USING THE CUMULATIVE AVAILABIITY CURVE TO ASSESS by

advertisement

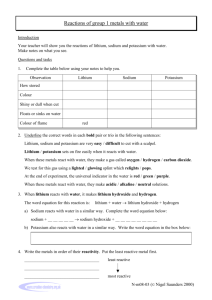

Version: 90521 USING THE CUMULATIVE AVAILABIITY CURVE TO ASSESS THE THREAT OF MINERAL DEPLETION: THE CASE OF LITHIUM by Andrés Yaksic Beckdorf and John E. Tilton1 Abstract The cumulative availability curve shows the quantities of a mineral commodity that can be recovered under current conditions from existing resources at various prices. The future availability of a mineral commodity depends on the shape of its cumulative availability curve (determined by geologic considerations, such as the nature and incidence of the available mineral deposits), the speed at which society moves up the curve (determined by future demand and the extent to which this demand is satisfied by recycling), and shifts in the curve (determined by cost-reducing technological change and other factors). While the shape of the curve for any given mineral commodity may or may not be known, it is knowable since the geologic processes responsible for the curve’s shape took place many years ago. In contrast, the factors governing how fast society moves up the curve and how the curve shifts over time are not only unknown but also unknowable. Using lithium as an example, this article shows that knowledge about the shape of the cumulative availability curve can by itself provide useful insights for some mineral commodities regarding the potential future threat of shortages due to depletion. Despite the inherent uncertainties surrounding the future growth in lithium demand as well as the uncertainties regarding the future cost-reducing effects of new production technologies, the shape of the lithium cumulative availability curve indicates that depletion is not likely to pose a serious problem over the rest of this century and well beyond. JEL Classifications: Q32; L72 Keywords: Mineral depletion, mineral availability, nonrenewable resources, cumulative availability curve, lithium 1 Andrés Yaksic Beckdorf (aiyaksic@puc.cl) was a graduate student in mineral economics at the Mining Center of the School of Engineering, Pontificia Universidad Católica de Chile at the time this study was conducted. John E. Tilton (jtilton@ing.puc.cl) is Profesor de la Cátedra de Economía de Minerales at the Mining Centre of the School of Engineering, Pontificia Universidad Católica de Chile, and Research Professor in the Division of Economics and Business, Colorado School of Mines. He is also a University Fellow at Resources for the Future. They are grateful to John H. DeYoung, Jr., and Philip Maxwell for helpful comments. 1 Version: 90521 Introduction Although depletion has not yet caused severe shortages, the rapid growth in demand for mineral commodities over the past century—coupled with the growth expected over the next century as the economies of China and other developing countries expand—have many pondering how long this benevolent situation can continue. Although scholars and others have debated this issue for some time, they remain divided. Nevertheless, we have learned a great deal about mineral depletion and the nature of the threat it poses. Still needed, however, are reliable indicators for individual mineral commodities of the potential for depletion to produce serious scarcity in the future—what some have called a ‘red list’ of depletion-threatened commodities, or what one might think of as an early warning system. In his book On Borrowed Time, Tilton (2003) proposes such a measure—the cumulative availability curve.2 Yaksic (2008) in his MS thesis Análisis de la Disponibilidad de Litio en el Largo Plazo has recently attempted to illustrate the usefulness of this methodology by applying it to the long-run availability of lithium. This article describes this analysis and its major findings.3 Before doing so, however, Section 2, which follows this introduction, briefly highlights the important findings of particular relevance for our purposes flowing from the on-going debate over mineral depletion. Section 3 then describes the cumulative availability curve and its usefulness. Sections 4 estimates the cumulative supply curve for lithium and discusses the insights it provides regarding the future availability of this mineral commodity. Finally, Section 5 reviews the major findings and explores some of 2 On Borrowed Time uses the term cumulative supply curve. Since this curve is quite different from the conventional supply curve, to avoid confusion we now refer to this curve as the cumulative availability curve. 3 The only other application of the cumulative availability curve of which we are aware is Aguilera and others (2009). This study assesses the threat that depletion poses for petroleum products. 2 Version: 90521 their implications for assessing the threat of depletion for mineral commodities in general. Depletion and the Long-Run Availability of Mineral Commodities Shortages of mineral commodities can arise for a variety of different reasons— wars, embargos, cartels and other market manipulations, natural disasters, accidents, cyclical booms in global demand, inadequate investment in new mines and processing facilities, and resource depletion.4 This last—resource depletion—it is important to note differs from all the other causes in at least two important respects. First, shortages due to depletion are likely to arise slowly and persistently, and to be permanent or at least of very long duration. Shortages due to business cycle fluctuations, wars, accidents, and so on are likely to arise suddenly, often without much warning. Despite a few exceptions— the DeBeers cartel, for example, probably kept diamond prices artificially high for over a century—such shortages are also temporary, lasting no more than a decade and often only a couple of years or less. Second, shortages of mineral commodities arising for reasons other than resource depletion are quite common. Surging demand for mineral commodities in India and especially China coupled with insufficient investment in new production capacity over the past decade or two, for example, have recently created global shortages for petroleum, copper, iron ore, tin, and a host of other mineral commodities. On the other hand, to our knowledge there is not yet a documented case of resource depletion causing significant shortages of mineral commodities. 4 A shortage, as the term is often used, reflects a surplus of the demand for a mineral commodity over its supply at the prevailing market price. For our purposes, however, this definition is too narrow, since it is always possible to bring demand and supply into balance by allowing price to rise. As a result, a shortage is defined here to include situations where rising and substantially higher prices are required to equate supply and demand. The terms shortage and scarcity are used interchangeably, and both imply a lack of availability. 3 Version: 90521 That depletion has not been a problem in the past, of course, does not mean this favorable situation will continue indefinitely in the future. Indeed, as noted earlier, many have argued and continue to argue that resource depletion poses a substantial threat to the long-run availability of mineral commodities. Others have challenged this view, and a lively debate over this issue continues to this day. We will not review this debate here, as Tilton (2003, 2006) has done so elsewhere. Suffice it to say that we have learned much from the exchange of views over the past 40 years. We know now, for example, that the world will never literally run out of mineral commodities despite their nonrenewable nature. This is in part because some mineral commodities, the metals for example, are not destroyed when used and so at some cost are available for reuse. In the case of petroleum and other energy resources, the substitution of cheaper alternatives, including solar and other renewable sources, will occur long before the highest-cost nonrenewable resources are extracted and consumed. The debate has also highlighted the serious shortcomings of using physical or fixed stock measures of mineral resources to assess the threat of depletion, even though the use of these measures somehow manages to persevere despite their shortcomings. The fixed-stock approach typically takes estimates of the reserves, resources, or resource base for a mineral commodity, and assumes they reflect a nonrenewable, fixed stock of what remains for society to consume.5 Estimates of future consumption are 5 Reserves indicate the amount of a mineral commodity contained in deposits that are both known (that is, discovered) and economic to exploit under current conditions. Resources encompass reserves plus the quantity of a mineral commodity contained (a) in deposits that are as yet undiscovered but which would be economic or potentially economic once discovered, and (b) in known deposits whose exploitation though not currently economic is potentially economic. The U.S. Geological Survey (2008, Appendix C) defines a resource as “a concentration of naturally occurring solid, liquid, or gaseous material in or on the Earth’s crust in such form and amount that economic extraction of a commodity from the concentration is currently or potentially feasible.” The resource base includes all of a mineral commodity found in the earth’s crust. It encompasses resources, as well as a great deal of other mineral occurrences not now considered potentially feasible for future exploitation. The U.S. Geological Survey (2008, Appendix C) does not use the term resource base. However, the resource base encompasses what the USGS calls 4 Version: 90521 then typically used to estimate how many years remain before the available stock is exhausted. Neither reserves nor resources, however, are really a fixed stock. This shortcoming is widely recognized in the case of reserves, since new discoveries and new technologies are constantly adding to mineral reserves.6 Though less appreciated, the same is true as well for resources. As Tilton and Lagos (2007) have documented, the U.S. Geological Survey has over the past several decades increased its estimates of global copper resources from 1.6 to 3.7 billion tonnes. Some of this increase came from the realization that new technology made seabed nodules a potential source of copper in the future, but most represents a reassessment in light of changes in technology, geologic science concepts, and other conditions of what is potentially available from land-based deposits. While a stronger case can be made that the resource base does indeed represent a fixed stock, it is of little use in assessing the long-run availability of mineral commodities for other reasons. In particular, long before the last barrel of oil or the last ton of copper were extracted from the earth’s crust, the cost of production would become prohibitive, causing demand to decline to zero. As a result, while the life expectancies of reserves and resources are unduly pessimistic, those based on the resource base are unduly optimistic. In the case of lithium, for example, the resource resources (which include reserves) and other occurrences. The USGS defines other occurrences as “materials that are too low grade or for other reasons are not considered potentially economic.” It also notes that the boundary between other occurrences and resources is “obviously uncertain, but limits may be specified in terms of grade, quality, thickness, depth, percent extractable, or other economic-feasibility variables.” 6 Moreover, within the mining industry it is widely recognized that there exists little economic incentive to identify reserves beyond 20 to 30 years of consumption, given the costs of such efforts and the time value of money. 5 Version: 90521 base estimated at 4.8 x 1014 tonnes would at current rates of consumption last for some 23 billion years.7 As a result, it is now widely (though not universally) accepted that economic measures of mineral scarcity are more useful than physical measures. Economic measures reflect the opportunity costs, or what society has to give up, to obtain one more ton of a mineral commodity. Real mineral commodity prices are the most frequently encountered economic measures.8 A rise over time in the real price of, for example, iron ore implies growing scarcity, while a decline implies growing availability. While generally considered far superior to physical measures of scarcity, trends in real prices do have their own shortcomings and limitations.9 For example, as noted earlier, scarcity and shortages can arise for reasons other than resource depletion. As a result, mineral commodity prices fluctuate considerably, particularly over the short run. For this reason, price trends over the long run offer the most useful insights regarding mineral depletion. In addition, prices reflect only those environmental and other social costs that producers and ultimately consumers actually pay. This means trends in real prices will overestimate the rise in scarcity if government policies are forcing producers to 7 The concentration of lithium in the earth’s crust is estimated at between 20 and 65 ppm and the weight of the earth’s crust at 2.4 x 1019 tonnes. See Erickson (1973). Using 20 ppm produces the resource base estimate of 4.8 x 1014 tonnes of lithium. In addition, the oceans contain 0.17 ppm of lithium, suggesting that this resource contains an additional 2.5 x 1011 tonnes of lithium. See Steinberg and Dang (1975). 8 Other economic measures include the real production costs of marginal producers and user costs. User costs, which are also called Hotelling rents and scarcity rents, reflect the net present value of the lost future profits associated with producing one more unit of a mineral commodity now rather than in the future. Under given conditions, user costs reflect the value of the marginal reserves in the ground required to produce one more unit of a mineral commodity. Data on production costs and user costs are difficult to obtain. For this and other reasons, the real prices of mineral commodities are by far the most widely used of the economic measures of mineral scarcity. 9 For a more complete discussion of the shortcomings of the economic measures of resource scarcity, see Tilton (2003), ch. 3. 6 Version: 90521 internalize an increasing share of the total social costs and underestimate the rise in scarcity if the opposite is the case. Perhaps the greatest shortcoming of trends in real prices as an indicator of the future threat of depletion is that the prices we have are historical. As a result, they largely reflect conditions in the past. Of course, where the market anticipates future scarcities current prices will rise as consumers and others build up their stocks. Still, given the long-run nature of the threat from mineral depletion, it is far from clear to what extent and how far into the future current prices anticipate scarcity. What we would like to know are the long-run trends in real mineral commodity prices far into the future. Here, as the next section shows, the cumulative availability curve can be of some help. The Cumulative Availability Curve The cumulative availability curve shows the amount of a mineral commodity that can be recovered profitably at various prices from different types of mineral deposits under current conditions (that is, current technology, prevailing labor and other input prices, and so on).10 One would like the cumulative availability curve to reflect estimates of both known (discovered) and unknown mineral deposits. Some times this is possible, as Aguilera and others (2009) in their attempt to construct cumulative availability curves for petroleum resources show. However, normally reliable 10 The cumulative availability curve differs from the common supply curve in economics in two important respects. First, the conventional supply curve indicates how much of a commodity will be supplied to the market during a given time period, such as a year or month, while the cumulative availability curve shows how much could be supplied cumulatively over all time. The former is a flow variable, the latter a stock variable. The cumulative availability curve only makes sense for commodities produced from nonrenewable resources. The cumulative availability of corn, television sets, and trucks at prices at or above production costs is presumably infinite. Second, the conventional supply curve indicates how much suppliers will actually provide to the market at various prices, which due to market power and other considerations may deviate from what they could supply profitably at various prices. The first reference, of which we are aware, to the cumulative availability curve is found in Tilton and Skinner (1987), where it is called the cumulative supply curve. For more on the cumulative availability curve, also see Tilton (2003) and Tilton (2006). 7 Version: 90521 information on unknown deposits is not available, as is the case for lithium. In this situation, cumulative availability curves can be estimated on the basis of known deposits, as long as one keeps in mind new discoveries are likely to shift the curve down and to the right over time. The slope of the cumulative availability curve is positive, since higher prices permit the profitable exploitation of poorer quality and so higher cost deposits. However, as Figure 1 indicates, a positive slope is consistent with a variety of shapes with very different implications for future resource availability. The gradually rising curve shown in Figure 1a implies that substantial future increases in output are possible with only modest increases in production costs and prices. The curves shown in Figures 1b and 1c are far less benign. Both suggest at some point substantial increases in costs will occur making much higher prices necessary. The cumulative availability curve is a useful expository device for grouping the many different factors governing future mineral commodity prices. The first group determines the shape of the cumulative availability curve. It encompasses the various geologic factors affecting future costs and prices, such as the nature and incidence of mineral occurrences. The second group determines how quickly the world moves up the cumulative availability curve. It includes all the factors that affect current and future demand for the mineral commodity, including growth in per capita income and population. It also encompasses the government policies and other factors influencing recycling and secondary production. The third group determines to what extent the cumulative availability curve shifts over time. It includes changes in factor costs and the forces behind such changes, and as well the effects of innovation and technological change on the costs of finding and producing mineral commodities. In addition, as noted 8 Version: 90521 above, if the cumulative availability curve is estimated on the basis of identified resources only, the discovery of new deposits also belongs to this group. In the past, we know that the cost-reducing effects of new technology have for most mineral commodities offset, at least over the longer run, any upward pressure on costs caused by higher factor prices. As a result, the cumulative availability curve has tended to shift downward over time. For a number of mineral commodities, the costreducing effects of new technology, reflected in the downward shift of the cumulative availability curve, have more than offset the cost-increasing effects of depletion, reflected in the movement over time up the curve. In such cases, the trends in real prices over the past century or more have been downward, suggesting growing rather than declining availability, mineral depletion notwithstanding. For most mineral commodities, the two countervailing forces have more or less offset each other, and their trends in real prices have been relatively flat. Significantly upward sloping, real price trends are harder to find over the past century, which is why, as noted earlier, there are few if any documented cases of depletion having caused shortages or scarcity of mineral commodities in the past. The future, of course, could be different, and our interest here lies with possible future scarcities and thus with expected future price trends. To assess the latter, we would like to know (a) the shape of the cumulative availability curve, (b) the speed at which society will move up the curve, and (c) extent to which the curve will shift with time. With a fair amount of certainty (which is rare when talking about the future), we know there is little hope of reliably predicting either of the last two developments. The extent to which the cumulative availability curve will shift depends on the introduction and diffusion of new technologies. Both are notoriously difficult to predict over the near term let alone over the next century. Similarly, how rapidly society will move up the 9 Version: 90521 curve hinges on changing consumer preferences for mineral-intensive products, population growth, per capita income growth, and trends in recycling, all of which are similarly difficult to anticipate over the longer term. Fortunately, the shape of the cumulative availability curve—the first consideration—is more tractable, since it depends on the nature and incidence of existing mineral occurrences. It is true that our knowledge of subeconomic resources for many mineral commodities is quite limited, since exploration is largely carried out by firms focused on finding economic and particularly highly economic deposits. However, it is clearly possible to obtain more information on subeconomic mineral occurrences. These resources were created in the past, in many cases hundreds of millions of years ago, and ignorance about them largely reflects a lack of interest on the part of exploration firms because such deposits are uneconomic at the present time. Moreover, as pointed out earlier, the shape of the cumulative availability curve can provide useful insights about the potential threat of depletion. This is true even though reliable information regarding how fast society will move up the curve and to what extent the curve will shift over time is unknown. The curve shown in Figure 1a implies, as cumulative production proceeds over time, that the price needed to elicit additional supply increases but at a decreasing rate. When this is the shape of the curve, new technology should find it increasingly easy to offset the cost-increasing effects of depletion. However, the cumulative availability curve, at least for a number of mineral commodities, may be less benevolent than the one shown in Figure 1a. For instance, the costs of mineral commodities produced as by-products and coproducts, such as indium, gallium, cobalt, the platinum-group metals, and of particular importance here lithium, are lower because a substantial share of the total mining and 10 Version: 90521 processing costs are borne by the associated joint products. Should demand at some point exceed the supply available from by-product and co-product output, these commodities would have to be produced as main products. At this point, a substantial jump in the price may be required, implying a sharp surge or a discrete break in the cumulative availability curve, as shown in Figures 1b and 1c. Moreover, according to Skinner (1976) and Gordon and others (1987), even copper and other major metals currently produced as main products may have cumulative availability curves similar to those shown in Figures 1b and 1c. This, they contend, is due to the geochemical processes that created the mineral deposits for these metals millions of years ago, which they believe are unlikely to have produced a benevolent unimodal relationship between the grade and quantity of metal. Rather they suspect this relationship may possess two or more peaks in the available quantity of metal as grade declines. In this case, once the rich (high-grade) deposits are exploited, society may have to turn to much lower grade, and thus much more costly, deposits for additional supplies. In addition, the processing methods required to liberate the copper and other metals in very low grade deposits may be quite different from those employed today. In particular, the use of mechanical and chemical processes for concentrating the ore may not be feasible. As a result, the energy required could be one or several orders of magnitude greater, also causing a sharp jump in costs. As Skinner himself points out, his thesis is largely based on theoretical considerations. Very little empirical work has been carried out on the costs incurred in processing very low grade deposits, largely because the latter are of little commercial interest. 11 Version: 90521 Lithium11 The Swedish scientist Johan August Arfwedson discovered lithium, a minor metal, in 1817. Today the world extracts lithium from two types of resources—brines and minerals—to produce lithium carbonate, lithium hydroxide, lithium chloride, lithium metal, and the other lithium-containing products shown in Figure 2. The major end-use industries consuming these lithium products, as Figure 3 shows, produce batteries, lubricating greases, frits, glass, air conditioners, aluminum, and pharmaceutical products. The annual output of these products contains about 21,800 tonnes of lithium. Chile, Australia, Argentina, China, and the United States are the major producing countries accounting for 43, 25, 13, 6, and 4 percent respectively of the lithium extracted from brines and minerals.12 As Figure 4 shows, the real price of lithium carbonate (the most important lithium product and the one for which a long-run price series exists) has declined since 1953 (the first year figures are available) due largely to new, low cost sources of lithium supply and new production technologies. As a result, lithium has over the past half century become less, not more, scarce, and depletion has not been a problem. Nevertheless, the expected growth in demand over the coming century for lithium batteries to power hybrid and fully electric automobiles has raised some concern about the future availability of lithium (Tahil, 2007; Tahil, 2008; Bradbury, 2008).13 11 This section is based on Yaksic (2008) and the sources cited there. Also, see Ebensperger and others (2005) for an overview of the lithium industry that examines the industry’s resources, production, end-use consumption, and prices as well as its future prospects. 12 The figure of 21,800 tonnes for annual lithium production and the country shares cited are estimates based on Ober (2008), Sernageomin (2006), Roskill (2006), and other sources. The estimate of 21,800 tonnes for total lithium production is slightly below estimates found elsewhere for the reasons noted in Yaksic (2008, pp. 25-28). The country production figures reflect extraction from natural resources. China and other countries that import and then further process lithium products have larger market shares when the total value of lithium production is considered. 13 Others, however, are less concerned. See, for example, Evans (2008a and 2008b). It is also worth noting that the current concern is not the first time that scientists and others have worried about the longrun availability of lithium. In the 1970s an expected surge in lithium demand for use in nuclear fusion raised fears that inadequate lithium resources could curtail the development of this new source of energy. See Hammond (1976). 12 Version: 90521 In addition to brines and mineral deposits, lithium can be extracted from clays and seawater. Brines—currently the most important and cheapest sources of lithium— are largely associated with dry lakes, such as the Salar de Atacama in the altiplano of northern Chile. Brines are also found with geothermal deposits as well as oil fields. Hard rock mineral deposits, as noted, constitute the other type of resource from which lithium is currently extracted. Although lithium is found in some 145 different minerals, only a few (spodumene, lepidolite, petalite, amblygonite, and eucriptite) are sources of lithium in deposits that have economic value. Clays (especially hectorite) and seawater are both potential sources of supply. Cumulative Availability Curves With the assistance of various industry and government officials and an extensive review of the available historical documents and studies, Yaksic (2008) has compiled a listing of known lithium resources along with estimates of their quantities and production costs (see Appendix). With this information, one can construct the cumulative availability curves for lithium shown in Figure 5. Estimating production costs is challenging, in part because many producing firms consider the costs of their on-going operations proprietary and in part because one can only approximate the costs of resources not currently being exploited. For this reason, Figure 5 shows production costs under two scenarios—a high cost or pessimistic scenario (the top curve) and a low cost or optimistic scenario (the bottom curve). The costs, shown on the vertical axis of Figure 5, and hence the prices needed to cover production costs are in terms of dollars per pound of lithium carbonate, the most important lithium chemical. The horizontal axis shows the available resources, measured in tonnes of contained lithium (rather than tonnes of lithium carbonate 13 Version: 90521 equivalent),14 whose production costs are at or below various prices. For our purposes, this difference in indicated units is unimportant. What is important is that the curves shown are incomplete. In particular, only a small part of the cumulative availability curves associated with lithium production from seawater (that is, the horizontal segment at 10 dollars for the top curve and at 7 dollars for the bottom curve) are shown.15 This is because the quantity of lithium recoverable from seawater is huge—44.8 billion tonnes.16 Including all this tonnage in Figure 5 would increase the length of the cumulative availability curves by more than a thousand fold. Implications for Depletion Having estimated cumulative availability curves for lithium, we can consider next the future demand for lithium and how rapidly society is likely to move up these curves. As pointed out earlier, predictions of future mineral demand are rarely accurate since they depend on technological change, shifting consumer preferences, population growth, and other variables that are difficult to estimate accurately in the longer run. For this reason, we consider a high growth scenario, which is likely to overestimate the growth in demand and so represents a worse-case scenario for lithium depletion. Table 1 identifies the specific assumptions on which this scenario rests. In general, it assumes that the demand for lithium in automobile batteries surges over the coming decades and 14 5.323 metric tonnes of lithium carbonate (Li2CO3) contain one metric ton of lithium (Li). The estimated production costs of 7 to 10 dollars per pound of lithium carbonate are based on Steinberg and Dang (1975). During the 1970s the expected growth in electric power generation from nuclear fusion was expected to increase greatly the demand for lithium, raising concerns about its long-run availability. Various researchers conducted laboratory scale studies to estimate the costs of recovering lithium from geothermal brines, oil field brines, and other potential resources. As part of this effort, Steinberg and Dang (1975) carried out an economic analysis for the extraction of lithium from seawater, estimating production costs for the process in the range of 22 to 32 (1974) dollars per kilogram of lithium metal. This compares with a selling price of lithium metal from conventional mineral sources of about 20 dollars per kilogram at the time. We then increased the estimated costs of 22 to 32 dollars for subsequent inflation, and then converted them from lithium metal to lithium carbonate and from kilograms to pounds to obtain the estimated costs of 7 to 10 dollars per pound of lithium carbonate from seawater. This approach, it is important to point out, does not take into account any reduction in production costs due to technological progress since the time of the Steinberg and Dang study. 16 This figure assumes that 20 percent of the lithium in seawater is recoverable. 15 14 Version: 90521 that the demand for lithium grows briskly in its traditional end uses (other than for aluminum production where lithium use is expected to be phased out over the next couple of decades). Under these conditions, the cumulative output of lithium required from 2008 to 2100 totals 17.5 million tonnes. This figure reflects only the needed primary lithium production, since recycled lithium or secondary production does not deplete lithium resources and thus does not move society up the cumulative availability curve.17 Under this worse case scenario, at some point in the 22nd century the world could find it attractive to extract lithium from seawater.18 The costs of producing lithium from this source are between 7.00 and 10.00 dollars per pound of lithium carbonate. Since the current price is around 2.80 dollars per pound (see Figure 4), at most depletion might drive the price up by 7.20 dollars a pound over the next century. Moreover, at that price an estimated 44.8 billion tonnes of lithium are available (see Appendix Table 3), which for all practical purposes is an unlimited source of supply. An increase of 7.20 dollars would not significantly curtail the use of lithium in automobile batteries. A 9 kWh lithium battery today requires approximately 15 pounds (6.75 kilograms) of lithium carbonate equivalent. As result, the lithium used in the battery today costs approximately 42 dollars.19 This would increase to 150 dollars if the price were to rise to 10.00 dollars per pound of lithium carbonate. This is but a small fraction of the total cost of the battery, which can exceed five thousand dollars, and of the total cost of the car, estimated at 20 to 30 thousand dollars. 17 Under the assumed conditions, annual production in the year 2100 is estimated at 330,000 tonnes of lithium equivalent or 1.76 million tonnes of lithium carbonate equivalent. 18 Actually, given our likely overestimation of demand and the many known resources of lithium we have not considered, either because resources estimates or costs estimates are not available, we doubt that lithium will be produced from seawater in the 22nd century unless costs of extracting lithium from seawater fall substantially. 19 The figure of 42 dollars is an estimate only, since the lithium products used in lithium batteries are not just lithium carbonate. 15 Version: 90521 The cumulative availability curves shown in Figure 5 similarly make it difficult to argue that depletion is behind the recent jump in lithium carbonate prices from around 1.50 dollars a pound in 2005 to 3.00 dollars a pound in 2007, as lithium can be extracted from many, currently available sources at less than 2.00 dollars a pound. Finally, it is worth highlighting two caveats that tend to reinforce the above findings. First, the discovery of new lithium deposits and new technologies that reduce production costs may well shift the cumulative availability curves shown in Figure 5 downward over time. Second, the cumulative availability curves shown in Figure 5 are based on conservative assumptions and estimates. The assumed recovery rates for various resources, for example, are quite low. In the case of seawater, for instance, only 20 percent of the 224 billion tonnes of lithium in this source is considered recoverable. In addition, a number of known but uneconomic sources of lithium are excluded from the curves due to the lack of reliable estimates for availability or costs.20 Overall, these caveats strengthen the conclusion that depletion does not pose a significant threat to the long-run availability of lithium. Conclusions Over the long run, as society consumes its high quality, low cost mineral resources, depletion could cause the real prices of mineral commodities to rise, threatening the high living standards currently enjoyed in many countries around the world. Whether this will actually take place, it is now known, depends largely on a race between the cost-increasing effects of depletion and the cost-reducing effects of new technology. We also know that in the past new technology has successfully offset the 20 These resources include various dry lakes in Chile, Argentina, and Bolivia that are known to contain important volumes of lithium but have not been explored in detail (see notes to Appendix Table 2). The same holds for a number of lithium mineral deposits recently discovered in Australia and Canada. Marginal geothermal brines in New Zealand, Italy, Japan, Iceland, and France are also not considered, nor the lithium resources in North Dakota and Utah in the United States associated with oil fields. 16 Version: 90521 tendency for depletion to push prices higher. What we do not know, given the inherent uncertainties surrounding the future course of technological change and the other determinants of mineral commodity prices, is whether this favorable situation will continue in the future. Despite such uncertainties, lithium shows that in some instances information about the shape of the cumulative availability curve can provide useful insights into the likely future threat of mineral depletion. Where the curve rises gradually and eventually becomes relatively flat (as is the case for lithium, particularly once extraction from seawater takes place), some assessment of the maximum long-run price is possible under any plausible scenario of future demand growth. In the case of lithium, for example, it appears that almost unlimited supplies can be extract from seawater for between 7.00 and 10.00 dollars per pound of lithium carbonate. As the current price is about 2.80 per pound, these figures suggest that depletion will not be a serious threat, even if lithium is widely used over the coming century in hybrid and fully electric automobiles. Not all mineral commodities, of course, may have such benevolent cumulative availability curves. Mineral commodities whose cumulative availability curves rise steeply or have discrete breaks are more exposed to the threat of depletion. In this regard, however, there is an important asymmetry between mineral commodities with gradually rising cumulative availability curves and those with steep slopes or with discrete breaks in terms of the implications for depletion. In the case of the former, if the relatively flat portion of the curve occurs at prices close to current prices, as is the case for lithium, one can confidently conclude that depletion will not be a serious threat. In the case of the latter, however, one cannot conclude that depletion will necessarily be a problem. The reason being in such cases we have no way of 17 Version: 90521 knowing how much of the upward pressure on costs likely to arise from depletion will be offset by the cost-reducing effects of new innovations and technology. Finally, for some mineral commodities the information needed to construct cumulative availability curves is not available. This, as we have seen, is the case for copper. On this issue, however, it is useful to highlight the difference between information that is unknown and unknowable and information that is unknown but knowable. Information on technological change, population growth, changes in future consumer preferences, and the other determinants governing how rapidly society will move up the cumulative availability curve and to what extent the curve will shift down over time is not just unknown. It is also essentially unknowable. In contrast, the geologic information needed to estimate cumulative availability curves, though it may currently be unknown for many mineral commodities, is knowable. At some cost and effort, it can be obtained. And, as the case of lithium illustrates, knowledge of the shape of cumulative availability curves can by itself provide useful insights into the future threat of depletion for some mineral commodities. 18 Version: 90521 References Admiralty Resources, 2008, Rincon salar, Argentina - The resource. Available at http://www.ady.com.au/admirality_resources_ricon_salar_resources.php (accessed on August 21, 2008). Aguilera, R.F., Eggert, R.G., Lagos, G., and Tilton, J.E., 2009, Depletion and the future availability of petroleum resources: Energy Journal, v. 30, p. 141-174. Anstett, T.F., Krauss, U.H., Ober, J.A., and Schmidt, H.W., 1990, International Strategic Minerals Inventory Report—Lithium, U.S. Geological Survey Circular 930-I: Washington, DC, Government Printing Office. Avalon Ventures, 2008, Separation Rapids lithium-tantalum project: Kenora, Ontario. Available at http://www.avalonventures.com/projects/rare/separation_rapids/ (accessed on August 26, 2008). Ballivián, O., and Risacher, F., 1981, Los salares del altiplano boliviano: O.R.S.T.O.M. and Universidad Mayor San Andrés, Paris, p. 123. Black Pearl Minerals, 2008a, Thompson Bros. lithium project. Available at http://www.blackpearlminerals.com/property_thompson_bros.php (accessed on August 25, 2008). Black Pearl Minerals, 2008b, Quebec lithium project. Available at http://www.blackpearlminerals.com/property_quebec_lithium.php (accessed on August 25, 2008). Bradbury, D., 2008, What is going to power our cars? The Guardian, July 31. Available at www.guardian.co.uk/ technology/2008/jul/31/motoring.energy (accessed on August 10, 2008). Ebensperger, A., Maxwell, P., and Moscoso, C., 2005, The lithium industry: Its recent evolution and future prospects: Resources Policy, v. 30, p. 218-231. Erickson, R.L., 1973, Crustal abundance of elements, and mineral reserves and resources, in Brobst, D.A., and Pratt, W.P., eds., United States Mineral Resources, U.S. Geological Survey Professional Paper 820: Washington, DC, Government Printing Office, p. 21-25. Evans, R.K., 1986, Reservas y recursos de litio en el mundo occidental, in Lagos, G., ed., El Litio, Un Nuevo Recurso para Chile: Santiago, Chile, Editorial Universidad de Chile, p. 45-52. Evans, R.K., 2008a, An abundance of lithium: Unpublished paper, March. Available at www.worldlithium.com/An_Abundance_of_Lithium_1.html (accessed on August 10, 2008). 19 Version: 90521 Evans, R.K., 2008b, An abundance of lithium: Part two: Unpublished paper, July. Available at www.worldlithium.com/An_Abundance_of_Lithium_-_Part_2.html (accessed on August 10, 2008). Galaxy Resources, 2008, Ravensthorpe - Mt Cattlin. Available at http://www.galaxyresources.com.au/projects-r-mtcattlin.php (accessed on August 25, 2008). Garrett, D.E., 2004, Handbook of Lithium and Natural Calcium Chloride: London, Elsevier Ltd., p. 1–223. Geoscience Australia, 2008, Australia's identified mineral resources 2008. Available at http://www.ga.gov.au/minerals/exploration/resources_advice/Table1_AIMR08.j sp (accessed on August 25, 2008). Gordon, R.B., Koopmans, T.C., Nordhaus, W.D., and Skinner, B.J., 1987. Toward a New Iron Age? Quantitative Modeling of Resource Exhaustion: Cambridge, Massachusetts, Harvard University Press, p. 1-173. Hammond, A.L., 1976, Research news: Lithium: Will short supply constrain energy technologies? Science, March 12, v. 191, p. 1037-1038. Industrial Minerals, 1999, SQM raises Li2CO3 prices: Industrial Minerals, no. 386, November, p. 90. Industrial Minerals, 2000, Chemetall and FMC raise lithium prices: Industrial Minerals, no. 399, December, p. 30. Industrial Minerals, 2007, Between a rock and a salt lake: Industrial Minerals, no. 477, June, p. 58–69. Kunasz, I.A.,1994, Lithium resources, in Carr, D.D., ed., Industrial Minerals and Rocks: Littleton, CO: Society for Mining, Metallurgy, and Exploration, p. 631–642. Norton, J.J., 1973, Lithium, cesium, and rubidium—The rare alkali metals, in Brobst, D.A., and Pratt, W.P., eds., United States Mineral Resources, Geological Survey Professional Paper 820: Washington, DC, Government Printing Office, p.365378. Ober, J.A., 1994 – 2006, Lithium, in Minerals Yearbook: Washington, DC, U.S. Geological Survey. Ober, J.A., 2000, Lithium, in Mineral Commodity Summaries 2000: Washington, DC, U.S. Geological Survey, p. 100-101. Also available at http://minerals.usgs.gov/minerals/pubs/commodity/lithium/450400.pdf (accessed on August 26, 2008). Ober, J.A., 2008, Lithium, in Mineral Commodity Summaries 2008: Washington, DC, U.S. Geological Survey, p. 98-99. Also available at 20 Version: 90521 http://minerals.er.usgs.gov/minerals/pubs/mcs/2008/mcs2008.pdf (accessed on August 9, 2008). Orocobre, 2008, Olaroz lithium project. Available at http://www.orocobre.com.au/Projects_Olaroz.htm (accessed on August 25, 2008). Pavlovic, P., 2002, Capítulo 2.1 Reservas de litio, in Estudio Económico-Jurídico de una Eventual Liberalización de la Explotación y Comercialización del Litio: unpublished study, Santiago, Chile, Ministerio de Minería. Roskill, 2006, The economics of lithium: London, Roskill Information Services. Sernageomin, 2006, Anuario de la minería chilena: Santiago, Chile, Servicio Nacional de Geología y Minería. Also available at http://www.sernageomin.cl/pdf/publicaciones/anuario2006.pdf (accessed on October 1, 2007). Skinner, B.J., 1976, A second iron age ahead? American Scientist, v. 64, p. 158-169. SQM, 2007, Annual report: Santiago, Chile, Sociedad Química y Minera de Chile S.A. Also available at http://www.sqm.com/PDF/Investors/AnnualReport/SQMAnnual_Report_2007_EN.pdf (accessed on September 23, 2008). SQM, 2009, Lithium resources and view of the lithium industry, paper presented at the Lithium Supply and Markets Conference 2009, Industrial Minerals, Santiago, Chile. Available at http://www.metalbulletin.com/events/Details/Element.aspx?eventId=736&typeI d=3 (accessed on February 3, 2009). Steinberg, M., and Dang, V., 1975, Preliminary design and analysis of a process for the extraction of lithium from seawater, Technical Report 20535-R: Upton, NY: Brookhaven National Laboratory. Also available at http://www.osti.gov/energycitations/product.biblio.jsp?osti_id=7351225 (accessed on December 9, 2008). Tahil, W., 2007, The trouble with lithium: Implications of the future PHEV production for lithium demand: Martainville, France, Meridian International Research. Available at http://www.meridian-int-res.com/Projects/Lithium_Problem_2.pdf (accessed on August 10, 2008). Tahil, W., 2008, The trouble with lithium 2: Under the Microscope: Martainville, France, Meridian International Research. Available at http://www.meridian-int res.com/Projects/Lithium_Microscope.pdf (accessed on September 24, 2008). Tilton, J.E., 2003, On Borrowed Time? Assessing the Threat of Mineral Depletion: Washington, DC, Resources for the Future, p. 1-158. 21 Version: 90521 Tilton, J.E., 2006, Depletion and the long-run availability of mineral commodities, in Doggett, M.E., and Parry, J.R., eds., Wealth Creation in the Minerals Industry: Integrating Science, Business and Education: Littleton, Colorado, Society of Economic Geologists Special Publication 12, p. 61-70. Tilton, J.E., and Lagos, G., 2007, Assessing the long-run availability of copper: Resources Policy, v. 32, p. 19-23. Tilton, J.E., and Skinner, B.J., 1987, The meaning of resources, in McLaren, D.J., and Skinner, B.J., eds., Resources and World Development: New York, John Wiley & Sons, p. 13-27. U.S. Bureau of Mines, 1953 – 1993, Minerals Yearbook: Washington, DC, U.S. Government Printing Office and U.S. Bureau of Mines. Vine, J.D., ed., 1976, Lithium Resources and Requirements by the Year 2000, U.S. Geological Survey Professional Paper 1005: Washington, DC, Government Printing Office. Western Lithium Corporation, 2008. Available at http://www.westernlithium.com/ (accessed on September 24, 2008). Yaksic Beckdorf, A., 2008, Análisis de la disponibilidad de litio en el largo plazo: Unpublished M.S. thesis, Santiago, Pontificia Universidad Católica de Chile, p. 1-150. 22 Version: 90521 Table 1 Lithium 2008 to 2100 Demand Forecast Assumptions by Major End Use Markets End Use Market Automobile Batteries Secondary Batteries (rechargeable - portable devices) Primary Batteries (nonrechargeable - portable devices) Lubricating Greases Frits and Glass Air Conditioning Aluminum Others Assumptions 1) World population will grow according UN estimations from 6.5 billion people in 2008 to 9.0 billion people in 2100. 2) The global ratio of people per automobile will fall from 8 in 2008 to 3 in 2100. 3) Annual battery production equals the growth in the world vehicle fleet plus the replacement of old car batteries (10 year average life assumed). 4) The percentage of hybrid and fully electric automobiles will increase from its 2008 level of under 1 to 100 percent by 2050 where it will remain for the rest of the century. 5) Hybrid and fully electric automobiles on average will use 9 kWh lithium batteries. 6) Lithium batteries will on average last for 10 years. 7) Lithium batteries will be recycled, recovering 80% of the lithium. 15% growth for ten years; then 10% growth for ten years more; 3% growth until 2050; 1% growth from 2051 to 2100. 8% growth for ten years; then 5% growth for ten years more; 3% growth until 2050; 1% growth from 2051 to 2100. 5% growth for next ten years; then 3% growth for the next twenty years; finally 1% growth until 2100. 3% growth for ten years; then 2% growth for the next twenty years; finally 0.5% growth until 2100. 5% growth for ten years; 3% growth for the next ten years; finally 1% growth until 2100. 0% growth for ten years; 5% reduction over the next ten years; no lithium consumption after 20 years. 4% growth for ten years; 2% growth in the next ten years, finally 1% growth until 2100. Notes: a These assumptions are likely to produce demand forecasts that exceed the actual growth in lithium consumption over the 21st century for the following reasons: (1)The ratio of people per automobile is unlike to reach 3 by the end of the century. (2) The assumed rate of growth of hybrid and electric vehicles—4.5 million by 2010, 27 million by 2020, 146 million by 2050, and 308 million by 2100—is optimistic, in part because all automobiles may not be hybrid or fully electric by 2050. (3) Some hybrid 23 Version: 90521 automobiles may use smaller batteries than the assumed 9 kWh battery, containing less lithium. For example, the Toyota Prius HEV uses a battery of 1.3 kWh. (4) New technologies may reduce the amount of lithium needed per battery. (5) The assumption that the use of lithium in secondary batteries, which are used in portable devices such as cell phones, will grow between 10 and 15 percent per year over the next 20 years is optimistic. (6) The forecasts only consider the recycling of automobile batteries, though other lithium batteries may be recycled as well. (7) The forecasts assume that demand for the other lithium applications (excluding aluminum production) will grow for more than 90 years without leveling off. Figure 1 Illustrative Cumulative Availability Curves a. Slowly rising slope due to gradual increase in costs. Price and costs b. Price and costs Cumulative output c. Discontinuity in slope due to jump in costs. Sharply rising slope due to rapid increase in costs Price and costs Cumulative output Source: Tilton and Skinner (1987), and Tilton (2003). 24 Cumulative output Version: 90521 Figure 2 Types of Lithium Resources, Reserves, Products, and Major End-Use Applications Lithium Minerals Resources Brines Clays Sea Water Lithium Reserves Minerals Brines Lithium Chloride Lithium Chloride Lithium Concentrates Lithium Carbonate Products Lithium Metal Lithium Hydroxide Butil Lithium Glazes and Frits Major Applications Aluminum, Continuous Casting Powder, Secondary Batteries, Pharmacuticals, Glazes and Frits Greases, Lubricants, Batteries and Inorganic Derivates Dehumidifier Systems 25 Synthetic Rubber, Polymers and Organic Derivates Pharmaceuticals and Primary Batteries Version: 90521 Figure 3 Major End Uses of Lithium Others 22% Batteries 25% Chemical Processing 3% Continuous Casting 3% Lubricating Greases 12% Pharmaceuticals 3% Aluminum 4% Polymers 4% Glass 8% Frits 10% Air Conditioning 6% Source: SQM (2007). Figure 4 Average Lithium Carbonate Prices, 1953-2008 7 Current Dollars 2008 Dollars Dollars per pound 6 5 4 3 2 1 0 1953 1958 1963 1968 1973 1978 26 1983 1988 1993 1998 2003 2008 Version: 90521 Sources: Industrial Minerals (1999, 2000), Ober (1994 – 2006), U.S. Bureau of Mines (1953 – 1993), Yaksic (2008). Figure 5 Cumulative Availability Curves for Lithium Under High and Low Cost Scenarios With Predicted Cumulative Demand from 2008 to 2100a High Cost Scenario Low Cost Scenario Predicted Cumulative Lithium Demand 2008 – 2100 2100 Cost (US$/lb. lithium carbonate) 10 8 6 4 2 0 5 10 15 20 25 30 35 40 Availability (Million tons of Lithium) Note: aThe reported data take into account losses that occur during processing. See Appendix Table 3. 27 Version: 90521 Appendix Appendix Table 1 Lithium Resources in Minerals by Country and Deposit COUNTRY AUSTRALIA AUSTRIA BRAZIL CANADA CHINA FINLAND MALI NAMIBIA PORTUGAL RUSSIA USA ZAIRE ZIMBABWE TOTAL DEPOSIT /PROVINCE RESOURCESa (tonnes of lithium equivalent) Greenbushes Mount Cattlin Mount Marion Koralpa Minas Gerais Bernic Lake Barraute, Quebec La Motte Thompson Brothers Yellowknife Separation Rapids Jaijika Gajika Maerkang Lantta Various Various Barroso - Alvao Various Kings Mountain Cherryville 255,000 64,500 19,800 100,000 85,000 18,600 106,000 22,600 26,000 129,000 72,200 450,000 560,000 220,000 12,800 26,000 11,500 10,000 1,160,000 200,000 335,000 North Carolina Undeveloped Manono - Kitololo Masvingo 2,600,000 2,300,000 56,700 8,800,000 Notes: a Lithium mineral resources include reserves. The figures are in-situ resources. As a result, they reflect the lithium in the ground before processing losses. It is recognized that there are more lithium mineral resources in other places of the world (e.g., China). However, there is no information to quantify them. 28 Version: 90521 Sources: Anstett and others (1990), Avalon Ventures (2008), Black Pearl Minerals (2008a, 2008b), Evans (2008a, 2008b), Galaxy Resources (2008), Garrett (2004), Geoscience Australia (2008), Norton (1973), Industrial Minerals (2007), Pavlovic (2002), Roskill (2006), Ober (2000), Vine (1976), Yaksic (2008). 29 Version: 90521 Appendix Table 2 Lithium Resources in Brines by Country and Deposits COUNTRY DEPOSIT /PROVINCE RESOURCESa (tonnes of lithium equivalent) ARGENTINAb Hombre Muerto 815,000a Rincon 1,870,000g Olaroz 325,000h BOLIVIAc Uyuni 5,500,000a CHILEd Atacama 35,700,000i Maricunga 220,000a Zhabuye 1,530,000a DXC 140,600a Taijinaier 260,000a Qaidam Basin, Qinghai 2,020,000j ISRAEL Dead Sea 2,000,000 USA Silver Peak 40,000a Searles Lake 31,600 Great Salt Lake 526,000 CHINA AND TIBET e 1,000,000 f 1,000,000 Salton Sea Smackover TOTAL 52,300,000 Notes: a Lithium brine resources include reserves. The figures reflect the lithium in the ground before processing losses. Other resources of lithium brines are known to exist elsewhere (e.g., northern Chile and Argentina). However, the information needed to quantify them is not available. Figures for Hombre Muerto, Uyuni, Maricunga, Zhabuye, DXC, Taijinaier, and Silver Peak only include reserves. As a result, their total resources are much greater than the reported figures. b Only three dry lakes are included. Other lithium containing salars in the Argentinian altiplano are Pastos Grandes, Ratones, Antofalla, Centenario, Pozuelos, Cauchari, Salinas Grandes, Jama, and others. c Only one dry lake is included. There are other lithium containing salars in the Bolivian altiplano including Empexa, Coipasa, and Pastos Grandes. d Only two dry lakes are included, while there are many lithium containing salars in the Chilean altiplano. 30 Version: 90521 e Only one geothermal brine is included. f Only one oilfield brine is included. g 1.40 million tonnes after 75% recovery is equivalent to 1.87 million tonnes in-situ. h Preliminary estimation. i Seven million tonnes are lithium reserves. j The Qaidam Basin has about 33 salt lakes, consisting of more than 13.92 million tonnes of lithium chloride resource. Taijinaier is included in the total figure. Sources: Admiralty Resources (2008), Ballivián and Risacher (1981), Evans (2008a, 2008b), Garrett (2004), Industrial Minerals (2007), Pavlovic (2002), Orocobre (2008), SQM (2009), Yaksic (2008). Appendix Table 3 Total Lithium Resources in Minerals, Brines, Clays, and Oceans Minerals Brines Hectoritesb Jaderitesc Total (without oceans) Oceans IN SITU (million tonnes of lithium equivalent) 8.8 52.3 2.0 0.9 RECOVERABLEa (million tonnes of lithium equivalent) 4.4 23.5 1.0 0.5 64.0 29.4 224,000 44,800 Notes: a The figures shown in this column are after processing losses. They assume a 50 percent recovery rate for hectorites and jaderites, a 50 percent recovery rate for pegmatites, a 45 percent recovery rate for brines, and a 20 percent recovery rate for oceans. An important portion of the lithium not recovered during processing could be recovered by reprocessing, though production costs would be higher. Such recovery, however, is not considered in the figures reported in this column. b The figures for hectorites may not include all the identified resources in the United States. See Evans (1986) and Kunasz (1994). c Lithium in jaderites is not considered in the cumulative availability curve because cost data for this resource are not available. Sources: Evans (2008b), Western Lithium Corporation (2008), Yaksic (2008). 31 Version: 90521 Appendix Table 4 Lithium Reserves and Resources by Country and Deposits, Ranked by Production Costs, With Grades, Evaporation Rates, and Magnesium to Lithium Ratios R A N K I N G 1 2 4 8 11 15 18 19 20 22 23 25 26 DEPOSIT, PROVINCE OR COUNTRY Atacama DXC Zhabuye Taijinaier Hombre Muerto Olaroz Silver Peak Rincon Maricunga Greenbushes Uyuni Masvingo (Bikita) Bernic Lake Cherryville Barroso-Alvao and Covas de Barroso Gajika Maerkang Brazil Separation Rapids Quebec Jaijika Qaidam Basin Searles Lake Kings Mountain Etykinskoe Namibia Salton Sea Great Salt Lake COUNTRY GRADE (percent lithium) Chile 0.15 China (Tibet) 0.04-0.05 China (Tibet) 0.05-0.1 China 0.03 Argentina 0.06 Argentina 0.09 USA 0.023 Argentina 0.04 Chile 0.092 Australia 3.00 Bolivia 0.04 RATIOS (magnesium to lithium) EVAPORATION RATE (mm per year) RANGE OF COSTS (dollars per pound) 6.4 0.22 0.001 34 1.37 2 1.5 8.5 8 n/a 19 3,700 2,300 2,300 3,560 2,600 2,600 1,000 2,600 2,600 n/a 1,500 0.70 – 1.00 1.00 – 1.20 1.00 – 1.20 1.10 – 1.30 1.10 – 1.30 1.10 – 1.30 1.10 – 1.30 1.20 – 1.50 1.20 – 1.50 1.20 – 1.50 1.30 – 1.80 Zimbabwe 1.4 n/a n/a 1.30 – 1.80 Canada USA 1.28 0.68 n/a n/a n/a n/a 1.30 – 1.80 1.30 – 1.80 Portugal 0.37-0.77 and 0.72 n/a n/a 1.40 – 2.00 China China Brazil n/d n/d n/d n/a n/a n/a n/a n/a n/a 1.40 – 2.00 1.40 – 2.00 1.50 – 2.00 Canada 0.62 n/a n/a 1.80 – 2.20 Canada China China USA USA Russia Namibia USA USA 0.53 0.59 n/d 0.0065 0.69 0.23-0.79 n/d 0.022 0.004 n/a n/a n/d 125 n/a n/a n/a 1.3 250 n/a n/a n/d 1,000 n/a n/a n/a 1,800 1,800 1.90 – 2.30 1.90 – 2.30 1.50 – 2.50 2.00 – 2.50 2.00 – 2.50 2.10 – 2.70 2.20 – 2.80 2.20 – 2.80 2.20 – 2.80 32 Version: 90521 Israel Jordan 0.002 2,000 n/d 2.40 – 3.00 Zaire 0.58 n/a n/a 2.40 – 3.00 Mali Canada n/a n/a n/a n/a 2.40 – 3.00 2.50 – 3.00 n/a n/a 3.50 – 4.70 USA 1.4 0.66 0.24 – 0.53 n/d n/a n/a 3.50 – 4.70 Russia n/d n/a n/a 3.50 – 4.70 20 n/d 5.00 – 6.40 n/a n/a 7.00 – 10.00 29 Dead Sea 32 Manono Kitololo Bougouni Area Yellowknife 33 McDermitt USA North Carolina Russian pegmatites 36 Smackover USA 37 Oceans n/a 0.0386/ 0.0365 0.000017 Notes: n/d = no data are available. n/a = not applicable, either because the evaporation rate and ratio of magnesium to lithium are not relevant for lithium extracted from hard-rock mineral deposits or for other reasons. Source: Yaksic (2008) and the sources cited there. Production costs are estimates by Yaksic (2008) based on a variety of industry sources. 33