Voice over lecture

advertisement

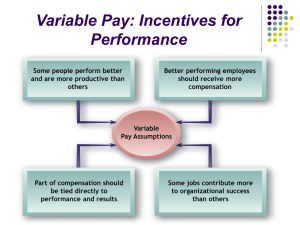

Variable Pay and Executive Compensation Module 4 CEO Pay Made in America—My Story Sam Walton and John Huey (1993) “A lot of what goes on these days with high-flying companies and these overpaid CEO’s who’re really looting from the top and aren’t watching out for anyone but themselves, really upsets me.” CEO Pay Variable Pay: Incentives for Performance Variable Pay Compensation linked to individual, group/team, and/or organizational performance. Basic assumptions: Some jobs contribute more to organizational success than others. Some people perform better and are more productive than others. Employees who perform better should receive more compensation. Some of employees’ total compensation should be tied directly to performance. Effective Incentive Plans Boeing, Nordstrom, Wal-Mart, Safeway Successes and Failures of Variable Pay Plans Successful incentive plans require: The development of clear, understandable plans that are continually communicated. The use of realistic performance measures. Strong links among performance results and payouts that truly recognize performance differences. Clear identification of variable pay incentives separately from base pay. Types of Variable Pay Plans Piece-Rate Systems Straight Piece-Rate Systems Wages are determined by multiplying the number of pieces produced by the piece rate for one unit. Differential Piece-Rate Systems Employees are paid one piece-rate for units produced up to a standard output and a higher piece-rate wage for units produced over the standard. Individual Incentives: Bonuses Bonus A one-time payment that does not become part of the employee’s base pay. Spot Bonus A special type of bonus used is a “spot” bonus, so called because it can be awarded at any time. Special Incentive Programs Performance Awards Cash or merchandise used as an incentive reward. Recognition Awards Recognition of individuals for their performance or service to customers in areas targeted by the firm. Service Awards Rewards to employees for lengthy service with an organization. Types of Sales Compensation Plans Salary-Only All compensation is paid as a base wage with no incentives. Commission Straight Commission Compensation is computed as a percentage of sales in units or dollars. The draw system make advance payments against future commissions to salesperson. Salary-Plus-Commission or Bonuses Compensation is part salary for income stability and part commission for incentive. Determining Sales Effectiveness Group/Team Incentives (cont’d) Distributing Rewards Same-size reward for each member Different-size reward for each member Problems with Group/Team Incentives Rewards in equal amounts may be perceived as “unfair” by employees who work harder, have more capabilities, or perform more difficult jobs. Group/team members may be unwilling to handle incentive decisions for co-workers. Many employees still expect to be paid according to individual performance. Social Loafing The folly of rewarding A and hoping for B Conditions for Successful Group/Team Incentives Organizational Incentives Profit Sharing A system to distribute a portion of the profits of the organization to employees. Primary objectives: Increase productivity and organizational performance Attract or retain employees Improve product/service quality Enhance employee morale Drawbacks Disclosure of financial information Variability of profits from year to year Profit results not strongly tied to employee efforts Framework Choices for a Profit-Sharing Plan Employee Stock Plans Stock Option Plan A plan that gives employees the right to purchase a fixed number of shares of company stock at a specified price for a limited period of time. If market price of the stock is above the specified option price, employees can purchase the stock and sell it for a profit. If the market price of the stock is below the specified option price, the stock option is “underwater” and is worthless to employees. Employee Stock Plans Employee Stock Ownership Plan (ESOP) A plan whereby employees gain significant stock ownership in the organization for which they work. Advantages Favorable tax treatment for ESOP earnings Employees motivated by their ownership stake in the firm Disadvantages Retirement benefit is tied to the firm’s future performance Management tool to fend off hostile takeover attempts. Components of Executive Compensation Packages Executive Compensation “Reasonableness” of Executive Compensation Would another company hire this person as an executive? How does the executive’s compensation compare with that for executives in similar companies in the industry Is the executive’s pay consistent with pay for other employees within the company? What would an investor pay for the level of performance of the executive? Investors are owners We as managers are stewards (agency theory) Common Executive Compensation Issues