The value of IRR in Section 4.5.1 was determined by a trial and error method. To use the trial and error procedure, a starting value of i is needed.. Generally, it is simplest to start with i = MARR. Recall, for our example first trial value was 15% which is also the MARR. At i = 15%, PW(15) = 2,505.80. As PW(i) is not zero, a different value of i is tried. Should this value of i be higher or lower than 15%? This question is best answered by examining a typical present worth function (Figure 4.5.1).

PW(i) i

15

Figure 4.5.1 A typical Present

Worth Function

At i = 15%, the PW(i) = $2,505.80. Examination of Figure 4.5.1 shows that a higher value of i is needed. We use i = 20% and PW(0.20) = 557.85. The next higher value of i in interest tables is 25%, therefore i = 25% is used and PW(0.25) = -1,063.45. As interest tables for interest rates between 20% and

25% are not available, linear interpolation is used to find an approximate value of IRR which is 21.72%.

104

4.5.4 Multiple Values of IRR

One major problem in using the IRR method for evaluation of projects is the possibility of existence of multiple values of IRR or i which satisfy PW(i) = 0. The present worth function for a project with multiple values of IRR may look like the one shown in Fig. 4.5.2. This present worth function has three values of IRR (intersection of the present worth function with the x-axis). The question i

Figure 4.5.2 Present Worth

Function is that if there are multiple values of i which satisfy PW(i) = 0 then which one is the correct value ? Recall that the decision to invest in a project is based on whether IRR is greater than MARR. This implies there is only one value of IRR. Therefore, it is important to determine whether a project has a unique value of IRR or not. If there is a single value of IRR there is no problem in using the decision rule. However, if more than one value of IRR are possible then the correct value of IRR must be established.

For determining whether a project has a single or multiple values of IRR, cash flows for all projects can be divided in three categories.

1. Cash flows which produce negative value/values of IRR.

2. Cash flows which yield a single positive value of IRR.

3. Cash flows which may result in more than one positive value of IRR.

Case I Cash Flows Which Produce Negative Value/Values of IRR

105

There are projects which require initial investment as well as periodic operation and maintenance costs but are not meant to produce any direct revenues. Thus, in essence, all cash flows associated with such investments are negative. Such projects are referred to as 'service' type projects. An example of a service type project is an air conditioning system. If an air conditioning system is purchased, then the initial cost and the yearly operating and maintenance expenses must be paid. As the air conditioning system will be installed for the comfort of the employees, there are no expectation of direct revenues. Therefore, all cash flows associated with this project are negative. One such set of cash flows is shown in Fig. 4.5.3.

1 2 3 4 5

6,000

540 540

Figure 4.5.3 Cash Flows

For Investment in an Air

Conditioning System

It is obvious that IRR for this project is less than zero, but we try i = 10% and find the present worth

PW(0.10) = -6,000 - 540(P/A, 10, 5)

= -6,000 - 540(3.791)

= - $8,047.14

As PW(0.10) is negative, a lower value of i is tried. Let us use i = 0%.

PW(0.0) = -6,000 - 540(5) = -$3,300

As PW(0.0) is still negative, a smaller value of i is needed. Therefore, a negative value of i will make

PW(i) = 0 (See Fig. 4.5.1). Thus the project has a negative value of IRR.

For service type projects, IRR is negative. An useful rule is that if the simple sum of all the cash flows for a project is negative, IRR is negative. For our example, simple sum is -6,000 + (5)(540) or

- $8,700 and the IRR is negative. Generally for service type of projects, there is more than one option.

Selection of the best project when there are more than one alternative is considered in Chapter V.

106

Case II Cash Flows Which Yield a Single Positive Value of IRR

As stated earlier, cash flows associated with many investment projects have a unique positive value of IRR. The structure of cash flows associated with a project which will produce a single positive value of

IRR is shown in Fig. 4.5.4. All of the following three conditions must be satisfied to ensure a unique positive value of IRR (mathematical proof is available in several text books).

(a) The starting cash flow/series of cash flows are negative.

(b) The cash flows in (a) are followed by a positive cash flow or a series of positive cash flows.

(c) The simple sum of positive cash flows is greater than the simple sum of negative cash flows.

1,000

3,000

1,000

1 2 3 4

1,000

2,000

Figure 4.5.4 Cash Flows

With Unique Value Of IRR

For a project with cash flows in Fig.4.5.4, all the three conditions are satisfied. The first two cash flows are -$2,000 and -$1,000 (the first condition). These two cash flows are followed by three positive cash flows (the second condition). The simple sum of positive cash flows is (1,000 + $3,000 + $1,000) or $5,000 is greater than the sum of negative cash flows, -$3,000 (the third condition). The project described by the cash flows in Fig. 4.5.4 has a unique positive value of IRR as all the three conditions are satisfied.

107

Example 4.5.1

Cash flows for a project, A, are shown in Fig.4.5.5. Is there a unique positive value of IRR for this project?

1,200 1,200

1 2 3 4 5

2,000

1,000

Figure 4.5.5 Cash Flows for

Project A

Solution: Using the three conditions that must be satisfied to for a unique positive value of IRR, it can be seen that the first two cash flows are negative($2,000 and $1,000) followed by a series of positive cash flows (four $1,200 cash flows) and the sum of positive cash flows ($ 4,800) is greater than the sum of negative cash flows ($3,000) Therefore, project A has a unique positive value of IRR.

As stated earlier, to ensure a unique positive value of IRR, all the three conditions must be satisfied.

Note that the third condition requires that sum of all the cash flows must be greater than zero. If it is not than

IRR is less than or equal to zero (See Case I).

Case III Cash flows which may produce more than one positive value of IRR

In general, for any project, (Fig. 4.5.6), the present worth function can be written as

PW(i) = C

0

+ C

1

(P/F, i, 1) + C

2

(P/F, i, 2) +...+ C

N

(P/F, i, N) (4.5.1) where C t

is the cash flow at the end of a period t.

c

0 c

1 c

2 c

3 c n-1 c n

Figure 4.5.6 Cash Flows for a General Project

108

To find IRR, we set PW(i) equal to zero.

PW(i) = C

0

+ C

1

(P/F, i, 1) + C

2

(P/F, i, 2) +...+C

N

(P/F, i, N) = 0 (4.5.2)

Recall that C t

is the cash flow at the end of the period t. The sign of a cash flow (positive or negative) is assigned to the value of the cash flow. For example, C

0

= -$1000 and C

2

= +$1500. Substitution of the interest formula for the factor (P/F, i, N) for different N values in Eq.(4.5.2) gives

PW(i) = C

0

+ C

1

(1 + i) -1 + C

2

(1 + i) -2 +...+ C

N

(1 + i) -N (4.5.3)

If we let (1+i) -j = x j , then Eq.(4.5.3) can be rewritten as

PW(i) = C

0

+ C

1 x + C

2 x 2 +...+ C

N x N (4.5.4)

Eq.(4.5.4) is a polynomial of order N in variable x where x = 1/(1 +i). In general a Nth order polynomial has N roots (positive, negative or complex). For real life problems, we are only interested in real positive roots, as negative and complex values of i are not useful in decision making.

The number of real positive roots of a polynomial can be determined using Descartes' Rule. This rule states that maximum number of real positive roots for a polynomial equals the number of sign changes in the coefficients of the polynomial. If the number of real positive roots is less than the maximum, it is always less by an even number. In counting the number of sign changes, zero is considered signless. For example, consider cash flows for a project shown in Fig.4.5.7. The number of sign changes in the coefficients (cash

flows) is three. The first cash flow is $5,000 with a negative sign (cash outflow). The

7,000

3,000

5,000

1 2

3,500

3

Figure 4.5.7 Cash Flows For a

Project

109 next cash flow is + $3,000 and this is the first sign change (from negative to positive). The second sign change is from +$3,000 to -$3,500 and the third sign change is from -$3,500 to +$7,000. Therefore, using

Descartes' Rule, it can be concluded that maximum number of real positive values of i which makes PW(i)

= 0 is three. If this project does not have three such values of i then it has either one or no such i value.

Example 4.5.2

The cash flows associated with a project B, are shown in Fig.4.5.8. Does this project have a unique positive value of IRR?

4,000

1,800 1,800

1 2 3 4 5 6 7 8

5,000

3,000

2,000

Figure 4.5.8 Cash Flows for

Project B

110

Solution: Maximum number of positive values of i which will make PW(i) = 0 is equal to the number of sign changes in the cash flows. The number of sign changes is three (first from -$3,000 to +$4,000, second

+$4,000 to -$2,000 and the third from -$2,000 to $1,800). According to Descartes' rule possible number of positive values of 'i' are three, one or none. Therefore, for this project we cannot determine whether there is a unique positive value of IRR or not. More analysis is needed for determination of number of values of i. Example 4.5.3. shows the type of analysis needed.

Example 4.5.3 The net cash flows for a project are shown in Fig. 4.5.9. Determine IRR for this investment. If MARR is 20%, should we invest in this project?

Solution: Before making calculations for determination of IRR for $1,000 investment one should establish if there is a unique positive value of i or not. First we check if the sum of positive cash flows is greater than the sum of negative cash flows. The sum of positive cash flows is 6,607 and the sum of negative cash flows is 6,595. Therefore, there is at least one positive value of i. Here, the first cash flow, $1,000, is negative followed by a positive cash flow of $4,150. This cash flow is then followed by another negative cash flow, $5,595 which is followed by a positive cash flow ($2,457). The number of sign changes is three.

Therefore, maximum number of positive values of i which satisfy PW(i) = 0 is

111

4,150

2,457

1 2 3

1,000

5,595

Figure 4.5.9 Cash Flows for

Example 4.5.3

three. The actual number of values of i is obtained by solving the following present worth equation.

PW(i) = -1,000 + 4,150(P/F, i, 1) - 5,595(P/F, i, 2) + 2457(P/F, i, 3) = 0 (4.5.5)

The roots, values of i, of the above equation can be obtained by either using a standard computer routine for solving polynomials or by a graphical method. For this example, graphical method will be used.

In the graphical method, we first determine values of PW(i) for a number of i values. These PW(i) values are then plotted on a graph paper. The intersection of present worth function with the abscissa will give us the approximate values of i. For our example, let us start with i=0.

PW(0) = -1,000 + 4,150 - 5,595 + 2,457 = 12.0

The PW(i) for i values of 0.10, 0.20, 0.30, 0.40 and 0.50 are given below

PW(0.10) = -5.26

PW(0.20) = -5.21

PW(0.30) = 0.0

PW(0.40) = 5.10

PW(0.50) = 8.00

A graph for these values is plotted in Fig. 4.5.10. From this graph we see that there is an i value

112

12

6

PW(i)

6

12

0.2

0.4

0.6

0.8 1.0 1.2

i

Figure 4.5.10 Present Worth Function Plot between zero and 0.10. Therefore, we try several other values of i in this range.

PW(0.02) = 6.71

PW(0.05) = 0.0

Two values of i, i.e., i = 0.05 and i = 0.30 are now known. Recall that according to Descartes' rule there are either three, one or no value of i. Since we have already found two values of i, a third value of i must exist.

We try some other values of i, 0.70 and 0.90, and find the present worth.

PW(0.70) = 5.29

PW(0.90) = -7.44

The third value of i is between 0.70 and 0.90. Since zero present worth is approximately in the middle of 0.80 and 0.90, we try i = 0.80

PW(0.80) = 0.0

The three values of i which satisfy PW(i) = 0 are i = 0.05, 0.030, and 0.80.

If IRR method is used to evaluate this investment, one must find the correct value of IRR as there are three values of IRR. Generally, if there are multiple values of i or IRR then none of these is the correct value of IRR. The approximate correct value of IRR can be determined by noting that a unique value of i is produced by cash flows which have only one sign change and start with a negative cash flow. We modify

113 the cash flows for the project so that there is only one sign change. This involves moving some cash flows from one time period to another. The cash flows from one time period can be moved to another time period by using an appropriate interest rate. Generally, we use MARR to move the cash flows. If MARR is 20%, then we can move the $5,595 at t=2 to t=0. The equivalent cash flow at t=0 is

Equivalent cash flow =5,595(P/F, 20, 2)

= 5,595(0.6944)

= 3,885.2

The revised cash flow diagram is shown in Fig. 4.5.11. Note that this set of cash flows have only one sign change, start with a negative cash flow and the sum of positive cash flows is greater than the sum of negative cash flows. Therefore, there is a unique positive value of i . This unique value of i is obtained by solving the following present worth equation using the revised cash flows shown in Fig. 4.5.11.

4,150

2,457

1 2 3

Figure 4.5.11 Modified Cash

Flow Diagram for Example 4.5.3

4,885.2

PW(i) = -4,885.7 + 4,150(P/F, i, 1) +2,457(P/F, i, 3) = 0 (4.5.6)

By trial and error, we find the value of i or IRR is 0.3935. Therefore, the correct value of IRR is

39.35%. As IRR (0.3935) is greater than MARR (0.20), we should invest in this project.

It is worth mentioning that this value of IRR, 0.3935, is approximate. The approximation is caused by the assumption that the cash flows can be moved using an interest rate which is MARR. It should be noted that none of three values of i , 5%, 30%, and 80%, is the correct value of IRR. Other methods for calculation

114 of IRR under these conditions, multiple values of i, are available but these methods are beyond the scope of this book.

4.6 THE PAYBACK PERIOD METHOD

Payback period is defined as the time needed to recoup the initial investment by the net cash flows produced by the investment. Generally no interest is used in this calculation.

Example 4.6.1

A project requires an investment of $10,000 and has a life of 6 years. The net revenues generated by this project for six years are : $3,000, $3,000, $4,000, $2,500, $2,500, and $5,000.

What is the pay back period for this project?

Solution: We tabulate cumulative cash flows for each year. Cumulative cash flow is the sum of all the cash flows up to and including the year. The following table shows cumulative cash flows for this project.

Table 4.6.1 Cumulative Cash Flows

Year Cash Flow Cumulative Cash flow

3

4

1

2

$3,000

3,000

4,000

2,500

$3,000

3,000+3,000 = 6,000

6,000+4,000 = 10,000

10,000+2,500 = 12,500

5

6

2,500 12,500+2,500 = 15,000

5,000 15,000+5,000 = 20,000

The $10,000 investment is completely recovered by the cumulative cash flows ($10,000) at the end of third year. The payback period is three years.

Calculation of payback period is straight forward. Note that time value of money or interest rate was

115 not used in finding the payback period.

If payback period is to be used in determining whether an investment should be made or not, then some sort of benchmark payback period is needed for evaluation of a project. Many corporations use two or three years as the benchmark pay back period. If for Example 4.6.1, benchmark payback period is two years, then this investment should not be made. The reason for this decision is that the corporation wants to recover all investments in two years or less while this investment requires three years.

The payback period defined here is sometimes referred to as the simple payback period because no interest rate is used in calculations. However, this is the most commonly used form.

Simple payback period, in general, should not be used. There are two reasons why it should not be used. First is that the time value of money is not used as cash flows are simply added. The second reason is that the calculation of payback period fails to reflect the effect of all cash flows after the payback period. For

Example 4.6.1, payback period is three years and the three cash flows, $2,500, $2,500, and $5,000, are not used at all. Theoretically, the payback period method of evaluating desirability of a project is incorrect and should not be used.

116

PROBLEMS

4.1

A single project is available for investment. It requires an initial investment of $25,000. The life is expected to be 7 years and the salvage value of the investment is $2,500. The net revenues are expected to be $5,500/year and MARR is 6%.

(a) Determine the PW for this investment. Should this investment be made? (7,366, yes)

(b) Find the annual worth for this investment. Based on AW, what is your recommendation

regarding investment in this project? (1,319, yes)

4.2

A small company is considering investment in a project. The initial investment is $48,000. Annual revenues and (O+M) costs are expected to be $18,000 and $6,000 respectively. Life of this investment is 5 years, the salvage value is 3,000 and MARR is 8%.

(a) Using the PW method, determine if this investment should be made? (1,958, yes)

(b) Using the AW method, determine if this investment should be made?

4.3

A corporation is considering following project for investment:

First cost

Life

Salvage Value

Net revenues

$12,500

5 years

None

$3,500

Find the IRR for this investment. If MARR is 8%, should this investment be made or not? (12%)

A corporation is considering the following project for investment: 4.4

Initial investment:

Life

Salvage value

Net revenues

MARR

$43,500

10 years

$7,200

$6,300/year

7%

(a) Using the PW method determine if this investment should be made? (Yes)

(b) Find the IRR for this investment. Based on the IRR method should this investment be made or not?

(Approximately 9%, yes)

(c) Determine profit on the unrecovered investment in the 7th year. ( Hint: See page 102) (2,310)

4.5

A project requiring an investment of $275,000 is being considered. Life of this project is expected to be 5 years and salvage value is $52,000. Annual (O+M) costs of $7,000 and receipts of $23,000 are expected from this project. Is this project justified if MARR is 10%?

4.6

A project requires an investment of $20,000. The life of the project is 3 years and salvage value is

117 zero. The net revenues produced by the project are: $8,000 in first year, 8,500 in second year, and 12,500 in the third year.

(a) Find the IRR for this investment.(19%)

(b) Determine the profit on the unrecovered investment in second year. (2,533)

4.7

A corporation is considering investment in a project with following cash flows:

Initial Investment

Life

Salvage Value

Net Revenues/yr

$30,000

5 years

Zero

$9,000

The corporation uses a MARR of 10% and benchmark payback period of 3 years.

(a) Using the PW method, determine if this investment should be made? (Yes)

(b) Using the payback period, determine if this investment should be made? (No)

(c) Why the decision obtained in (a) is different than one obtained in (b)?

Following is relevant data for an investment 4.8

First Cost

Life

$36,000

12 years

Salvage value $3,600

Net revenues $4,600/year

MARR 8%

(a) Using the FW method, determine if this investment should be made ? (Yes)

(b) What is this the AW for this investment?

(c) Determine the profit on unrecovered investments in the 3 rd and the 10 th year. ( Hint: See page

102) (2,984 and 1,646)

4.9

zero)?

For each of the following cash flows, determine the maximum number of values of IRR (positive or

(a) End of Year 0 1 2 3 4

Net Cash Flow,$ -2,000 1,000 1,000 -750 1,000 1,500

5

(b) End of Year 0 1 2 3 4

Net Cash Flow,$ -6,000 1,200 1,000 1,000 2,800

4.10

Determine the IRR for the cash flows in problem 9(b).

118

4.11

The G&K Corporation is planning to expand one of its warehouses. Total first cost is: the land costs

$250,000; the building costs $650,000, the equipment costs $200,000 and a $150,000 start-up cost. Expected net revenues are $600,000/ year for10 years at which time the land and building can be sold for

$475,000, and the equipment for $50,000. Annual cost (O+M) are $350,000. What is the IRR for this investment? If the company requires a MARR of 15% determine if they should expand the warehouse or not?

(18%, yes)

4.12

A company purchases a new machine with an initial cost of $15,000 and a salvage value of $1,800.

Net revenues in year 1 are $8,000, $8,150 in year 2, and increase by $150 each year the following 8 years.

Using an MARR of 12%.

(a) Determine the PW. (33,817)

(b) What is the annual worth? (5,986)

(c) Determine the number of positive values of IRR for this machine. (One)

4.13

A proposal is being considered for an investment of $100,000 with a salvage value of $20,000 after its 30 year life. Annual receipts of $15,000 and annual costs of $4,000 are expected. Is the proposal justified if the MARR is 10%?

4.14 A forklift truck can be purchased for $17,500. Its expected life is 7 years and salvage value is

$2,000. It will save $4,100 in annual labor costs. If MARR is 6%.

(a) Using the AW method, determine if this fork lift truck should be purchased?

(b) What is the IRR for investment in the fork lift truck? (16%)

4.15

ENCOS, an energy consulting company, has prepared a proposal for changing the existing fluorescent light in production areas to high pressure sodium lights. Total cost of installing new lights, is estimated to be $16,425. Salvage value is zero. Annual estimated savings in electricity cost are $6,390.

Assuming a planning horizon or life of three years, for what values of MARR this proposal should be accepted? (less than 8%)

4.16

POFAC manufacturing company is investigating the possibility of installing capacitors for improving the power factor. Annual reduction in electricity cost by installing the capacitors is $4,075 and estimated life is 5 years. First cost of purchasing and installing the capacitors is estimated as $14,250. Assume no salvage value of capacitors at the end of the 5th year.

(a) Using a benchmark period of three years determine if capacitors should be installed?

(b) Using a life of five years and MARR of 10% determine if capacitors should be installed?

(c) Why the answers in parts (a) and (b) are different?